Thesis

The Enhanced Capital and Income Fund (NYSE:CII) is an equity closed end fund. The CEF comes from the BlackRock family and focuses on the buy-write space. Similarly to another fund we covered, namely Eaton Vance Enhanced Equity Income Fund (EOI), this vehicle tends to write options on roughly half its portfolio. The fund historically has tracked the S&P 500 very closely, exposing long periods of time when it outperformed. In this article we are going to have a look at CII’s build, its performance this year, its drivers and our estimate for its outlook.

CII: Tracking closely the S&P 500

As per its literature, the fund:

[…] seeks to provide investors with a combination of current income and capital appreciation. The fund seeks to achieve its investment objective by investing primarily in a diversified portfolio of common stocks in an attempt to generate current income and by employing a strategy of writing (selling) call options on equities in an attempt to generate gains from option premiums.

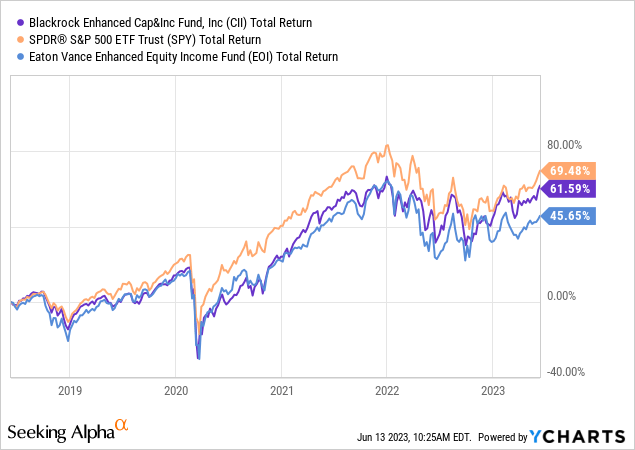

Let us see how the fund does historically from a total return perspective:

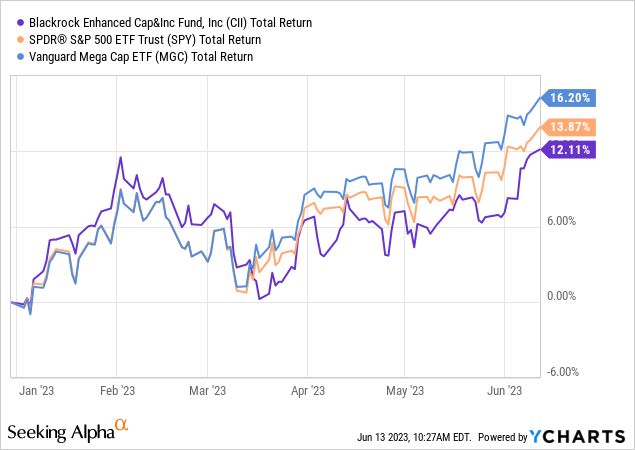

The CEF does a good job of transforming equity returns into dividends, and has historically tracked the S&P 500 very well, while we can see the Eaton Vance Enhanced Equity Income Fund lagging as of late. One of the factors behind this recent out-performance is CII’s build, which focuses on large capitalization stocks. Mega caps have outperformed as of late, especially in 2023:

We can see how the Vanguard Mega Cap ETF (MGC) has been the clear outperformer in 2023 with a 16.2% total return. Breadth has been very narrow this year. CII has done a decent job of being ‘married’ to the SPY total return chart so far this year.

CII Build

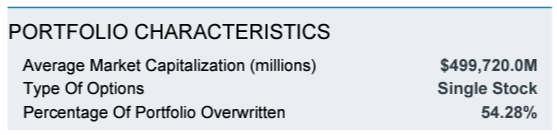

Unlike some other buy-write funds, CII only writes call options on around half of its portfolio:

Portfolio (Fund Fact Sheet)

This translates into a higher upside when the market rallies, like we have seen so far this year. Also very important to note that the options written are single name ones, not the index options. This is an important aspect to note, since single stock options can have higher volatilities when compared to the index, hence can generate higher profits. There can be liquidity issues with single name stock options, but all of the companies in the CII portfolio are very large capitalization names.

