Introduction

I’ve written five articles on SA about lithium-ion battery recycling technology company American Battery Technology (OTCQX:ABML), the latest of which was in January when I said that it could take months before its Fernley pilot plant enters into service and that significant stock dilution in the near future was likely.

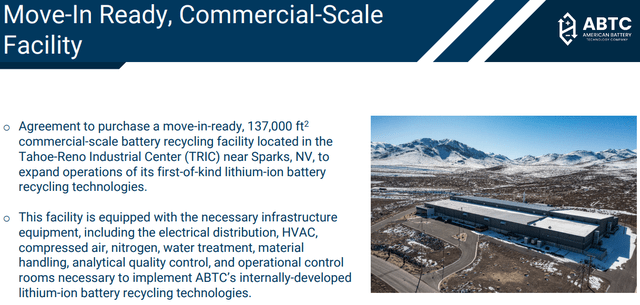

Well, ABML announced a $10 million equity offering at the end of March shortly after agreeing to buy a commercial-scale battery recycling facility in McCarran. There is no mention of the Fernley pilot plant in the company’s latest corporate presentation, and the Q1 2023 financial report of ABML leads me to think that construction of the facility is still ongoing. In addition, I find it disappointing that the McCarran facility is being sold for just $15 million under a sale and leaseback agreement. I’m even more bearish on the stock now. Let’s review.

Overview of the recent developments

In case you’re not familiar with ABML, here’s a brief description of the business. The company’s focus over the past few years has been on the construction of a pilot plant for the recycling of lithium-ion battery metals, such as lithium, cobalt, and nickel. The selected site for the facility was in Fernley, Nevada, which is close to the gigafactory of Tesla (TSLA) in the state.

ABML

The $35 million facility is set to manage 20,000 metric tons of scrap materials and end-of-life batteries per year and AMBL expects it to generate annual revenues of about $160 million per year, with an EBITDA margin of about 80%. This pilot plant was first announced in January 2020 and was supposed to be fully operational by the second half of 2020. Construction started shortly after ABML closed a $39.1 million equity offering in September 2021 and the facility was then set to become operational in 2022. However, it seems that the pilot plant is still under construction according to the Q1, 2023 financial report of ABML which was released in May (page 22 here).

As the Company moves towards completion of its Pilot Facility in Fernley, NV, the buildout of the recycling facility in McCarran, NV, and continues its development of the Tonopah Flats Lithium Exploration Project, the Company is actively engaged in the purchase of the necessary equipment to support its operations and activities.

What I find even more worrying is that the Fernley pilot plant isn’t even mentioned in the latest corporate presentation of ABML. Sure, the presentation mentions the company’s closed-loop technology as well as several government grants, but the only physical assets that are mentioned are the McCarran commercial-scale battery recycling facility and the Tonopah Flats lithium project.

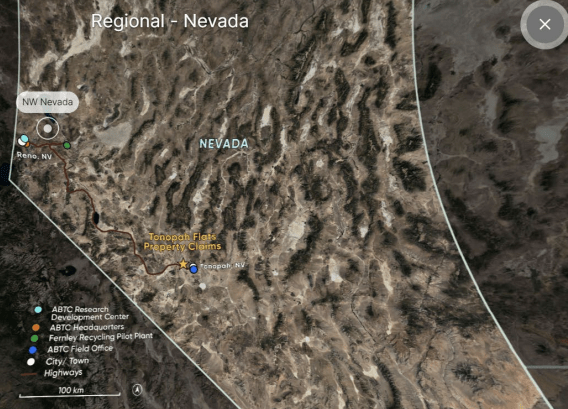

ABML ABML

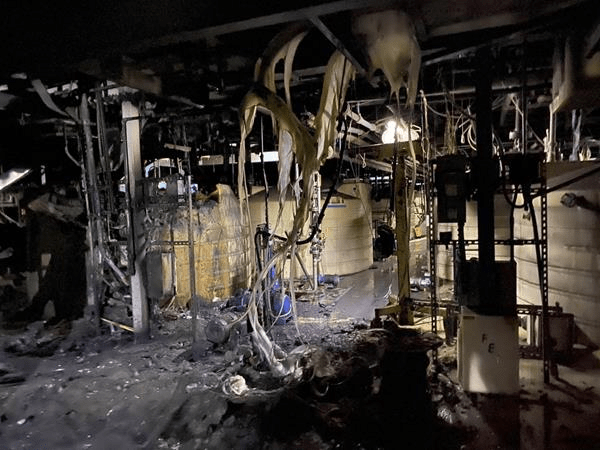

Tonopah Flats was bought in 2022, and it has inferred resources of 15.8 million tons of lithium carbonate equivalent. It’s an early-stage project that is likely to require hundreds of millions of dollars to reach the production stage. The McCarran facility, in turn, was bought from a company called Aqua Metals (AQMS) with the idea that it can speed up ABML’s transition into commercial production. As I mentioned in my January 2023 SA article on Aqua Metals, this used to be a lead acid battery recycling plant that encountered technical issues before being damaged severely by a fire in December 2019.

