If you are looking for an under-covered stock secured by a company with a substantial market share in a niche industry, then you’re in the right place. Malibu Boats, Inc. (NASDAQ:MBUU) is an American recreational boat producer and distributor with scintillating prospects that are probably yet to be priced in by the market. The stock has surged by roughly 15% since the turn of the year, and we have reason to believe that more gains are in store.

Without further ado, let us delve into a deeper discussion about Malibu Boats and its stock.

Financial Overview

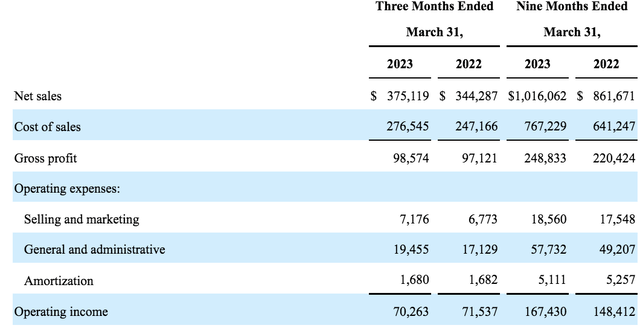

Despite year-to-date drawdowns in the producer price index for boats and the U.S. consumer sentiment index, Malibu Boats has continued to scale. Owing to its 14.51% market share, the firm bolstered its top line by approximately 8.9% (year-over-year) in its previous quarter, eclipsing analysts’ estimates by $31.97 million.

Malibu Boats; Seeking Alpha

Although Malibu possesses a substantial market share, its upward product price adjustment during the past year has led to lower volumes, causing its gross profit margin and EBITDA to fall by 190 basis points and 210 basis points, respectively.

Although retrospective results convey softening demand and profit margins, a forward-looking vantage point indicates the opposite. In our view, the Federal Reserve’s announcement pertaining to an early 2024 interest rate pivot will stimulate consumer confidence and result in pent-up demand for durable goods such as boats and vehicles.

Furthermore, from an idiosyncratic point of view, Malibu might partake in filling customer demand after Hurricane Ian totaled as many as 15,000 boats. According to management’s comments in May, the reorder cycle has not yet hit full flow, and it could be a future benefactor for Malibu Boats. In addition, Malibu’s sterndrive engines (for its cobalt segment) are set to launch in early 2024, which is anticipated to deliver a triple-digit ROI. Therefore, various catalysts exist that might drive up Malibu’s top line.

Malibu Boats also possesses prospects to cut its costs in the coming year/s. From a top-down point of view, general wage demands are slowing, as are material costs. On top of it all, Malibu Boats is in the process of reinvigorating parts of its upstream channel; the firm has historically leased much of its property at a weighted average borrowing rate of 3.67%. However, recently, Malibu successfully bid for a 100 000-square-foot toolings facility to bring its toolings in-house. This adds to the company’s recent announcement that it plans to build a 260 000 square foot facility in Tennessee in an attempt to recognize long-term synergies.

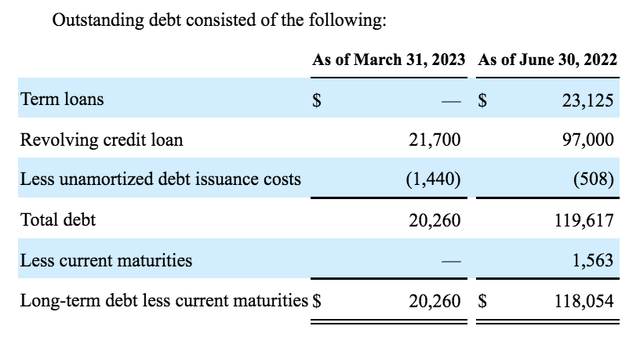

Lastly, Malibu Boats is doing an excellent job of reducing its debt load. According to its latest 10-Q statement, Malibu reduced its long-term net borrowing to merely $20 260, which is an infinitesimal amount compared to its available revolving credit facility of $350 000. Thus, Malibu has created a significant amount of shareholder value during its past year by purely reducing its net borrowing.

Malibu Boats

Valuation

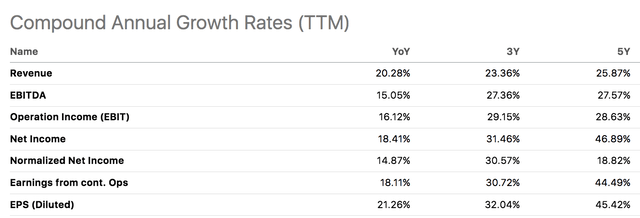

Before discussing Malibu Boats’ valuation, a talk about its decision not to pay dividends must be discussed. In our view, the company is wise to reinvest at this stage instead of paying dividends to its shareholders. Our basis for the statement is that Malibu is still growing at scale at a compound annual growth rate of 25.87%, suggesting that continued internal and external investments will possibly create more investor value than a distribution of excess capital in the form of dividend payouts would.

