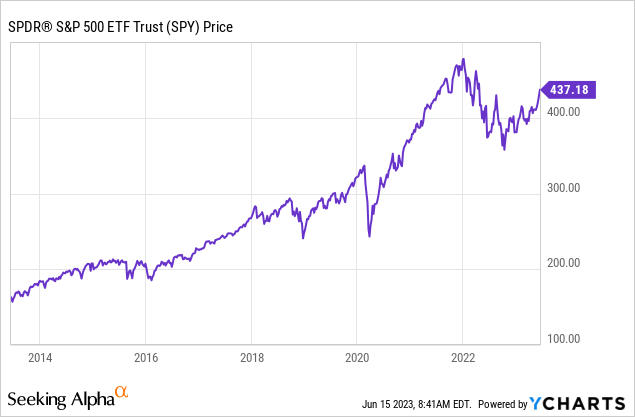

First, let’s me point that, based on my analysis, the recent breach of the 20% level from the October lows for S&P 500 is still a bear market rally, and not the beginning of a new bull market. The most popular ETF that tracks the S&P 500 (NYSEARCA:SPY) is up by 15% YTD, the reversal is likely in the second half of 2023.

Here is the 10Y-year SPY chart that shows the beginning of the bear market in January 2022 and the recent bear market bounce since October 2022:

Why is this still a bear market rally?

Yes, the media has been exuberant about the recent breach of the 20% threshold from the lows and pronounced that the “it’s official, we are in a bull market”.

However, this is still a bear market rally, for a simple reason – we are currently in a recession or we will be in a recession very shortly. Further, given the valuation and the more than optimistic earnings projections, the stock market is not priced for a recession. In fact, it could be argued it’s a bubble with the Schiller P/E ratio at 31.

This should be very easy to understand – the Fed has increased the interest rates by 5% since March 2022, along with the balance sheet reduction, to bring the inflation down to the 2% target. In October of 2022 the Fed inverted the 10Y-3m yield curve, which has been a reliable indicator of a recession within 12 months.

Thus, now we are currently waiting for the lagged effect of 1) the interest rate hikes on the consumption and the unemployment rate, and 2) the yield curve inversion on credit availability (inverted yield curve tightens the lending standard). These lagged effect will eventually show up and confirm a recession. The market is not priced this.

In fact, there are signs that we are already in a recession.

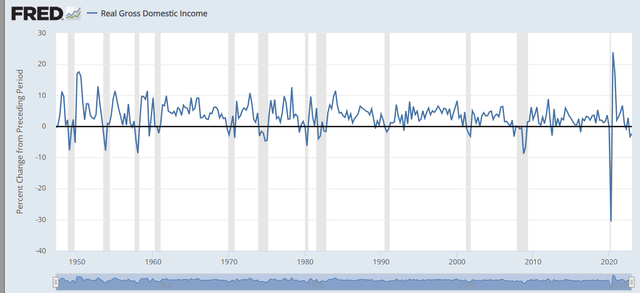

First, if you measure the economic activity based on income (Real Gross Domestic Income or GDI), we have been in a recession over the last two quarters, Q4 of 2022 (-3.3%) and Q1 of 2023 (-2.3%). As you can see in the chart below, Real GDI has been fairly accurate in tracking the Real GDP recessions.

FRED

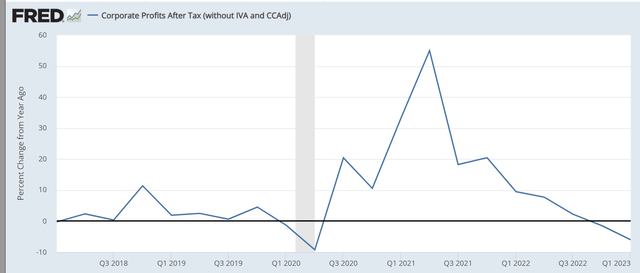

Second, we also have a Corporate Profits After Tax (without IVA and CCAdj) recession, down by 1.4% in Q4 2022 and down by 6% in Q3 2023.

FRED

Third, the Redbook Index, or the weekly index of yoy change in retail sales at major US retailers is currently just above 0%, showing that consumption has stalled compared to last year and indicating an unfolding consumer weakness.

Trading Economics

The other indicators will likely follow.

What supports the bear market rally?

