In the days and weeks after six Republican-led states filed a lawsuit challenging the Biden administration’s debt-cancellation plan, workers at the student-loan servicer at the center of the case that will soon be decided by the Supreme Court expressed confusion about the extent of their employer’s involvement.

That’s one takeaway from a collection of emails from employees at the Higher Education Loan Authority of Missouri, or MOHELA, released through an open records request by the Student Borrower Protection Center, an advocacy group.

“Just out of curiosity, is MOHELA apart of the lawsuit going on to prevent the loan forgiveness? Are we the bad guys?” one employee asked via email in October, shortly after the states filed their case. MOHELA, which was created by Missouri’s state legislature, is not a party to the lawsuit, but it’s at the center of it. A key component in the case hinges on the idea that debt cancellation would cost MOHELA revenue and therefore harm Missouri, one of the six states bringing the suit.

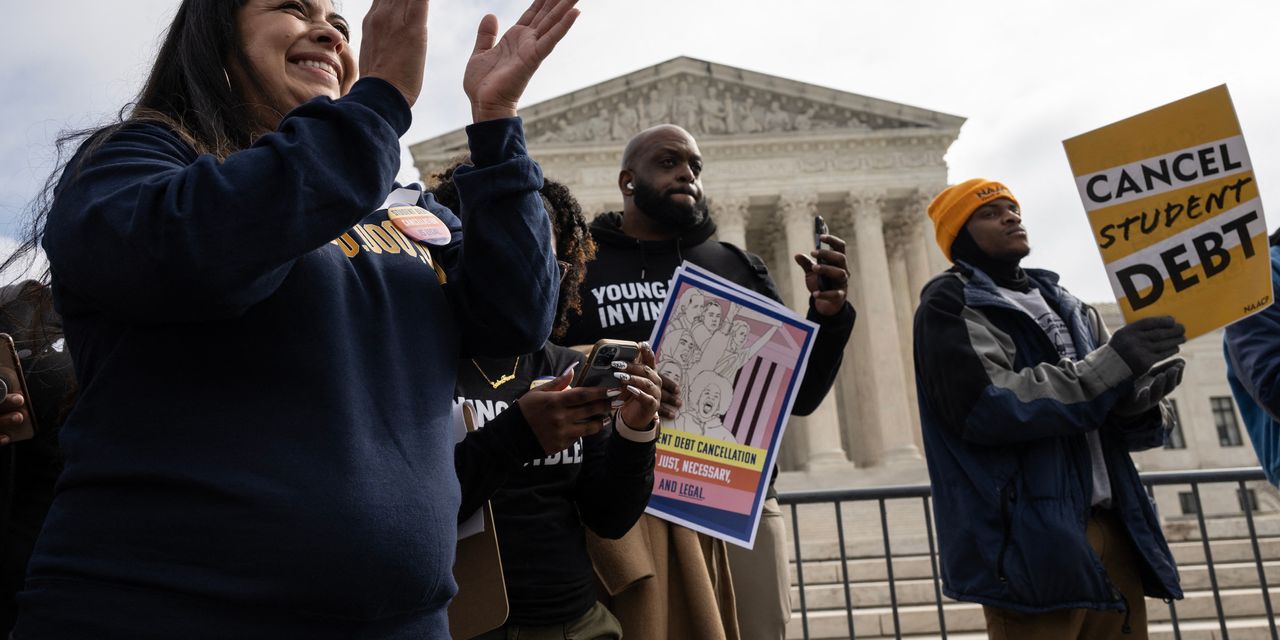

The release of the emails comes as borrowers and other stakeholders are waiting for the Supreme Court to issue a ruling in state’s case and one other suit challenging the Biden administration’s plan to cancel up to $20,000 in student debt for a wide swath of borrowers. The decision could come as early as this week and will determine the future of the initiative, which officials have said would benefit more than 40 million borrowers.

