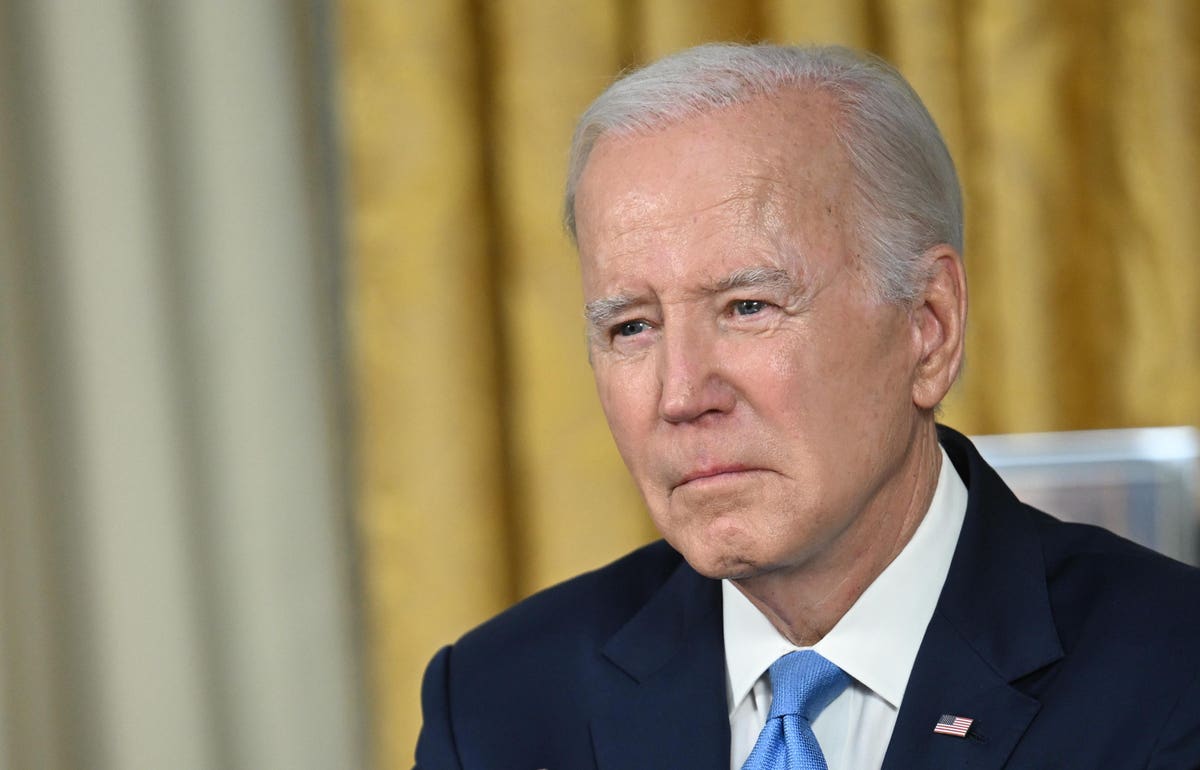

The Supreme Court is poised to rule on President Joe Biden’s student loan forgiveness plan in the next few weeks. Based on how oral arguments went in February, a majority of the court could be looking to strike down the program. But if that happens, borrowers will still have other potential paths to loan forgiveness.

Here’s what you need to know.

Supreme Court Decision On Biden’s Student Loan Forgiveness Plan Expected Any Day

Biden’s mass student loan forgiveness plan unveiled last summer would provide billions of dollars in debt relief. Most federal student loan borrowers with incomes under $125,000 (or $250,000 if married-filing-jointly) could receive up to $10,000 in loan forgiveness, although that figure could increase to $20,000 if they received a Pell Grant.

But no one has received loan forgiveness under the plan yet. The Biden administration had approved 16 million borrowers for relief in the weeks following the release of the application portal. But federal courts suspended the program in response to legal challenges, which ultimately made their way to the Supreme Court.

At a blockbuster hearing in February, a majority of justices on the court appeared ready to strike down the program. However, questions remain about whether the challengers who brought the lawsuits have standing to sue — meaning they can demonstrate a concrete harm sufficiently linked to Biden’s debt relief plan. If the court determines that the challengers have no standing, the plan could survive.

