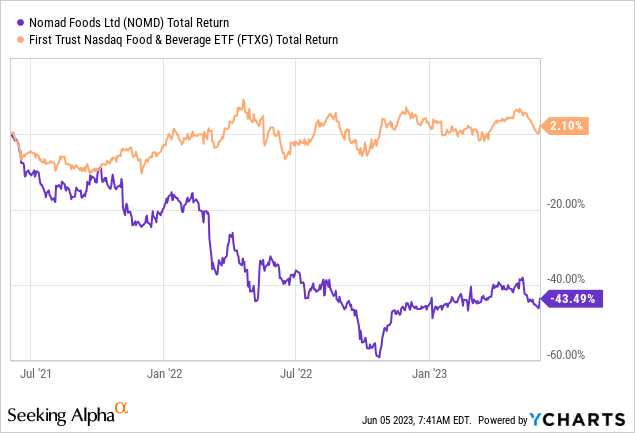

Since hitting a peak of over $31.60 per share two years ago, shares of Europe-focused frozen food company Nomad Foods (NYSE:NOMD) have suffered a significant reversal in fortune, declining by around 45% in that time and materially underperforming the company’s peer group.

While Nomad has been grappling with downward pressure on profit margins, the chief problem here is that the stock has suffered a fairly significant de-rating of its valuation multiple amid turbulence in the business post-COVID.

As a result, these shares now trade on a historically low EPS multiple. With organic sales growth trending positive, margins stabilizing, debt refinanced and earnings growth targets affirmed, these shares look like an enticing value pick in the consumer staples space. Buy.

A Brief Look At Nomad

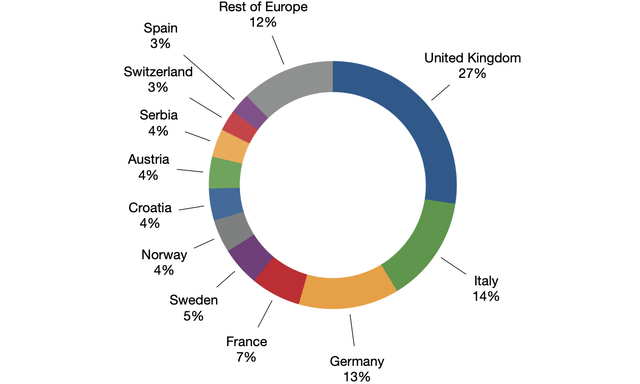

Nomad owns a number of frozen food brands in Europe, including Birds Eye, Findus, Iglo, Ledo and Goodfella’s. These names may not mean much to US-based readers, so think frozen fish, ready meals, vegetables, pizzas and ice cream. Nomad’s brands are ubiquitous in Europe, with a household penetration rate of around 65% in its top five markets (UK, Germany, Italy, France and Sweden).

Nomad Foods 2022 Sales By Country

Data Source: Nomad Foods FY22 Annual Report

The company principally sells its products to large European grocery stores like Tesco (OTCPK:TSCDY), J Sainsbury (OTCQX:JSAIY) and Carrefour (OTCPK:CRRFY). Nomad’s top ten customers in terms of sales accounted for just over one-third of the company’s top line. Said differently, Nomad is a fairly boring business, but it is also one with fairly dependable and recurring cash flows.

Post-COVID Hangover

COVID was good for Nomad’s business. Strict measures were enacted in its European markets to reduce transmission, which meant consumers spent much more time in their homes. This was a boon for grocery store sales in general and for long-lived food categories like frozen in particular. In 2020, Nomad increased both its sales and adjusted EBITDA by 8% on a flat 18.6% margin. That propelled the stock to a 2021 high of around $31.60 per share, which was equal to a then valuation of around 19x prior-year adjusted EPS.

