Investment Thesis

Informatica Inc. (NYSE:INFA) is a leader in data integration despite a rapidly changing technological landscape in data infrastructure. The company has achieved this through continuous innovation, including a complete overhaul of its product portfolio into a cloud-native architecture since 2015. Informatica has also expanded its platform into emerging areas to stay ahead. The company is a recognized leader in data integration, consistently ranked at the top in Gartner’s Magic Quadrant for Data Integration Tools and other categories. I remain bullish on the stock and have an end-of-year price target of $24, based on ~4x EV/CY24E Sales.

Healthy Q1 2023 Despite Challenging Macro

Informatica reported a solid first-quarter performance, surpassing expectations in terms of revenue, operating margin, and key ARR metrics. The standout achievement was the growth of their Cloud ARR, which exceeded the projected and consensus expectations with a remarkable 41% year-over-year increase. The majority of the new cloud bookings were driven by net-new workloads, and a significant portion of the net-new Subscription ARR came from the cloud. Informatica also disclosed its cloud retention rate for the first time, showing improvement compared to the previous quarter. The overall ARR also exceeded consensus, growing by 10% year-over-year, although slightly slower than the previous quarter due to slower growth in self-managed ARR and a decline in maintenance ARR. The company noted that the macro environment remained relatively consistent compared to the previous quarter, with no significant changes in booking trends. Despite these factors, Informatica maintained its guidance for the full fiscal year, including revenue, ARR, operating margin, and free cash flow. This decision reflects the management’s prudence in navigating the current dynamic macro environment. In summary, Informatica’s portfolio of top-quality products on a unified cloud-native platform continues to differentiate them in the market, and they anticipate sustainable momentum in their cloud ARR as they move towards a “cloud-only” future.

Leader in Data Integration Workflows

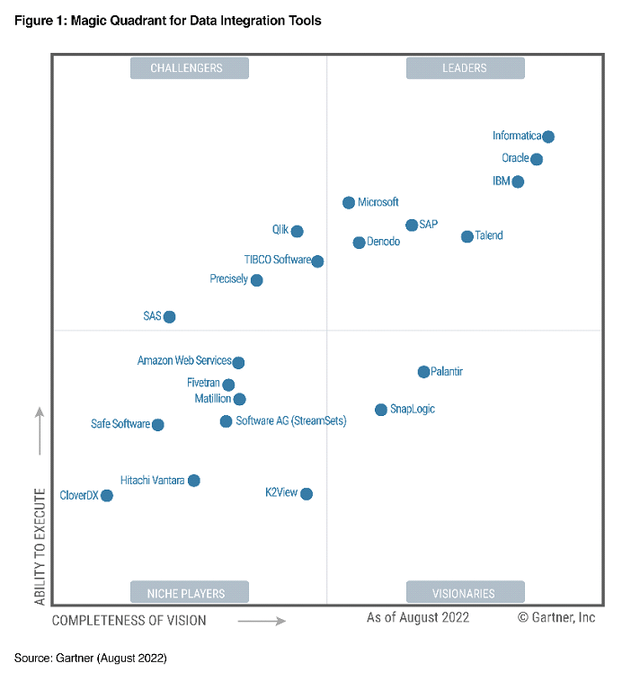

Despite the rapidly changing technology landscape in data infrastructure, Informatica continues to be recognized as the leader in data integration. They have consistently ranked as a leader in Gartner’s Magic Quadrant for Data Integration Tools for several years, including the last three consecutive years. Informatica has also been positioned as the leader in four other Gartner Magic Quadrants, covering areas such as cloud integration, metadata management, data quality, and master data management solutions. INFA’s range of products enables customers to integrate data from various sources and prepare it for analytical purposes, whether that involves traditional solutions like Teradata or modern platforms like Snowflake. Additionally, Informatica’s solutions support use cases such as Customer 360, data governance, and data quality. The company boasts a large customer base of over 5,000 organizations, with 90% of the Fortune 10, 85% of the Fortune 100, and 45% of the Global 2000 companies relying on their services.

