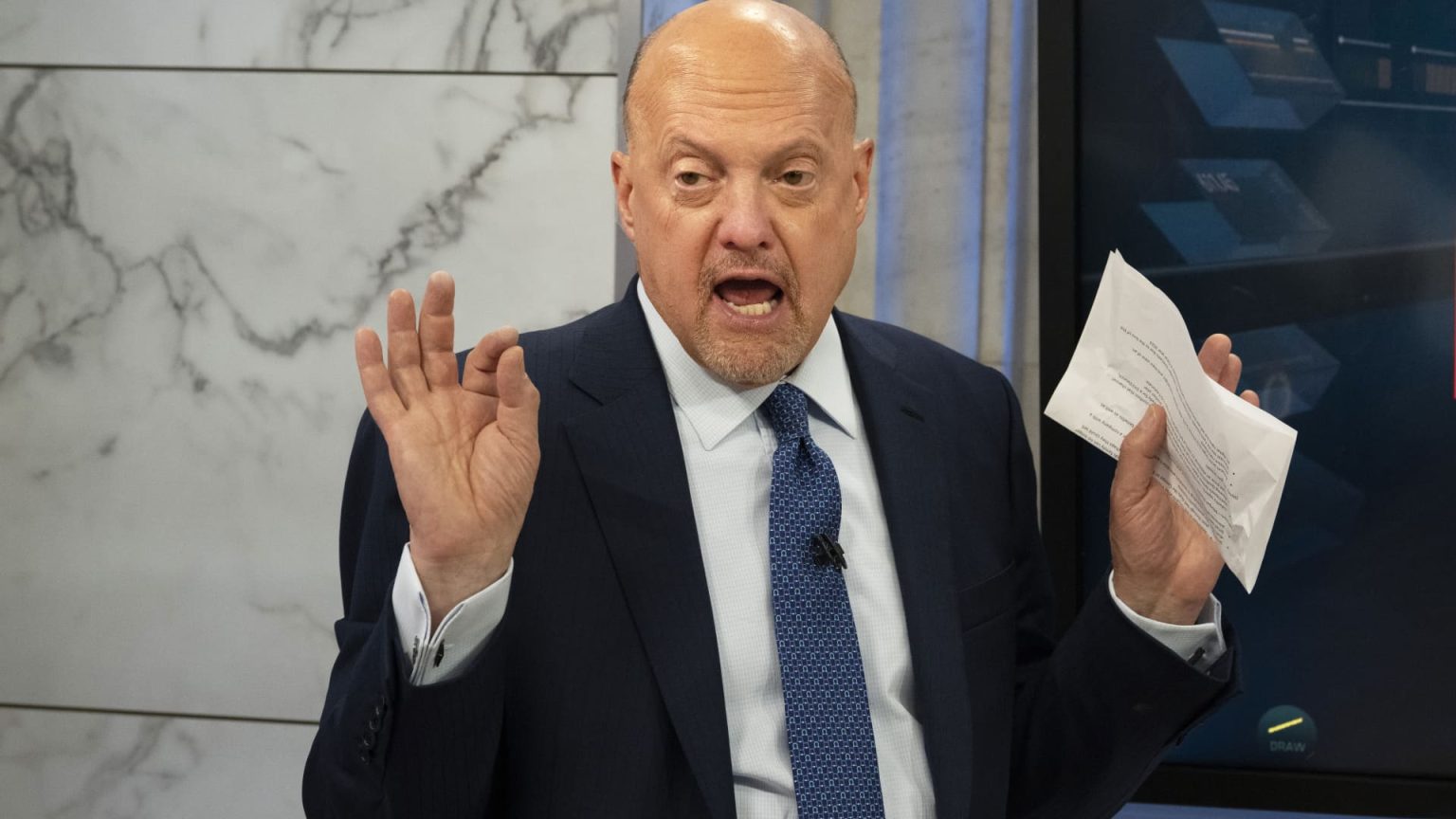

Every weekday the CNBC Investing Club with Jim Cramer holds a “Morning Meeting” livestream at 10:20 a.m. ET. Here’s a recap of Tuesday’s key moments. ‘Don’t like the tape’ Stick with Apple Stay bullish on Wells Fargo 1. ‘Don’t like the tape’ U.S. stocks rose Tuesday, with the rate of inflation slowing to its lowest annual rate in more than two years in May, according to the Labor Department’s monthly consumer price index . The report bolstered investor hopes that the Federal Reserve would skip an interest-rate hike at its two-day policy meeting, which gets underway Tuesday. However, Jim Cramer urged caution. “I don’t like the tape here,” he said, noting some stocks seem to be on a one-way march higher, including Oracle (ORCL) and Adobe (ADBE). “Stop buying things that are up over-and-over again because of the same research,” he said. 2. Stick with Apple Speaking of research, Jim said he’s not a fan of the Apple (AAPL) downgrade at UBS, which on Monday night took its rating on the iPhone maker’s stock to neutral from buy. The firm bumped its price target on Apple shares to $190 each, from $180, implying 3.4% upside from the stock’s Monday close. UBS expressed concerns about slowing revenue growth in Apple’s key services segment, citing its analysis of App Store spending through May. The firm also said its surveys suggest demand for new iPhones in developed markets, including the U.S., has softened over the past six months. Jim said he believes Apple’s services revenue has actually accelerated and emphasized that iPhone demand in emerging markets, such as India, remains key to the Apple’s next chapter. Apple remains a stock that investors should own for the long term. 3. Stay bullish on Wells Fargo Wells Fargo (WFC) shares still look attractively valued, Jim said, despite their more-than-2% pop Tuesday. The stock is trading at less than 9-times forward earnings, compared with its five-year average of 11.4, according to FactSet. “People are choosing the bullish side of Wells, not the bearish side,” Jim said, contending that Wells Fargo CEO Charlie Scharf still has more opportunities to reduce expenses. Speaking at a conference earlier Tuesday, Wells Fargo CFO Mike Santomassimo said the bank expects upside to it outlook for net interest income. In April, Wells Fargo guided for net interest income to increase 10% in 2023. (Jim Cramer’s Charitable Trust is long AAPL and WFC. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Read the full article here