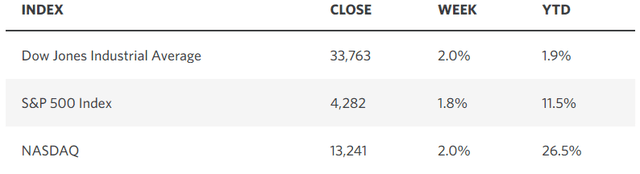

Last week was another strong showing for the bulls. The S&P 500 is now just a few points away from ending the bear market with a close above 4,292. Historically, most bear markets have ended in October, and this one looks to be no different. With the drama of the debt ceiling behind us, incoming economic data continues to show an economy that remains resilient, albeit slowing to just the right degree that inflation continues to recede. It looks to be what I have been calling a soft landing since the fall of last year. We saw a perfect example of this in Friday’s jobs report, which is why the Dow Jones Industrial Average soared more 700 points on Friday, as the stock market rally broadened significantly.

Edward Jones

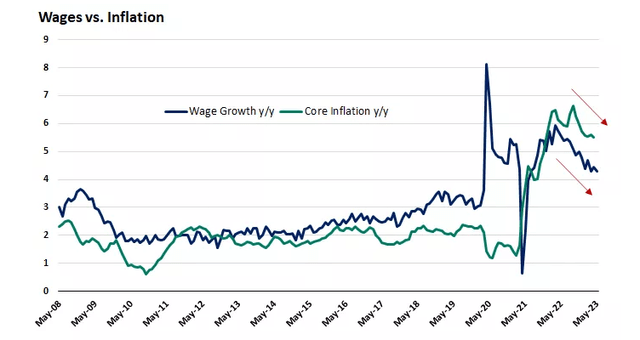

The economy continues to add jobs at a healthy base, as evidenced by the 339,000 in May, while the unemployment rate is creeping higher, which is partly due to more prime-age workers entering the labor force. Meanwhile, job openings have fallen by two million over the past year, job postings are in a gradual downtrend, and weekly unemployment claims have inched higher. For these reasons, we are seeing a slower rate of wage growth, which is music to the Fed’s ears. Wage growth fuels inflation, and its downward trajectory suggests that the rate of inflation will continue to fall. This is why investors expect the Fed to pause at its meeting next week, and it is why I believe the rate-hike cycle is over.

Edward Jones

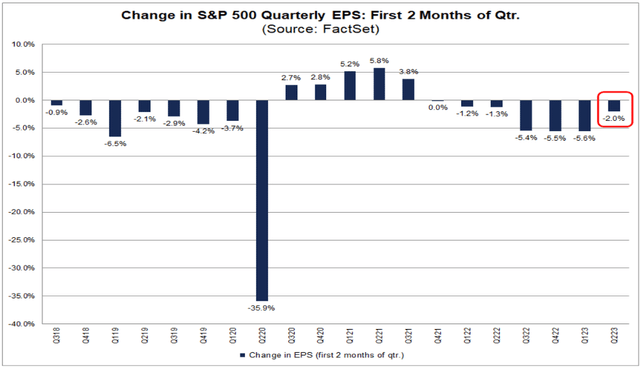

Friday’s goldilocks jobs report was not the only reason stocks performed well. I talk a lot about rates of change in my analysis, because my father taught me many years ago that the rate of change is always more important than the absolute number when it comes to markets, especially when we are at inflection points. According to FactSet, after reducing estimates during the first two months of each upcoming quarter in each of the past seven quarters by an increasing percentage, analysts have lowered their estimates by a significantly smaller margin. This looks like an inflection point, and it is not for just the upcoming quarter.

FactSet

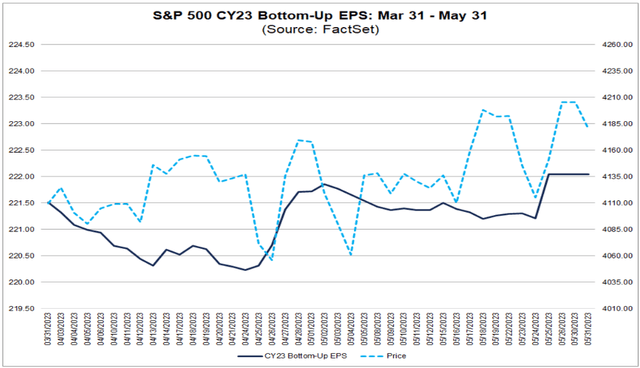

At the same time, the consensus bottoms-up estimate for 2023 has started to rise after bottoming in April. The inflection point came in April in what is another positive rate of change. The S&P 500 index has been trending up with the increase during April and May. We are seeing a similar uptrend, albeit very modest, in the estimate for 2024. It appears that the earnings recession is coming to an end with far less damage than the bears were expecting.

FactSet

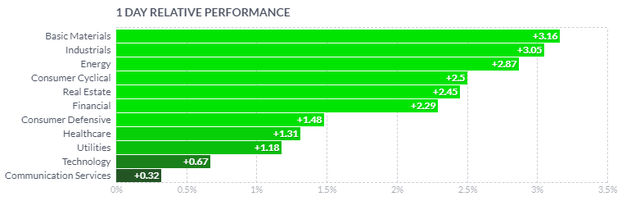

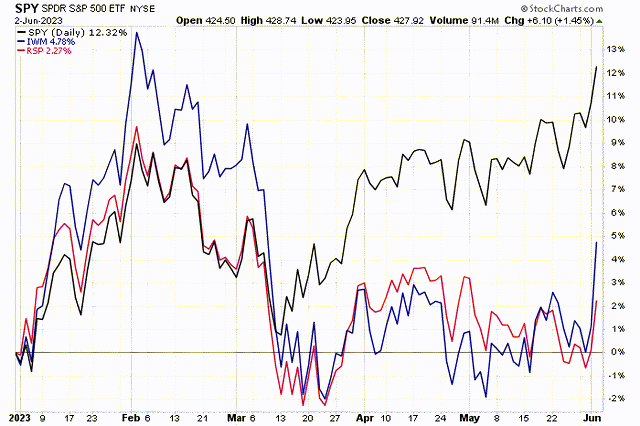

One of the most notable developments on Friday was the significant outperformance of the average stock over the largest technology names that have been driving the major market indexes higher this year. The Russell 2000 index of small-cap stocks, which is more domestically focused, had a breakout day with a gain of 3.6%. The equal-weight S&P 500 index outpaced the gain of the market-cap weighted index with cyclical sectors leading the way, while technology lagged behind.

Finviz

This should be the theme of this bull market moving forward, as the mega-cap technology names consolidate their gains of the past three months and the rest of the market plays catch up. I suspect many bullish investors feel like they have owned the wrong stocks this year, but patience should be rewarded on this front as this theme plays out.

Stockcharts

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Read the full article here