Investment Thesis

Modine Manufacturing Company (NYSE:MOD) designs and manufactures engineered heat transfer systems and components for use in on- and off-highway original equipment manufacturer (OEM) automotive applications. Over the last year, the company has seen exemplary performance as marked by record financial performance both in Q4 and 2023 FY, with both top and bottom lines growing.

In my opinion, the good financial performance justifies the 200% share growth over the last year. The company attributes its solid financial performance to robust product demand. To a larger extent, they attribute the performance to the internal changes adopted about two years ago. Given this, I am upbeat on the stock, owing to the growing heat pump market in Europe, where the firm is now expanding, as well as rising demands for EVs, which I believe will keep the company’s product demand elevated.

Financial Performance: Record Q4 2023 And FY 2023

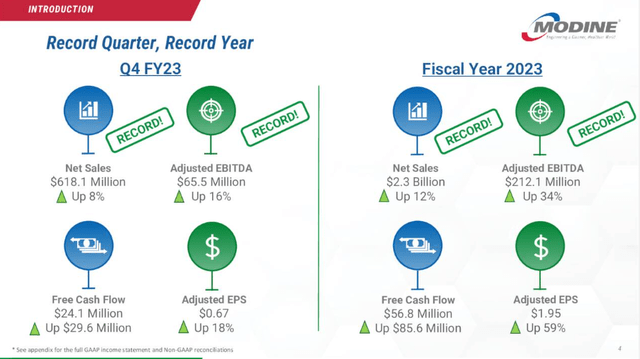

MOD had a strong financial performance in both the MRQ and the 2023 fiscal year, both of which were record results.

Q4 2023 Results Presentation

In the MRQ, Sales of $618 million, up 8% and 11% in constant currency, exceeded forecasts. They reported an adjusted EBITDA of $66 million, up 16% over the previous year. They also earned $24 million in free cash flow and $0.67 in adjusted EPS. This excellent performance culminated in a record year with the highest sales and adjusted EBITDA in their history.

For the full year, sales increased by 12%, while adjusted EBITDA increased by 34% to a record-breaking $212 million. This translates to an EBITDA margin of 9.2%, up 150 basis points from the previous year. In addition, the company generated $57 million in free cash flow and posted adjusted earnings per share of $1.95.

Looking at this outstanding financial performance, I notice the company’s tenacity in the face of adversity. Furthermore, its future upbeat financial projections, in my opinion, demonstrate how optimistic its stock is. Given the company’s growth levers, which will be described in the following sections, I believe those expected outcomes are feasible.

Expansion To Europe: A Response To Growing Demand

MOD is expanding its operations at its existing location in Sremska, Serbia, to fulfill rising demand in Europe’s heat pump sector. The new factory, which will be completed later this year, will be a dedicated maker of coils for commercial and residential heat pump systems.

The European heat pump market is growing at a double-digit rate. Government regulations to reduce fossil fuel usage and greenhouse gas emissions across industries have increased governmental support and incentives to install heat pumps. According to the International Energy Agency, yearly heat pump sales in the European Union will reach 7 million units by 2030, up from 2 million in 2021.

Modine has decades of experience producing high-quality heat transfer coils for HVAC contractors, integrators, distributors, and OEMs. Modine Serbia was founded in 2014 to produce heat transfer coils for commercial refrigeration and HVAC applications. The plant has received new investment over the years and was extended in 2019 to service the rising heat pump market. The new factory will be built next to the present one.

Given the rising market and the government incentive, this is a wise move, in my opinion. In my opinion, this expansion will translate into more revenues, leading to higher margins. In other words, after this expansion is completed, I anticipate greater financial success.

