Thesis

2023 has been a fairly bizarre year. Entering, all large bank analysts were screaming for a market crash in Q1. It hasn’t happened. In fact the 2022 losers have been the 2023 outperformers. Equities have definitely surprised many, and in our view the year is still to provide some fireworks. ‘Steady Eddy’ type assets on the other hand have done incredibly well this year with no surprises. One of our picks from December 2022 has delivered:

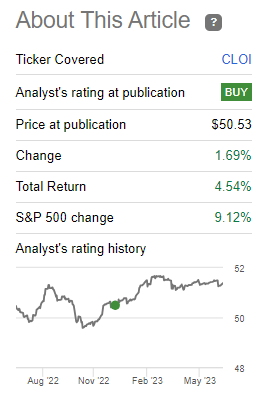

Analyst Rating (Seeking Alpha)

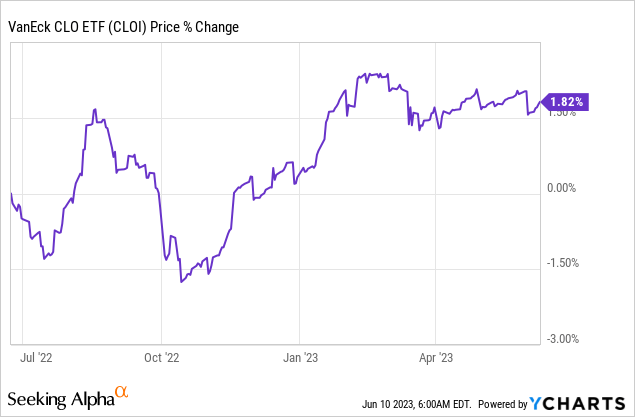

The VanEck CLO ETF (NYSEARCA:CLOI) is an actively managed ETF focused on CLO investments. The underlying asset class is floating, hence the fund has benefited from higher rates and it will continue to do so. CLOI is a fixed income instrument, hence it falls into the lower volatility bucket. The optics above need to be adjusted for bond comparisons, not equity comparisons. While the S&P 500 is up over 9% since we assigned CLOI a Buy rating, the equity index has a high standard deviation of 18%. Let us have a look at CLOI’s standard deviation:

The fund is new, so the historic information is limited, but we can see from the available data that we are looking at a 2% standard deviation here. Even during the depth of the market sell-off in October 2022 this name was not down more than -1.5% for the year. Quite robust one would say.

The reasons behind the robustness in the fund is the asset class – we talked extensively in our prior article regarding the composition, but suffice to say that AAA and AA CLO tranches never defaulted. Hence there is a limit to how wide their credit spreads blow up. It is more of a funding trade rather than anything else. So do expect this state of affairs to continue, with CLOI to be only modestly affected by future market sell-offs.

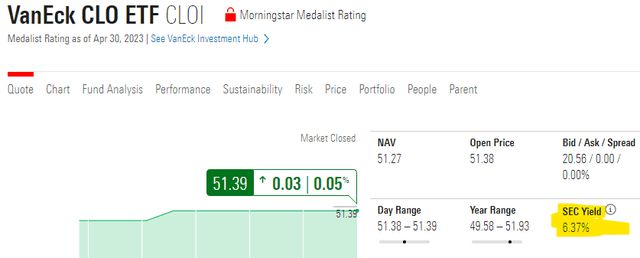

Given the astounding rise in rates, the fund is now sporting a 30-day SEC yield of 6.4% almost:

30-day SEC Yield (Morningstar)

Not too shabby for a 2% standard deviation! If you look around in the financial securities sector you will see much higher standard deviations for this unit of dividend yield.

What is next for CLOI?

CLOI is going to continue to do what it was designed to – extract a high, safe yield from senior CLO tranches. Do expect this high yield to persist for the rest of 2023, with rates higher for longer in our view. There is certainly a credit spread risk component, but as we have seen from the fund’s performance last year, this is limited to a -2% type of drawdown. We expect some more fireworks this year in terms of a market sell-off, but that would only provide a better entry point for this name. There will be no stomach churning drawdowns of -10% here, which is the beauty of the product. We are penciling in a 7.5% total return for this name for 2023. Not a bad way to navigate 2023 one would say.

