Jardine Cycle & Carriage (JC&C), the investment arm of Hong Kong-based conglomerate Jardine Matheson, has teamed up with Singapore’s online automotive marketplace Carro in a deal worth more than $60 million to step up used car sales amid new vehicle shortages.

The partnership, announced on Friday, will see JC&C pick up an undisclosed interest in Carro. Carro will in turn receive a stake of equivalent value in Republic Auto, a Singapore-headquartered second-hand car dealer controlled by JC&C. The companies said in a statement that the collaboration will grant Carro access to an expanded supply of high-quality used cars, while allowing Carro to enhance Republic Auto’s digital offerings.

Meanwhile, the companies will form a joint venture to launch an automotive aftermarket business, which will initially focus on Singapore and neighboring Malaysia.

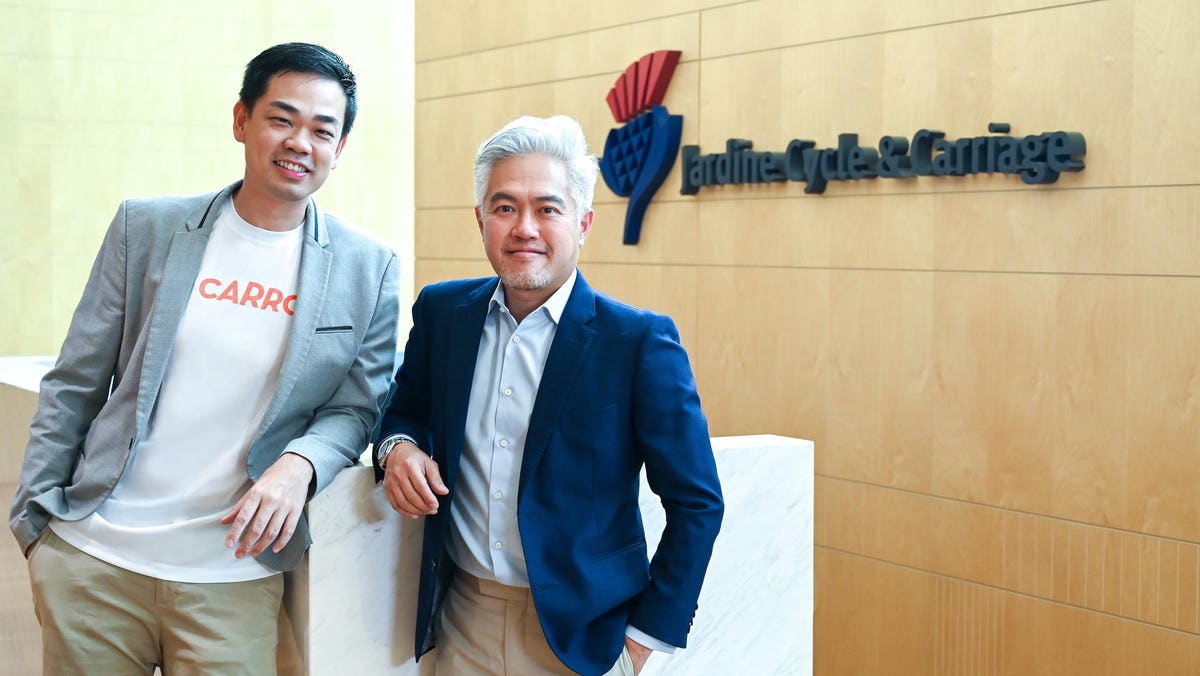

“JC&C chose to partner with Carro because we look beyond used car wholesaling and retailing, setting our sights on the larger ecosystem that facilitates deeper cooperation in financing, insurance and aftersales,” Wilfrid Foo, managing director of regional direct motor interests at JC&C, said in the statement. “The partnership will enable us to scale up our operations and capabilities faster by leveraging our combined areas of expertise.”

JC&C’s partnership with Carro comes as a prolonged global chip shortage has kept vehicle production low and worries about a potential economic recession drove up used car demand. Carro said it had nearly doubled its revenue to more than $800 million in the financial year ended March, and had a positive Ebitda of $4 million during the same period. Founded in 2015, Carro raised $360 million in a round led by SoftBank’s Vision Fund 2 in 2021, which at the time valued the company at more than $1 billion.

“JC&C operates not only in Singapore but also in other geographies such as Indonesia, Vietnam, Malaysia and Hong Kong. We have found their footprint to be extremely synergistic,” said Aaron Tan, cofounder and CEO of Carro, in a written response. “Furthermore, JC&C deals upstream and has a good quality supply of used vehicles which Carro can now tap into. This partnership provides us with access to good quality inventory that we otherwise would not have.”

Singapore-listed JC&C is the investment holding company of Jardine Matheson, the 190-year-old empire helmed by the Keswick family that has business operations spanning real estate, hospitality, heavy engineering, financial services and others.

Southeast Asia-focused JC&C controls Astra International, an automotive group based in Indonesia and one of the two flagship businesses of the Jardines conglomerate. The investment company also has interests in Vietnam’s leading car maker Truong Hai Group Corporation, the country’s biggest dairy producer Vinamilk and Thailand’s leading cement maker Siam City Cement, among others.

MORE FROM FORBES

Read the full article here