HSBC UK CEO tells CNBC how the bank bought Silicon Valley Bank’s UK unit.

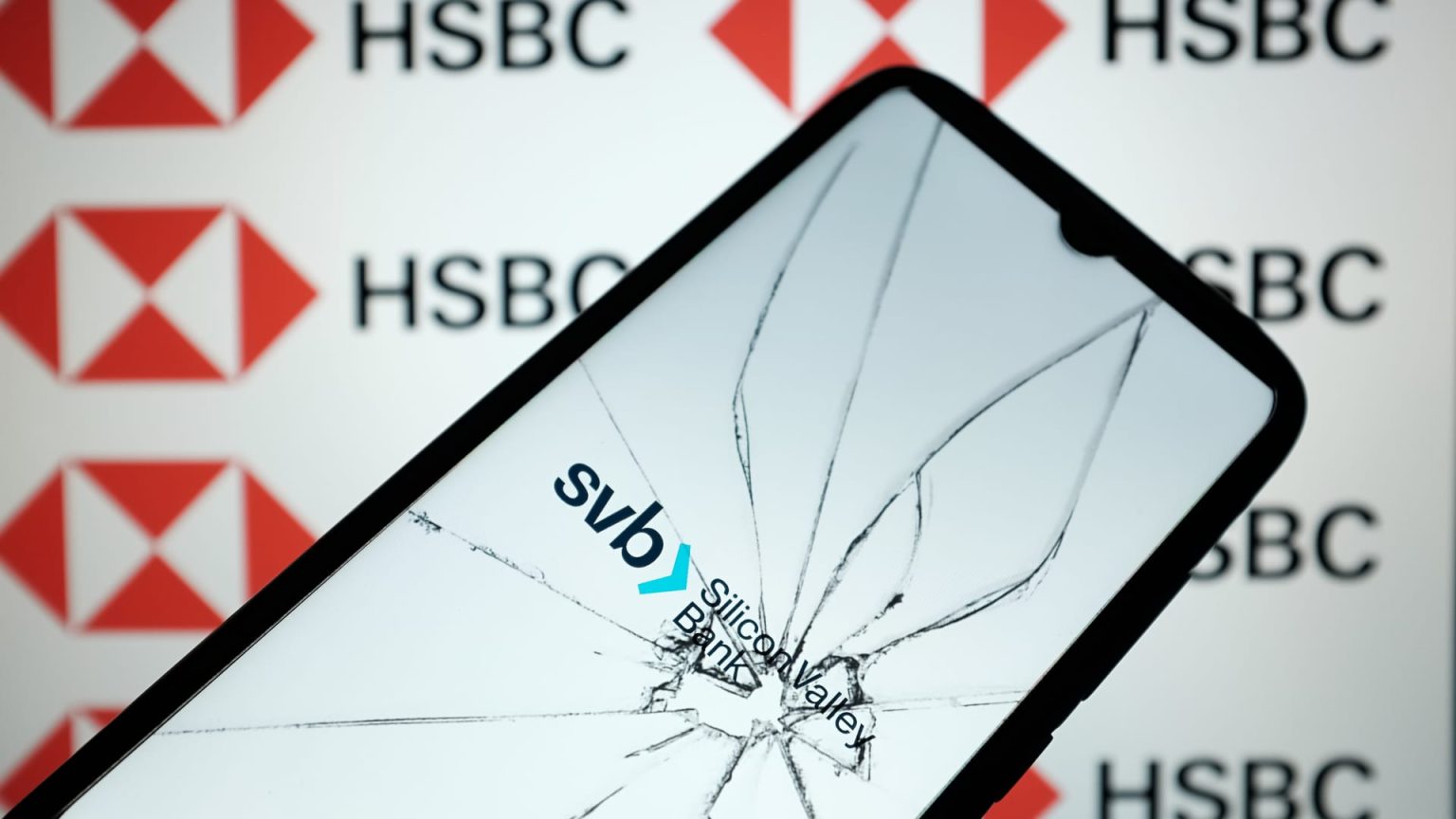

Nurphoto | Nurphoto | Getty Images

U.K. banking titan HSBC unveiled a new HSBC Innovation Banking unit Monday, as it seeks to push into the technology sector following its eleventh-hour rescue of the U.K. subsidiary of failed Silicon Valley Bank (SVB) in March.

HSBC acquired the London-based SVB unit for £1 after its parent company suffered a run on its assets fueled by customer fears over the bank’s solvency. SVB was one of several U.S. and European lenders that met their downfall earlier this year as broader turmoil rattled the global banking sector.

The U.K. government and Bank of England facilitated the purchase in a bid to protect deposits, as Britain separately struggles to retain its position as an international tech capital.

Some have questioned whether traditional financial institution HSBC is well placed to take over the legacy of SVB and finance tech-focused startups and small businesses.

The criticism was shot down last week by HSBC UK CEO Ian Stuart, who told CNBC’s Arjun Kharpal that the bank would take its activity “from seed funding all the way through to IPO, customers will never have to go outside of that network to meet their funding requirements.”

HSBC said Monday that its Innovation Banking unit, launched at London Tech Week, will bring together SVB UK and freshly formed teams in the U.S., Israel and Hong Kong as it focuses on tech and life science enterprises.

“The UK’s world-leading technology and life sciences sectors are central to growing the UK economy and boosting global exports,” HSBC Group Chief Executive Noel Quinn said in a Monday statement.

“HSBC now has a world-class team focused on innovation companies, their founders and their investors. We will protect this specialisms and take it to the next level.”

British Prime Minister Rishi Sunak said that the new HSBC division will assist innovative businesses and create additional jobs, “supporting my priority to grow the UK economy and cement our position as a science and tech superpower.”

Read the full article here