Deluxe Corporation (NYSE:DLX) is down at 2009 crisis lows, and the multiple is pretty tight, but there are many good reasons why the equity is in a bad spot. We’re not raising the alarm on solvency, but higher rates were already a huge problem for the company, and the expiration of some derivatives hedging the rate risk in March 2023 are going to worsen the picture meaningfully. With disposals shrinking cash flows, and some tech overhaul at the company hampering cash flow generation and checks profitability, the moment is poor for Deluxe. With debt being a real hindrance for the company, the realistic equity investor should eschew this stock, especially with hawkishness persisting. Were that to change, Deluxe could become suddenly very interesting, but not yet.

Q1 Comments

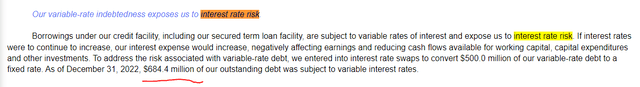

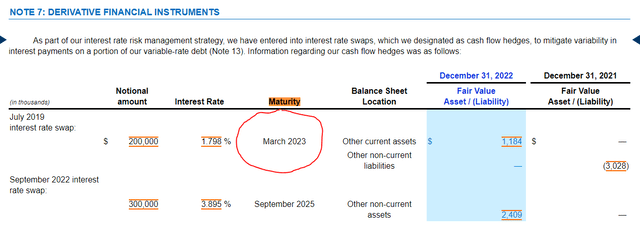

Let’s start with the rate situation. Hawkishness seems to be persisting, certainly despite banking concerns which did not meaningfully faze the Fed. We are seeing some recessionary forces to ease inflation, but rates are quite reasonably expected to stay higher for the time being. As of the FY 2022, 43% of DLX’s debt was exposed to rate changes. Now it’s closer to 56% due to expiration of some important hedges.

Variable Rate Debt (SEC.gov) Derivatives (SEC.gov)

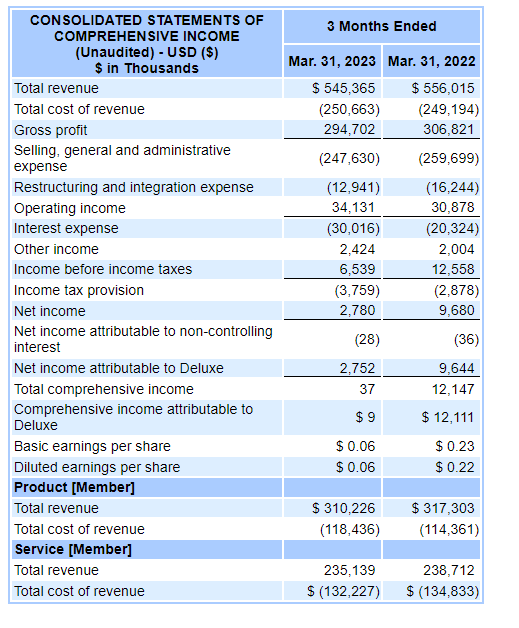

Net income was already getting decimated this Q1 by higher interest rate charges which have come up substantially just as was our concern. The income will be even less protected going forward.

IS (SEC.gov)

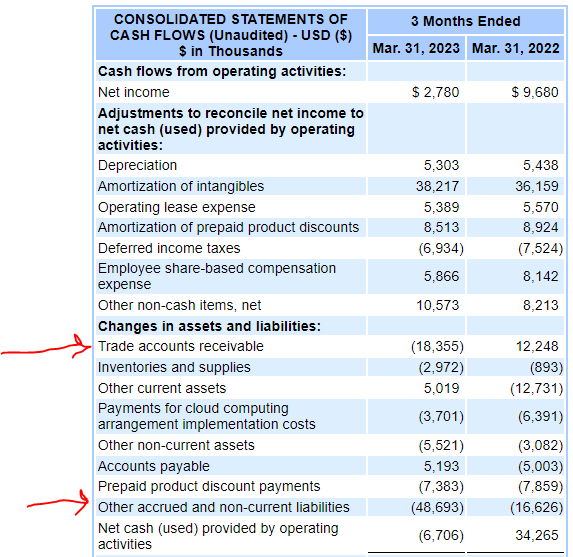

It doesn’t help that Deluxe has been doing an ERP overhaul which has ruined their operating cash flow. Receivables have bloated, and most alarmingly there are enormous cash outflows related to the ‘other’ line. Not impressive, but management maintains that this overhaul is finished and collections are rebounding sharply.