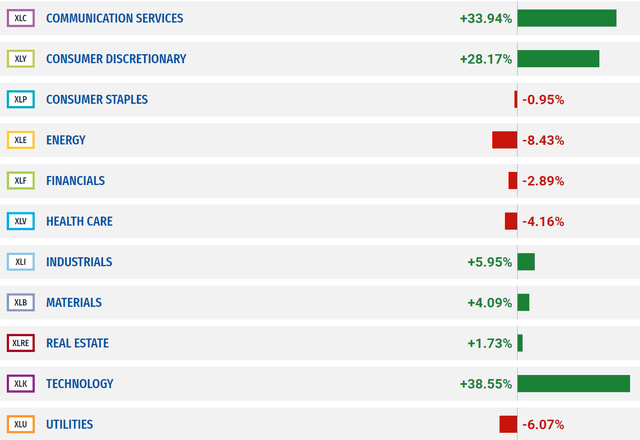

As previously stated, the popular ETF that tracks S&P 500 is up 15% YTD. But when you look at the SPY sectors, you see a very unbalanced performance.

The performance is heavily weighted by the Technology sector (XLK) which is up by over 38% YTD, followed by Communications (XLC) up by 34% and Discretionary sector (XLY) up by 28%.

SelectSectorSPDR

In fact, the common theme for the tech, communications, and discretionary spike is the generative AI, and the trigger for the spike was the news in late January 2023 that Microsoft invested billions in ChatGPT.

So, the bear market rally is not based on a macro systematic event – it based on a firm-specific or industry-specific event, with no short-term or medium term effect on the economy. Yes, maybe in few years for now, we will see some systematic effect of AI on growth and inflation, but it will not help with the current “sticky inflation” or prevent a recession.

In fact, it could be argued that the AI theme triggered a massive short covering rally in heavily sold tech stock, which were near the October bottom in late December, facing higher interest rates and a deeper selloff.

How will the Fed cap the bear market rally?

The narrow AI themed rally can only take the stock market higher for a limited time, other stocks must join in – the rally must broaden.

I wrote the article explaining the microstructure of the recent false breakout, focusing on Goldman’s upgrade of S&P 500 with arguments that the probability of a recession has decreased. On June 6th, Goldman lowered the recession probability only to 25%, based on the prediction that the banking crisis was mostly over:

…regional bank stock prices have stabilized, deposit outflows have slowed, lending volumes have held up, and lending surveys point to only limited tightening ahead

The Goldman’s suggestion here is that the economy could possibly avoid a recession, which “gives the legs for the new bull market” – and could broad the rally to include other cyclical sectors.

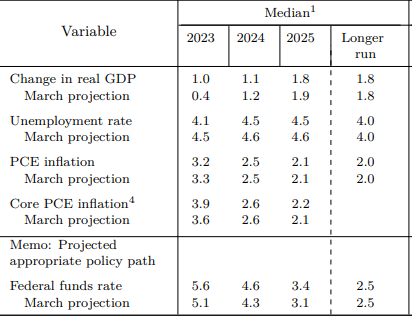

Well, the Fed made the following predictions in the Summary of Economic Projections on June 14th:

The Fed

- the GDP growth for 2023 is upgraded from 0.4% to 1%

- the Core PCE for 2023 is upgraded from 3.6% to 3.9%

- the expected Federal Funds rate is upgraded from 5.1% to 5.6%, implying 2 more hikes

What does this mean?

Very simply, the Fed is saying that if the growth remains modest, without a recession (1%), they will keep hiking, which is likely to deepen the banking crisis, further invert the yield curve, and cause a much deeper recession later.

This essentially rules out the soft-landing scenario. Either, we are in a recession or near a recession, or the Fed will continue hiking until a recession. Thus, the current bear market rally is unlikely to broaden, which caps the rally. The AI megacaps can only do so much, and eventually the AI bubble will burst.

Implications

The index investor allocating to the popular ETF that tracks S&P 500 have decent gains YTD. It really doesn’t matter how we got here, that’s a history.

What matters is what happens next.

Based on my analysis, the economic data will start confirming that we are in/near recession, and the earnings estimates will have to be downgraded. Alternatively, if the growth continues, the Fed will continue to tighten monetary policy until the data confirms a recession.

Thus, it makes sense to sell SPY. Alternatively, T-Bill are yielding over 5%.

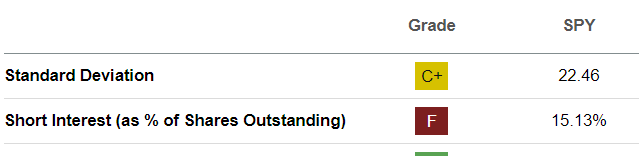

The further bet on the SPY upside is just a bet on further short covering – which could continue to work. The current short interest on SPY is over 15%, as many are betting on a fall and for good reasons, but many shorts will not be able to hold the position until the fall, and be forced to cover. However, this is a game for traders, not for investors.

Seeking Alpha

Read the full article here