Co-authored with Treading Softly.

When you were a kid, did your father bother you about turning off the lights? I realized I had become a father when I found myself spending more time every day turning off lights that I had not turned on than doing other things around the house. There is a classic saying attributed to fathers asking their children, who left the lights on, “Do you think we own the power company?”

How often do you get into your car, and only then remember you decided not to fill up your gas tank on your way home last night? For most of us, purchasing fuel is simply an errand that must be completed and a cost that must be borne. It’s a necessity to drive to and from work every day. It used to be called the “commuting tax” because they were forced to pay it in order to go to work and earn the money that would pay for the fuel that they were burning.

When it comes to the market, my goal is to generate income from activities that people have no choice but to pay for. Because I’m not a taxing authority, I cannot levy a tax on everyone’s income, but I can own utilities and gas stations. Everyone has to pay their power bill as long as they’re connected to the grid. Everyone has to buy fuel so long as they’re driving a car that burns it. These are bills or costs that we pay without even a second thought. They’re basic necessities in most of our minds.

Today, I want to look at two opportunities to be able to get paid for the basic necessities that others spend their money on.

Let’s dive in!

Pick #1: NEP – Yield 5.4%

NextEra Energy Partners, LP (NEP) is an energy “yieldco” specializing in “green” energy, primarily solar and wind power. Yieldcos are structured very similarly to MLPs in the oil and gas sectors but file taxes as a C-corporation. This means that investors get a 1099 at tax time and avoid a lot of the confusing tax implications that MLPs sometimes have.

NEP‘s manager is NextEra Energy, Inc. (NEE). NEE owns and operates the largest electric utility in the United States – Florida Power & Light. Additionally, it owns NextEra Energy Resources (“NEER”), a world leader in wind, solar, and battery storage.

NEP primarily works with NEER, which invests in constructing wind and solar farms. After construction is complete and the asset is operational, NEER sells it to NEP. This frees up NEER’s capital to start new developments. NEP then sells the generated electricity to NEE, creating an income stream that funds distributions to NEP shareholders, rewarding them for the capital they provided.

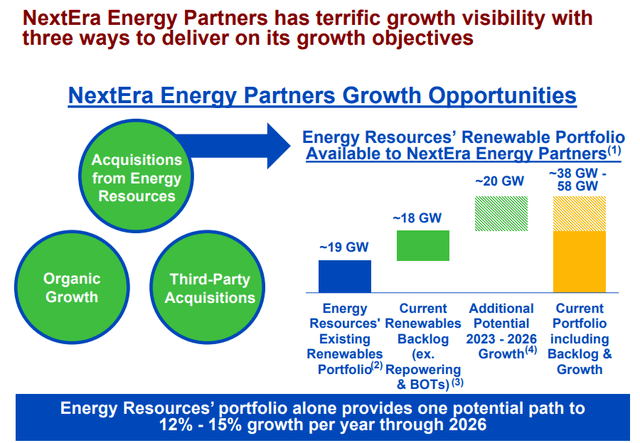

This system provides NEP with excellent visibility of its future growth. After all, the manager owns the company that sells NEP most of its assets. NEER has a significant backlog of projects that are already finished and ready to be acquired – along with plans to build a lot more. Source.

NEP May Presentation

However, there is a fly in the pudding, and that is the current state of the equity markets. In order to fund new acquisitions, NEP needs to get capital from somewhere. When share prices are high, this is easy – NEP can just issue new shares. However, with the share prices having fallen since early 2022, issuing equity at current prices isn’t a particularly attractive option.

We’ve seen some management teams just issue shares at poor prices and not worry about slowing growth for investors; fortunately, NEE is not that kind of management.

Rather than allow NEP to struggle, NEE decided to waive its incentive distribution rights (“IDRs”). In 2022, NEP paid IDR fees of $152 million. This will allow NEP to sell its natural gas pipelines without compromising cash available for distribution (“CAFD”) to shareholders. In turn, proceeds from the sale will provide enough capital for NEP to fund its expansion plans through 2026 without having to turn to the equity markets and issue shares at poor prices.

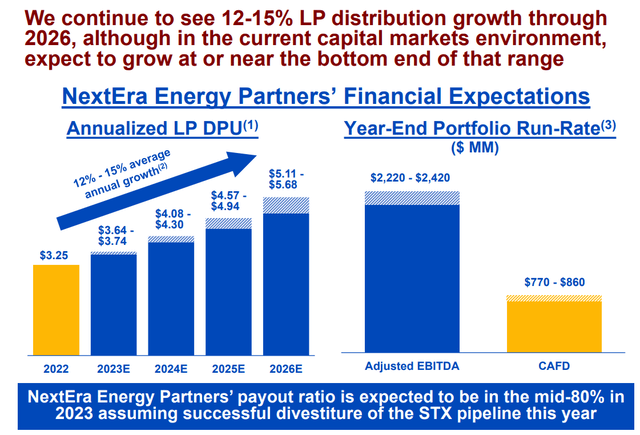

NEP already hiked its distribution once this year and remains on track to achieve its 12-15% distribution growth target.

