Investment Summary

There’s been two additional updates in the Enhabit, Inc. (NYSE:EHAB) story since my last update and thus I wanted to check in to examine what might have changed for the benefit of investors. As a reminder, EHAB is a carve-out of Encompass Health (EHC), having listed in June last year. It is a fruitful exercise to check in on its progress since then as well.

As one can plainly see, performance since listing is yet to be realized. Just as Men at Work sang, EHAB is heading to a land ‘down under’, and unless something changes, I cannot recommend EHAB to my clients as a strong buy at this stage, even with investment criteria as:

- Flat long-term momentum, trading below 100DMA and 200DMA;

- Growth strategy on full display, adding de novos is the go, and management are aiming for another 10 in FY’23;

- Free cash flow of $20mm YTD, run-rate of $80mm if continued.

Net-net, there isn’t sufficient evidence to suggest there’s been a change in fundamentals or sentiment, thus it would need a very tidy multiple to go by, but at 20x forward earnings I’m not ready to pay this kind of premium for the headwinds discussed in this report. For the benefit of investors, I’ve summarised the critical facts pertaining to EHAB going forward, with relevant discussion on valuation at the end. Reiterate hold.

Figure 1. EHAB performance since listing

Data: Updata

Discussion of critical facts

The firm reported Q1 FY’23 earnings midway last month. Since then, the price response has been notable, with a spike off 52-week lows. Difficult to know if this is just plain old deep value players ‘scooping up a bargain’, or if a positive post-earnings drift.

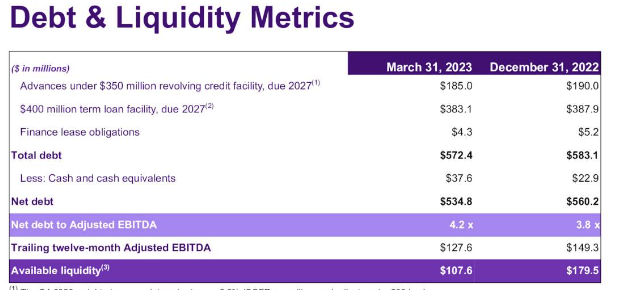

Leverage and Liquidity

Looking at the quarter, there was discussion around potential drains and pulls on liquidity, which is worth explaining first.

Specifically, there are two identifiable points:

- Leverage Ratio:

- EHAB, in the closing quarter, recorded a net leverage ratio of 4.2x, narrowly below the stipulated credit agreement requirement of not exceeding 4.75x. This is telling. Given the macro-climate, it is absolutely critical to maintain a manageable level of debt to safeguard the balance sheet. Hence, I would expect the company to address this promptly, to avoid a negative reaction to the current rates regime. I wouldn’t overlook this point either. There is evidence of firms getting into strife with interest payments, and a handful of companies on the NYSE are even ‘zombie’ companies, that require new debt service for their own existing debt. Not suggesting EHAB is the case here, but it is now a different landscape, so leverage needs to be contained.

- In that vein, if I was to put forward my view, the focus for EHAB should be on adding more pre-tax earnings, to exert a more significant influence on the leverage ratio. However, you can expect a challenging period in FY’23 on the growth front, given a high comps period last year, amid other pressures to growth.

- Liquidity:

- In total, at the end of Q1, EHAB had $107.6mm liquid, with another $37.6mm in cash on the balance sheet. Maintaining adequate liquidity is essential anyway, but in my view, it would be equally as prudent for EHAB to maintain its cash reserves to navigate the current market, especially as contingencies arise (think of all the surprises over the last 3 years).

- Management believes the $107mm is sufficient runway for the next 2-years. Still, the current ratio of 1.6x and debt ratio (ex-goodwill on the asset side) of 0.53x must improve in order to attract investment. It is an issue in my view, because profitability is a difficult mountain to climb when trailing interest expense is 32% of operating income.

Figure 2.

Data: EHAB Investor Presentation

So you’ve got the higher gearing and the EBITDA challenges. As the CFO mentioned on the call, “this shift pressures our leverage ratio”, and thus will require prudent capital budgeting going forward.

Plus that large expense, along with other liabilities, leaves less room to grow or expand because any money that does come in is consumed back into the business, instead of being reinvested into new growth opportunities, or returned to investors via earnings growth, dividends, or buybacks.

Alas, there are several investment implications arising from this. It would be wise to think of these points if keeping EHAB in your watch list moving forward, let alone buying the company. One might consider these two factors:

- EHAB must vigilantly monitor and work its leverage ratio to ensure compliance with credit agreements. To mitigate the impact of the expected decline in the trailing 12-month calculation, as mentioned, I believe it must prioritize growing that EBITDA line. This would directly attack that leverage position and bring it back into acceptable range.

