This article was published at iREIT™ on Alpha on Wednesday May 31, 2023.

Real estate investment trusts, or REITs, did not have a great year last year. Not in terms of stock gains, anyway.

The dividends kept coming, which is a very, very big deal. But let’s face it…

Stock gains – or losses – are much easier to account for. All you need to do is go onto Bloomberg or Yahoo Finance or whatever your market-news preference is (i.e., Seeking Alpha). That information is always front and center for any publicly traded company you look up.

For my part, I published article after article detailing the less-than-ideal details of last year’s stock performance – including on December 31, when I wrote how:

“I always try to write an end-of-year piece about my biggest winners and another one about my biggest losers.

“Usually, that first category more than makes up for the second. But I’ll admit that this has been a different kind of year, where mid-term hopes and dreams – and even hard-core, careful, experience-based analysis – just didn’t pan out as expected.

“2022 was a year for the books in so many ways. While there were still winners to be found in the larger stock market, the losers took the consistent spotlight.”

But, to quote my subsequent New Year’s Day article, “I’m not bitter about 2022. And I’m not worried about 2023.” Instead, I wrote out “my list of resolutions” like every other year “with the same good cheer” as ever.

In case you haven’t guessed yet, that good cheer hasn’t faded these five months later.

The Bad News First, but the Good News Is Better

So, yeah. 2023 hasn’t been a banner year for REITs either. Not in terms of stock gains, anyway.

Again, the dividend situation makes it worth it to stay in well-placed REIT holdings despite such swings. But it’s definitely preferable to get some positive share price action as well.

We’re not getting much of that these days though, as evidenced by this year-to-date chart of the Vanguard Real Estate Index Fund ETF (VNQ):

Yahoo Finance

Here’s the two-year too, for comparison:

Yahoo Finance

Not pretty, I know. So I understand why you might want to give up. But I don’t agree, and not just because of the consistent dividend streams REITs offer.

I’m also not just falling back on the Wall Street truism that a loss isn’t a loss until you sell the stock. That’s true as well, though I once again understand why it might not make you feel better in the moment.

So let me point out a third reason, this one from Cohen & Steers in a January publication titled “Why We See Favorable Entry Points Emerging for REITs” (emphasis added):

- “We believe we are entering a more favorable environment for REIT investing after a year that has been particularly challenging for listed real estate as it repriced quickly to the new interest rate regime and the anticipated recession.”

- “Though financing costs are higher and growth will be slower, REITs enter this recessionary period in a relative position of strength, buoyed by tight supply and subsequent healthy cash flows.”

- “REITs have historically performed well in the environments we are now anticipating in succession: when both growth and real yields are down; the end of the rate hiking cycles; and the transition to an early cycle environment.”

In other words, it’s not just me who’s optimistic about REITs out there.

And Another Very Big Deal for REITs

Yeah, the skeptics will say, but that’s five months ago. Which is a valid point.

But I also have this WealthManagement.com article from May 16, as featured on Cohen & Steers’ website: “Having Priced in Market Volatility, Publicly-Traded REITs Are Attracting More Investors.”

It reads (emphasis added):

“While the private real estate markets have been slow to adapt pricing to reflect higher interest rates and a more uncertain economic climate, publicly traded REITs offer both discounts and a historic record of outperforming during recessions. Some investors are cycling money from private vehicles and into REITs.”

Plus:

“Solid property-level performance, conservative debt ratios and attractive pricing have been driving some investors who have traditionally focused on private real estate to consider funds that invest in publicly traded REITs in recent months.”

I know from separate research that this includes institutional investors – pension funds, hedge funds, insurance companies and the like. Do you know what their big money can do to your “little guy” cash?

I just wrote about it for (the first draft of) my upcoming book, REITs for Dummies:

“Approximately 64% of the top 25 largest [pension funds] use REITs to boost their real estate holdings’ growth potential. They average about $430 in total assets under management (AUM), with their real estate portfolios averaging above $30 billion.

