A few weeks ago, I noted that positive catalysts were percolating for the wheat market, and that I was waiting for further positive updates on the catalysts before issuing a buy recommendation.

This past week, we got confirmation on two of our catalysts, with El Niño conditions confirmed and the Russia/Ukraine grain deal falling apart. I am upgrading the Teucrium Wheat ETF (NYSEARCA:WEAT) to a buy to take advantage of a possible price surge in wheat as El Niño will likely lead to worsening drought conditions in North America and extreme weather may disrupt grain production in the rest of the world.

El Niño Confirmed With Sea Temperatures Likely To Break Record

This past week (June 8th), the National Oceanic and Atmospheric Administration (“NOAA”) officially confirmed that El Niño has begun, with El Niño conditions expected to strengthen into the Northern Hemisphere winter season.

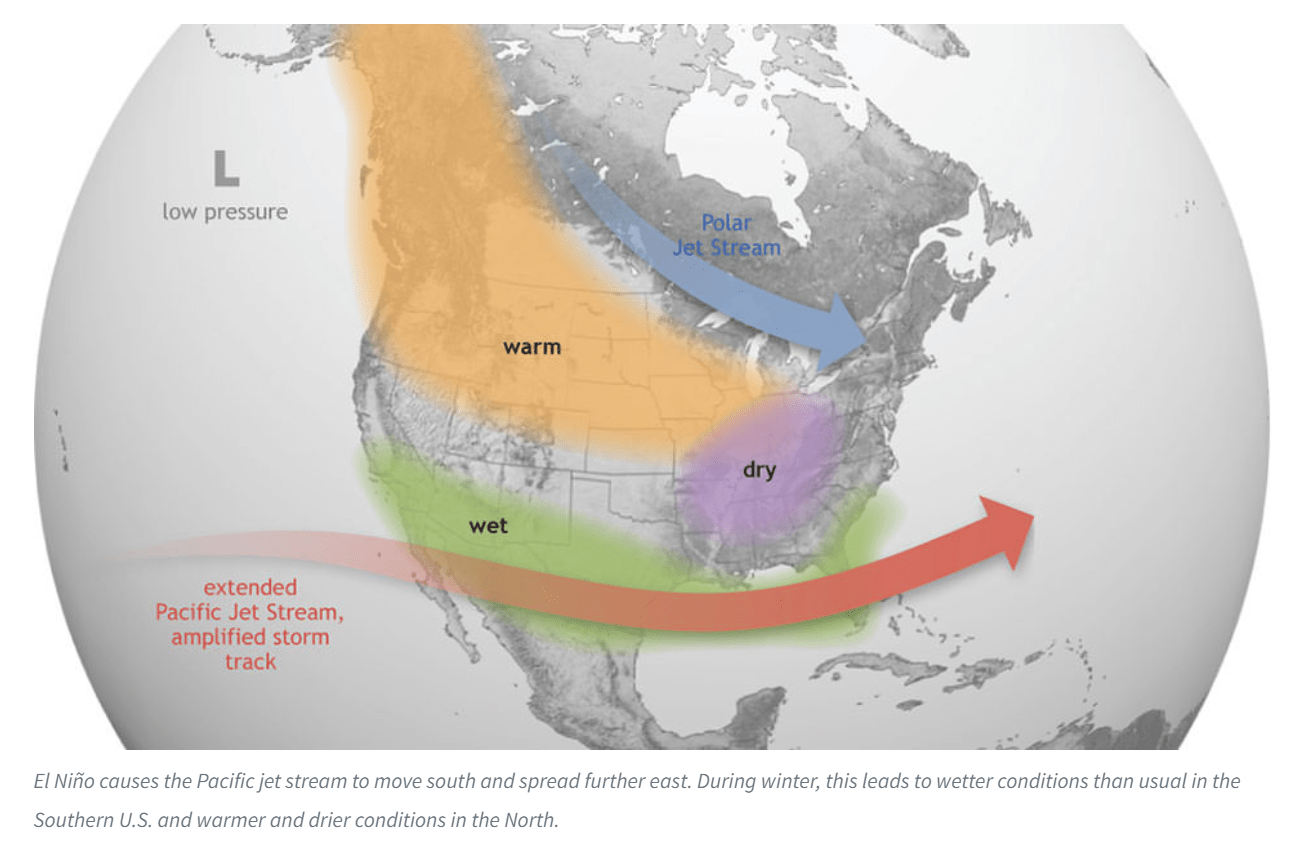

Recall from my previous article, “El Niño tends to cause areas in the northern U.S. and Canada to be dryer and warmer than usual, which could be detrimental to wheat production” (Figure 1).

Figure 1 – El Niño could bring dryer and warmer weather to U.S. and Canada (NOAA)

Although the USDA currently expects ample wheat supplies in its latest June WASDE report, I fear wheat conditions will deteriorate in the coming months due to El Niño.