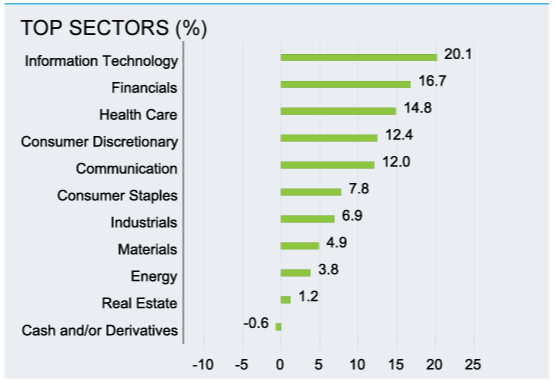

The fund only contains 55 holdings, and has a sectoral build which is similar to the S&P 500:

Sectors (Fund Fact Sheet)

The fund does not disclose the details around its options program, such as percentage out of the money, tenor schedule and covered names, with annual reports data already very outdated. Suffice to say that there is a bit of flexibility and latitude the fund managers can have here, which is beneficial. Systematic vol strategies have done poorly so far this year when compared to more discretionary ones.

The opacity around the current strategy is a bit unwelcome because we do not know how to characterize the current set-up. If the fund wants to be defensive, then it can write high delta call options (i.e. call strikes close to the spot price), whereas a more aggressive stance will see more out of the money strikes. The option skew depending on maturity date is also quite important here in determining the alpha generated by each strategy.

Also to note that single name options have held up their vol levels higher this year versus the index due to the introduction of 0-day options for the S&P 500:

Many theories abound for why this once-reliable indicator of sentiment — famously known as Wall Street’s fear gauge — seems to be losing its edge. But one in particular keeps coming up: That traders hedging against — or betting on — turmoil are piling into options with zero-days-to-expiration, or 0DTE.

Since the VIX is calculated using derivatives that expire 23 to 37 days into the future, the thinking is that it has been struggling to capture this near-term sentiment, which largely emerged last year when the introduction of new expiration days fomented the boom.

Put simply: In the age of 0DTE, Wall Street may need a new fear gauge.

Enter the one-day VIX.

Cboe Global Markets Inc., the Chicago-based exchange operator behind the VIX, has announced that a new one-day version of its flagship volatility index is poised to launch. The Cboe 1-Day Volatility Index (ticker VIX1D) is scheduled to start Monday, according to a notice on Cboe’s website.

Source: Bloomberg

You can therefore now trade 0DTE options for the SPY, but not for single name stocks. Efficient market theory states that vol compression should percolate to single name options as well, but in effect it has not done so fully.

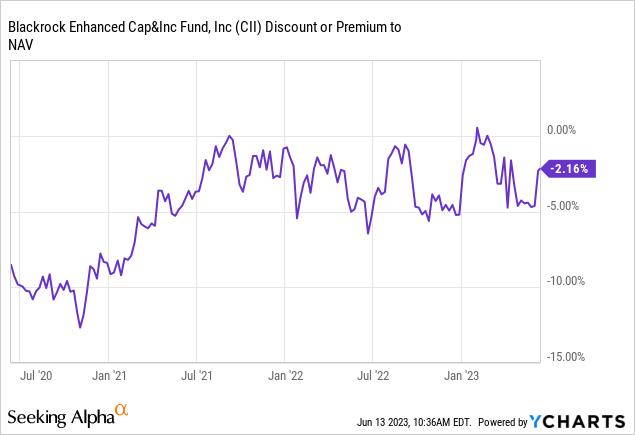

Premium / Discount to NAV

The fund has had a very narrow range as of late:

There are no extremely exciting discounts here. We can see that in the past two years the range for the discount has been very narrow, alternating between -5% and 0%. At the moment there are no clear cut opportunities around the discount to NAV. In effect we expect this to widen once we enter a new bull market since investors will not want to give up the upside in the market.

Conclusion

CII is an equity CEF. The fund falls in the buy-write strategy sector, although its options overlay covers only half of its portfolio. What is particular about this CEF is the fact that it writes single name options rather than index ones. This particularity has helped it in 2023, when single name vol has held up better than index vol. The introduction of 0DTE options has served as a VIX compressor throughout 2023, translating into lower premiums for funds selling index options. CII is also focused on mega-caps, its 55 holdings largely falling in that category. Mega-caps have outperformed the market in 2023. Nonetheless CII is closely correlated to the S&P 500, and any risk-off event will see this fund drop as much as the index. If you are in the camp of a new bull market then you should sell CII since it is giving up too much of the upside in classic bull set-ups. If you are in the camp of a range bound market then you should hold on to it. Do expect the ‘marriage’ to the SPY to continue for a risk-off scenario as well, with the CEF having a very similar drawdown profile to the SPY in 2022.

Read the full article here