- In that vein, I would also like to comment on what I am not seeing in EHAB at this given point in time. Given the anticipated challenges in the coming quarters, I would expect EHAB to be more focused on strategic planning on how to resolve the critical issues. It is growing via acquisitions, noted, but what I am not seeing is language which underscores long-term thinking, evidence of a durable competitive advantage, and the acquisitions pull through to growth.

Hence, any change to these factors would be something to take note of. You would see this in growth down the P&L and the market throwing a bid EHAB’s way, indicating the change in sentiment. Yet, there’s none of that, and there’s been 4 earnings revisions down in the last 3-months. This is something to consider on the sentiment side.

P&L, Divisional Takeouts

Now moving on to the positives, and there were a few, these center around EHAB’s financials in Q1. Findings from my analysis have implications on the company’s outlook going forward, especially on the intrinsic valuation front. It pulled in $265mm in quarterly revenue on $25mm of adj. EBITDA and $0.05 in earnings. Both the home health and hospice segments performed well, booking growth in admissions.

- Staffing improvement and capacity constraints

- EHAB has shown improvements in staffing, as indicated by the 50bps sequential decrease in the full-time vacancy rate (“FTVR”). From a high-level view, the company’s efforts in completing staff orientation and ramping up patient caseloads look to have positively impacted staffing levels. EHAB ended the quarter with only 4 hospice locations at capacity constraints, and 71 in home health. It is worth noting that 24% of these locations resulted from growth to new census levels. To address this, management said it has posted new physicians in these locations to enhance core staffing.

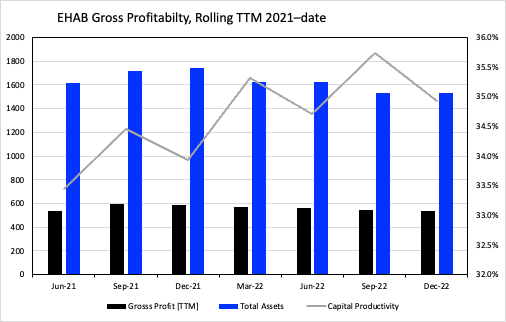

- Cost optimization and productivity

- I would also opine that productivity gains are starting to pull through for EHAB as well. In its home health division, the company achieved a 4% sequential decline in cost per visit from the fourth quarter of 2022. Improvements were put to productivity gains, as evidence of what I mentioned earlier. However, EHAB experienced a 2.3% YoY increase from Q1 FY’2022 in its home health cost per visit. While this increase might seem concerning, it was underscored by improvements in a number of domains (such as clinical productivity, contract labor, and employee group medical claims). Meanwhile, you can see the firm’s gross capital productivity ratcheting higher since listing, now resting at 35% from 33% 2-years ago. This tells me it is generating $0.35 in gross from its entire asset base.

Figure 3.

Data: Author, EHEAB SEC Filings

Progress and Growth Strategy

I wanted to make a few comments on the firm’s growth route, and where capital is being diverted to achieve this. EHAB has made multiple acquisitions since its new listing. In March, the company acquired a home health agency in Indiana, continuing its strategy to buy growth. Furthermore, with its de novo strategy, it opened 2 hospice de novos in Q1, and reports to have increased survey activity at other sites already in Q2. This progress is crucial as EHAB aims to open 10 de novo locations this year, clear evidence of this growth strategy.

Hence, with this growth route in mind, the implications for EHAB include:

- The potential for revenue growth through payer innovation;

- The importance of staffing and retention for sustained growth;

- The need for cost management and efficiency to optimize financial performance.

I believe the company is part-way there and there’s plenty of evidence of this in its latest numbers.

One, EHAB has made progress in payer innovation in my view. You find this evident in the executed agreement with a national payer and deals with 2 conveners. Simple analysis shows these agreements can enhance EHAB’s accessibility for patients, allowing the company to accept patients it historically had to decline, effectively broadening its market. Hence, this is where the investment may payoff for the firm, in opening up the potential scope of patients it can provide service too. In that vein, the symbiotic implications of these partnerships are to improve patient access to home-based care, and potential revenue growth for EHAB.

