As Tesla, Inc. (TSLA) stock has gained more than 50% since our previous article, we thought it would be prudent to provide our readers with an update on our outlook on the stock.

Today’s article, titled: “Riding the Wave,” replaces our previous thesis, “The Show Goes On,” which echoes our belief that Tesla is now well and truly a momentum play. A few months ago, we still deemed the stock a contrarian pick; however, in today’s article, we argue that the structural changes needed to boost the stock have been realized and will likely sustain in the coming quarters.

Seeking Alpha

Without further delay, let’s delve into a deeper discussion about our latest findings on Tesla’s stock.

Operational Update

Current Value Drivers

Based on anecdotes, most analysts and market commentators seem focused on Tesla’s product price cuts, suggesting that it might derail the company’s profit margins. However, a few factors are overlooked.

Firstly, yes, aspects like more stringent electric vehicle (“EV”) tax credits and waning demand has asserted pressure on the company to lower its prices. Nevertheless, everyone seems to be ignoring variables such as lower material costs, a softer labor market, a potential market share increase (due to price cutting), and demand elasticity.

Moreover, many analysts are looking backward instead of examining the prospects for future demand. For instance, won’t consumer confidence be reinvigorated with an interest rate pivot likely to realize in 2024? The theory of consumer utility certainly suggests so.

I am not implying that softer product prices will not diminish profitability. Instead, we argue that it is very easy to jump on the bandwagon of a shared narrative instead of looking at an opposing argument.

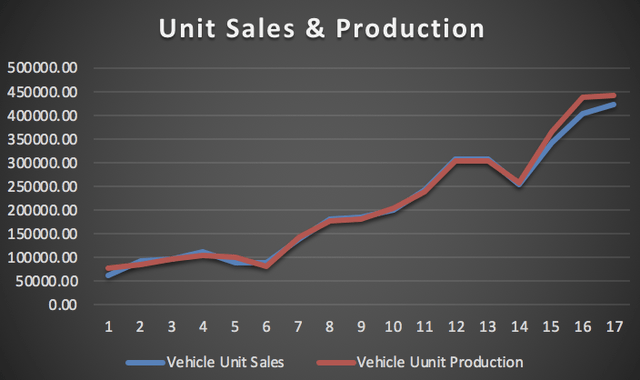

Figure 1 (Author’s Work with Data from Gurufocus)

Illustrated in Figure 1 are Tesla’s broad-based vehicle production and sales numbers, starting in March 2019 and ending in March 2023. As per its latest reporting quarter, Tesla experienced another surge in automotive sales, as the segment’s revenue increased by approximately 21.68% year-over-year. In our view, considering exogenous and endogenous factors, Tesla’s revenue growth will likely keep expanding over the coming quarters amid a nearing interest rate pivot and the firm’s history of successfully executing product differentiation strategies.

Lastly, a critical consideration for Tesla’s primary segment is the pending launch of its new Model S. This might provide structural support. And in addition, this once again shows that Tesla constantly refreshes and updates its product line, always keeping complacency from entering the building.

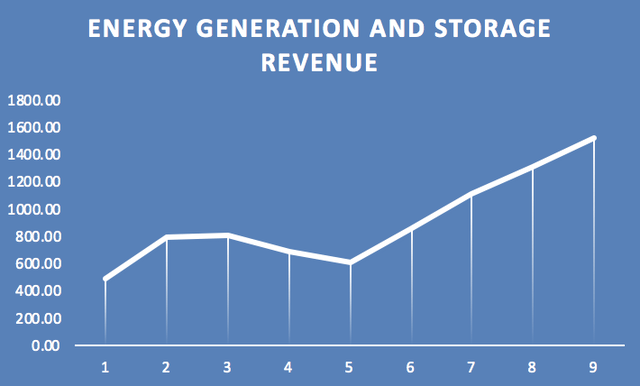

Author’s Work With Data From Gurufocus

Another influencing variable is the progress of Tesla’s energy generation and storage segment. In our view, the value add here stems from Tesla’s venture into new markets that still provide synergies to its main business. In essence, the segment phases out the risk of concentrated revenue while still providing cross-sales opportunities to Tesla’s main business.

