Investment Thesis

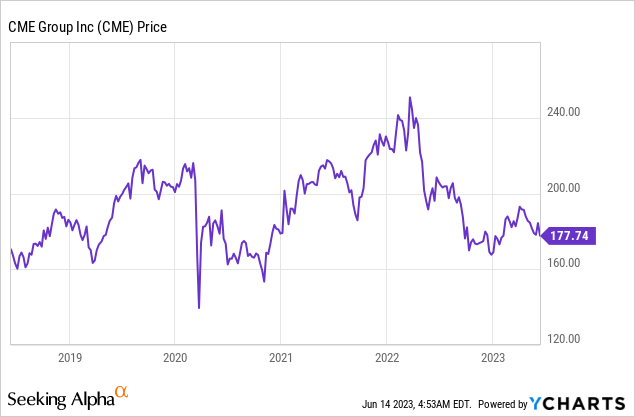

CME Group (NASDAQ:CME) is currently down over 25% from its all-time high last year, as the financial companies continue to face pressure from rising interest rates and a weakening economy. However, I believe the market has been punishing the wrong company, as CME Group’s fundamentals are superb, and it is also relatively immune to a macroeconomic slowdown.

For instance, the company actually benefits from the volatility in the economy. The rising popularity of 0DTE options should also present meaningful tailwinds moving forward. After the meaningful drop, the company’s valuation has become quite compelling, with multiples being discounted on a historical basis. I believe the pullback presents a decent buying opportunity for investors.

Why CME Group?

CME Group is a Chicago-based leading financial services company that is comprised of four exchanges, which include CME, CBOT, NYMEX, and COMEX. These exchanges specialize in derivatives (eg. options and futures) and offer products based on different asset classes such as interest rates, indexes, FX, energy, and more. It also operates other segments, including clearing services and market data, but they have a much lower presence.

CME Group has extremely wide moats with strong competitive advantages. The company is the clear leader in the derivatives marketplace, with broad product coverage across different asset classes. For instance, other exchanges like Intercontinental Exchange (ICE) mostly focus on Energy products (31% of total revenue) while CBOE (CBOE) focuses on volatility and index products (59% of total revenue). They provide products for other asset classes as well, but their presence is substantially lower. This gives CME a dominant market share in asset classes such as interest rates, FX, and agriculture.

Thanks to its diverse offerings and market position, the company has built out a strong brand within the industry. This continues to attract customers, which subsequently increases the liquidity of its products. It is extremely hard for other companies to challenge CME Group, as the financial exchange industry has high and complex regulatory barriers. Customers are also highly unlikely to switch to emerging exchanges due to their inferior liquidity and reputation.

Benefiting From Volatility

With the economy slowing and uncertainties increasing, I believe CME is a great defensive pick for conservative investors. Unlike most financial companies that struggle with volatility, the company actually benefits from it.

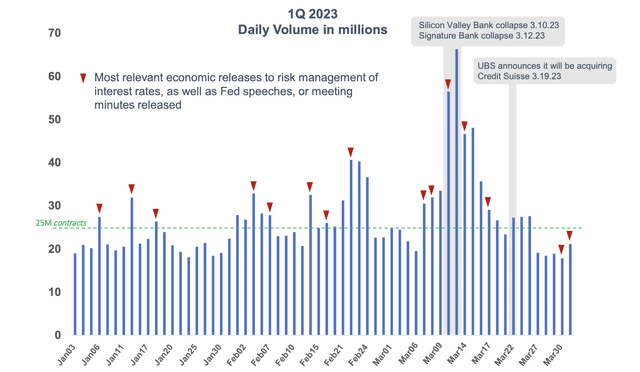

The company generates revenue based on the instrument’s trading volume, rather than its price direction. Higher volatility generally creates higher trading volume, which means more revenue for the company. For instance, CME’s daily trading volume doubled from its average of 25 million to nearly 70 million during the collapse of Silicon Valley Bank, as shown in the chart below. This helped the company generate revenue and EPS growth of 7% and 15% in the first quarter, despite facing a serious deterioration in the finance industry.

The diverse product offerings also allow the company to benefit from different situations and backdrops. For example, inflation has been the key focus last year, therefore trading volumes for commodity-related products saw substantial increases. The focus has shifted to the FED in the past year, which subsequently benefited interest-rate-related products. Considering the company’s business model and diverse offerings, it should be able to demonstrate great resilience during uncertain economic environments.