Aqua Metals

Aqua Metals collected $30.25 million in insurance payments but didn’t put the facility back into production, and now it’s empty. Overall, this could be a good move for ABML as it’s a large facility that would enable the company to boost production once it works out the kinks in its recycling technology at the nearby Fernley facility. However, there are no details on how much it would cost to install lithium-ion battery recycling equipment at McCarran or when this plant is expected to enter production. In addition, the Q1 2023 financial report of ABML revealed that the company has inked an agreement for the sale of the McCarran facility for just $15 million under a sale and leaseback agreement (see page 19 here). Considering the purchase consideration for the building included $15 million in cash and the issue of 11 million shares (worth $8.7 million as of the time of writing), the sale price seems underwhelming.

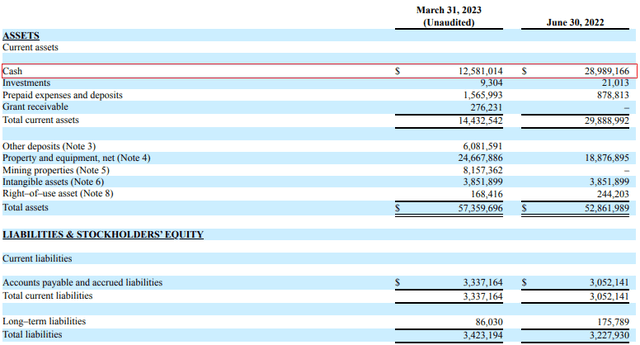

Overall, I think that the continuing delays of the Fernley pilot plant raise concerns about whether this facility will ever be completed, especially considering ABML has stopped mentioning it in its corporate presentations. In addition, the McCarran and Tonopah Flats projects seem to be in an early stage and the focus of investing in these three separate projects could result in significant stock dilution soon. Looking at the Q1 2023 financial results, cash used in operating activities for the quarter stood at $3.4 million, while cash used for investing activities was $7.8 million. Thanks to the $10 million equity offering in late March, ABML closed the quarter with $12.6 million in cash and cash equivalents.

ABML

Keep in mind that ABML had to make a $2 million payment for the McCarran facility in May, and that the sale and leaseback of the property can add $15 million in cash. In addition, the company received net proceeds of $3.4 million in a private placement in Q2, 2023 (see page 19 here). While these transactions could potentially boost the cash balance to $29 million, I think that ABML is likely to launch another equity offering by the end of 2023 as the cash used in operating and investing activities in Q1 alone was $11.2 million.

So, how do you play this? Well, I continue to think that short selling seems like a viable idea, as data from Fintel shows that the short borrow fee rate is 8.61% as of the time of writing. Yet, it could be best for risk-averse investors to avoid this stock, considering there are currently no call options available. In addition, it takes over 17 days to cover, which means that there’s a significant short squeeze risk here.

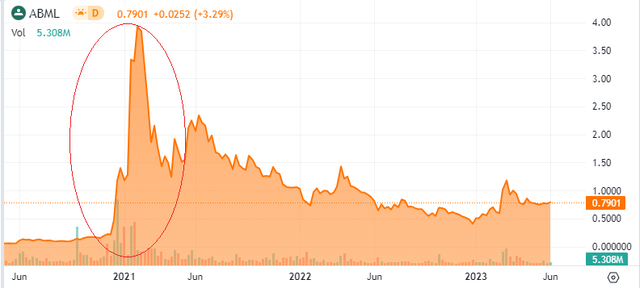

Looking at the risks for the bear case, I think that a major one is that an announcement about the completion of the Fernley pilot plant could boost the share price, although the impact could be limited considering ABML seems to be focusing on McCarran and Tonopah Flats now. Another major risk is that the share prices of microcaps can soar without any news or catalysts, which can lead to significant losses for short sellers. ABML itself is a good example of this, as its share price increased 20 times between November 2020 and January 2021.

Seeking Alpha

In my view, it could be a good idea to set a stop-loss and its level depends on your risk tolerance. For me personally, it would be around $1.20 per share.

Investor takeaway

It’s been close to three years since the lithium-ion battery metals recycling pilot plant of ABML was supposed to be fully operational, and at this point I’m concerned if the facility will ever be completed. It seems that the company is shifting its focus to the McCarran and Tonopah Flats projects, which I expect to boost cash burn and thus result in significant stock dilution by the end of 2023. I find it disappointing that the McCarran facility is being sold for just $15 million shortly after its purchase. I’m bearish on ABML and the short borrow fee rate is below 9%, but there are no call options, and it takes over 17 days to cover. In my view, it could be best for risk-averse investors to avoid this stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here