The Rising Market In Europe: Justifying The Expansion To Europe

In 2022, approximately 3 million heat pumps were sold in Europe, representing a nearly 40% increase over the previous year. Russia’s invasion of Ukraine fueled this trend by driving up natural gas and power prices, prompting people to switch to heat pumps, which are substantially more efficient than traditional heating methods. Last year, the European Commission also announced plans to quadruple the deployment pace of heat pumps, as originally envisaged in the IEA’s 10-Point Plan to Reduce the European Union’s Reliance on Russian Natural Gas.

The majority of air-to-air units, which make up between 50% and 80% of installations, are sold in the Nordic and Baltic nations. Similarly, Southern Europe likewise has a high rate of such unit purchases. Air-to-water heat pumps are the preferred technology in Germany and Poland. For instance, hybrid systems, which pair heat pumps with gas boilers, are common in Italy, where they will account for more than 40% of air-to-water market sales in 2022. The most effective kinds are ground- and water-source heat pumps, which are also the priciest. They currently make up less than 10% of European sales due to the requirement for drilling operations and additional space.

In 2022, the first year of a nationwide ban on gas boilers in new buildings, heat pumps in buildings in France outsold fossil fuel boilers for the first time. Despite declining demand in other significant European nations, fossil fuel boilers still hold a larger market share than heat pumps. For instance, in Germany and Italy, heat pumps were outsold by fossil fuel boilers by a factor of two in 2022.

There are plans to phase out polluting technologies and fuels simultaneously. According to German government plans, new heating systems must rely primarily on renewable energy sources starting in 2024. Seventeen European nations have enacted or made plans to enact prohibitions on installing boilers that use only fossil fuels.

Given this context, I believe that MOD’s expansion to Europe is justified and may be profitable. Government policies are encouraging this economic tendency, and the market is expanding due to surging demand. It strikes me as a worthwhile and promising endeavor.

What’s The Shareholder Position?

While some still promote the efficient markets concept, it has been demonstrated that markets are too reactive dynamic systems, and investors are not always rational. Analyzing the relationship between earnings per share [EPS] and share price is a faulty but reasonable technique to determine how perceptions of a firm have evolved.

MOD saw compound earnings per share climb by 87% annually over the course of three years of share price growth. The average yearly share price growth of 69% is less than the EPS growth. So, assuming that the market has cooled on the stock is reasonable. Further, I’m happy to note that over the course of a year, the company’s stockholders saw a total shareholder return of 143%. It would appear that the stock’s performance has improved recently because the one-year TSR is higher than the five-year TSR, which is lower at 2% annually. Based on this information, I am thrilled with the intriguing position that shareholders have given this company. I think prospective investors will find this to be quite attractive.

Valuation

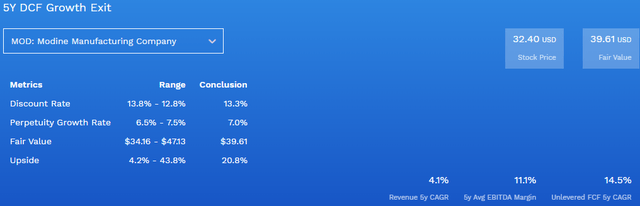

Going by relative valuation metrics, MOD appears to be trading at a discount. With PE, PS, and PEG ratios of 11.31, 0.69, and 0.14, respectively, being below the industry medians of 16.72, 0.86, and 0.57, respectively, this company is undervalued in relation to its peers. Further, to support this assertion is a DCF model from finbox, which estimates a fair value of $39.61; this leaves the company with an upside potential of about 20%, which I believe is even conservative, looking at the company’s solid growth levers. Below is the output of the model and its assumptions.

Finbox

This company has had strong shareholder returns and eps growth, so I believe this is a good entry point for potential investors. I believe they should seize this opportunity and enter this promising investment at a discount.

Conclusion

Given its recent financial performance and increasing shareholder returns, I believe MOD is an excellent investment. Furthermore, its expected future financials demonstrate the optimism underlying its growth levers. I rank the company as a buy since it is undervalued, but investors should be cautious because the current macroeconomic climate could potentially put their investment at risk.

Read the full article here