Deere & Company(NYSE:DE) is much more than a tractor manufacturer within the agriculture sector. Deere is revolutionizing the agriculture sector by installing self-driving capabilities is its large machinery tractors, making them the Tesla (TSLA) of agriculture.

The company recently reported a solid quarter, but the stock was unable to retest the 2022 highs, instead falling and now finding themselves 10% below its 52-week high.

Since last covering the stock, DE shares are up nearly 30%, and although I still am a big believer in the stock long-term, the current valuation has me waiting on adding shares right now. While self-driving should add to both the top and bottom line more over time, I am choosing to be patient to look for a better entry point.

In this piece we will take a closer look at those recent quarterly results, the status of the business, the company dividend, and its current valuation.

Strong Recent Results

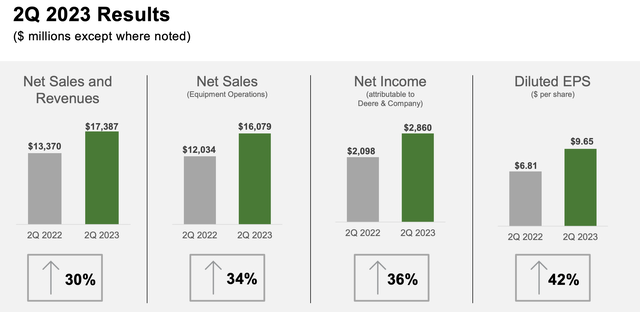

The industrial sector has been hitting on all cylinders and Deere has been right there in the thick of it. Deere recently reported strong earnings to back up its performance, showing no signs of slowing, yet. Here is a closer look at the company’s Q2 earnings:

- Net Revenues of $17.4 billion

- Net Income of $2.9 billion

- EPS: $9.65 per share

DE Q2 Presentation

Revenues of $17.4 billion were a 30% increase year over year. The production and precision ag segment generated revenues of $7.8 billion, which was an increase of 53% year over year.

EPS of $9.65 per share during the quarter was a 42% increase year over year.

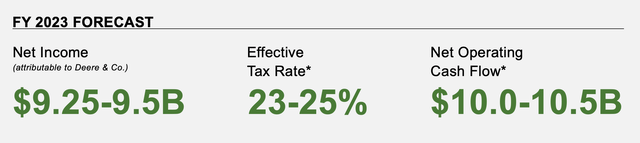

During the quarter, management again increased their 2023 guidance after another strong quarter for the company. Net income is expected to come in between $9.25 billion and $9.5 billion with net operating cash flow of $10.0 to $10.5 billion.

DE Q2 Presentation

Outside of the strong performance that the company reported, which were above analyst expectations, investors seem pleased to see that supply chain issues are largely behind them.

Since the pandemic, many companies that sold products saw huge supply chains issues. In the early parts of the pandemic, companies saw a lack of inventory, which then flipped to companies having too much inventory that they had to dispose of at discounted prices.

Management attributed two main drivers to the outperformance during the quarter, first being that the company’s factories saw their most efficient quarter of execution since the beginning of the pandemic. Secondly, management attributed the strong quarter to the lack of supply chain related issues. With factories running more smoothly, the company experienced fewer production inefficiencies, stating that Q2 the company saw the lowest level of production cost inflation since 1Q, 2021. A more efficient supply chain kept costs down and margins up.

Technology Within Agriculture

Deere is making great strides to be a game changer within their respective sector. After all, there is no additional land being made these days, so the importance of efficiency is key within the farming and agriculture sector.

Deere introduced its fully autonomous self-driving tractor at the 2022 CES, which was a huge breakthrough within the farming sector. This add on, although pricey for farmers, over time it can help solve the lack of labor as well as help bring down wages expense.

Deere is aiming to deliver a fully autonomous, battery-powered electric ag tractor to the market by 2026.

