The AI Investment Thesis Is Inevitably Robust With CrowdStrike

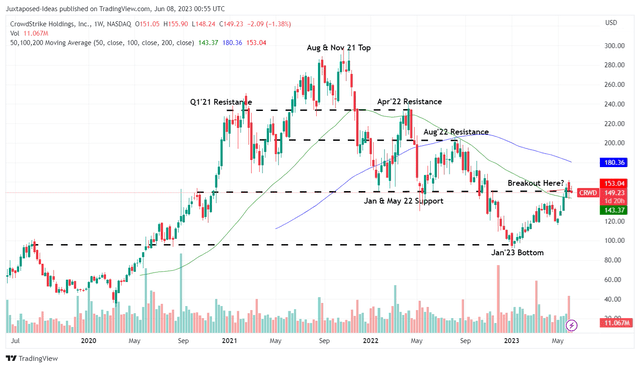

CRWD 3Y Stock Price

Trading View

CrowdStrike Holdings (NASDAQ:CRWD) continues to ride the AI wave and has recorded an impressive recovery of +57.5% since its recent bottom in January 2023. We are cautiously optimistic that the stock may be able to break its next resistance level of $160s over the next few months and sustain its gains at those levels.

Its early AI adoption in the cybersecurity end market has allowed CRWD to achieve a market-leading share of 17.7% by 2022 (+5.1 points YoY), ranking first in IDC’s annual Worldwide Modern Endpoint Security Market Share report for the third consecutive year. This sustains our bullish investment thesis as previously covered here in March 2023.

Most of our optimism is also attributed to the cybersecurity company’s excellent FQ1’24 (CQ1’23) results released in May 2023. It has smashed consensus estimates by delivering revenues of $692.58M (+8.6% QoQ/ +42.1% YoY) and an adj EPS of $0.57 (+21.2% QoQ/ +83.8% YoY).

Most importantly, consumer demand remains robust despite the supposed economic downturn and elongated sales cycle. CRWD recorded an ending ARR of $2.73B (+6.6% QoQ/ +42.1% YoY) and 23.01K subscription customers by the latest quarter (+28.2% YoY).

This is on top of the cybersecurity company’s sustained consumer stickiness at 125.3% of Dollar-Based Net Retention and expanding module adoption rates of 62% for five/ more modules (inline QoQ/ +3 YoY), 40% for six/ more (+1 point QoQ/ +5 YoY), and 23% for seven/ more by April 2023 (+1 point QoQ).

We are also seeing an excellent expansion in CRWD’s non-cancelable Remaining Performance Obligations to $3.3B over the next three years (-2.9% QoQ/ +37.5% YoY). Combined with the optimistic forward guidance of FY2024 (CY2023) revenues of $3.01B (+34.3% YoY) and adj EPS of $2.37 (+53.8% YoY) at the midpoint, we are not surprised by the optimism embedded in its valuations indeed.

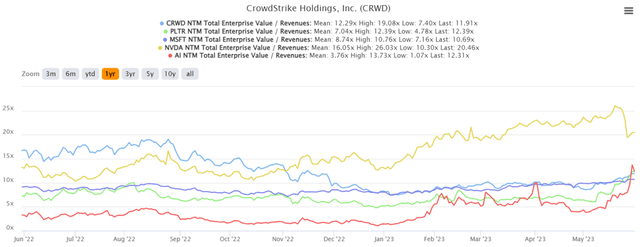

CRWD 1Y EV/Revenue

S&P Capital IQ

CRWD is now trading at NTM EV/ Revenues of 11.91x, much improved compared to the January 2023 low of 7.40x. The same optimism has also been witnessed with other stocks related to the AI story thus far, most notably with Nvidia (NVDA), which has guided robust top-line expansion over the next few quarters from the massive GPU demand for generative AI.

Palantir (PLTR) and C3.ai (AI) have similarly enjoyed increased interest in their AI offerings, sustaining the momentum in their valuations and stock prices against their historical cadence.

