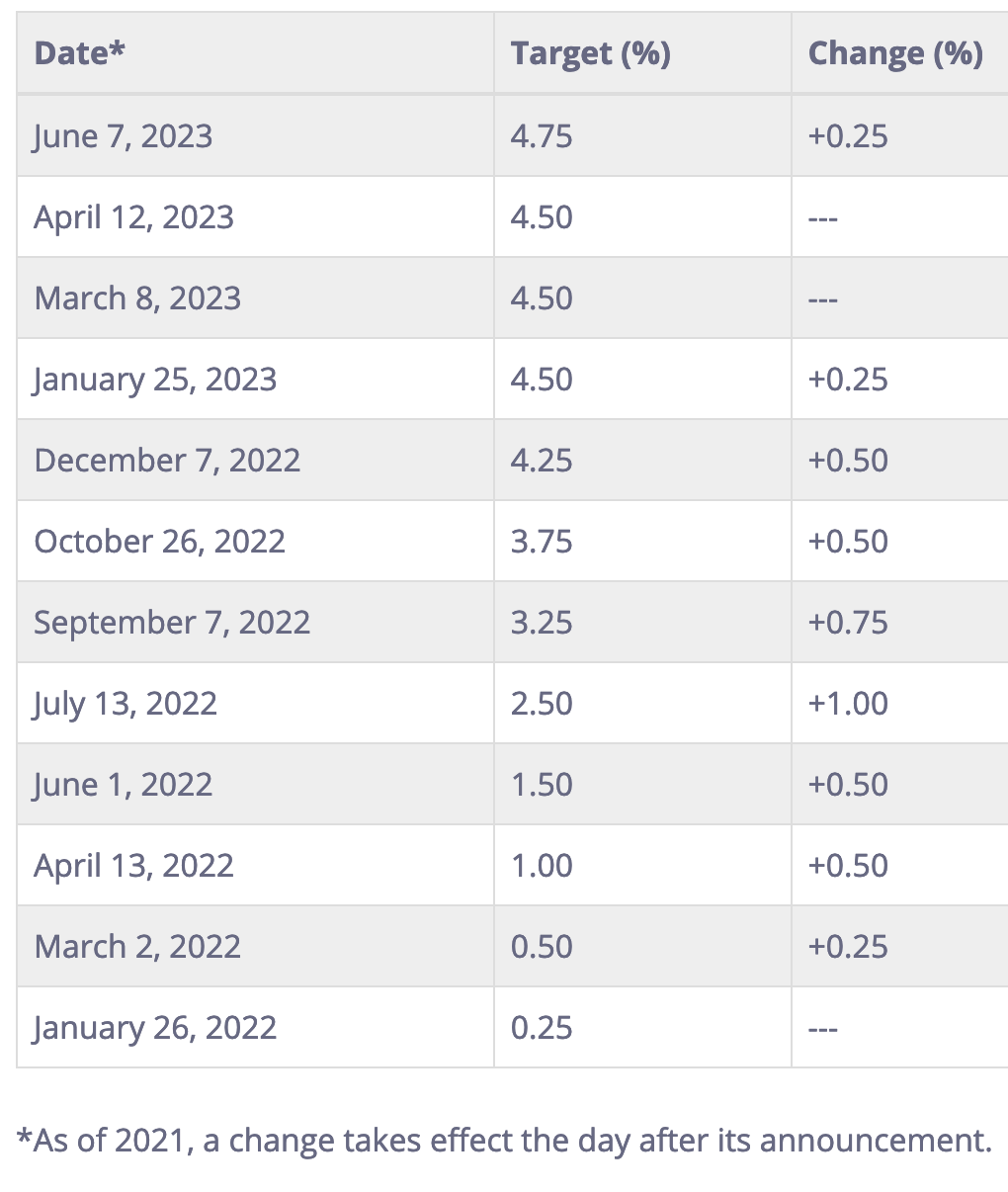

Yesterday, concerned about lagging inflation readings and renewed froth in Canadian housing markets, the Bank of Canada came off its pause since January and announced yet another 25 bps hike. Now at 4.75%, the dramatic 450bps of rate increases since March 2022 are shown below from the BOC website, all in addition to quantitative tightening (liquidity withdrawal via balance sheet reduction). Fed futures are now pricing a 100% chance of another 25 bps in 2023.

Bonds and dividend-paying equities have sold off in response. Before banking on the BOC’s present prediction for a 5% base rate by the end of 2023, it’s worth remembering that in 2021 they predicted it would be .75%. So, pinches of salt apply.

Lest anyone forget, changes in monetary policy move through the economy at a lag of 12-18 months, suggesting that the tightening since March 2022 has only started to be felt.