Gartner

AI-Driven Metadata Engine Remains a Differentiation Factor

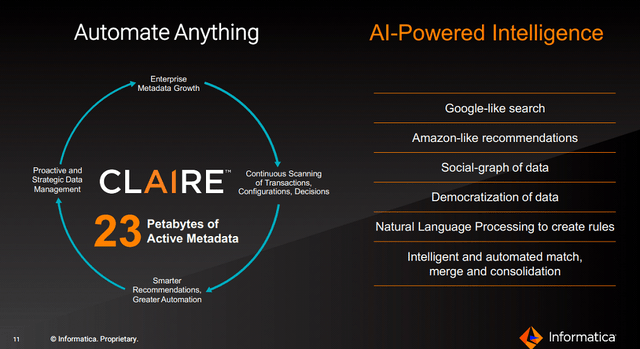

The AI-powered metadata engine is a crucial aspect of Informatica’s differentiation within its new product portfolio. Informatica has been investing in AI since 2016 and has integrated it comprehensively across its product offerings. The metadata layer, developed by Informatica, serves as the foundation for the AI engine. Metadata contains essential information about the data, such as data modification details, source system information, sensitivity of the data, and more. Informatica has amassed an impressive 11 petabytes of active metadata and has over 50,000 “metadata aware” connectors that understand the data context as it moves through Informatica’s systems. The combination of the metadata engine and AI layer enhances automation, improves productivity, and strengthens security and compliance measures. For example, the AI system can automatically generate data quality rules based on metadata, identify and resolve data quality issues without human intervention, classify and tag data, discover relationships between data elements, and link sensitive data to relevant government policies. Additionally, the metadata engine benefits from a network effect, as the accumulation of more data leads to enhanced metadata insights and automation capabilities, further reinforcing Informatica’s competitive advantage.

Company Presentation

Valuation

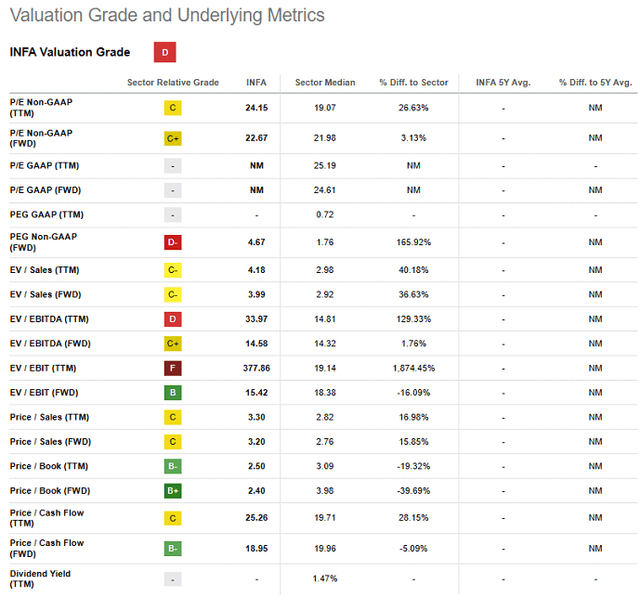

My December 2023 price target of $24 is based on ~4x EV/CY24E Sales. My assumed multiple of ~4x for INFA is slightly lower than the comp group of mature software companies Cadence Design Systems, Inc. (CDNS), Synopsys, Inc. (SNPS), Qualys, Inc. (QLYS), Oracle Corporation (ORCL), and VMware, Inc. (VMW), which is trading at a significant premium. I believe INFA deserves to trade at a slight discount to peers due to INFA’s relatively lower margins and slightly lower CY24E revenue growth.

Seeking Alpha

Risks to Rating

Informatica has strong and mutually beneficial partnerships with leading cloud warehouses and hyperscalers, such as Snowflake Inc. (SNOW), Databricks, AWS, Azure, and GCP. However, there is a possibility that these partners might create competing solutions that could potentially impact Informatica’s growth negatively. Moreover, Informatica operates in a competitive landscape within the data management and utilization industry, facing competition from established giants like SAP SE (SAP), Oracle, and International Business Machines Corporation (IBM), as well as emerging players like Talend, who offer comprehensive or specialized solutions.

Conclusion

Informatica remains a leading player in data integration despite the rapidly changing technology landscape in data infrastructure. Informatica has also expanded its platform into emerging areas experiencing rapid growth. Informatica remains a leader in data integration, as recognized by Gartner’s Magic Quadrant in multiple categories. Their AI-driven metadata engine benefits from a network effect, strengthening Informatica’s competitive edge through enhanced insights and automation capabilities. I view the stock as a buy at current levels and derive a price target of $24 based on ~4x EV/CY24E Sales.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here