CF Statement (SEC.gov)

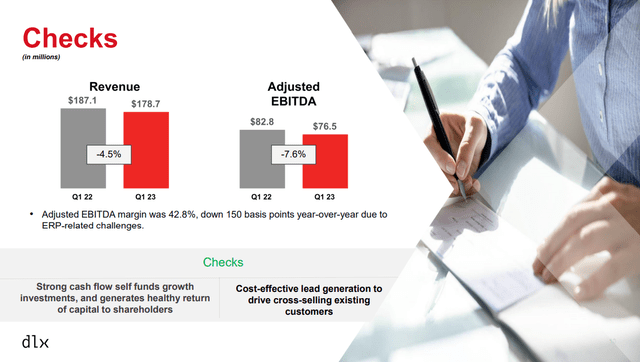

On top of that, some disposals in data solutions which were not sold for high values take away from cash flow generation. The ERP overhaul also hurt checks profitability which is so important for cash generation of DLX.

Checks Decline in EBITDA (Q1 2023 Pres)

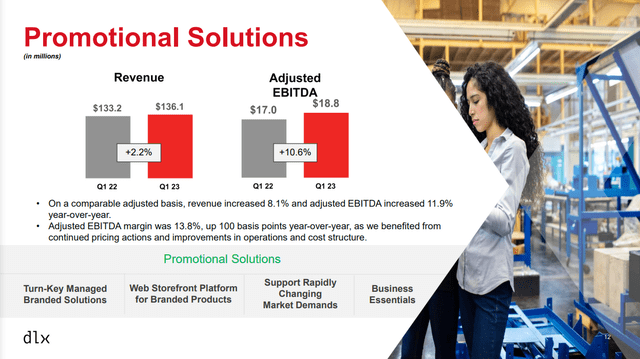

The offsets were from inflation reversals in promotional solutions which contributed positively.

Promotional Solutions Hit by Disposal (Q1 2023 Pres)

Overall EBITDA actually stayed on track, EBIT actually even grew – but net income got annihilated.

Bottom Line

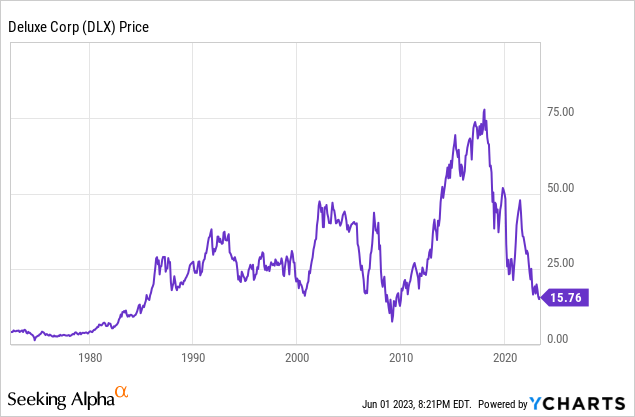

The stock price has tanked to historical lows.

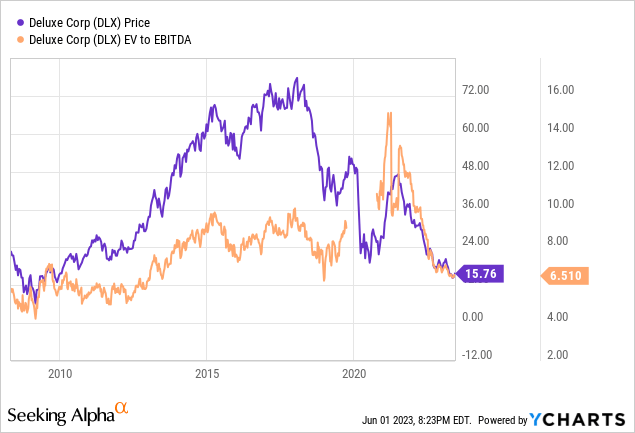

This is reasonable. When there is debt hindering a company in a meaningful way, you can’t just wave that away, even if EV/EBITDA multiples are close to historical lows.

5.6x EV/EBITDA isn’t even relatively low, where in developed markets safe propositions with better growth prospects and superior balance sheets can be found in the dozens, especially in Japan.

The markets may miss the idea here if hawkishness reverses. DLX has more than average to benefit, but in relative and absolute terms today, assuming expectations over rates are appropriate, DLX offers nothing to the practical investor.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Read the full article here