Overview

For the benefit of new readers, RXO (NYSE:RXO) is a truckload broker that operates solely in the for-hire truckload transportation industry, which is notoriously competitive and decentralized. I anticipate RXO’s continued market share gains within this sizable industry to be driven by the company’s dedication to investing heavily in technology and automation. I recommend continuing staying patient with RXO even though there are already signs of bottoming in the freight market.

Signs of bottoming

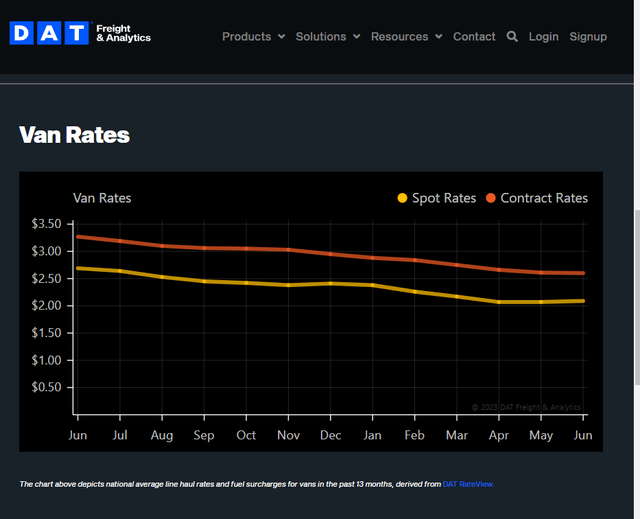

The core driver for earnings growth is the bottoming of the freight market, which I believe is showing signs of bottoming as seen in Spot Van Rates stabilizing and modestly increase in May and so far in June. While I agree that inflation and low consumer confidence have dampened overall demand, and that there has been no discernible improvement in recent months (no headline news to suggest improvements), I found it encouraging that management singled out areas of optimism within the network and noted some players have exited the market (which means more market share up for grasp). Management’s remarks also provide a positive outlook as they indicate that customer inventory levels have effectively rebalanced following a destocking period of over six months. Additionally, the recruitment of drivers for dedicated business has shown signs of easing, suggesting a gradual departure of subscale operators from the market. In regard to the latter, this means that established players will have a greater chance to further their market position and expand their market share. Overall, the market seems to be nearing a bottom, although questions remain about the health of consumers in the coming months.

DAT

RXO well-positioned

While I agree that now is not the time to buy RXO, I can’t deny that the company has demonstrated the qualities of a winner in its stock performance and business operations. RXO has shown consistent volume growth despite the current difficult macroeconomic environment, while smaller players continue to exit; this means RXO’s market share is growing, which in turn increases RXO’s scale and logistical advantage. I also think that the natural cyclicality of the industry has led to RXO’s increased market share as shippers cut back on the number of broker partners they work with, keeping only those who are crucial to their transportation strategy. RXO will be in a good position to capitalize on an uptick in the market and customer demand, I believe, because of the solid customer contracts it has established during this market downturn (earning the trust and gaining creditability within the industry). Even if margins in the contract business were to decline as spot rates rose, the additional profit generated from the spot business would increase gross profit per load.

The management team’s doggedness in forging ahead with improvements despite the recession is another plus. With a recent $15 million investment, RXO has increased its real estate brokerage capacity and is actively hiring new staff to assist clients when the market recovers. When the market reaches an inflection point and demand recovers, I believe RXO will be in a strong position thanks to its ongoing investments. Even more so now, when many rival asset-light brokerages are slashing jobs and fleet owners are relying lesser on brokerage platforms.

Secular tailwind

For the for-hire truckload industry, which is valued at $400 billion, I anticipate continued growth of the brokerage market in the coming years. There are a number of reasons for the brokerage industry’s sustained expansion. To begin, as industry cycle times continue to decrease, shippers are looking for ways to incorporate more flexibility into their cost structure which will allow them to flex it according to demand. I believe the covid situation has highlighted the inadequacies of owning fleets as there are fixed costs and lack of adaptability, who often have 12- to 18-month wait times for ordering new supply. In contrast, brokers link shippers with a ready supply of trucks from which to choose, with the added benefit of a variable pricing model. Because of this core benefit, I remain optimistic about the truck brokerage industry’s prospects for growth within the larger truckload market and for winning over customers from private fleets and asset-based for-hire carriers.

What to look out for

Given the ongoing positives with RXO, when is the best time to load up on the shares? In my opinion, it will be obvious when contract rates show better performance than expected and re-price at higher levels. RXO’s ability to consistently increase volume despite the presence of competing products is also a qualitatively significant factor.

Conclusion

RXO shows promising signs of market share gains and resilience in a challenging freight market. The company’s focus on technology and automation, along with its established customer contracts, positions it well for future growth. Additionally, the secular tailwind of the brokerage industry’s continued growth within the truckload market provides further opportunities for RXO to gain market share.

Read the full article here