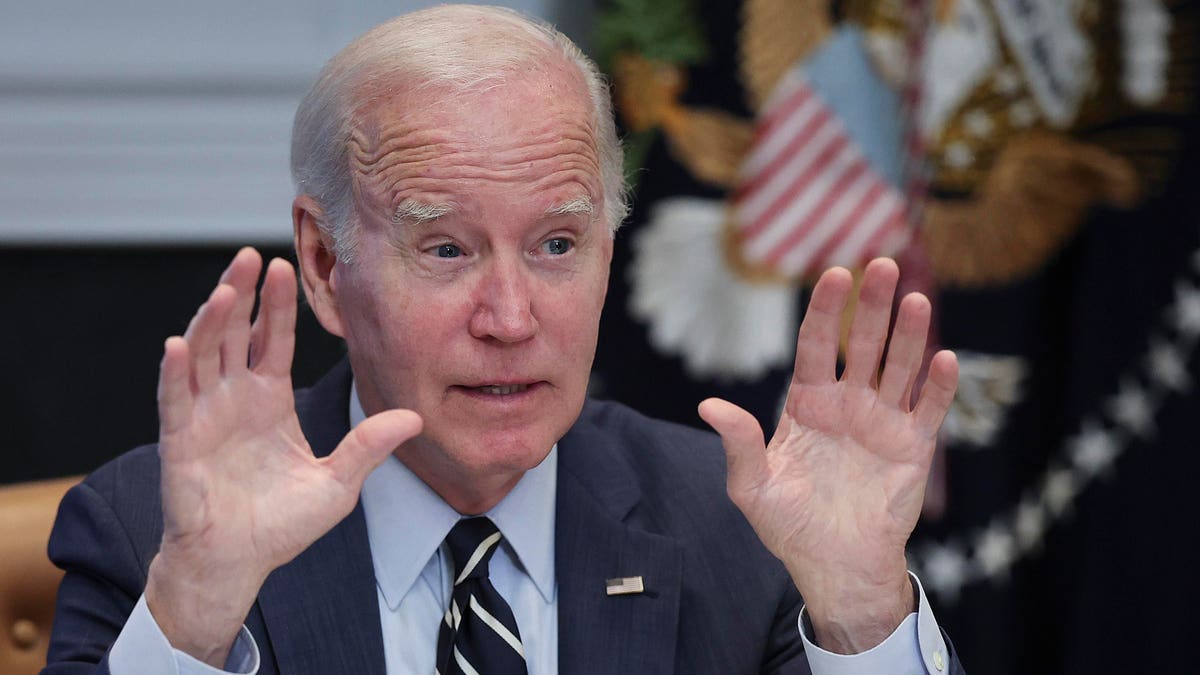

The student loan pause is actually, definitively coming to an end after over three years. President Joe Biden is soon expected to sign the debt ceiling bill approved by the House and Senate earlier this week. The compromise measure would preserve Biden’s signature student loan forgiveness plan, but would codify the end of the student loan pause.

Here’s what borrowers need to know.

Why Biden Cannot Extend The Student Loan Pause Again

The student loan moratorium has suspended monthly payments and interest for most federal student loan borrowers since March 2020. Former President Trump initially enacted the relief on a short-term basis in response to the Covid-19 national emergency.

Trump, and subsequently President Biden, then issued multiple extensions — often after suggesting that there would be no further extensions. Some had speculated that there could be yet another extension of the student loan pause, particularly if the Supreme Court rules against Biden’s sweeping loan forgiveness plan later this month. Advocates and Biden administration officials had suggested that payments should not resume before borrowers could receive the debt relief promised under that plan.

But this time is different. The debt ceiling bill’s statutory language will tie Biden’s hands. Barring a new national emergency, he will no longer have the statutory authority to extend the current student loan pause. That means that payments will be resuming for over 40 million borrowers.

When Interest Will Start Accruing After The Student Loan Pause Ends

The student loan pause is scheduled to end 60 days after June 30. That would be August 29. Since March 2020, interest rates have been set at zero percent for all government-held federal student loans. But after August 29, interest will start accruing again.

Most federal student loan interest rates are fixed based on statutory constraints set by Congress at the time of the loan’s initial disbursement. So for most borrowers, interest rates will revert back to the rates they were prior to the student loan pause going into effect three years ago.

For borrowers who consolidated their loans via the government’s Direct loan program during the student loan pause, the interest rate for the Direct consolidation loan will be the weighted average of the rates of the underlying loans that were consolidated, rounded up to the nearest eighth of a percentage point.

When Payments Will Restart After The Student Loan Pause Ends

While the student loan pause is set to end on August 29, that does not mean borrowers will immediately have to make payments. The Education Department’s vast student loan servicing system will have to generate billing statements and send them to borrowers. Those bills must then provide borrowers with a sufficient window of time to make their first payments.

So as a practical matter, the first billing due dates for most borrowers after the student loan pause ends should be in late September or October.

When Collections Efforts Against Borrowers In Default Will Start After The Student Loan Pause Ends

The student loan pause has also suspended collections efforts against most borrowers who are in default on their federal student loans. Typically, borrowers in default can be subjected to draconian collection activities including substantial financial penalties and fees, wage garnishment, social security offset, and seizure of federal tax refunds.

However, many defaulted borrowers will have a much longer period of time to rectify their student loan situations before collections efforts resume. The Biden administration has enacted the Fresh Start program, which is not impacted by the debt ceiling bill. This temporary program will provide many borrowers with a path out of default, and may even allow recent periods of default to count toward eventual student loan forgiveness. Fresh Start will be available for one year after the payment pause ends — presumably to the summer of 2024 — during which defaulted borrowers will continue to benefit from suspended collections efforts.

“All defaulted borrowers temporarily have these benefits. But you must use Fresh Start to get out of default to keep these benefits long-term. Otherwise, you will stop getting these benefits one year after the payment pause ends,” according to Education Department guidance.

Biden Administration May Provide Other Flexibilities After Student Loan Pause Ends

The Biden administration is reportedly eyeing other flexibilities to ease borrowers’ transition back into repayment.

For example, there may be a grace period after the student loan pause ends. During this grace period, borrowers won’t be penalized for missing a payment (such as incurring penalties or adverse credit reporting, or being placed into default status). Officials have not yet released details on the length of such a grace period, but it could be several months or longer. The administration is also considering writing off small loan balances of $100 or less.

Other flexibilities are already in place. The Education Department has implemented a self-certification process for borrowers applying for (or renewing) income-driven repayment plans, which may significantly streamline requests for lowering monthly payments.

Other Biden Student Loan Forgiveness Programs Still Available

While the debt ceiling bill ends the student loan pause, it does not touch other critical Biden administration student debt relief initiatives. The Education Department will continue to process applications submitted for the Limited PSLF Waiver, which has already resulted in hundreds of thousands of public service borrowers receiving student loan forgiveness.

In addition, the administration is continuing to roll out the IDR Account Adjustment, another temporary program that may accelerate millions of borrower’s progress toward eventual student loan forgiveness. Borrowers who qualify for immediate relief under this initiative may start to see their loan balances discharged as soon as this August.

Further Student Loan Forgiveness Reading

These Democrats Just Joined Republicans To Repeal Student Loan Forgiveness

If The Supreme Court Rejects Student Loan Forgiveness Plan, Biden Could Do This

Senate Advances Bill Repealing Biden’s Student Loan Forgiveness And Debt Relief Plans

Student Loan Forgiveness Eligibility Expanded In 3 Ways Under New Account Adjustment Guidance

Read the full article here