Investment thesis

Alibaba’s (NYSE:BABA) stock has been substantially undervalued for a long time. There is only one reason why: vast potential and geopolitical risks. The company’s fundamentals are immense, with an impressive growth profile and stellar profitability. Alibaba invests vast resources to fuel further growth, and its firm financial position allows the company to develop many new projects. The stock’s valuation looks ridiculously cheap. I believe all these solid positive fundamental signals substantially outweigh all political and geopolitical risks. Therefore, I assign BABA a “Strong Buy” rating.

Company information

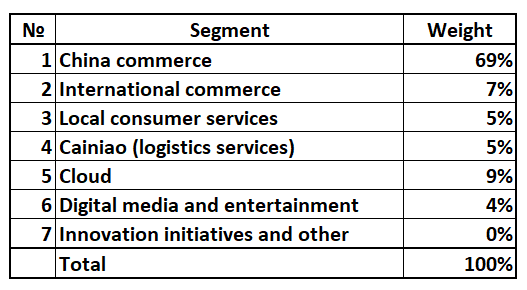

Alibaba is a multinational conglomerate whose e-commerce business is one of the world’s largest. Apart from e-commerce, the company’s businesses comprise consumer services, logistics services, cloud, digital media, and entertainment. In a word, Alibaba is an ecosystem. According to BABA’s latest available annual SEC filing, the company served approximately 1.31 billion annual active consumers, including above 1 billion in China and the rest internationally. Alibaba reports its business in seven operating segments, of which e-commerce represented more than 75% in FY 2022.

Compiled by the author

Financials

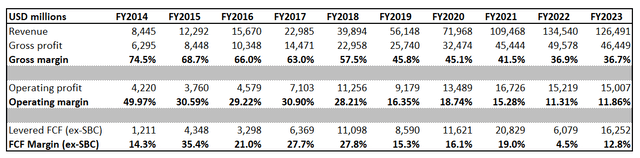

Alibaba demonstrated a stellar above 30% revenue CAGR over the last decade. On the other hand, profitability metrics deteriorated significantly.

Author’s calculations

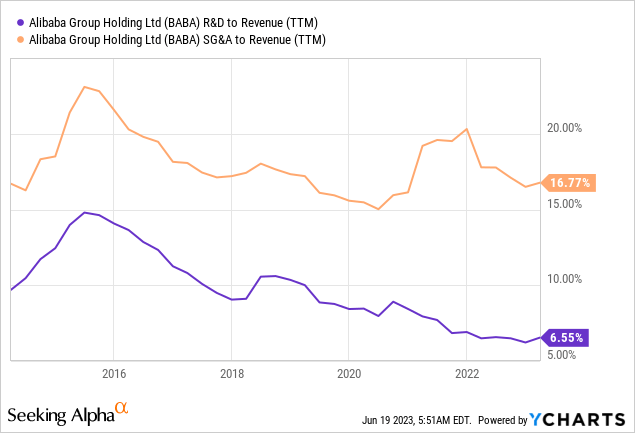

The decline in profitability metrics should be clear to readers. The decrease is not due to secular challenges but because of the company’s strategy to expand its business and diversify revenue streams. Alibaba reinvested a substantial portion of its revenue into the business to fuel its growth. The 6.5% R&D to revenue ratio might look low, but the amounts are vast if we consider the large scale of BABA. For example, in the last five years, the company invested more than $30 billion in R&D.

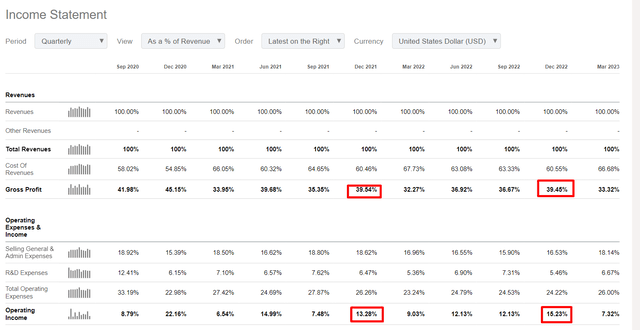

Now let me go ahead and narrow down the financial analysis to the quarterly level. The company faces headwinds due to challenges in the macroenvironment, which are outside the company’s control. These challenges are temporary and not secular, in my opinion. Still, the company demonstrated four straight quarters of YoY revenue decline. March quarter was historically the weakest for the company from a margins perspective. This year’s calendar Q1 was weaker YoY, but Q4 was more robust on a YoY basis. The company improved SG&A to revenue ratio, which indicates the management is proactive in addressing the challenging macro environment. It is more difficult to drive revenue growth in current circumstances. Therefore keeping an eye on costs becomes crucial. I think that Alibaba has been executing well from the cost-control perspective.