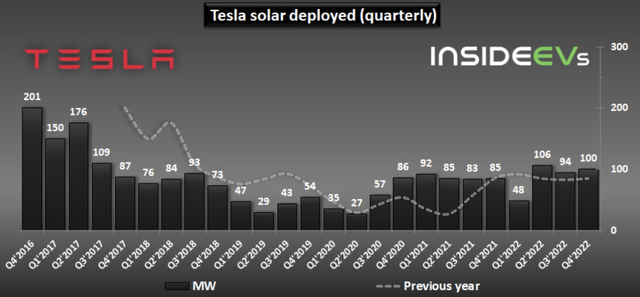

Although the segment’s solar deployment endeavors remain at an early stage, an 18% CAGR is forecasted for the solar industry until 2030, which supports the division very well. Moreover, Tesla is a cash-rich firm, allowing it to enter the market as a serious competitor as opposed to a participant faced with arduous barriers to entry. Therefore, we see this aspect of Tesla’s business as a potential hidden asset that could yield material gains in the coming years.

Solar Deployment (Inside EVs)

Efficiency Remeasured

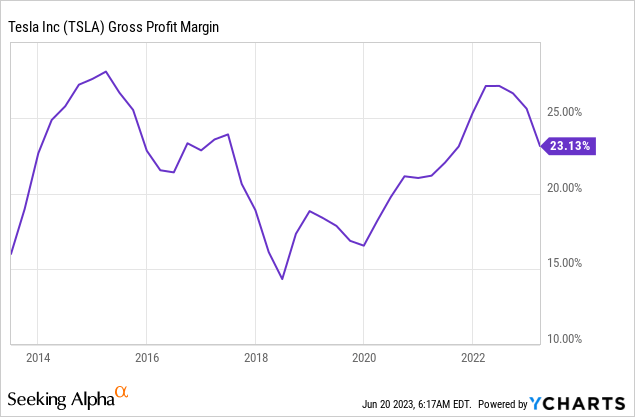

As mentioned earlier, a trade-off exists between Tesla’s product price cuts and its input costs. In our opinion, the industrial commodity price index’s 7.71% year-over-year slump shows that material costs are on a downward trajectory, which could allow Tesla to curb its variable costs and sustain respectable profit margins until demand-side factors start realigning within the durable goods space.

Of course, it has to be conceded that the risk of depleted prices enforced to sustain government credits will remain a risk factor for the foreseeable future.

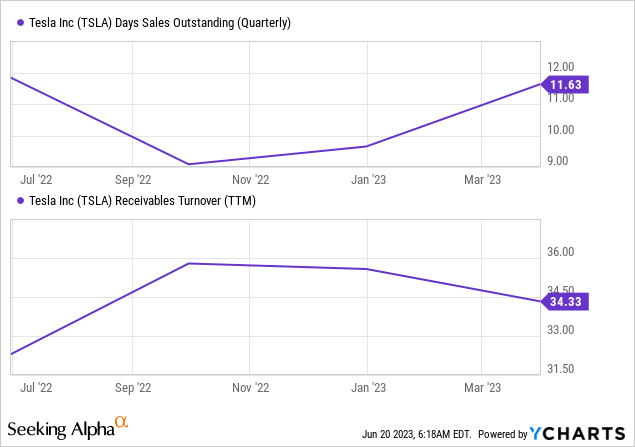

Tesla’s days sales outstanding ratio has ticked up a tad since our latest engagement. The company’s 10-Q claims that its payments schedule depends on bank settlements and monthly sales dispersion. However, in our view, any extended payment schedule should be considered a risk in today’s economy, as exogenous factors like bank liquidity and an uptick in automotive delinquencies suggest that settlements might be less sure than before.

Furthermore, Tesla’s recently weakened receivables turnover ratio plays into our DSO argument. Companies often ramp up receivables as credit sales wane in trying economic circumstances.

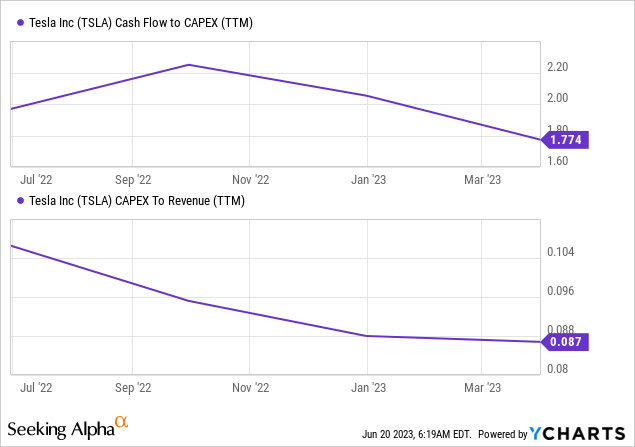

Cash flow and revenue to CapEx ratios are a sound way of judging a firm’s growth trajectory and how sustainable its growth trajectory is.