Again, that’s real estate in general, not real estate investment trusts in particular. But even a slice of that collective $75 billion+ can and does make a whale-sized difference for the REITs they choose to get involved in.”

Don’t you want to ride that wave? I know I do, which is why I’m sticking with REITs. In fact, I’m buying into the fear with full faith that prices are headed higher from here.

And I’ll enjoy those dividends in the meantime.

The Dream Team

I put together the “dream team” list below of some spectacular REITs that I’m encouraging you to gobble up. I own all of these, and I plan to meet with all of their management teams next week at REIT Week (in NYC).

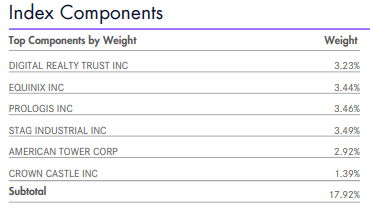

In addition, all five of these REITs are included in my new REIT ETF Index, iREIT™-MarketVector™ Quality REIT Index (weighted equally with a tilt toward stocks selected in the Higher Quality REITs bucket).

Top Holdings for iREIT™-MarketVector™ Quality REIT Index:

MarketVector™

Realty Income Corporation (O)

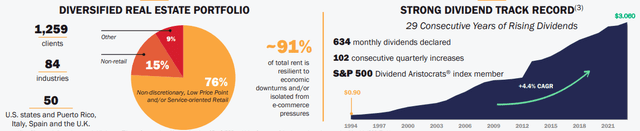

Realty Income is a real estate investment trust that invests in single-tenant, freestanding properties that are leased on a triple-net basis. They have a very stable income stream with over 12,000 properties that have an occupancy rate of 99.0% and a weighted average lease term of 9.5 years.

Realty Income’s properties are leased to 1,259 tenants doing business across 84 different industries with properties located in all 50 States, the UK, Spain, and Italy that in total encompass approximately 236.8 million leasable square feet.

They have delivered a 14.6% compound annual total return since their public listing in 1994 and have had positive adjusted funds from operations (“AFFO”) growth in 26 out of the last 27 years. Realty Income is probably best known for their monthly dividend, which has been increased for the last 29 consecutive years and has had a compound annual growth rate of 4.4% since 1994.

Realty Income – IR

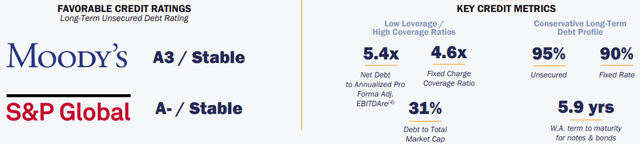

Realty Income has an A- credit rating from S&P Global and solid debt metrics with a net debt to pro forma adjusted EBITDAre of 5.4x, a long-term debt to capital ratio of 41.21%, and a fixed charge coverage ratio of 4.6x. Their debt is 95% unsecured, 90% fixed rate, and has a weighted average term to maturity of 5.9 years.

Realty Income – IR

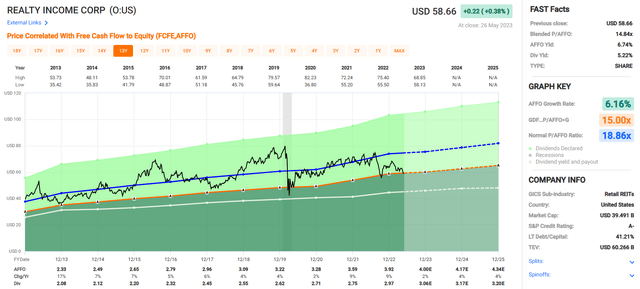

Realty Income has an average AFFO (adjusted funds from operations) growth rate of 6.16% and pays a 5.22% dividend yield that is secure with an AFFO dividend payout ratio of 75.69%. Currently they are trading at a P/AFFO ratio of 14.84x which is well below their normal P/AFFO ratio of 18.86x.

At iREIT, we rate Realty Income stock a BUY.