NEP May Presentation

NEP has rebounded from lows but is still trading at a very attractive price paying approximately a 5.4% yield that is expected to have 12-15% annual growth.

Pick #2: CAPL – Yield 10.5%

CrossAmerica Partners LP (CAPL) is the smallest of the “big 3” fuel distributors and one we’ve been closely watching for a while now.

When we look at CAPL, we find its large and generous yield of 10.5% attractive, so we’re not looking for growth but sustainability. 2022 was an unusually high year for fuel profit margins. So we’re expecting lower margins in 2023.

Throughout 2022 management was very focused on maintaining the distributions and reducing leverage – this is important as we look to 2023. As profit margins decline, leverage ratios will climb due to nothing more than lower earnings. The big question is: by how much and how will distribution coverage fare?

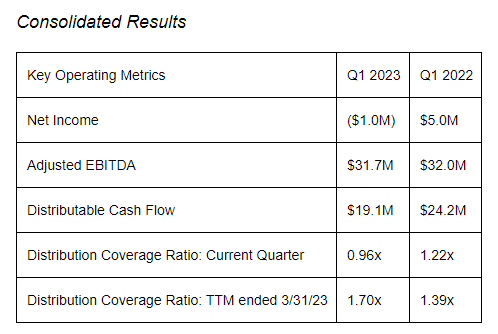

Q1 of 2022 was just the beginning of the fuel profit margins ramping up to higher levels. Therefore, we’re seeing that Q1 2023 profit margins are elevated compared to 2022 but still significantly lower than the end of last year. Source.

CAPL Earning Release

When looking at the key results from last year to this year, we can see that overall, it was relatively flat. This is due to the decline in profit margins in Q1 of 2023 versus the remainder of the year of 2022. The bottom line results are lower due to the almost double increase in their interest expense. This is understandable, given the large number of rate increases we saw throughout 2022. When it comes to fuel distributors, the first and last quarters of the year are always the weakest. This is because quarter two and quarter three are typically referred to as summer travel season – there’s a much higher level of fuel demand during those time periods allowing for greater profits.

For CAPL, it was less than a 1x coverage ratio for the distribution this last quarter. This will be concerning if it becomes a continuing trend. However, looking over the last 12 months, we see strong coverage, and then looking through 2021, we see strong coverage as well, albeit lower than 2022.

The key for CAPL to maintain strong distribution coverage will be due to the fact that they have lowered their debt significantly throughout 2022. Management’s focus on reducing debt more than organic growth or increasing the distribution made the distribution more sustainable. We did see the leverage ratio tick up over 4x, but just barely. This is partially due to the fact that they refinanced their credit line facility and removed one of the two of them, amalgamating everything into a single upsized facility.

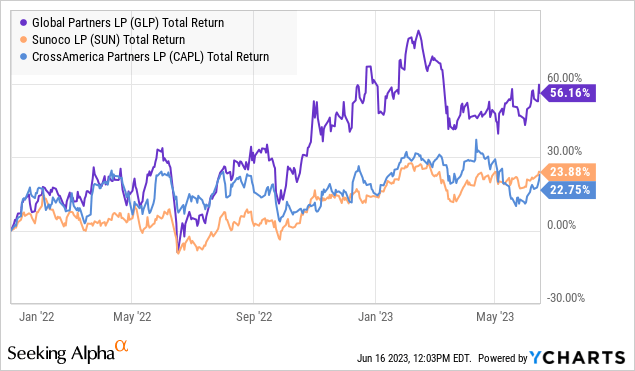

All three major fuel distributors provided strong returns since January 1st, 2022. We find that CAPL is the most attractive at this time. Previously, HDO members were able to exit GLP with strong returns near the top of its price movement. We moved to a safer level in the preferred securities and traditional bond offerings offered by Global Partners LP (GLP). When it comes to CAPL, we find that the common units currently provide the best value, and we get paid strong distributions while management carefully moves to reduce leverage.

Note: CAPL issues a K-1 at tax time.

Conclusion

With NEP and CAPL, we can generate high levels of income in the average everyday spending on others. Every time somebody flips on the light switch or starts their car, you can be earning money directly into your bank account.

This is the kind of income that a retiree dreams of. This is not an income that is depending on the market to climb or rise and then having to sell shares at a profit to pocket income. This is income you can rely on, month after month because others rely on the services provided by these companies. Just like you depend on your utility company to power your house and your local gas station for fuel. The big difference is that you can choose to be paid by those companies instead of simply paying them.

This way, your retirement will be the one that is completely funded by the spending of others. This is not discretionary spending that comes and goes with recessions but required spending that people have to do every single month and every single day. You will have expenses while retired, so you’re going to need income to match them and exceed them to do other things you enjoy. These companies can provide that income.

That’s the beauty of our Income Method. That’s the beauty of income investing.

Read the full article here