Deere

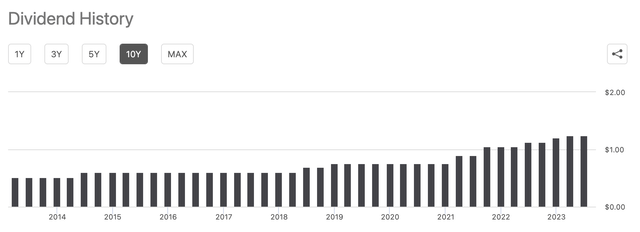

Plowing Up Dividend Growth

Deere has long been known as a solid company that pays a safe and growing dividend. Over the past 10 years, the dividend has grown from $2.04 in 2013 to $5.00 per share in 2023. This is growth of 145%.

Seeking Alpha

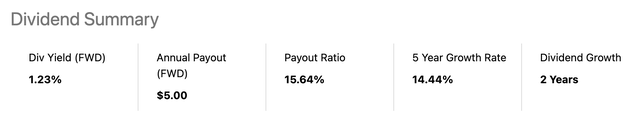

Deere currently pays an annual dividend of $5 per share which equates to a dividend yield of 1.2%. The payout ratio is very low at 15% and the company has a five-year dividend growth rate of 14%.

Seeking Alpha

Buy, Sell, or Hold

John Deere has been a great stock to own over the past few years, but it is also making a name for itself in the dividend community. Over the past few years, Deere has increased the dividend over 10% per year.

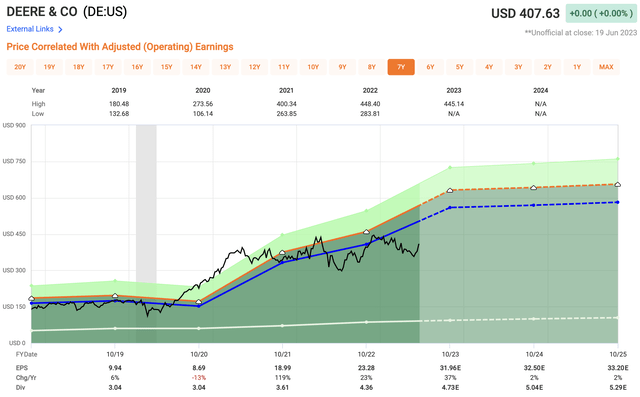

Analysts are looking for DE to generate EPS of $31.96, which equates to an earnings multiple of 12.7x. For comparable purposes, shares of DE have traded at a multiple of 17.5x over the past five years and closer to 16x the past decade, suggesting shares are currently undervalued.

Fast Graphs

Although the company does appear undervalued, given my current position in the stock and the expected economic headwinds, I am content on taking a wait and see approach. This in no way sways my conviction about the stock moving forward, and if I were not in the position already, I could understand wanting to initiate a small position at current levels. After all, I do prefer time in the market over trying to time the market.

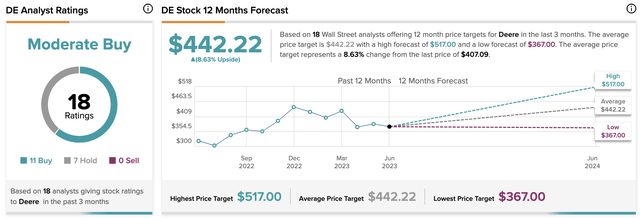

The average analyst price target is $442, which implies only 8% upside from current levels over the course of the next 12-months.

Tipranks

Investor Takeaway

Deere & Company is looking to revolutionize the agriculture sector with its driverless technology. The company just reported a strong quarter on improving efficiencies, which benefited from less supply chain disruptions.

Deere has a strong balance sheet with an A credit rating combined with a growing dividend.

What risks does this agriculture giant face? In the near-term, if the economy does in fact slowdown as many expect and businesses start to cut costs further, spending on much of Deere’s products may be pushed out a year or more, negatively impacting the industrial giant. In addition, they are rolling out a very sophisticated product in self-driving, something we have seen the likes of Tesla run into issues with for years. That could definitely get in the way for DE as well with their self-driving tractors.

Although the stock looks slightly cheap at recent levels, there appear to be increasing headwinds within the sector due to a slower moving economy, which could negatively impact industrials. Long-term, DE is a great company, but short-term headwinds could be coming.

Disclosure: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.

Read the full article here