One of the questions before the court is whether the states have standing, or the right to sue, over the policy because it’s caused them a direct injury that could be redressed by the court. The states have argued they have standing to bring the case because debt cancellation would hurt the bottom line of MOHELA, which services federal student loans, and therefore cost Missouri.

In order for the justices to rule on the merits of the case, or whether the Biden administration was within its legal authority when creating the debt-cancellation plan, they have to find the states or the plaintiffs in the other case have standing to sue.

Legal experts, including some who believe the White House overstepped its authority in issuing the debt-relief plan, have said the states don’t have standing. Ben Kaufman, the director of research and investigations at SBPC, said the MOHELA employee emails only cast more doubt on the states’ arguments.

“What these emails do is they confirm the worst fears of anyone who might have thought that this was essentially a bad-faith lawsuit,” Kaufman said.

Latest evidence raising question about the states’ standing claims

The emails come after other evidence that’s raised questions about the states’ claim that the debt relief plan would harm MOHELA and that any injury to MOHELA as a result of the plan would harm Missouri. Part of the evidence the states cited in their briefs in the case is that MOHELA owes Missouri money and any injury to MOHELA’s bottom line would put the organization at risk of not paying on its debt. In reality, MOHELA hasn’t paid on that debt in years.

In addition, research published last month by the Debt Collective, a debtor advocacy organization, and the Roosevelt Institute, a progressive think tank, indicates that MOHELA will earn more from servicing federal student loans in the year following cancellation than it did in 2022 or any previous year.

The emails are another piece of information that “just demonstrates that the injury that the states are asserting is just wholly speculative,” said David Nahmias, a staff attorney at the Center for Consumer Law & Economic Justice at UC Berkeley School of Law. The messages indicate the distance that the employees, and perhaps MOHELA itself, have from the case, he said. In one message an employee asks, “Why do these states care about us?” In another, an employee says of the lawsuit, “It has nothing to do with us.”

“All of this evidence that we’ve seen is that any harm to the states is so weak, it’s way too hypothetical,” Nahmias said. For a party to have standing to sue they need to indicate they’ll be directly injured by a policy and that a court could redress the harm.

While “it’s kind of neat” to have a sense of how employees view the situation, what employees think about MOHELA’s relationship to the student-loan lawsuit doesn’t say much about the states’ standing claims, said Tara Grove, a professor at the University of Texas School of Law.

“The question should be, under state law is MOHELA part of the state and if so does that somehow give the state standing?” Grove said. “If you look at the way the state legal system is set up, is it part of the state or is it not, and what people think about it doesn’t tell us very much.”

Supreme Court denied a state standing in another case

During oral arguments, multiple justices seemed skeptical of the idea that MOHELA is a part of the state for standing purposes. Some questioned the solicitor general of Nebraska, who was representing the states, about why MOHELA didn’t sue over the policy itself. MOHELA executives have said they weren’t involved in the states’ decision to file the lawsuit. MOHELA did not respond to a request for comment on the emails.

“If MOHELA is an arm of the state, why didn’t you just strong-arm MOHELA and say you’ve got to pursue this suit?” Justice Amy Coney Barrett, one of the conservative-leaning members of the court, asked.

A recent decision authored by Barrett, in a case challenging the Indian Child Welfare Act, indicates to Grove that other claims to standing made by the states in the student loan case may not survive, like that the debt-relief plan could cost them tax revenue.

“I feel a bit more confident that those other arguments won’t win after reading the Supreme Court’s short analysis,” in that case, Grove said. As part of that decision, which upheld the Indian Child Welfare Act, Barrett rejected Texas’ claim it had standing in the case in part because the state couldn’t demonstrate an “injury in fact.”

“It was notable because the Supreme Court actually denied a state standing, which the lower courts have not been doing as much,” Grove said.

Still, it didn’t provide much insight as to how the court may view the states’ argument surrounding MOHELA.

The decision provided “tea leaves,” Grove said, “but does not tell us how the student loan case is going to come out.”

Read the full article here