Firstly, it must be emphasized that Tesla’s maintenance CapEx might settle lower in succeeding quarters as inflation has started tapering, which we consider a positive for the firm. In contrast, as the financial markets have discovered renewed support and an interest rate pivot nears, M&A activity, re-investment rates, and acquisition completions will likely proliferate, resulting in higher expansionary CapEx for Tesla.

Although there is a trade-off within Tesla’s CapEx sphere, we consider it a healthy scenario as lower maintenance CapEx requires less of a drag on liquidity, and higher expansionary CapEx is not too much of a hassle.

Tesla’s high product turnover and expansion into other domains like energy storage and generation show that the company is seeking to occupy its entire value chain, which means its CapEx will likely remain high for years to come. However, key ratios illustrate that its cash flow and revenue allow for heavy spending, making sustained internal growth possible.

Beta Sensitivity Analysis and Valuation

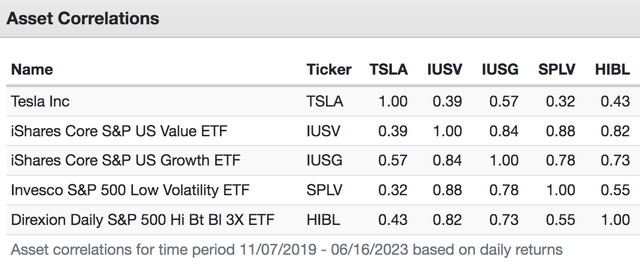

Understanding a stock’s beta support is critical for any financial market participant. In a nutshell, a stock’s beta sensitivity measures how it performs relative to different segments of the market, i.e., certain stocks outperform the market when value stocks are preferred by investors, and vice versa.

Furthermore, due to the sensitivity involved in pricing Tesla’s risk, we decided to keep our valuation analysis simple and stock with a relative valuation.

Let’s delve into a few of our findings about Tesla stock’s valuation.

Smart Beta

A regression analysis shows that Tesla’s realized returns are highly correlated with the iShares Core S&P U.S. Growth ETF (IUSG) and the Direxion Daily S&P 500® High Beta Bull 3X Shares ETF (HIBL), illustrating the stock’s proclivity to outperform the market when investors are risk-seeking.

TSLA correlation with investment styles (Author in Portfolio Visualizer)

The question now becomes: will growth and high-risk stocks continue to rise, and will that result in support for Tesla’s stock?

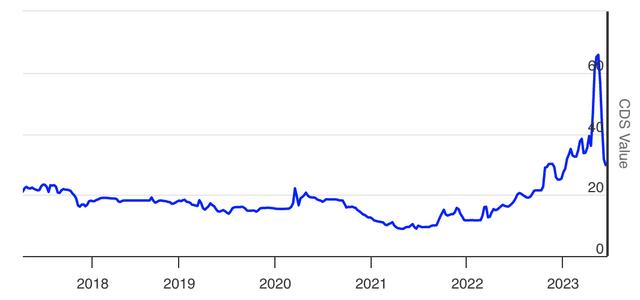

In our view, growth and high-beta stocks might continue to rise in the coming quarters. We base our premise on factors such as diminishing CDS values (credit risk), leveling in inflation volatility, and more clarity from the Federal Reserve on interest rate policy. Therefore, we think the outlook is bright for higher-risk assets such as high-beta growth plays like Tesla.

U.S. CDS Values (worldgovernmentbonds.com)

Relative Valuation and Technical Price Level

The reality is that Tesla possesses elevated price multiples, leaving it exposed should a growth stock reversion occur. However, on the other end of the playing field, an inward look suggests the stock is probably not overvalued.

Yes, Tesla’s salient price multiples are at sector-relative premiums, but we argue that it is justified due to the company’s robust market position. In addition, most of Tesla’s headline multiples are at normalized discounts, communicating the possibility that the stock is at a cyclical discount.

| Metric | Value | 5y Discount |

| price-sales (forward) | 8.24 | -0.80% |

| price-earnings (forward) | 74.17 | -39.66% |

| EV/EBITDA | 48.61 | -3.76% |

| price-book (forward) | 15.42 | -12.44% |

Source: Seeking Alpha.