Seeking Alpha

Problems with revenue growth might be in the rearview mirror because, for the upcoming quarter earnings, about 2.5% YoY growth is expected by the consensus. The good sign is that the bottom line is also poised to expand, with normalized EPS expected to rise from $1.74 to $1.98. The earnings release is scheduled for August 3.

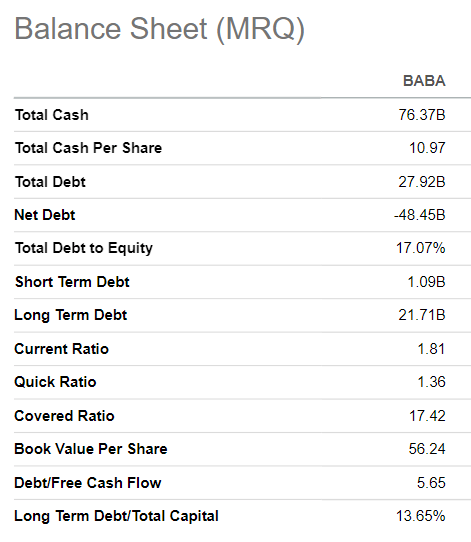

The company’s balance sheet is a fortress with vast cash significantly larger than the total debt. Leverage and liquidity ratios are in excellent shape, meaning the company has vast potential to finance further growth and innovation.

Seeking Alpha

Overall, Alibaba is well-positioned to remain on the impressive growth trajectory the company has demonstrated over the past decade. The company is a huge ecosystem meaning the network effect is strong to expand into new revenue streams. The company’s vast user base means it has an unmatched data source that can be used to improve both customer experience and merchant efficiency. Apart from good growth prospects and solid competitive advantage in its core e-commerce business, Alibaba is poised to benefit from a secular shift to cloud services. The company invested substantial funds to build its cloud business, and more investments are expected soon. According to Fortune Business Insights, the cloud computing market size is expected to grow at about 20% CAGR until 2030, meaning that the Cloud segment will likely be the major revenue growth and profitability expansion driver for Alibaba.

Valuation

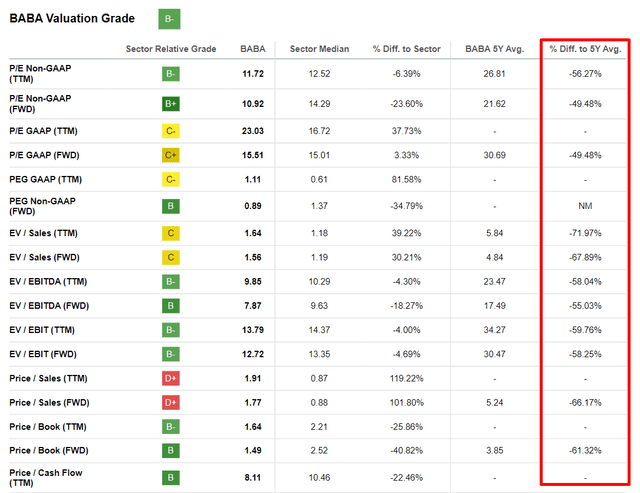

Alibaba’s stock price was almost flat year-to-date, significantly underperforming the broad market. Though, I also have to underline that iShares MSCI China ETF (MCHI) also demonstrated weak performance, with about a 2% decline year-to-date. Seeking Alpha Quant assigned BABA a “B-” valuation grade, which is high for growth, highly-profitable businesses like Alibaba. The company also looks very cheap compared to its 5-year average multiples.

