Shoals Technologies Group (NASDAQ:SHLS) stock price is up 30% since the 4th of May. The reason for this? A good set of results for the first quarter ended 31 March.

There is a lot to like about the business. It’s situated in a solar industry dominated by strong tailwinds, taking on the role of providing the key ‘plumbing’ infrastructure to support these positive forces. My outlook on renewables is rosy and I am optimistic about further innovation within the industry. This will lead to more disruption but Shoals’ moat is strong and they are willing to protect it (demonstrated by the recent patent infringement filing).

This article will walk through the Q1 results and the patent infringement filing, with a look ahead at what’s next for Shoals.

Quality or quantity? Why not both?

Since Dean Solon first started Shoals back in 1996, the focus has always been on quality. When competing against cheap Chinese labour and prices, quality allows Shoals to charge a premium. Its customers see that premium as justifiable because its solutions are longer-lasting, which delivers cost savings on both the installation and maintenance fronts. Quality as a focal point is embedded into Shoals’ DNA. An explanation of Shoals’ production process in a 2021 Forbes piece gives a good explanation of this:

Plant managers sit above the factory floor on a mezzanine platform Solon calls Pride Rock, after the prominent slab in The Lion King. They rarely get involved; teams help one another sort out problems, because if one person slows down for too long, the next in line runs out of parts. “Don’t yell at anyone; let them have a self-win,” Solon says. “I don’t need to squeeze another 10 seconds out of them. If the green light is on, we’re making money.”

Businesses can spend years building a foolproof manufacturing process, this will inevitably improve efficiency and reduce costs, but these processes can also easily be replicated, especially by foreign counterparts who have cheaper labour. Organisation culture on the other hand evolves over a long period of time and varies between firms. The above extract highlights why Shoals have been so successful; its focus on quality runs from the board room to the factory floor.

Customers prefer their solutions to Chinese competitors, and that was shown once again in the Q1 results. Demand was exceptionally strong. Revenue of $105M, exceeded expectations by $7.5M. On the bottom line, adjusted EBITDA was $36.1M. Both of these mark a significant improvement from the year prior. The cash balance was largely unchanged due to investment in working capital investments that will normalise going forward.

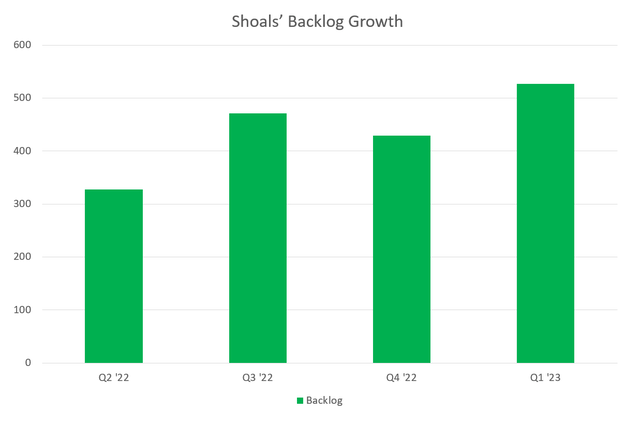

Backlog and awarded orders is a key measure of demand and can be used to assess the overall health of Shoals’ businesses. That grew sequentially from $428M to $527M, a 23% increase. $299M of this is for orders where they are in the process of documenting a contract but for which a contract has not been signed. Backlog likely has a high conversion rate because when customers engage with Shoals, that relationship starts to build and the solutions developed in the planning process become tailored to that project – pulling out can be costly for EPCs.

Compiled by author from accounts

Patent filing

Shoals holds many patents in order to protect its IP. The company’s IP is crucial to the success of business and ensuring its moat stays intact. The risks of under-cutting from foreign competitors is the largest risk facing the business. Therefore the success of the recent filing regarding patent infringement is important.

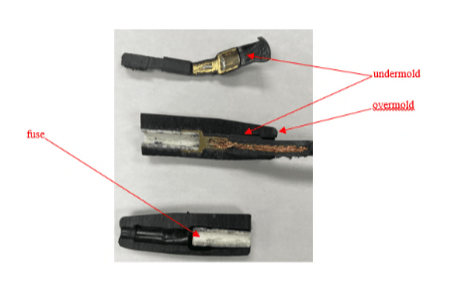

This filing is against Hikam America, owned by Hirakawa Hewtech, the Japanese electric products producer. Both infringements relate to connectors (patent ‘739), which are easier to transport, use and make up a more simplified configuration in a solar field. The connectors are a core component of Shoals’ Big Lead Assembly (BLA) offering and was invented by founder Dean Solon (awarded in 2020). The track document can be accessed here. An image of a part of the accused product is below:

Court docket for patent infringement filing (Bloomberg Law)

As per 31. of the complaint, Shoals has lost sales due to these products. So this case will be important to keep tabs on to see the willingness of ITC to protect Shoals and as a measure of how good the patents are.

Dean Solon Starts Create Energy

There has been substantial insider selling since Shoals listed in 2021. Most notably by Dean Solon, the founder, who owned 40% of Shoals on IPO and has since sold his entire stake in the business. Recently he announced his new venture – Create Energy LLC. There is little information available so far on what Create Energy will do, but nonetheless, it is worth keeping tabs on for Shoals shareholders.

Valuation and a look ahead

Management increased their guidance for the FY when Q1 results were released. Revenue is now expected to be between $480m and $510m, with adjusted net income expected to be $102M and adjusted EBITDA $160M. This would give Shoals a forward P/E of 40x on net income and 25x on adjusted EBITDA. Considering the current backdrop in solar, and strong tailwinds for EBOS, I believe Shoals can achieve the guidance figures and that they are not overplaying it. Jeff Tolnar is also the new interim CEO and it is unlikely he would increase guidance without the confidence that they can deliver on it.

This guidance is underpinned by the backlog – it usually takes between 9-12 months for awarded orders to be booked into revenues. Shoals leave the guided book to billing timings quite wide because it varies depending on the size of project and specific customer. CFO Dominic Bardos did note on the call that they may be able to pull or ‘sneak’ some of the Q1 backlog build increase into 2023.

At this point, we still have little information about how well the battery storage and EV solutions segments are performing. The opportunity in both segments is large. I discussed this in more detail in my last article. The share of revenue for non-solar revenue is likely minuscule. It does take time to get off the ground and with dedicated resources we should start to see some more traction. It was only in September that Shoals got UL certification for its eMobility solutions. Considering the success they have had in solar, I am optimistic about what they can do in new segments that are also growing fast with large TAMs. Shoals is a predominantly US-centred, solar-focused business. New markets, both internationally and in different products, will drastically improve prospects. An area to watch but will be a key lever to unlock shareholder value moving forward.

Jeff Tolnar (CEO) also noted on the conference call that Shoals will look further than just storage and eMobility:

When you look at the different opportunities fundamentally, what Shoals does is deliver electrons, whether it’s AC power or DC Power. We do it in a very efficient and effective ways, and we do it above ground. So whenever you think of a solution that requires electrons, and it has some kind of inhibition of digging or mounting in a landfill or whatever the case may be, Shoals is a perfect opportunity. Whenever there’s a one for many, that’s our big lead assembly. Our trunk and our caps off of that, Shoals has an opportunity.

The Bottom Line

Shoals stock does charge a premium, but considering the opportunities internationally for solar and domestically for EV and battery storage – I still believe it is a premium worth paying. The valuation isn’t too unreasonable when considering the strength of the core product and the additional growth opportunities ahead for the business. I maintain my buy rating following the Q1 results and am optimistic for the remainder of 2023.

Read the full article here