As a result of these optimistic developments, we are confident that CRWD may be able to achieve the ending ARR ambition of $5B by the end of FY2026 (CY2025), with an implied CAGR of +52.81%. The cadence may be potentially accelerated by the insatiable demand for accelerated cloud computing and generative AI, with the management already projecting an Addressable Market size of $158B over the next three years.

For example, due to NVDA’s aggressive guidance, Mr. Market already lifted the semi-chip company’s top-line estimates to a CAGR of 32.5% through CY2025, compared to the previous 20.6% suggesting an increased transition toward centralized cloud-native applications, as opposed to the conventional data servers. This is on top of more consumers operating generative AI tools on personal devices (including automobiles) along with IoT, 5G, and WiFi6.

The sustained transition toward cloud/ AI-based work may further accelerate the need for robust cybersecurity offerings, with untapped upside and opportunities for market leaders, such as CRWD. The company is also notably eating Microsoft’s (MSFT) lunch in the cybersecurity end market, as highlighted by George Kurtz, the CEO of CRWD, in the recent Investor Briefing in April 2023:

Eight out of ten times when an enterprise customer tests CrowdStrike, they choose CrowdStrike over Microsoft, eight out of ten times? Well, why is that? There’s a few problems with Microsoft that I’ve boiled down into the three C’s, starting with coverage, complexity and catastrophe. (Seeking Alpha)

Combined with CRWD achieving the Impact Level 5 Provisional Authorization from the United States Department of Defense, the cybersecurity company has proven that it has more than what it takes to succeed in the booming generative AI market, while similarly protecting “mission-critical data.”

Most importantly, we believe the increased module adoption rates may further boost the cybersecurity company’s gross margins moving forward, due to the improved operating and workload efficiencies. By the latest quarter, it has reported expanding adj gross margins of 78% (+3 points QoQ/ +1 YoY), despite the rising inflationary pressures and capacity growth.

As a result of CRWD’s cost optimization and improved Free Cash Flow generation to $227.4M (+4.3% QoQ/ +39.7% YoY), it has been able to maintain a strong balance sheet, with cash/ short-term investments of $2.93B (+8.5% QoQ/ +36.2% YoY), while keeping a stable long-term debt of $741.3M.

These results have convinced us to further nibble at these levels, since they offer an excellent upside potential of +60% to our price target of $240. This is based on the market analysts’ FY2026 EPS projection of $4.01 and a moderate P/E of 60x, nearing its AI peers’ valuations of 63.98x for PLTR and 69.72x for NVDA.

Therefore, we continue to rate the CRWD stock as a Buy, since the AI story may provide further tailwinds to its adoption and consequently, its top and bottom-line expansion over the next few years.

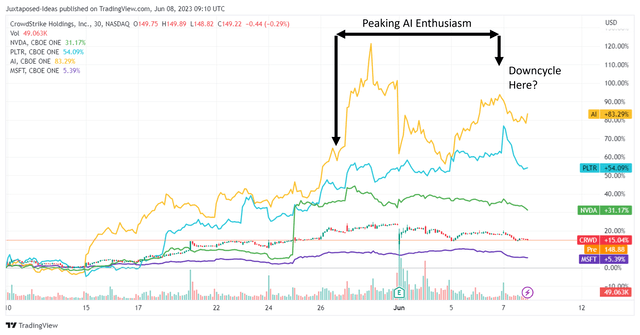

Peaking AI Enthusiasm May Be Digested Soon

Trading View

Naturally, we must also highlight that there are risks to adding CRWD here, since it is uncertain if the stock may break out from the November 2022 resistance levels, with the current AI momentum appearing to be stalling. The same has been observed with NVDA, PLTR, MSFT, and AI thus far, suggesting potential volatility ahead.

As a result, investors want to wait for a moderate retracement to the previous March/ April 2023 top of $135 for an improved margin of safety.

Read the full article here