Nationwide Nasdaq-100 Risk-Managed Income ETF (NYSEARCA:NUSI) became popular last year as a covered call with a twist. The fund employs an options strategy known as collar. This is a version of covered call where the option writer uses some of the premiums from call options sold to buy puts as an “insurance” in order to limit downside. On paper this seems like a great idea and conservative thing to do but in reality it rarely works.

There is no one way to build a collar position. One can set their position up in a variety of ways. For example, let’s say you want to write covered calls against a stock which trades for $100. You buy 100 shares of the stock, write calls at a strike price of $102 for a premium of $2 and buy puts at strike price of $95 for a price of $1. This would protect your portfolio from drops below $95 while the options are still active. Alternatively you could write calls at $100 and collect more premium and set your protective puts at $90 instead of $95. This time you are collecting more premium, buying cheaper puts but you are also capping all of your upside.

Here is the biggest problem with collars. By their nature, covered calls already give up most or all upside for a call premium so they have the propensity to underperform during bull markets as it is. When you are adding a put to the mix, you are giving up even more of the upside by giving a portion of the covered call premium.

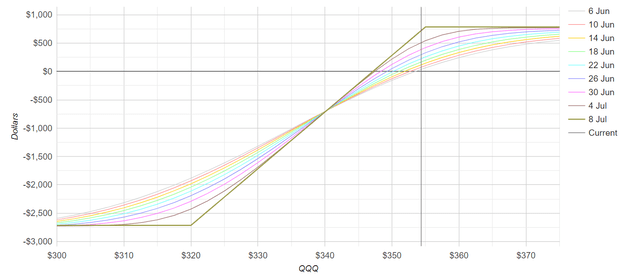

NUSI typically sells monthly at-the-money covered calls on Nasdaq 100 index (QQQ) and buys protective puts at a strike price which is 10% below the current price. So if we were to replicate NUSI’s position for next month, we’d be buying 100 shares of QQQ, selling QQQ calls at $355 and buying QQQ puts at around $320. We’d be collecting a premium of $7 from our call and spending about $1 on our protective put. Our profit loss graph would look as below.

optionsprofitcalculator.com

A few observations, since the fund buys puts at a strike price 10% below the current price, protective puts wouldn’t really kick in unless the fund dropped 10% or more during the next month. If the market dropped anywhere from 1% to 9% in the next month, the fund would suffer all the losses and protective puts would expire worthless, offering no protection.

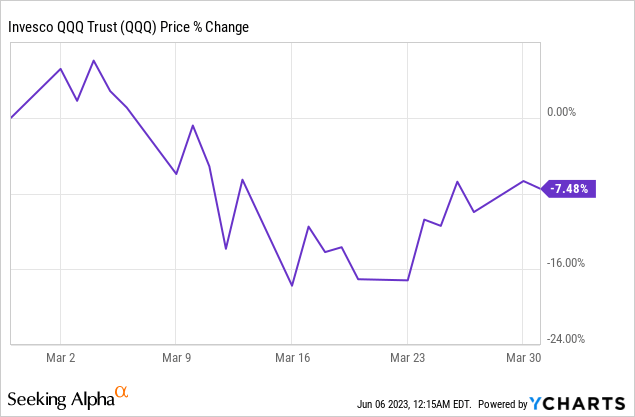

Since protective puts only kick in if Nasdaq drops 10% or more in one month, we should look at how often Nasdaq drops 10% in one month. It turns out that in the last 10 years (120 months) we’ve had only 2 instances where Nasdaq dropped 10% or more in one month and both instances happened last year. In April of 2022, Nasdaq was down -13.60% and in September of 2022 it was down -10.70%. Other than that we found 2 instances where it was down -9%, 4 instances where it was down -8% and 1 instance where it was down -7% on monthly basis. During the COVID-19 crash of March 2020, Nasdaq dropped more than 20% at one point but it was actually only down -7.48% in the month of March (from March 1st to March 31st).

So in the last 120 months we had only 2 instances where Nasdaq dropped enough to trigger NUSI’s monthly protective puts. In last September’s drop of -10.70%, NUSI’s protective puts would barely kick in and offer very minimal protection and in last April’s drop of -13.60%, it would have offered a protection of about 3.6%.

Yet NUSI pays about $1 per month on protective puts on QQQ. It may not sound like much but that’s $12 per year and $36 for 3 years which roughly corresponds to 10% of QQQ’s total value. Considering that the fund is already giving up virtually all upside by selling covered calls, this will reduce the fund’s performance even more.