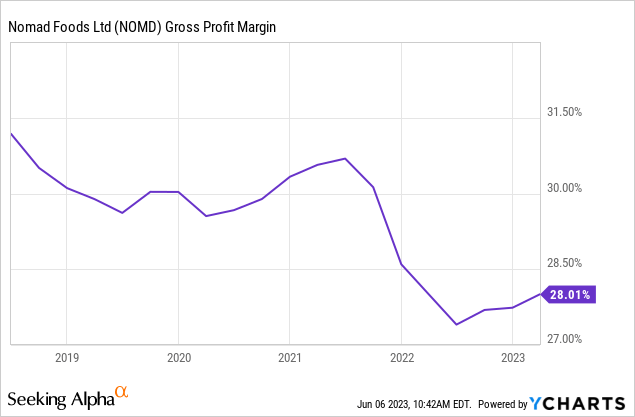

The macro environment since then has been more difficult for the company. Firstly, there was a slowdown in organic sales and earnings growth against the tough COVID comp. Secondly, inflation has also put significant upward pressure on raw materials and other expenses like wages, and that has led to a degree of margin contraction. Adjusted gross margin was 27.7% last year, down 120 basis points on FY21, while adjusted EBITDA margin of 17.8% was down 90 basis points year-on-year.

Several Reasons To Remain Bullish

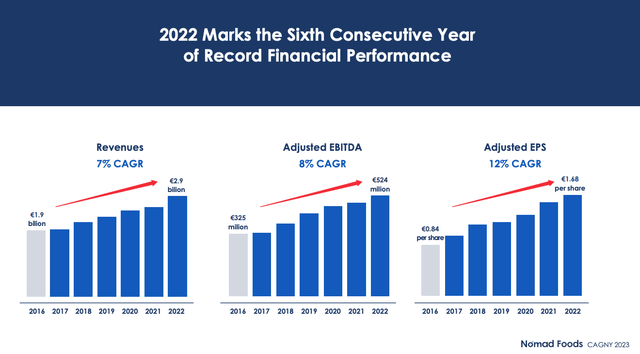

There are a number of reasons to remain bullish despite the steep share price decline. Firstly, sales and earnings have been growing in absolute terms, albeit this is due in large part to the acquisition of Fortenova Group (a Balkans-based frozen food group) in late 2021. Organic sales growth was also positive last year, increasing by 1.8%.

Nomad Foods: Annual Sales & Adjusted EBITDA

Source: Nomad Foods 2023 CAGNY Investor Presentation

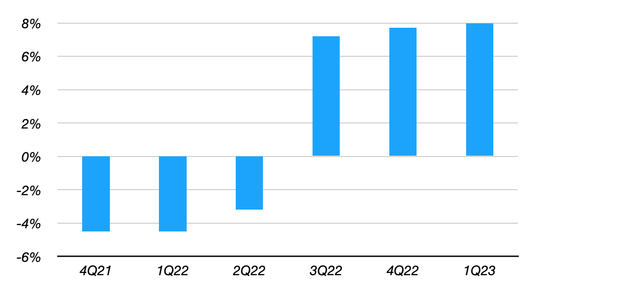

Secondly, as per below, organic sales growth has now been trending positive for several quarters in a row. Organic sales growth was 8% in Q1 FY23, with a mid-teens increase in price more than offsetting a 7.1% fall in volume/mix.

Nomad Foods: Quarterly Organic Sales Growth

Data Source: Nomad Foods Quarterly Earnings Releases

Management also expects profit margins to stabilize this year as inflation moderates and price hikes feed through to the company’s financials. As the CFO stated in response to analyst queries on Nomad’s gross margin performance:

No, we maintained the guidance, which is effective about flat margin for the year. The bump we had in Q1 was expected and is going to then deliver. I mean, it’s going to lead us to deliver in line with expectations on that.