Two, the improved FTVR level and reduced vacancy rates are crucial for its growth strategy. Last few years due to Covid-19, many providers got caught out on the labour front, and had to take it on the chin with respect to margins and OpEx. Not only that, there was a demand component, in that missed demand by not normalizing patient turnover levels back to pre-pandemic range. With the opening of new locations, it will be required for the company to continue prioritizing staffing and retention efforts to avoid capacity constraints and ensure quality care delivery. Hence, by focusing on recruiting and retaining clinical staff, EHAB would ensure it has the necessary workforce to meet the increasing demand for services. Very important moving forward.

Three, EHAB also implemented a case management model in its hospice segment, resulting in a $9 YoY increase in cost per day to $77. Sequentially, the price per day in hospice increased by 400bps, mainly due to the impact of fixed costs associated with the case management model. EHAB acknowledged these costs are needed to drive recruitment, retention, referral sources, and that kind of thing, however, I’d be watching this closely because I’m not sure the increase in cost/day was intended to be as drastic. Nevertheless, there may be some merit to this, when thinking in first principles.

Collectively, you can see where the effort and capital are going to push EHAB down its growth stream. However, it needs more than a gentle push to attract serious investment in my opinion.

Market factors

There is also encouragement found in the underlying economics of EHAB’s end-markets, should it successfully convert on its opportunities. As you’ve gathered, the firm operates in the hospice and home-health markets, two meticulously integrated segments that serve critical function within society. In my opinion, combined with its growth strategy above, the state of its playing field is critical in determining what’s possible for the company going forward.

Key findings from my deep dive on the global hospice and home health markets follow. Both are high growth avenues looking forward and thus consequently could be markets investors seek to position against, given the interesting economics on show.

According to multiple reports, the global hospice market is expected to grow substantially in the coming years. The market size is projected to increase from $76.14 billion in FY’23 to $117.69 billion by FY’28, representing a CAGR of 9.10% into that period. It appears this to be driven by two major factors, namely:

- Increasing geriatric population. As people age, the need for specialized end-of-life care and support services, such as pain management, emotional assistance, and palliative care, and so on.

- Governments are also allocating larger budgets to healthcare, including hospice care. In Australia for one example, a high income nation, the Medicare system subsidized AUD$390 per patient in palliative care in FY’19, with an average of 4.8 different services per patient annually. Hence, global budget spending is creeping up to support these trends.

Research also suggests growth will be obtained in three critical areas, presenting opportunities in nursing services, home care settings and acute care. Unsurprisingly, this is one reason we are seeing names like EHAB focus heavily on nursing service providers, and complementing its offering via its home health business.

That segues into findings on the home health market, that is itself poised for a reasonable route heading forward, driven by several factors. Forecasts indicate a geometric growth range of 8–11%, and reach $505Bn by FY’30. That is an enormous size and could be profitable if done right.

Just like the hospice industry the aging population is expected to have an impact here as well. In addition, the rapid advancement of technology and integration of things like AI could play a pivotal role in transforming the home health landscape. Innovations in segments like telemedicine, remote monitoring devices, and wearable health trackers enable physicians to consult remotely via a hub and spoke model, versus a one-way funnel. In short, if EHAB can get it right, there are two high-growth markets it has potential to put capital to work in.

Valuation and conclusion

It is difficult to advocate a screaming buy even on the speculative front when you’re asked to pay 20x forward consensus earnings for questionable earnings growth going forward. This is above the sector’s 19x. Further, the stock is priced at 0.9x book value, but at the same time, priced at negative 1.32x tangible book value (if there is such a thing). Point is, a bulk of the asset and equity value underpinning EHAB as a going concern is tied up to goodwill – 75% of total assets at the end of Q1. So the question is what are we really buying in EHAB, and how to value that.

At the current market cap of $612mm, and a discount rate of 12%, the market expects $73.5mm in pre-tax earnings from the company (73.5/0.12 = 612), which is actually a step back from the trailing figure of $76mm, and off its FY’22 $98mm. This, along with the expensive market multiples, supports a neutral view in my opinion.

The above findings are telling. The market expects less from EHAB going forward, suggesting a potential further pricing lower. Question is, is there reason to deviate from investors’ consensus?

In my informed opinion, I believe the market has it just about right. For one, 20x forward earnings is just too much of a stretch, even for some of the best of companies. It just isn’t worth it on the payback front. Second, the market is a fairly accurate judge of fair value over time. If that’s the expectation, and it could be within a range, then it tells me that opposing data better be pretty compelling to fall out of range with consensus. At this point in time, I am not convinced, despite the outlook for hospice and home health. Finally, the opportunity cost factor comes into play, and to allocate capital here right now, would be to miss more of the endless golden opportunities presented to us on a daily basis. Net-net, reiterate hold.

Read the full article here