FAST Graphs

Alexandria Real Estate Equities, Inc. (ARE)

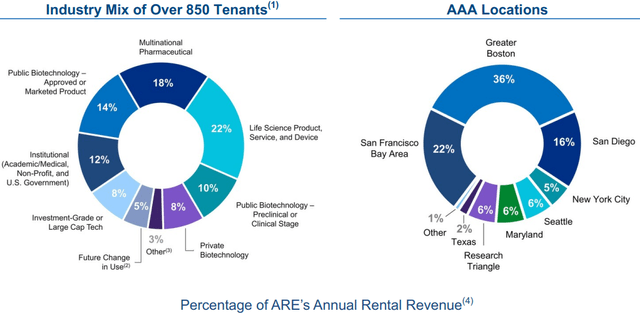

Alexandria is an office REIT that was formed in 1994 as the pioneer of life science real estate. Their properties contain laboratories and research facilities that are leased to biotechnology companies, pharmaceutical companies, medical research institutions, medical device companies, and academic institutions.

Unlike other REITs in the office sector, ARE is insulated from the work from home movement since most of the tasks performed in their buildings cannot be done from home. As of the end of the first quarter, ARE’s portfolio consisted of 64 operating properties that have an occupancy rate of 93.6% and a weighted average remaining lease term of 7.7 years.

Their properties are leased to well established businesses such as Bristol-Myers, Moderna, Pfizer, Merck, and the Massachusetts Institute of Technology. Along with the strong tenant roster, they are well diversified by tenant with their top tenant making up 3.6% of their annual rental revenue and their top 20 tenants only contributing 31.7%.

ARE – IR

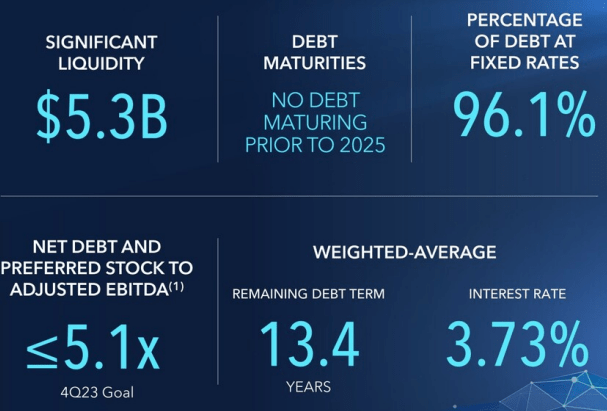

Alexandria has a BBB+ credit rating from S&P Global and excellent debt metrics, including a net debt and preferred stock to adjusted EBITDA of 5.3x, a long-term debt to capital ratio of 38.41%, and a fixed charge coverage ratio of 5.0x.

Their debt is 96.1% fixed rate with a weighted average interest rate of 3.73% and a weighted average term to maturity of 13.4 years. Additionally, no debt matures prior to 2025 and they have $5.3 billion in total liquidity.

ARE – IR

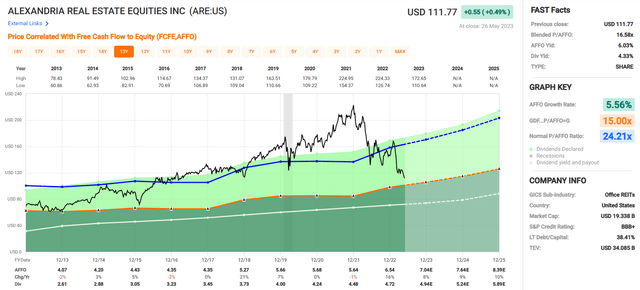

Alexandria has an average AFFO growth rate of 5.56% and an average dividend growth rate of 8.62% over the past 10 years. They pay a 4.33% dividend yield that is well covered with an AFFO dividend payout ratio of 72.17% and currently trade at a P/AFFO ratio of 16.58x, which is a significant discount to their normal P/AFFO ratio of 24.21x.

At iREIT, we rate Alexandria a STRONG BUY.