Think of this like paying a huge premium for an insurance policy that also happens to have a huge deductible and isn’t likely to kick in except for extreme cases.

To make this even more simple, let me give this example. Let’s say you are paying 1% of your portfolio’s value every month for insurance against a crash. In other words you are paying 12% per year to protect your portfolio every year and 36% every 3 years. Assume that you are fully protected and there is no “deductible”. In order for this insurance to make sense, the market has to crash (on average) at least once every 3 years and the size of the crash would have to be at least 36%. If the market crashes every 4+ years or if the average market crash’s size is less than 36%, this insurance policy wouldn’t make sense to buy.

If you keep paying $1 a month for insure your QQQ share for a period of 5 years, you will have paid about $60 in total to protect your share. At the end of 5 years, if QQQ doesn’t crash at all, you are out $60 in insurance money (which is 20% of QQQ’s value) so you already paid for a crash that didn’t happen. In other words the “crash” you were trying to protect yourself against already happened in your portfolio. Let’s say QQQ dropped 20% during this period but it dropped in slow motion. Well, your protective puts still didn’t kick in and now you are down 20% in QQQ plus another 20% in protective put money. Of course you’ve collected some money in covered calls so you are not completely out but you did worse than you would if you didn’t have protective puts.

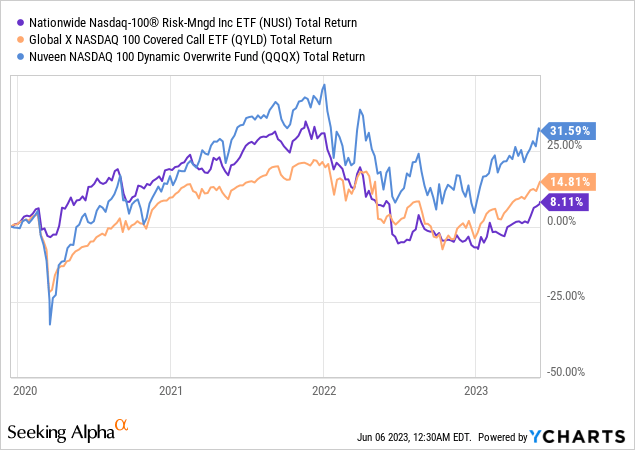

NUSI has been around for a little over 3 years and it’s total return during this time is 8% which is about 2.5% annualized. During this time, Global X NASDAQ 100 Covered Call ETF (QYLD) had a total return of 15% and Nuveen NASDAQ 100 Dynamic Overwrite Fund (QQQX) had a total return of 32%. While QYLD’s performance wasn’t impressive either, it was better than NUSI’s and the performance of another Nasdaq-based covered call fund QQQX was better than the other two funds combined.

If the market were to crash 20% tomorrow, NUSI would suddenly outperform its competitors but how often do those crashes realistically occur and is it worth paying a monthly “insurance fee” for many years for an event that is so rare and unlikely to happen that your insurance premiums over the years will total up to be bigger than the crash you are being protected against?

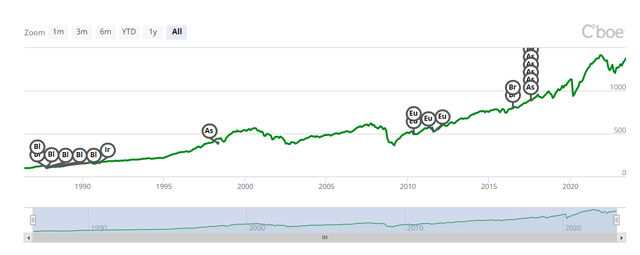

There is another collar approach that seems to work better. Cboe (CBOE) has an index called Cboe S&P 500 Zero-Cost Put Spread Collar Index which has been around since 1986. The index has returned about 1400% since its inception (8% annualized). How does this index do it? It buys put-spreads at 2.5%-5% of the current price instead of buying puts which is vastly cheaper and the protection kicks in much sooner than NUSI’s protective puts do.

Cboe S&P 500 Zero-Cost Put Spread Collar Index (CBOE)

So instead of buying QQQ $320 puts for $1, you are buying $345-340 put spreads for $1 and you are at least partially protected if QQQ drops just a few percentage points. This method seems to have outperformed NUSI’s method.

Investors interested in covered call funds can probably do much better in other funds than NUSI including QQQX, JPMorgan Equity Premium Income ETF (JEPI) or Global X S&P 500 Covered Call ETF (XYLD).

Read the full article here