This article was first released to Systematic Income subscribers and free trials on June 4.

Welcome to another installment of our CEF Market Weekly Review, where we discuss closed-end fund (“CEF”) market activity from both the bottom-up – highlighting individual fund news and events – as well as the top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the first week of June. Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

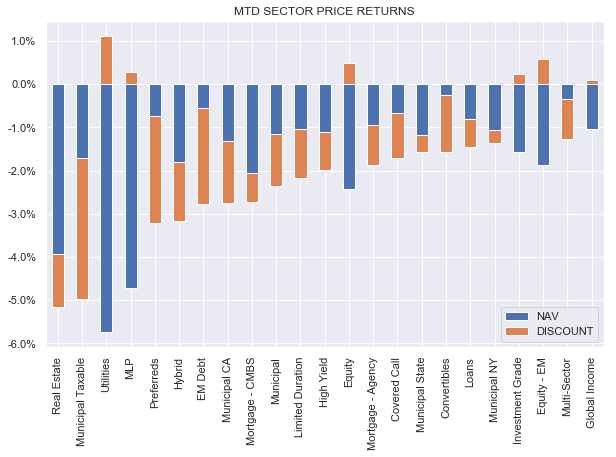

It was a strong week for CEFs as all sectors registered NAV gains, while most sectors enjoyed discount tightening as well.

Much of that strength however happened in the first few days of June, as May was not a great month for CEFs. In fact, all sectors finished lower in May.

Systematic Income

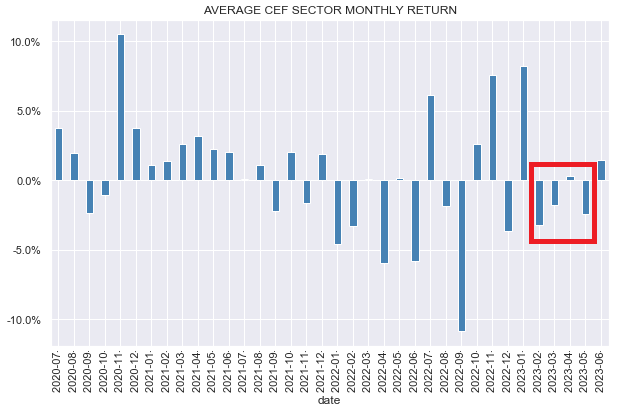

After a strong January, it’s been a tough run for CEFs as the following months have whittled down a great start to the year.

Systematic Income

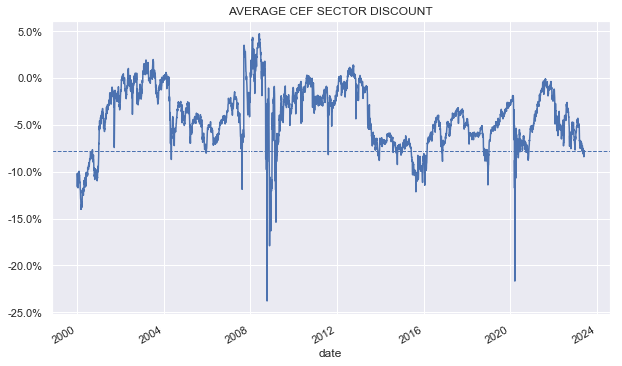

CEF discounts remain fairly depressed, in contrast to a fairly upbeat environment elsewhere in markets.

Systematic Income

Market Themes

Investors are well aware of the adage “sell in May and go away”. With a bad May behind us, we take a look at this seasonality pattern and whether there is anything behind the adage when it comes to CEFs.

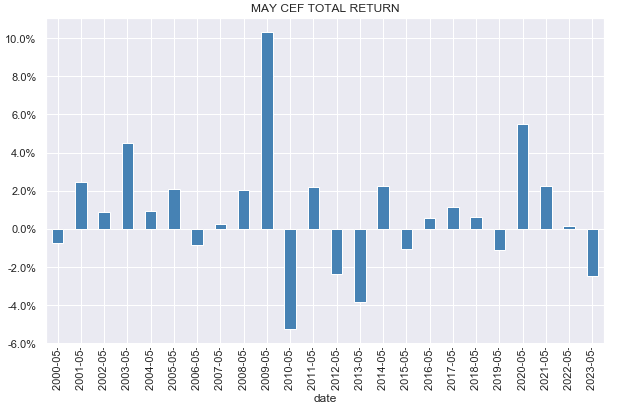

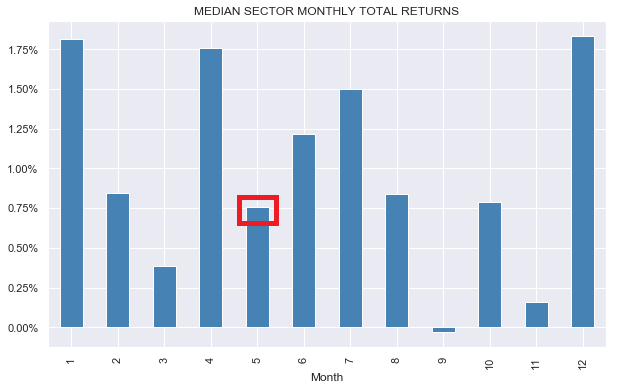

If we just look at CEF total returns over May (measured as the median CEF sector total return) we see that this past May was the worst May in 10 years. However, this chart doesn’t tell us that May is a bad month overall. In fact, 6 of the 7 previous Mays were positive and most Mays feature positive total returns.

Systematic Income

Relative to other months, May is not a particular standout even if 8 other months are ahead of May in their median return. If anything, investors should avoid September, though its median return is only slightly below zero.

Systematic Income

Overall, it’s clear that this was an unusually bad May, but investors should probably not avoid months due to seasonality patterns. There is an argument however to add exposure prior to December, as it and January are unusually strong months for CEF returns historically.

Market Commentary

The Nuveen Corporate Income 2023 Target Term Fund (JHAA) has announced a wind-up period in anticipation of its termination around December this year. The termination date can be extended by 6 months by the fund’s board, however this seems unlikely.

As we highlighted earlier, the fund has been making all the right noises which suggested it would terminate as expected: it derisked, deleveraged and cut its distribution. There is a decent amount of discount left to amortize at 2.8% while the NAV is likely to be very stable into the termination owing to high-quality very low-duration assets.

Stance And Takeaways

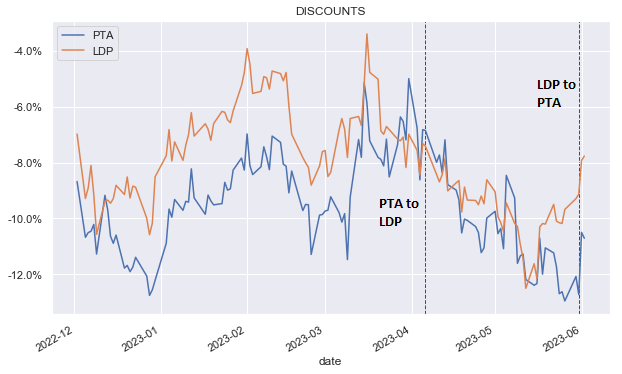

This week we did a full circle rotation by swapping back to the preferred CEF PTA from sister preferred CEF LDP which we swapped to in early April. LDP tends to trade at a tighter discount than PTA owing to its lower management fee. However, occasionally and briefly, it moves out to trade at a wider discount to PTA, at which point we like to rotate to it from PTA. Now that LDP is trading back at its more typical 3% tighter discount vs. PTA, we swap back to PTA.

Systematic Income

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!

Read the full article here