Seeking Alpha

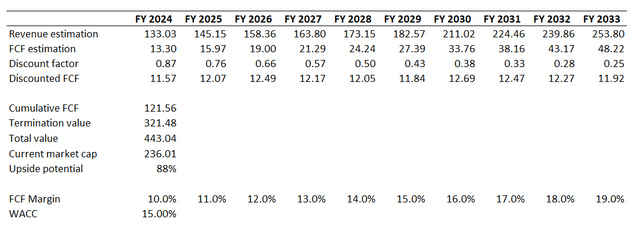

BABA is a growth company and does not pay dividends. Therefore, I use discounted cash flow [DCF] approach for valuation. Investing in Chinese stocks is inherently riskier than in North American companies. Therefore, I use an elevated 15% discount rate. I have earnings consensus estimates projecting about 7% revenue CAGR. BABA’s FCF margin has been volatile in recent years. To be conservative, I use a 10% level and expect it to expand by one percentage point yearly.

Author’s calculations

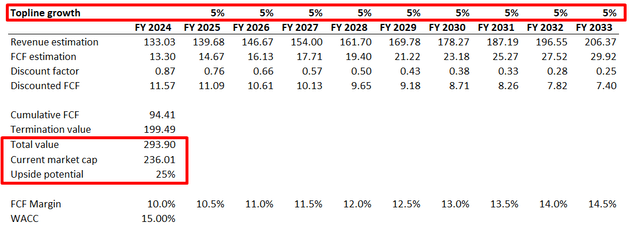

The upside potential looks immense since my DCF estimates the business’s fair value at about $443 billion. It is approximately 88% higher than the current market cap. It seems too good to be true, so let me simulate a much more conservative scenario. For the second scenario, I expect revenue growth at a 5% CAGR and FCF margin to expand by 50 basis points yearly.

Author’s calculations

As you can see above, the stock is about 25% undervalued, even under super-conservative assumptions. The upside potential looks tempting, meaning risks are substantial. Let’s now discuss the risks related to investing in the BABA stock.

Risks to consider

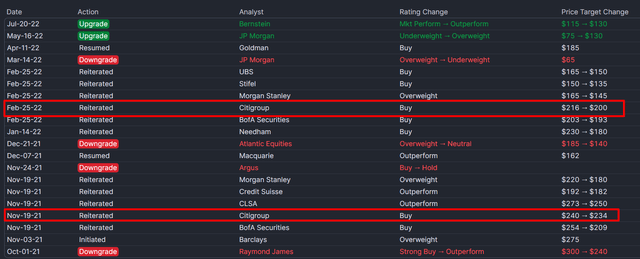

BABA stock looks very undervalued, according to my analysis above. But I want to remind readers that the stock has been undervalued for a long time. Target prices of analysts from the most significant investment banks were substantially higher than $200 per share in 2021 and have been consistently revised downward since then. But we all remember that the stock price was never close to $200 per share since the Summer of 2021. Moreover, the screenshot below shows that the target price was steadily downgraded and more than halved in less than two years.

Finviz.com

The reason for such substantial and stable undervaluation is apparent. The company’s founder, Jack Ma, had tensions with the Chinese Communist Party [CCP]. The company suffered multi-billion fines from the Chinese government and was urged to restructure its business to address antitrust issues. I consider political risk as the most substantial for investors.

The geopolitical risk is also substantial, especially given the escalating tensions between China and the U.S. In recent years, relationships between China and the U.S. have been complicated and characterized by trade disputes, intellectual property concerns, and technological competition. Tensions with the U.S. might mean that the company can face the same issues with European developed countries. These tensions might mean complicated international expansion for Alibaba. Without international expansion, Alibaba’s vast potential risks being locked for a long period. This will ultimately adversely affect growth prospects.

Bottom line

To conclude, Alibaba stock looks like a very attractive investment opportunity at the current stock price level. Potential investors should remember that it is a very risky bet, though. The risk is substantial because political outcomes are very difficult to forecast. On the other hand, the upside potential is massive and outweighs the uncertainty. I also like the vast ecosystem of Alibaba, meaning the company is well-positioned to absorb a favorable secular shift to e-commerce and cloud computing. Therefore, I assign BABA a “Strong Buy” rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here