Thesis Summary

Following a 100% price increase, Bitcoin (BTC-USD) has sold off 20% since reaching local highs back in April. And yet, sentiment right now would suggest that we are getting ready to make new lows.

A lot of this negativity can also be attributed to the recent actions of the SEC against major exchanges.

And yet, the technical picture remains bullish, and what we have now is a good opportunity to buy BTC at support. This could break, and lower lows would follow, but the Risk/reward is good here for a long trade.

If BTC holds and a rally ensues, I expect altcoins to begin to outperform. Are you positioned for this?

Fear Is In The Air

Crypto is under attack, again, as I recently wrote about in this piece. The SEC has issued lawsuits against Binance (BNB-USD) and Coinbase (COIN); Binance and its CEO Zhao have been accused of running a “web of deception”, while Coinbase is under investigation for listing 13 crypto assets that should have been registered.

The reality of the matter is that the SEC has been very unclear on its crypto regulations, and at the very least Coinbase, has done everything in its power to comply with regulations. The company’s CEO well summarized this on Twitter:

1. The SEC reviewed our business and allowed us to become a public company in 2021.

2. There is no path to “come in and register” – we tried, repeatedly – so we don’t list securities. We reject the vast majority of assets we review.

3. The SEC and CFTC have made conflicting statements, and don’t even agree on what is a security and what is a commodity….

Source: Brian Armstrong

In any case, the effects of this debacle have been felt across the crypto industry, with cryptocurrencies selling off across the board.

With that said, looking at the larger picture, BTC has only given up a small part of its 2023 gains, and from a technical perspective, this sell-off was expected, and we are still well on track to continue an upward trend.

Technical Outlook Still Bullish

Let’s begin by zooming into the 4h chart.

BTC 4h chart (TradingView)

From an EWT perspective, we topped in March in a wave 1, inside a larger (3) not visible here. We have since formed a corrective structure that now looks like it could be complete. We have a completed ABC and we can even clearly see the five waves inside of C.

For the moment, we have rebounded just above $25,300, which is just above the 50% retracement of the wave 1. It is also exactly above the lower channel trendline and exactly at the top of an inverse head and shoulders neckline. This is more clear if we zoom out to the daily chart.

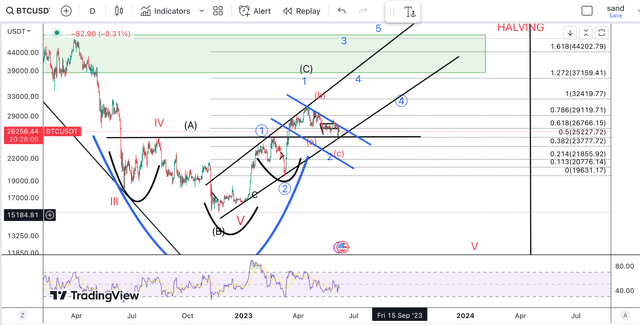

BTC 1D chart (TradingView)

We can make an argument that we have formed an inverse head and shoulders shown by the black curves. The black line is the neckline, and this is exactly where we have reversed. Holding above this keeps the momentum up.

From a charting perspective, we can also appreciate a cup and handle, which would also suggest a breakout to the upside.

And finally, it’s worth mentioning that we are still within the large channel we have formed since the bottom.

To sum up, why are you bearish here? The structure is still very much bullish. We are testing support, something that happens even in bull markets. This is a good opportunity to accumulate or enter a trade with a tight stop.

Having said that, if we do brake support then the 61.8% retracement at $23,300 is the next key support. Arguably, this would get the RSI on the daily chart back to the oversold levels that, in recent sell-offs, have led to strong reversals. If we break below support and quickly bounce back into the channel, then we could still count this as a fake-out. Of course, if we were to stay beneath $25,000 for an extended period of time, I would have to reconsider this more immediate bullish outlook.

It Won’t Just Be Bitcoin

Just on a side note, there’s also a lot of reasons fundamentally to be bullish on Bitcoin, but I have covered these extensively already. In short, I expect global liquidity will begin to increase soon.

To wrap up this article, I did want to alert you that I expect the next crypto bull run to be led by the altcoins. Bitcoin has outperformed so far this year, and I think a rotation into altcoins is beginning.

It is a consensus idea that altcoin usually begins with outperformance in Ethereum (ETH-USD), the largest altcoin there is. And what do we see in the ETHBTC chart?

ETHBTC (TradingView)

After forming a large wedge over the last few months, we have finally got a breakout in the ETHBTC chart. In other words, ETH is beginning to outperform, and the smaller cryptocurrencies will be next.

The right altcoins could provide investors with very high returns, and I cover these extensively for my subscribers.

Takeaway

In conclusion, now is the time to take a risk as Bitcoin hovers above support. If we break below, we might have to reassess, but this is not my primary expectation. The next step for Bitcoin is the $44,000 area, which is the 1.618 ext of the large wave 1, visible in the daily chart. However, I suggest you pay close attention to the alts. These are riskier but also offer a much higher reward.

Read the full article here