Introduction

PBF Energy (PBF), an old-school refiner, presents an enticing opportunity for investors seeking an asymmetric risk/reward profile. Despite significant improvements in the company’s business over the past year, the market remains fixated on historical concerns, leading to undervaluation. However, with a shift in the company’s fortunes, a robust net cash position, and potential capital allocation clarity, PBF Energy is poised for a turnaround. Moreover, the company’s strategic play in renewable diesel conversion further adds to its potential upside. This article delves into the reasons why PBF Energy warrants attention and examines the factors influencing its stock value.

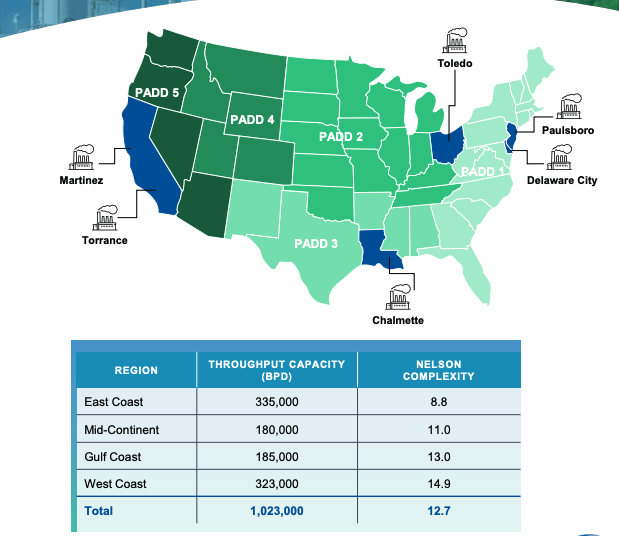

Company overview (PBF IR)

Shifting Business Dynamics

PBF Energy has made significant progress in the past 12 months, transitioning from a financially strained company with substantial debt to one with over $500 million in excess net cash. The elimination of historical concerns, such as overleveraged balance sheets and COVID-related challenges, has bolstered the company’s position. As a result, PBF Energy is now in a position of strength, likely leading to capital allocation clarity in the near term, potentially through share repurchases or dividend policies.

Evidencing the Diesel Market and Renewable Diesel Conversion

Over the next six months, PBF Energy is expected to provide further evidence of the global cost curve shift and the structural short position of the diesel market. This is crucial for substantiating the company’s competitive advantage. Additionally, PBF Energy’s foray into renewable diesel conversion, with a substantial investment of $600 million in a conversion plant, presents a free but powerful option for the company. Despite being in the final stages of this project, the market remains skeptical and fails to attribute any value to this promising venture.

Undervalued Stock and Market View

Remarkably, PBF Energy’s stock is currently trading at levels similar to those observed prior to the pandemic, when the company faced significant risks. Considering the approximately $3.25 billion cash flow generated over the past year, the implied value per share is around $60, suggesting a substantial undervaluation. The market, however, holds reservations and assumes a reversion to historical margins without acknowledging the potential advantages PBF Energy possesses.

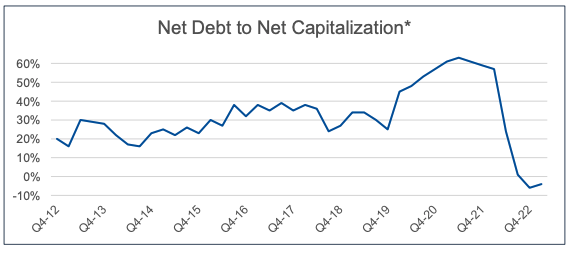

Net cash (PBF IR)

Investment Perspective

While PBF Energy operates in a controversial sector, it offers an attractive risk-reward proposition, particularly for those optimistic about the long-term diesel market. The company is well-positioned to benefit from the ongoing tightness in the diesel market, driven by factors such as a diversification of energy sources in Europe and a sustained structural short position. Furthermore, the overlooked conversion of the Chalmette facility into renewable diesel production could unlock substantial value, estimated to be over $2.5 billion. PBF Energy’s management appears cognizant of its potential and the market’s underestimation, indicating a likelihood of value-unlocking scenarios.

Fair Value Analysis

Taking into account the potential value of the renewable diesel asset and applying conservative multiples to the core business, various scenarios yield upside potentials ranging from 50% to over 150% for PBF Energy’s equity. Additionally, with a net cash position of over $500 million, the company possesses a unique advantage that can drive even better outcomes.

Conclusion

PBF Energy presents a compelling investment opportunity with its undervalued stock, the potential for capital allocation clarity, and a strategic position in renewable diesel conversion. Investors willing to embrace the volatility of the refining industry can stand to gain significantly, particularly if they believe in the sustainability of the diesel market. With the potential for substantial upside, PBF Energy emerges as an intriguing option in the energy sector.

Read the full article here