FAST Graphs

Camden Property Trust (CPT)

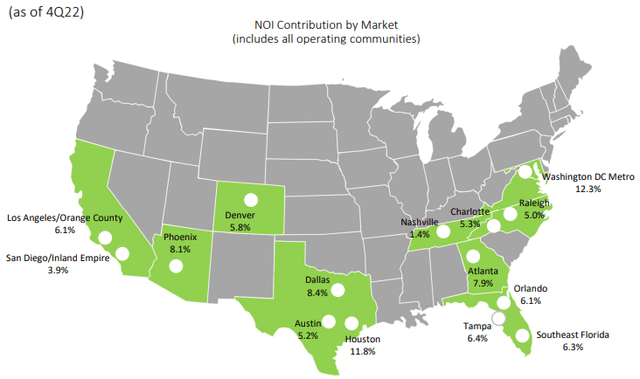

Camden Property Trust is a REIT that specializes in multifamily communities that are primarily located in the sunbelt region of the country. As of April 30, 2023, CPT owned 172 operating communities that contains 58,702 apartment homes with an average age of 14 years and an average occupancy rate of 96.0%.

CPT’s has 6 properties that are under construction and are expected to add 1,950 apartment homes upon completion. Additionally, CPT owns land banks that they can use for future development. CPT’s largest market is in Washington D.C. which makes up 12.3% of their net operating income (“NOI”), followed by Houston at 11.8% and Dallas at 8.4% of their NOI.

CPT – IR

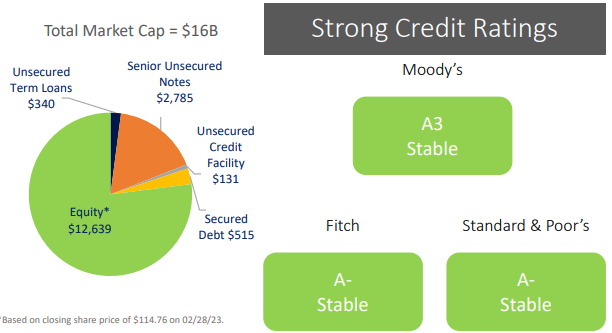

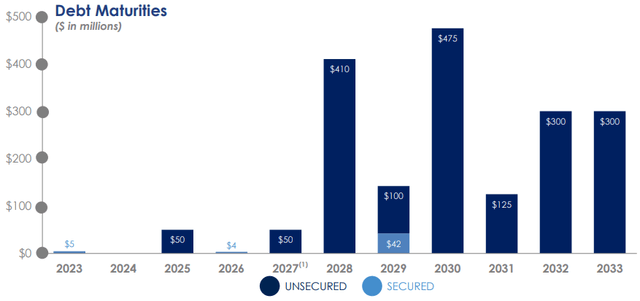

CPT has an investment grade credit rating of A- and excellent debt metrics. They have a net debt to adjusted EBITDA of 4.1x and a long-term debt to capital ratio of 40.32%.

Their debt is 82.6% fixed rate and 86.3% unsecured with a weighted average term to maturity of 6.2 years and a weighted average interest rate of 4.1%. Additionally, they have an unencumbered asset pool of roughly $18.0 billion and $1.1 billion available to them under their unsecured credit facility.