State of the CLO and leveraged loan market

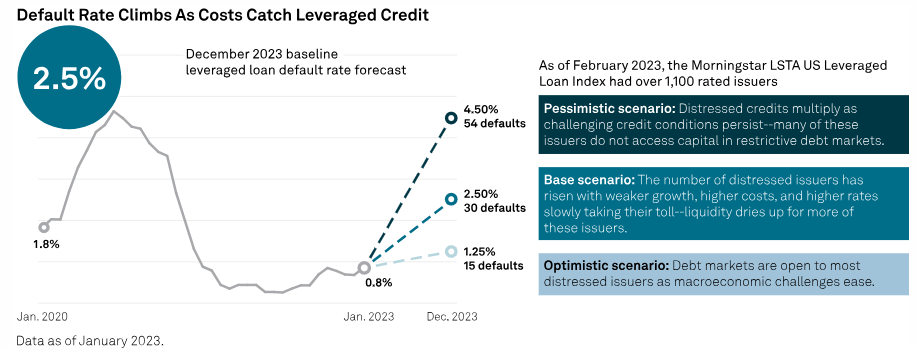

The default rate this year has been rising for leveraged loans, albeit from extremely low levels:

Default Rates (S&P)

To put things into context with CLOI, a typical AAA CLO tranche has a 30% to 35% subordination, meaning you need to see spike to 30% annual default rates for us to talk about credit risk. And this is assuming 0% recovery on the underlying loans. It just does not happen. Even in an adverse scenario the default rate will not be as high as it was in 2020 or certainly not what it was in 2009. The fact that the default rising is important, however, because we are now in a very high inflationary environment globally. Rising central bank rates make it expensive and challenging for companies to refinance. Banks that lend to leveraged companies will have to be attentive to measuring rising risk weights and capital associated with these assets.

In terms of AAA spreads, Wellington believes they will stay range bound this year:

AAA CLO spreads are likely to stay rangebound in the near term until some of the larger AAA investors return. Large US money center banks and overseas investors typically have driven demand for new issue AAAs. However, banks’ appetite for securities has waned as they attempt to repair their balance sheets. Meanwhile, increased hedging costs have made it less attractive for overseas investors to own AAA CLOs. Further, the recent move by the Bank of Japan to expand its 10-year yield target band is likely a net negative for Japanese bank demand, which could decrease marginal overseas buying in 2023.

Still, we believe these investors will return in 2023 as central bank rate-hiking cycles peak and the macro outlook comes into sharper focus, which would help support spreads. AAAs look attractive to most banks at these yield levels, given their preferred capital treatment. Eventual tightening in AAA spreads and resumed loan issuance should improve equity arbitrage, spurring new CLO creation from pent-up 2022 supply and creating an exit for outstanding warehouses. This demand “push-pull” for AAAs and new CLO supply could keep spreads rangebound, which seems healthy to us after a year of unhealthy technical imbalance.

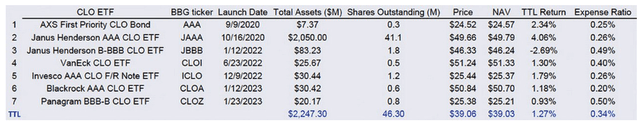

And then there is a very nice piece from Deutsche Bank that talks about the evolution of the CLO ETF market, which is happening right before our eyes:

CLO ETFs (Deutsche Bank)

In a couple of years we will see AUMs in the billions here, mark it.

Conclusion

CLOI is a fixed income exchange traded fund. The vehicle packages AAA and AA CLO tranches in order to pass investors the dividend yields from this floating rate asset class. The fund is new, but has an incredibly low standard deviation, which we estimate at 2%. CLOI navigated the October 2022 sell-off with a minimal drawdown, and has been a very sturdy, low volatility way to navigate 2023. Since our Buy rating the fund has provided a ‘Steady Eddy’ type of dividend yield, and we estimate a total return of roughly 7.5% for 2023 for this name. Continue to hold for the dividend and low volatility.

Read the full article here