This article was first released to Systematic Income subscribers and free trials on June 3.

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the first week of June.

Market Action

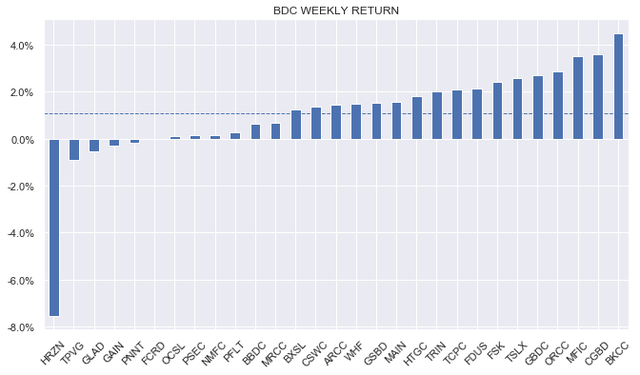

BDCs had a strong week with a 1% total return. Risk sentiment improved towards the end of the week with the lifting of the debt ceiling. BDC HRZN underperformed due to its stock offering.

Systematic Income

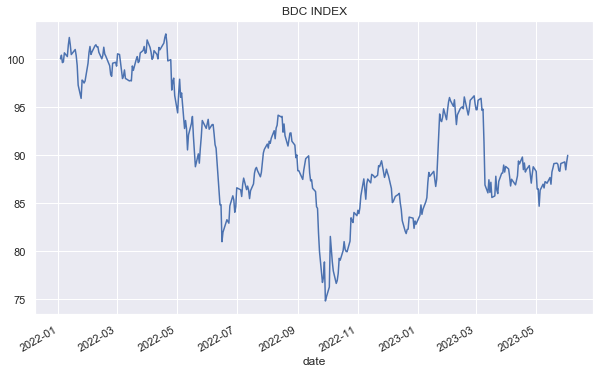

The BDC index is trading at the higher end of its post bank tantrum range though it’s still down around 5% since the start of bank-induced volatility.

Systematic Income

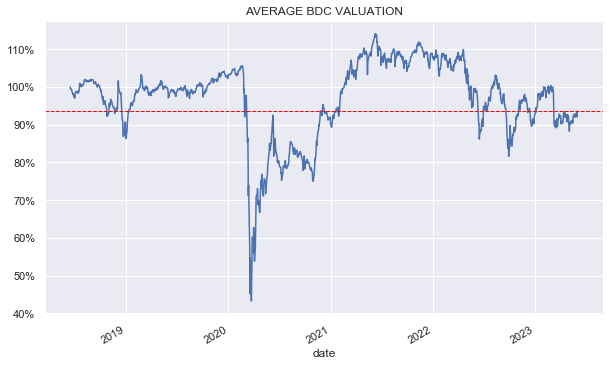

BDC valuations continue to creep higher and look fairly-valued in our view. The broader economic environment is still fairly robust and BDCs are enjoying record net income levels in many cases.

Systematic Income

Market Themes

One of the ways investors go about allocating to the BDC sector is through screens. This can be an effective way to cut through a lot of the noise and to focus on a few companies that tick the boxes. At the same time this exercise can also easily go awry.

For example, a reader recently noted that Blackstone Secured Lending (BXSL) is not in the list of BDCs whose NAV and dividend has grown year-on-year. This is a good example where this kind screening approach will filter out high-quality BDCs.

First, BXSL yoy NAV change is -0.1% so a binary cutoff at zero doesn’t make much sense. Separately, the main reason for the drop in the NAV are the very large specials the company paid out earlier which pushed the NAV lower. These specials (explicitly put on to support the price during lock-up expiries) is also the reason why the total dividend is lower yoy. Base dividend yoy growth is up.

The key takeaway here is that it’s important to understand the reasons for the changes in NAV and dividends as they can often be innocuous and not indicative of quality or developing issues. As we saw with BXSL, oversized specials can push the NAV lower. A more conservative marking approach such as the one used by the Oaktree Specialty Lending Corp (OCSL) is another reason NAVs can move lower. Finally, a higher-beta portfolio with a larger proportion of subordinated loans and common shares such as the one featured by the Ares Capital Corp (ARCC) can also do it.

All of these are high-quality companies and investors should not exclude them from the investable population based on spurious signals.

Market Commentary

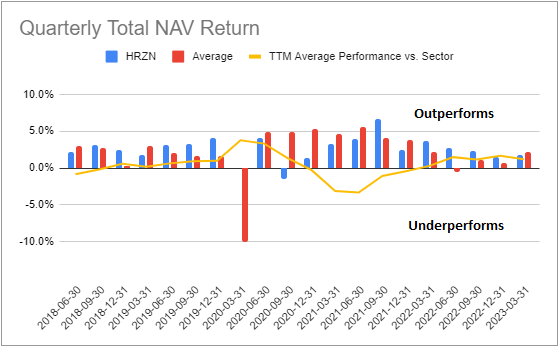

Horizon Technology Finance (HRZN) priced a $40m share issuance at $12.50. As expected, the stock fell to around that level at first but then, curiously kept falling and ended the day at $11.66 or 12% lower and almost 7% below its offering level.

The stock has been an inconsistent performer in the sector – it has underperformed over the last 3 years but outperformed over the past year.

Systematic Income BDC Tool

It’s a stock that should do very well in a risk-on environment with a lot of deal activity that would generate fee income given its focus on venture debt. Even after the drop it’s a tad expensive, however, from a buy-and-hold perspective, being 12% above the sector average valuation but from a tactical perspective it can be a nice play as it occasionally jumps up to a very high valuation.

The stock has already retraced 3.3% from the initial drop which leaves a bit more upside in our view.

Stance and Takeaways

It’s clear that the economy remains more resilient than many thought could be the case with the policy rate at 5%. The Atlanta Fed GDPNow estimate is at 2% which is not only very respectable but also above the Q1 number. On the one hand, that’s a very good sign as it shows the economy is very resilient.

On the other hand, it also means that the Fed may need to keep tightening in order to push activity lower. In its own projections, the Fed expects unemployment to rise by 1%. Every time that’s happened after WW2 (12 out of 12 times), a recession followed.

The key question is the speed with which the Fed brings activity lower – a sharp drop is likely to be more damaging than a slow descent. Much depends on inflation expectations. If these remain well behaved like now, the Fed could pause and wait for monetary tightening to work through the economy.

However, if they rise and look like they could become unanchored, the Fed will likely slam on the brakes and push rates higher more quickly, resulting in a hard landing.

If that happens, it will be a good result for BDC net income but likely a bad result for the quality of their portfolios as a sharp drop in economic activity will likely lead to a rise in defaults and non-accruals. This risk of “killing the goose that lays the golden eggs” remains a key one to watch for BDC investors. For this reason we remain tilted to BDCs with higher-quality portfolios.

Read the full article here