Investment Thesis

REV Group, Inc. (NYSE:REVG) positively surprised investors in its fiscal Q2, 2023 results with its upwards revised guidance. This is a stock that had been for the most part a disappointment to investors in the past 2 years.

Consequently, the stock was largely laying dormant and out of favor. However, its recently appointed CEO Mark Skonieczny declares that the business will succeed in increasing its profitability throughout the year. And in this spirit, the company has now raised its revenues and EBITDA outlook for fiscal 2023.

Therefore, on the back of its reasonable valuation, together with prospects of improved profitability going forward, plus its more than 20% announced share repurchase program, I assert a buy rating on REV Group, Inc. stock.

Why REV Group? Why Now?

REV Group is a company that manufactures specialty vehicles for a range of industries. They provide vehicle solutions for the commercial, fire and emergency, and recreational markets, including ambulances and fire trucks.

This investment has one crucial bearish aspect that I believe warrants attention. Namely, REV Group carries approximately $220 million of debt. That being said, apparently, this debt on REV Group’s balance sheet isn’t restricting its ability to repurchase shares, something we’ll soon discuss.

Revenue Growth Rates Guided Higher

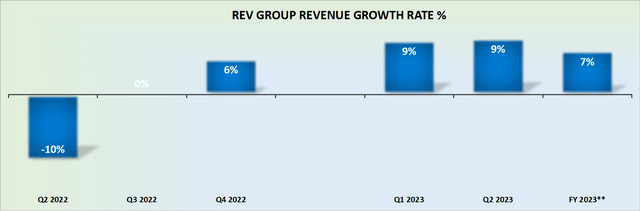

REVG revenue growth rates

Above, we see that fiscal 2023 has been slightly upwards revised and is now expected to grow at around 7% CAGR, compared with around 5% prior to this updated guidance being announced.

In actuality, one would hope that management is being conservative with this guidance, since fiscal Q2 2023 just beat revenue estimates by $100 million (or a revenue beat of 18%, which is meaningful).

Next, we’ll turn our focus to the core of the bull case.

The Bull Case in Focus

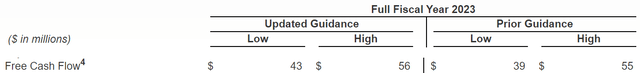

REV Group has now raised the midpoint of its guidance, and we are led to assume that approximately $50 million of free cash flow could be on the cards.

REVG Q2 2023

This would put the stock priced at a fair multiple of 16x this year’s free cash flows.

While I don’t make the case that this is a particularly cheaply valued stock, management makes the case that these shares are undervalued. And apparently in an attempt to highlight this to investors, REV Group has opted to announce a new share repurchase program of $175 million.

Note, this announced share repurchase program is slightly more than 20% of its market cap. A pretty substantial figure.

The Bottom Line

The highlight of the quarter was undoubtedly REV Group’s significant revenue beat for fiscal Q2, 2023. REV Group notes how its main segment, Fire & Emergency, saw increased shipments of fire apparatus, primarily the result of an improved supply chain, and labor efficiencies related to initiatives put in place designed to increase productivity.

One has to wonder whether this could be down to positive dynamics that the new CEO has put in place, or a natural easing of the supply chain.

On the other side of the argument, as already discussed, the one negative consideration here is that the business is significantly leveraged.

However, management clearly believes that this is not a problem, and has now announced a large buyback that amounts to more than 20% of its market cap. Of course, this is an open-ended buyback and may not be completed. But it highlights the intention, nevertheless.

If, indeed, REV Group can continue to improve its profitability, it’s entirely possible that the stock could be priced at approximately 14x next year’s free cash flows. A multiple that isn’t stretched, particularly if REV Group, Inc. can continue to grow its revenues in the high single digits.

Read the full article here