Investment Thesis

Hewlett Packard Enterprise (NYSE:HPE), which holds a prominent position among the top contributors to computing innovation, seems to be underpriced at the moment, and it might be a good opportunity to acquire its shares.

Despite being in a sector where stocks are often overpriced, HPE’s low P/E, Price/Sales, and Price/Cash Flow ratios indicate that the stock may be a bargain when compared to its peers. The alignment of the P/E multiple with the company’s 5-year average suggests stability and consistency in earnings. Additionally, HPE’s ability to generate strong cash flows and its efficient capital allocation, as demonstrated by the high CAPEX/Sales ratio, highlight its financial strength and effective business investing.

This, combined with the positive consensus from both Seeking Alpha and Wall Street analysts, reinforces my confidence that HPE is able to deliver solid performance and value in the future ahead. On top of that, HPE’s satisfactory dividend yields offer income-seeking investors an additional avenue for returns, making it an appealing long-term investment option. While the stock may require some time for its developments to reflect in the share price, investors can still benefit from dividend distributions during this period.

A brief description of Hewlett Packard Enterprise

Hewlett Packard Enterprise is a multinational information technology company that specializes in providing a wide range of enterprise-level products and services. HPE was formed in 2015 when Hewlett-Packard Company split into two separate entities: Hewlett Packard Enterprise and HP Inc (HPQ).

HPE focuses on enterprise solutions, including servers, storage, networking, software, and services. They offer a comprehensive portfolio of hardware and software products designed to meet the needs of businesses and organizations of all sizes. Some of their notable products and services include HPE ProLiant servers, HPE 3PAR storage systems, Aruba networking equipment, and HPE OneView infrastructure management software.

HPE also offers consulting and support services to help businesses implement and manage their IT infrastructure. They provide services such as IT consulting, technology support, and education and training programs.

Over the years, HPE has been involved in various strategic partnerships and acquisitions to expand its offerings and capabilities. They have a strong presence in the enterprise market and cater to a wide range of industries, including finance, healthcare, telecommunications, and government sectors.

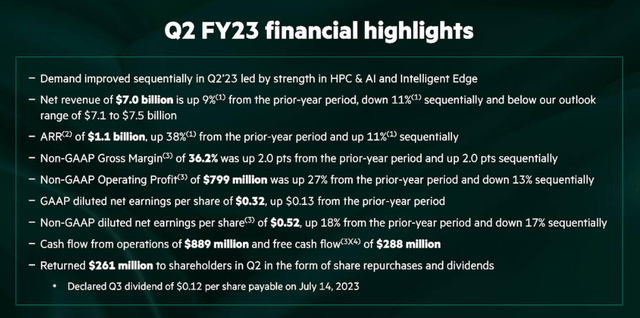

Assessing last quarter’s results

HPE’s overall financial performance in the second quarter showed positive growth, with a 9% year-over-year increase in revenue to $7 billion. This growth was primarily the result of the Intelligent Edge and High Performance Computing (HPC) and AI segments. The company’s strategy to focus on higher-growth, higher-margin areas appears to be working, as indicated by the increased revenue and record gross margins of 36.2%.

HPE’s investor relations

HPE’s HPC and AI business experienced a notable increase in orders from Fortune 500 companies and large cloud providers. What I see is that the company’s end-to-end portfolio and differentiated capabilities in supercomputing, Interconnect IP, AI software, and services are attracting customers in this space.

Another arm of the company, the HPE GreenLake platform, which offers software infrastructure and services, continues to drive growth and capture new opportunities. The platform achieved a relevant total contract value of over $10 billion and contributed to the growth of the annualized revenue run rate (ARR) to $1.1 billion. The macroeconomic conditions and customer demand in certain segments, such as general-purpose computing, have been uneven. I believe that customers, especially large enterprises in North America, have been more conservative in their spending, leading to elongated sales cycles and the need for additional internal approvals.

HPE’s strategic focus on the edge, hybrid cloud, and AI is helping the company navigate the dynamic macroeconomic environment and win customers who are prioritizing data-first approaches to modernizing their IT infrastructure. The company’s storage segment showed strong growth, with the HPE Alletra offerings experiencing revenue growth of over 100% year-over-year. The great news is that the introduction of new storage services under the HPE GreenLake umbrella, such as block storage and file storage, has been well-received by customers.