Samy Zekhout – CFO

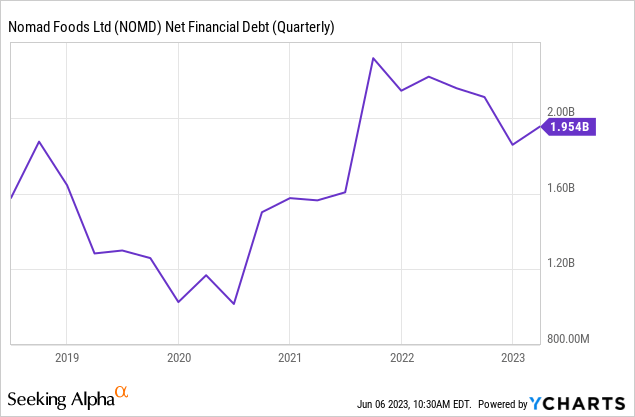

Thirdly, debt was refinanced last year. Nomad’s debt load is fairly significant, with Q1 FY23 net debt of €1.79B equal to around 3.4x FY22 adjusted EBITDA and 5.9x FY22 net operating cash flow, respectively.

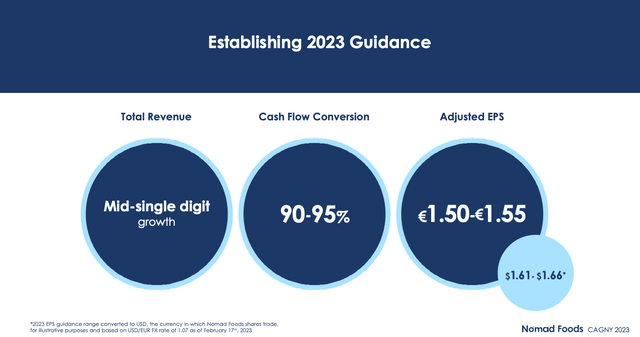

Following its refinancing, Nomad does not face any debt maturities until mid-2028. Even on a flat FY22 free cash flow margin (7.6%) and zero revenue growth, Nomad would generate around €1.5B in cumulative free cash flow in that time. In reality, this is likely too conservative because it is unlikely that the company will not be able to grow its revenue over the next five years. Indeed, FY23 revenue is guided to grow mid-single-digits, while management is targeting a revenue CAGR of the “high end of low single-digits” per annum out to FY25. On a 90-95% cash conversion target, this applies growing annual free cash flow.

Source: Nomad Foods 2023 CAGNY Investor Presentation

Finally, management also reaffirmed FY25 fiscal targets at the end of last year in response to analyst questions. These targets include annual FY25 EPS of €2.30, which at the current EUR/USD exchange rate would work out to around $2.46 per share:

To make it simple, we are still on track operationally for 2025.

Stefan Descheemaeker – CEO

That would represent EPS growth of approximately 50% compared to FY23 adjusted EPS guidance of €1.52-€1.55, which implies that stock buybacks will be resumed before then. Nomad suspended its prior buyback program in the first half of FY22 in response to the deteriorating operating environment. Resuming it would provide support for the stock.

Nomad Foods Stock Is Cheap

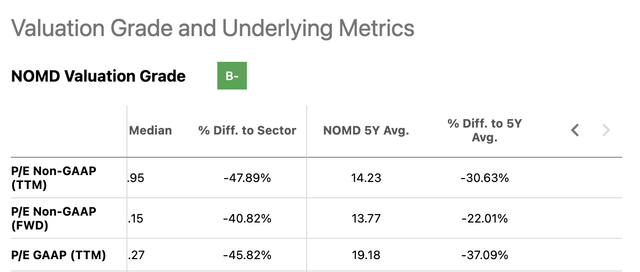

Nomad Foods stock trades for $17.65 each at time of writing, putting it at 9.8x FY22 adjusted EPS. Its current valuation is materially below average levels over the past five years as per Seeking Alpha:

Source: Seeking Alpha

I expect this to be a source of upside over the next couple of years, with its valuation moving back toward its five-year average as profit margins recover and share buybacks resume.

While multiple expansion forms part of the bull case, it isn’t necessary to generate attractive shareholder returns. If management hits its FY25 adjusted EPS goal then even a 10x EPS multiple would lead to a share price of $24.60, which implies a 40% total return in under three years. Buy.

Read the full article here