CPT – IR

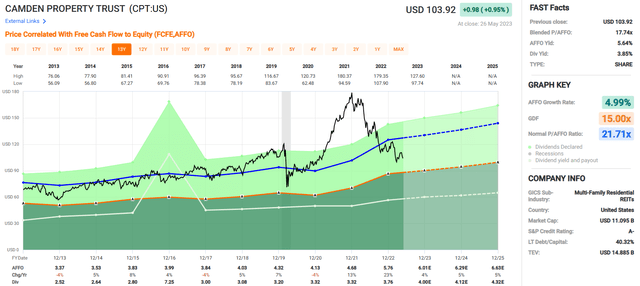

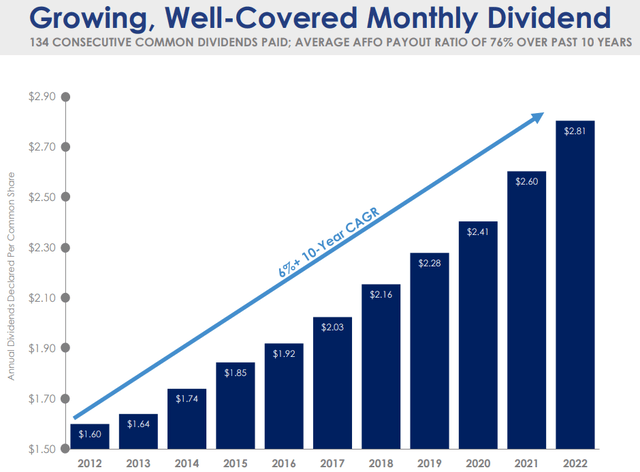

Camden Property Trust has an average AFFO growth rate of 4.99% and a compound average dividend growth rate of 5.32% over the last 10 years.

They currently pay a 3.85% dividend yield that is secure with an AFFO dividend payout ratio of 65.28% and trade for a P/AFFO ratio of 17.74x, which is well below their normal P/AFFO ratio of 21.71x.

At iREIT, we rate Camden Property Trust a BUY.

FAST Graphs

Agree Realty Corporation (ADC)

Agree Realty is a net-lease REIT that specializes in free-standing retail properties. Their portfolio consists of 1,908 retail properties that are located in 48 states and cover approximately 38.1 million square feet.

Their properties are 99.7% leased with a weighted average lease term of around 8.8 years and 67.8% of their base rent comes from tenants, or a parent company, that have an investment grade credit rating.

In addition to their retail properties, Agree Realty also invests in ground leases that made up 12.1% of their annualized base rent as of the end of the first quarter.

ADC has a strong list of tenants that includes Walmart, Tractor Supply, Kroger, Lowes, and CVS Pharmacy that operate in e-commerce resistant sectors such as grocery stores, auto service, home improvement, and convenience stores. ADC pays a monthly dividend and has a 6% compound annual dividend growth rate over the past 10 years.

ADC – IR

Agree Realty is investment grade with a BBB credit rating from S&P Global. They have strong debt metrics including a net debt to recurring EBITDA of 4.5x, a long-term debt to capital ratio of 30.33% and a fixed charge coverage ratio of 5.1x.

The vast majority of their debt is unsecured and they have a weighted average debt maturity of approximately 8 years. Additionally they have $1.2 billion in total liquidity as of the end of the first quarter and no material debt maturities until 2028.

ADC – IR

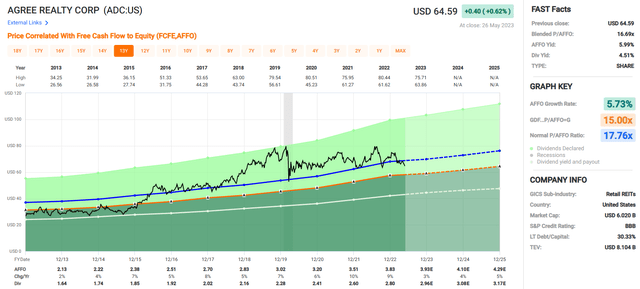

Agree Realty has had an average AFFO growth rate of 5.73% over the past 10 years and pays a 4.51% dividend yield that is well covered with an AFFO dividend payout ratio of 73.24%.

ADC currently trades at a P/AFFO ratio of 16.69x, which is slightly under their normal P/AFFO ratio of 17.76x.

At iREIT, we rate Agree Realty a BUY.

FAST Graphs

VICI Properties Inc. (VICI)

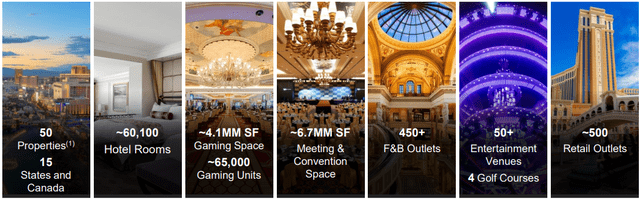

VICI is a gaming REIT that specializes in experiential real estate that includes iconic casinos such as Caesars Palace Las Vegas, the Venetian Resort Las Vegas and MGM Grand. In total VICI owns 50 gaming properties located in the U.S. and Canada that cover roughly 124.0 million square feet and feature over 450 restaurants, nightclubs and bars, and approximately 60,100 hotel rooms.