A decision is expected by the end of June.

IDR Account Adjustment Offers Alternative Path To Student Loan Forgiveness

While billions of dollars in student loan forgiveness is at stake, the Supreme Court is only considering the legality of Biden’s one-time debt relief plan. Other student loan forgiveness and relief initiatives by the Biden administration are not facing Supreme Court legal challenges. Congressional Republicans had tried to limit the administration’s other student debt relief plans through legislation, but Biden managed to keep these restrictions out of the recent debt ceiling bill, allowing these programs to continue moving forward.

One of the most significant of these initiatives is the IDR Account Adjustment. This one-time program will offer borrowers the opportunity to receive retroactive credit toward loan forgiveness terms under Income-Driven Repayment (or IDR) plans, as well as toward Public Service Loan Forgiveness (PSLF). Some borrowers will start receiving loan forgiveness under the initiative as soon as this August, regardless of how the Supreme Court rules. Many other borrowers can start receiving benefits under the program next year.

The Education Department recently released massive new guidance for the IDR Account Adjustment, providing new details on who can benefit and what borrowers must do to apply.

New Income-Driven Repayment Plan For Student Loan Borrowers Is Coming

The Biden administration is also finalizing a proposed overhaul of IDR, beyond just the one-time IDR Account Adjustment. The Education Department released new regulations earlier this year that would fundamentally change the Revised Pay As You Earn (REPAYE) plan, one of the current IDR options.

The new version of REPAYE would reduce monthly payments for millions of borrowers by up to 50 percent compared to current options. The proposed changes would also shorten the path to eventual loan forgiveness, curtail runaway interest accrual, and expand flexibilities for married borrowers. Some observers have argued that in the long run, the REPAYE overhaul could end up being even more generous to borrowers than Biden’s one-time student loan forgiveness plan.

The Education Department is still in the process of finalizing the regulations governing the REPAYE overhaul. The benefits should start to be available to borrowers sometime in 2024.

Student Loan Forgiveness Through PSLF Will Get Easier

The Public Service Loan Forgiveness program — commonly referred to as PSLF — remains one of the most popular federal student loan forgiveness programs. Temporary PSLF flexibilities implemented by the Biden administration have already resulted in billions of dollars in student loan forgiveness this year.

In addition to the extended one-time PSLF flexibilities offered by the IDR Account Adjustment, the Biden administration will also be launching new PSLF regulations this July that will ease some of the longstanding restrictive rules that blocked many borrowers from relief in the past. These new regulations will relax some of the requirements defining qualifying PSLF payments and qualifying employment, and will provide a clearer and more streamlined process for borrowers to apply for loan forgiveness and appeal erroneous determinations.

New Regulation For Other Student Loan Forgiveness Programs

Updated regulations governing other federal student loan forgiveness programs will also go into effect this summer.

New rules for Borrower Defense to Repayment — a loan discharge program for borrowers defrauded or misled by their school — will provide tangible benefits. The Education Department is expanding the definition of school misconduct that can be the basis for debt relief, and creating a more borrower-friendly application process. This should result in more borrowers qualifying for, and ultimately receiving, loan discharges under this program.

New regulations governing the Total and Permanent Disability (TPD) discharge program will eliminate cumbersome post-discharge income monitoring, which historically has resulted in thousands of borrowers having their previously-discharged loan reinstated. The new rules will also automate and streamline discharges for some borrowers receiving Social Security benefits, and will expand the pool of medical providers who can certify that a borrower is disabled.

The rules will also make it easier for the Education Department to automatically cancel federal student loans for groups of borrowers simultaneously, such as if their school closes or if their school falsely certified their eligibility for federal student aid.

Further Student Loan Forgiveness Reading

The Student Loan Pause Is Actually, Really Ending — 6 Key Dates And Details

These Democrats Just Joined Republicans To Repeal Student Loan Forgiveness

If The Supreme Court Rejects Student Loan Forgiveness Plan, Biden Could Do This

Student Loan Forgiveness Eligibility Expanded In 3 Ways Under New Account Adjustment Guidance

Read the full article here