Seeking Alpha

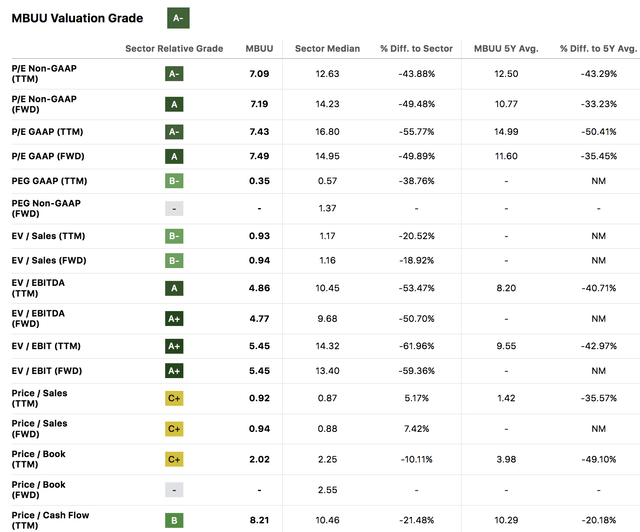

From a valuation perspective, we think valuing the stock based on a peer analysis and its forward earnings is most prudent. Firstly, a peer comparison shows that Malibu Boats’ salient price multiples are trading at sector discounts, apart from its price-to-sales ratio. Thus, there is a fair argument that this is a best-in-class stock.

Seeking Alpha

An absolute valuation also contributes to a claim that the stock is undervalued. Based on the expanded price-to-earnings formula, Malibu Boats’ stock might reach x by June 2024.

Although the method does not guarantee that the stock will be priced in, it provides a useful indicator.

- Formula = EPS Forecast for June 2024 x 5-year Average P/E = 7.69 x 12.50 = $96.13 (rounded).

- The stock price at the time of writing this article was around $61.40 per share.

Risks

Despite our general outlook on Malibu Boats’ stock being positive, it does possess a few fault lines worth discussing.

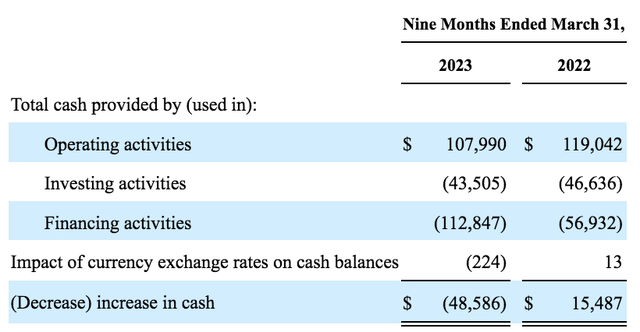

Firstly, the company’s cash flow statement endured a knock in its previous operating quarter. Although most of its cash flow weakening was due to a financing outflow (often considered positive), Malibu’s operating cash flow also experienced a setback; if this trend continues, the stock might be subject to a downward valuation adjustment by many analysts.

Malibu Boats

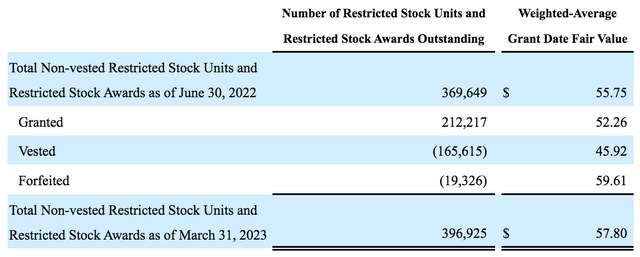

A risk relating to the firm’s income statement is its employee stock grants and options package. The company has over $11 million worth of restricted stock awards outstanding that are yet to be vested. Once the official vesting date occurs, Malibu Boats will need to expense the grants, leading to a possible downturn in the company’s retained earnings.

Malibu Boats

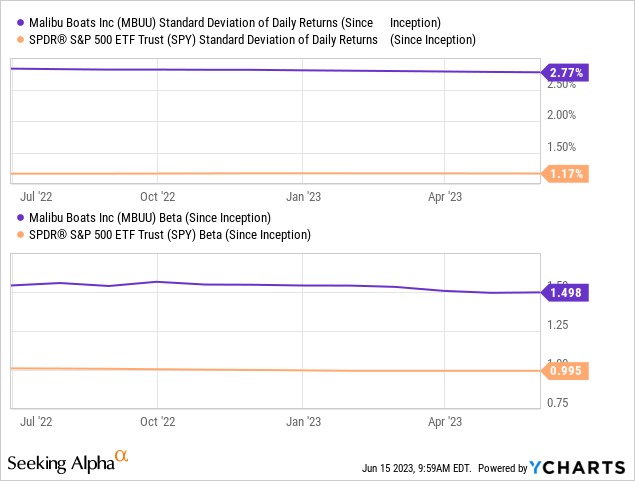

Lastly, Malibu Boats is an exceptionally volatile stock. And, considering the market experienced a broad-based uptick since the turn of the year, a temporary retracement might cause severe damage to investors’ positions, which would be particularly unfavorable to new market entrants.

Final Word

Malibu Boats, Inc. possesses the necessary characteristics to emerge as one of the primary breadwinners within the durable goods space in the coming quarters. The company’s robust market share and attempt to bring all of its upstream in-house might add to its future profitability. In addition, introducing new engines for one of its key product lines could generate significant ROI, suggesting that internal value creation is in play.

Although certain risks are evident, we think Malibu Boats’ stock is grossly undervalued and ready to rumble.

Read the full article here