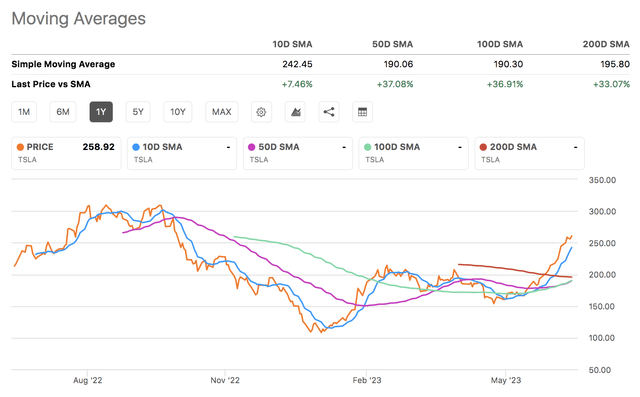

Lastly, based on its moving averages, Tesla’s stock is at odds to benefit from the momentum anomaly, which is a theory stating that in an up-market, previous winners are likely to outperform previous losers. In our view, the momentum anomaly could come into play, as no recent structural breaks have occurred within the market that suggests a change in trajectory is in store (measured year-to-date).

SMAs (Seeking Alpha)

Additional Risks To Consider

Even though various risks were mentioned throughout the article, additional risk factors must be accounted for before considering an investment in Tesla’s stock.

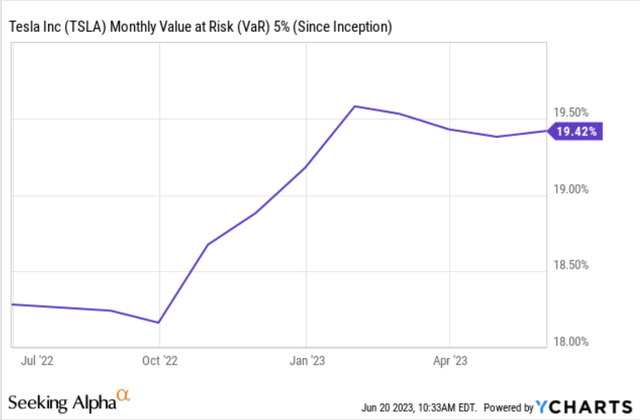

Firstly, Tesla’s stock possesses a lot of price risk, illustrated by its VaR, meaning that investors run the risk of losing a significant amount of their invested capital if the stock enters another dip.

Seeking Alpha; YCHARTS

Furthermore, investors must understand that the electronic vehicles market is heating up, and although Tesla was early-to-market, a more fragmented landscape is likely to occur in the coming years. If market fragmentation realizes, Tesla will likely need to spend a significant amount of its cash to sustain its market position, raising the risk of diminishing shareholder value.

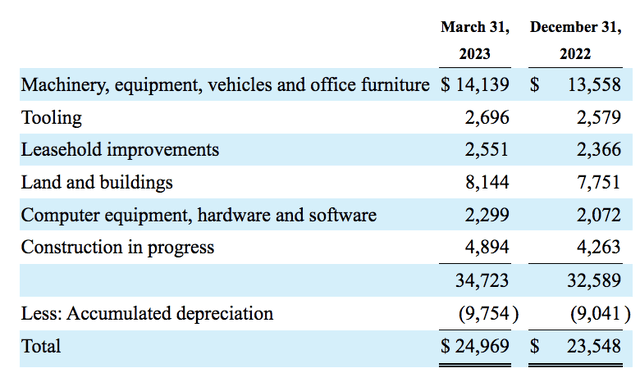

Another factor that investors should consider is Tesla’s substantial operating asset base driven by ownership of various Gigafactories. We outline this as a risk due to potential year-end impairments on the firm’s long-lived assets driven by higher interest rates and lower industry cash flow growth amid a trying economic period. Impairment risk is uniform across most industries at the moment, and Tesla is no exception in our view.

PP&E – $ in Millions (Tesla)

Final Word

Our outlook on Tesla, Inc. stock remains positive. Sure, various challenges, such as price cuts and industry fragmentation, should not be overlooked. However, the company’s emphasis on product differentiation and its expansion into new markets provide substance to a bullish argument. Moreover, few have considered the benefits that might accrue from lower material costs and a softened maintenance CapEx landscape.

Lastly, a stock market-based analysis indicates that high-beta stocks like Tesla are at good odds to achieve further gains. Thus, we affirm our strong buy rating.

Read the full article here