CME

The Rise Of 0DTE

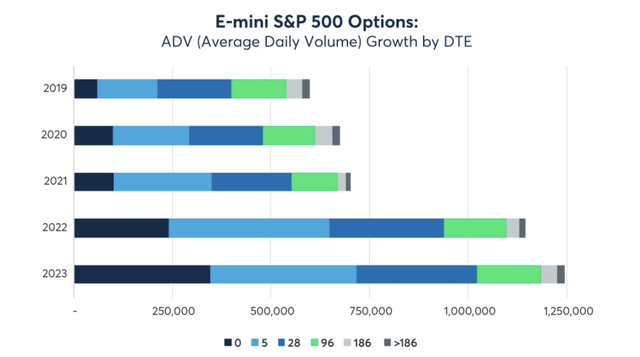

The unprecedented rise of 0DTE options should also present meaningful tailwinds for CME Group. For those who are unaware, 0DTE options are option contracts that expire in less than a day. Due to the short expiring time frame, the volatility of these options is often significantly higher. Its volatile nature makes them the perfect instrument for traders with a short time frame. The captivating excitement from volatility continues to boost its popularity, especially among amateurs that aim to make a quick gain or simply gamble.

The rise of 0DTE options has been exponential in the past few years. According to CME Group, the average daily volume of 0DTE options traded for the S&P 500 (SPY) tripled from 2021 to 2023 YTD, as shown in the chart below. It is worth noting that we are only halfway through 2023, so the final figure at the end of the year should be even higher.

CME

Modest Valuation

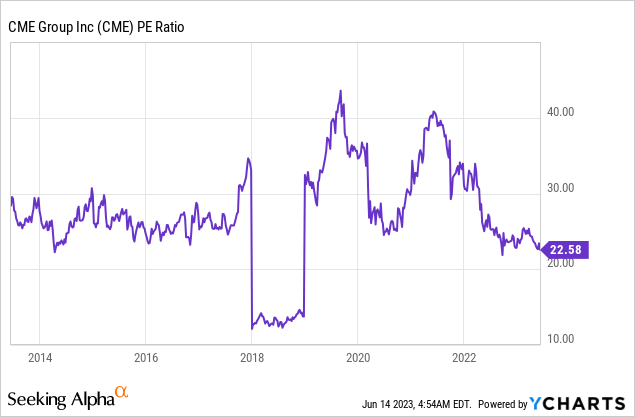

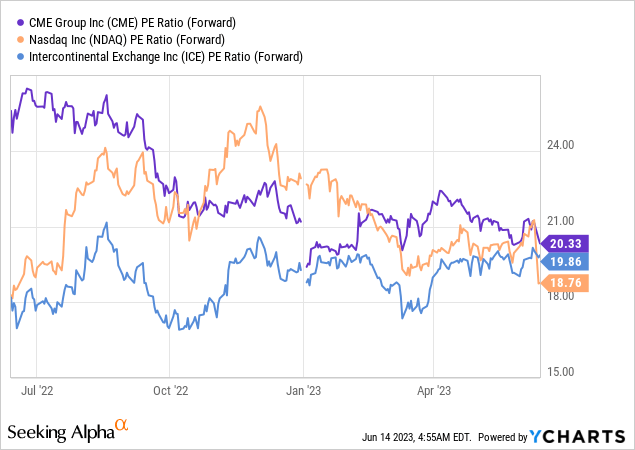

After the 25% drop in the past year, CME Group is now trading at a PE ratio of 22.6x, which is very reasonable when considering the quality of its business. The company currently looks pretty discounted on a historical basis. As you can see from the first chart below, the multiple is now at the low end of its historical range, representing a meaningful discount of 22.1% compared to its 5-year average PE ratio of 29x.

The valuation is now also in-line with peers. As shown in the second chart below, the company has been historically trading at a premium compared to other exchanges including Nasdaq Inc (NDAQ) and Intercontinental Exchange (ICE), but the gap has almost closed as the company’s share price continues to decline despite its financials continuing to improve. I believe a premium should be given to CME as its earnings remain best-in-class. For instance, its revenue growth of 7% in the latest quarter substantially outpaced peers’ growth of less than 1%.

Investors Takeaway

Given the highly uncertain economic outlook, I believe CME Group should be an excellent holding with great stability. There are certainly risks regarding a slowdown in trading volume, but I am not too right now as the current market sentiment seems to be in favor of CME.

Not to mention, the rising popularity of 0DTE options should also be a major growth driver for trading volume, especially when considering the euphoric price action as of late. Considering the strong fundamentals and the modest valuation, CME should be a solid buy at the current price.

Read the full article here