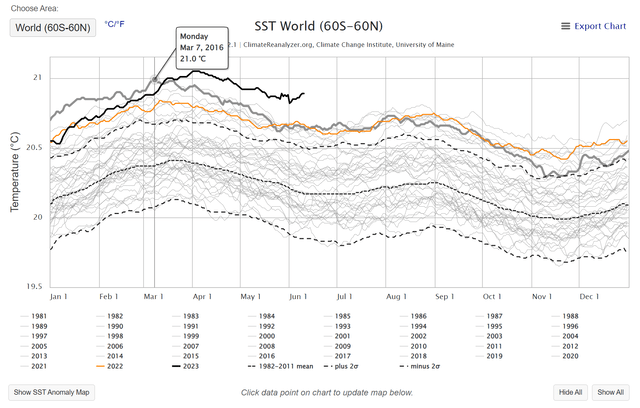

More importantly, coming into the current El Niño, global sea surface temperatures are already near peak levels, even with the cooling effects of a 3-year La Niña. As the current El Niño develops over the coming months, we will very likely smash through 2016’s El Niño-driven temperature records (Figure 2).

Figure 2 – Surface sea temperatures near record highs to begin current El Nino (climatereanalyzer.org)

High sea temperatures are often associated with extreme weather events, especially for droughts and tropical storms. In the last few months, we have seen record-shattering heat waves across large swathes of Asia and massive wildfires in Canada. The developing El Niño will likely create even more extreme weather over the coming months, which could be detrimental to food production across the world.

As I highlighted in my prior article, one area in particular that have benefited from La Niña was Australia, which enjoyed several record-breaking wheat crops and was the main ballast to global wheat prices last year when Russia invaded Ukraine.

However, the Australian government is now projecting wheat production to decline by 34% in 2023/24, below the 10 year average, due to the unfolding El Niño. Australia is the world’s second-largest wheat exporter, supplying Asian buyers. If Australian wheat exports are cut back, Asian buyers will have to source wheat from elsewhere.

Russia May Not Renew Wheat Export Deal

Unfortunately, one area where wheat exports may decline will be Ukraine / Russia. Although Russia renewed the July 2022 export deal at the last minute in May, the Russian government has indicated they see ‘no prospect’ of extending the agreement when it expires in mid-July.

This is because recent escalation in attacks from both sides (Russia allegedly destroyed the Kakhovka dam, while Ukraine is rumoured to be behind the destruction of Russia’s ammonia pipeline) may make any deal untenable.

WEAT ETF As A Medium-Term Play

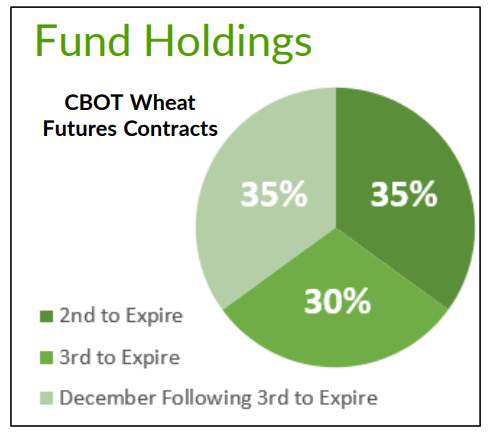

The Teucrium Wheat ETF does not hold physical wheat commodities; instead, it owns a basket of wheat futures that must be rolled at each contract expiry (Figure 4).

Figure 3 – WEAT ETF holds wheat futures (teucrium.com)

Due to the contango nature of commodity futures where longer-dated futures tend to be higher in price, the WEAT ETF should not be held for the long term as the fund loses value during each contract ‘roll’. However, for short- to medium-term trades, the WEAT ETF does offer the desired exposure to the commodity.

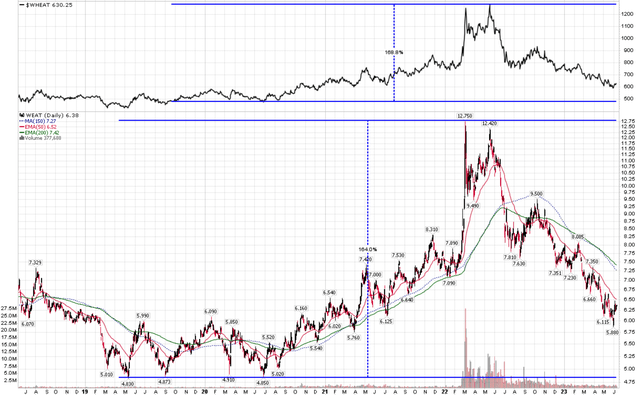

For example, in 2020 to 2022, when spot wheat prices rallied 169% from $4.80 / bushel to $12.00 / bushel, the WEAT ETF delivered similar returns of 164% (Figure 4).

Figure 4 – WEAT can be suitable for short- to medium-term trades (Author created with price chart from stockcharts.com)

Conclusion

I am upgrading the WEAT ETF to a buy on a confirmation of El Niño conditions. I believe the developing El Niño may cause extreme weather events that will reduce the global wheat crop, causing wheat prices to rally. Already, Australia is forecasting a 1/3 drop in its upcoming 2023/24 crop. Furthermore, the Russia/Ukraine grain export deal may not be extended in July due to recent escalation in attacks by both sides.

While I understand the contango decay from the WEAT ETF’s structure, I feel the upside catalysts will probably be far stronger than the futures roll decay in the coming quarters.

Read the full article here