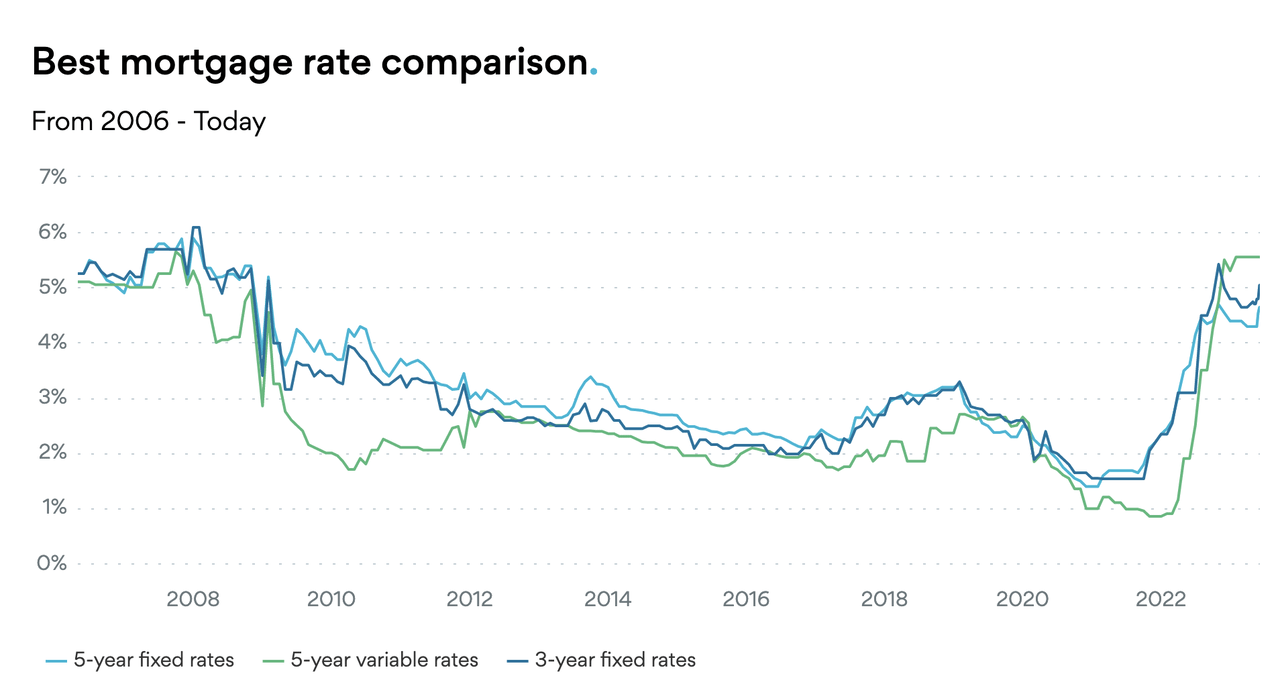

Floating-rate loans and variable-rate mortgages move with central bank base rates. Fixed-rate loans and mortgages move with Treasury bond yields as loans come up for renewal. The chart below from Ratehub (since 2006) shows the leap in Canadian variable and new fixed-term mortgages since 2021–now the highest in 17 years.

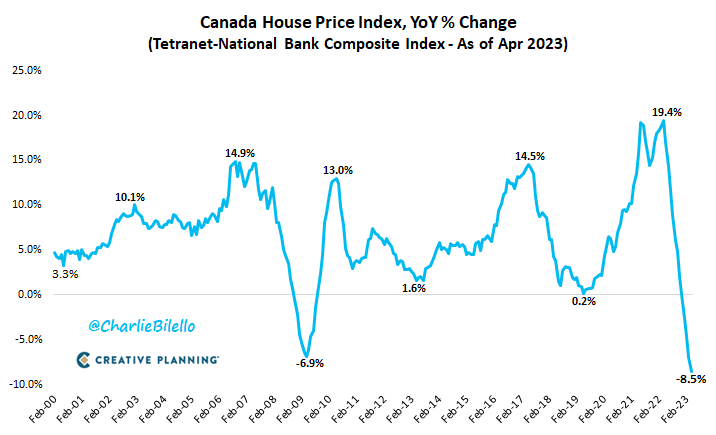

This matters a ton: A third of Canadian mortgages are variable rate (have already seen a 50% increase in interest costs year-over-year), and the other two-thirds will be renewing between now and 2026 with a 20 to 40% increase in payments (BOC data). Already, in April, the year-over-year drop in the price of Canadian homes that sold was 8.5% (shown below since 2000, courtesy of Charlie Bilello)–the largest decline since 1981.

Given the multi-month time lags, monetary policy will continue to be a drag on consumer spending, the housing market and the economy long after the central banks stop hiking and return to loosening efforts once more.

As unemployment (lagging labour indicator) starts to leap, policymakers will reverse course. But as in past recessions and bear markets, that will be too late to avoid job losses, bankruptcies and imploding asset markets.

After leaving monetary conditions recklessly loose for years, central banks are trying to restore their credibility through tough love. What the BOC did yesterday will make the financial and economic downside deeper for longer in Canada. On the upside, painful as it will be for many, the flush-out is needed and will undoubtedly produce highly valuable investment opportunities in the process.

Disclosure: No positions.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here