Additionally, VICI owns 4 championship golf courses and 34 acres of land that is located next to the Las Vegas Strip which can be used for future growth. VICI was formed as part of the Chapter 11 Reorganization filed by Caesars Entertainment Operating Company in 2015 and shortly thereafter filed its initial public offering in 2018.

Just several years later, in 2022, VICI was included as a S&P 500 constituent, making it one of the fastest REITs to be included into the S&P 500 after it was formed.

VICI – IR

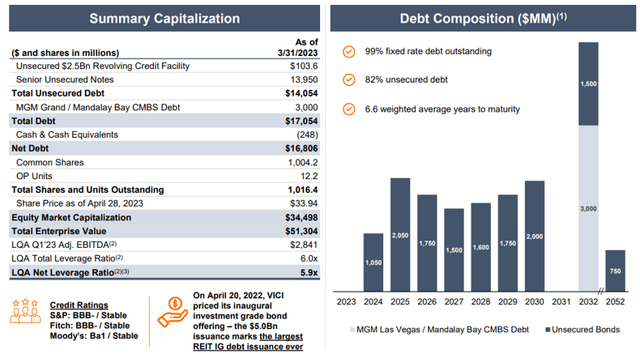

VICI is investment grade with a credit rating of BBB- from S&P Global and has a strong balance sheet with a last quarter annualized (“LQA”) net leverage ratio of 5.9x and a long-term debt to capital of 42.68%.

Their debt is 82% unsecured, 99% fixed rate, and has a weighted average term to maturity of 6.6 years. Additionally, no debt matures in 2023 and as of their most recent quarterly filing they have $3.6 billion in total liquidity.

VICI – IR

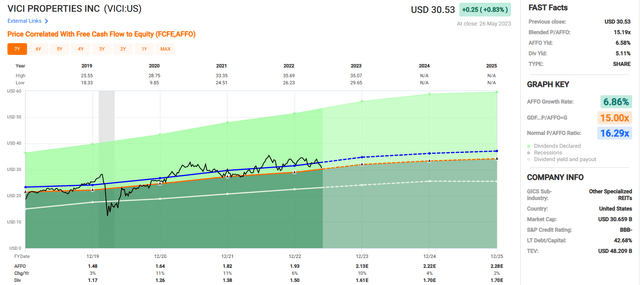

VICI has an average AFFO growth rate of 6.86% and an average dividend growth rate of 10.80% since 2019. They currently pay a 5.11% dividend yield that is well covered with an AFFO payout ratio of 77.72% and are trading at a P/AFFO ratio of 15.19x, which compares favorably to their normal P/AFFO ratio of 16.29x.

At iREIT, we rate VICI a BUY.

FAST Graphs

This Too Will Pass…

I know that many of you have become fearful of REITs, and I don’t blame you, especially when you read headlines like this:

Fortune

At iREIT™ on Alpha we help members navigate the chaos as we have a firm grasp on the commercial real estate market. Our team of analysts have a combined 100 years of experience, and our customized portfolios are designed to deliver optimal returns with reduced risk.

I don’t have a crystal ball that will tell me when rates cease to increase or when the recession will start and end, however, I do know that most REITs (not all) are trading at price levels that reflect we’re in a recession right now.

However, REITs have also strengthened their balance sheets over the past few years and reduced leverage by relying heavily on equity capital or JVs to finance their external growth.

The average debt-to-book assets ratio of REITs has declined -9.0% from the end of 2007. The decrease in the use of debt is a positive in the current rising interest rate environment as the cost of debt rises.

It’s May 31, 2023…

I’ll check back with you in 12 months to see how this list of “dream team” REITs are holding up…I like the odds!

Happy SWAN Investing!

Read the full article here