The House voted 241-187 on Wednesday to back a procedural measure tied to the crucial debt-limit deal. The vote clears the way for the final vote on the bill tonight, expected around 8:30 p.m. Eastern time.

The “yea” votes included 189 Republicans and 52 Democrats, while “nays” included 29 Republicans and 158 Democrats.

House leaders were pressing members to back the deal over the objections of some GOP lawmakers.

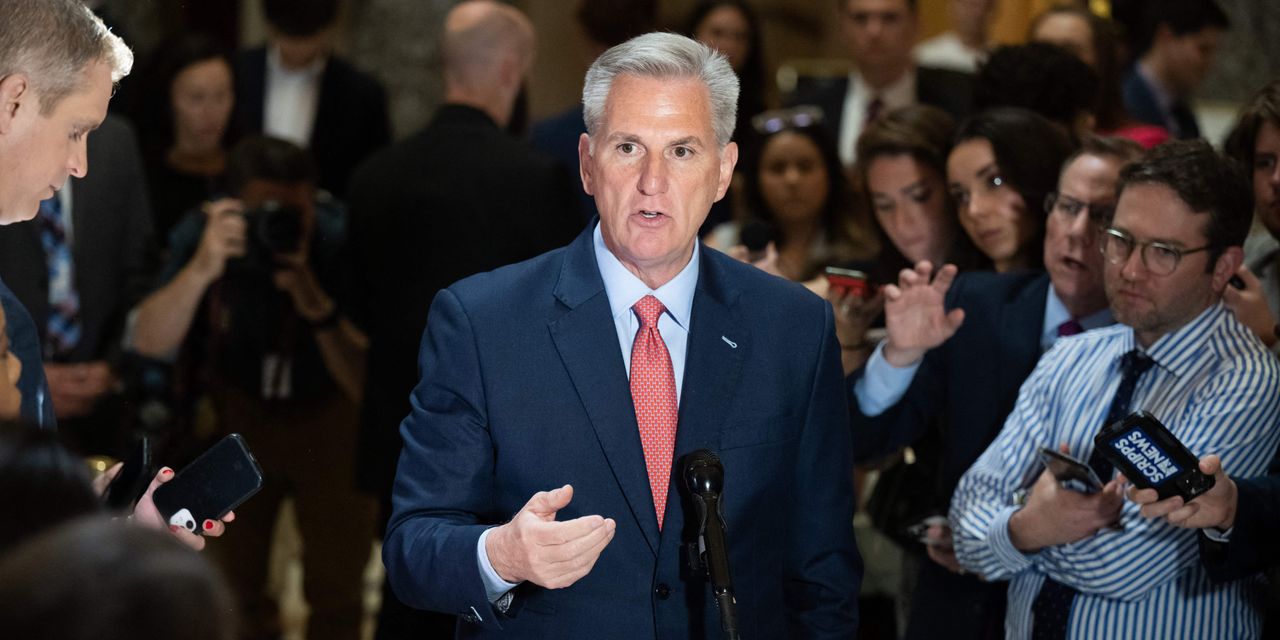

A revolt by GOP members means Speaker Kevin McCarthy might have to lean on Democrats to get the 218 votes he needs to pass it. On Tuesday, McCarthy, a California Republican, told reporters he was confident. “We’ll pass the bill,” he said.

Two conservative Republicans on the House Rules Committee, Rep. Chip Roy of Texas and Rep. Ralph Norman of South Carolina, have voiced opposition to it. But Kentucky GOP Rep. Tom Massie, a key vote on the committee, said he anticipates voting to send the deal to the floor.

Even if 10% to 20% of lawmakers representing their party’s extreme views vote against the measure, “any deal that was negotiated by leadership was almost guaranteed to get widespread bipartisan support,” said Stephen Stanley, chief U.S. economist for Santander U.S. Capital Markets, in a research note. “Both Republicans and Democrats want to show that they can govern effectively, and causing a trainwreck does not further that cause.”

According to the 99-page text released Sunday, the deal would lift the debt limit for two years, through January 2025 and impose limits on nonmilitary discretionary spending for the next couple of years. The proposal also tightens work requirements for some adult recipients of federal food aid, cuts some Internal Revenue Service enforcement funding, and reclaims unused but allocated funds to fight Covid-19.

President Joe Biden had been pushing for a debt ceiling increase without conditions. But he said he felt good about the bill’s chances of passing. He has been calling lawmakers personally, asking them to support the measure, as members of his administration reached out to House Democrats, Bloomberg reported.

Among other Republicans tweeting they would vote “no” on the bill are Rep. Andrew Clyde (R., Ga.); Rep. Wesley Hunt (R., Texas); Rep. Nancy Mace (R., S.C.); Rep. Mary Miller (R., Ill.); and Rep. Cory Mills (R., Fla.)

Passing the debt-ceiling proposal would be a clear win for Equitrans Midstream, a small energy company that owns the largest stake in the MVP Pipeline, a 303-mile natural gas pipeline that runs through Virginia and West Virginia and has been sitting in legal and regulatory limbo for five years because of federal court cases and environmental reviews.

Language in the agreement that would limit judicial review and speed up federal permits means the MVP Pipeline is more likely to win approval. Equitrans (ticker: ETRN) shares, rocketed 36% higher on Tuesday.

Sen. Joe Manchin (D., W.Va.) has spent years fighting for the nearly-finished project, while environmentalists who oppose the pipeline say it would lead to decades of rising carbon emissions and air pollution. Pipeline operators say they will buy enough carbon offsets to make the project’s operations carbon-neutral for its first decade, and pipeline spokeswoman Natalie Cox said the pipeline could be in service by the end of this year.

The bill doesn’t include a heavy tax on cryptocurrency miners that the White House had proposed. The administration’s earlier proposal for an excise tax on crypto miners equal to 30% of the cost of electricity their server farms use would have cut severely into the profits of miners such as Marathon Digital Holdings (MARA) and Riot Platforms (RIOT), whose stocks have risen 181% and 267% this year, respectively, on the back of the Bitcoin rebound.

A potential agreement would also reinstate government student loan repayments, which have been paused for more than three years, by Aug. 29. Shares of the online personal finance company SoFi Technologies (SOFI), which refinances student loans, jumped 11% on Tuesday.

The current bill prohibits another extension of the moratorium on payments, but doesn’t mention Biden’s roughly $400 billion student loan forgiveness plan. The Supreme Court is expected to rule on that program by the end of June, the Education Department said.

Assuming it passes the House, the measure must be approved by 60 votes in the Senate before going to the White House for the president’s signature.

Senate Majority Leader Chuck Schumer (D., N.Y.) told senators that they should be prepared to vote on Friday or potentially over the weekend, reminding them that Treasury Secretary Janet Yellen has warned that the U.S. won’t be able to pay all of its bills on time starting June 5.

Write to Janet H. Cho at [email protected]

Read the full article here