Despite some challenges and adjustments in revenue growth guidance, HPE remains confident in its long-term strategy and expects solid revenue growth for the fiscal year 2023. The company’s order book remains elevated, and there are promising indicators of growth in the Intelligent Edge and AI segments.

HPE’s strongest points against its peers in the sector

It’s easy to spot that HPE has positioned itself as one of the leaders in hybrid IT solutions, offering a comprehensive portfolio of hardware, software, and services that enable customers to manage and integrate their traditional IT systems with cloud-based solutions. The company’s focus on this business segment provided an edge against its competitors, aiming for the needs of customers who prefer a flexible and integrated approach to their IT infrastructure.

Throughout the time, HPE has made significant investments in Intelligent Edge, which refers to the network of devices, sensors, and systems located closer to the source of data generation. By leveraging its expertise in networking, security, and edge computing, HPE manages to provide solutions that enable organizations to harness the power of real-time data processing, analytics, and AI at the edge. This leadership differentiates HPE from its peers and, in my opinion, positions the company among the top contributors to computing innovation.

HPE has been expanding its software and services offerings, particularly through its HPE GreenLake platform. GreenLake offers a range of flexible and consumption-based IT services, allowing customers to pay for the resources they use, similar to a cloud model, but with the added benefits of on-premises infrastructure. With the growing demand for hybrid cloud solutions ahead, I feel that this approach addresses and provides customers with greater flexibility and control over their IT environments.

The company has a long-standing reputation and expertise in the high-performance computing market, offering a comprehensive range of solutions, including supercomputers, storage, networking, and software. HPE’s expertise in this field has made it a preferred choice for organizations and research institutions that require advanced computing capabilities, such as academic institutions, government agencies, and industries like healthcare, finance, and energy.

On top of all that, HPE has demonstrated a commitment to sustainability and corporate social responsibility, which can be a key differentiator in the industry. The company has set ambitious goals to reduce its greenhouse gas emissions, promote circular economy principles, and drive social impact through various initiatives. HPE’s strong stance on sustainability resonates with customers who prioritize environmental responsibility and social consciousness, a topic that gets more attention every year.

HPE’s cheap multiples contribute to its buy case

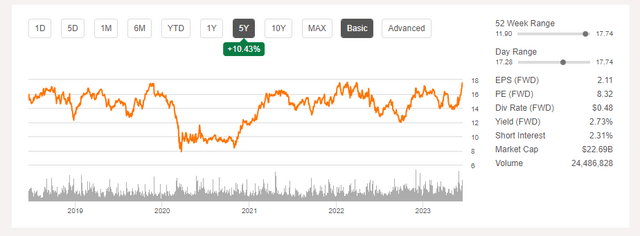

Despite being in a sector where most stocks are usually overpriced, HPE’s valuation metrics, such as the P/E, Price/Sales, and Price/Cash Flow ratios, suggest an attractive entry point. Anyhow, I believe investors should approach it with a medium- to long-term horizon, as the stock might need a bit more time to absorb the company’s developments to its share price.

HPE’s share price throughout the years. (Seeking Alpha)

Analyzing HPE’s current P/E multiple of 8.32 alone, we can spot it’s significantly lower than the sector average, indicating that the stock might be undervalued. The alignment of this multiple with the company’s 5-year average tells me that HPE has been able to provide stability and consistency in earnings overall. Furthermore, the Price/Sales (FWD) multiple of 0.77, also substantially lower than the sector median, shows that investors are able to acquire HPE at an attractive price relative to the company’s revenue generation potential.

As for the last indicator I’ll analyze when it comes to pricing, the low Price/Cash Flow ratio of 5.93 reflects HPE’s ability to generate strong cash flows at current price conditions. In my view, this is the most important multiple among all three mentioned, after all, HPE is not a startup anymore, so being able to generate strong cash flows and not relying entirely on debt is of the utmost importance.

HPE’s efficient capital allocation is also something that I’d like to put on evidence, which can be proved in its CAPEX/Sales ratio of 11% (TTM), much higher than the sector median of 2.27%. This substantial difference of 383.51% highlights the company’s effective utilization of investments, something that not all peers are able to deliver. By allocating capital wisely, HPE will maximize the returns to shareholders, driving growth and profitability in the long run.

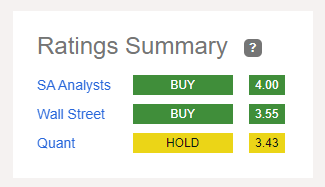

Apart from my positive perspective on the stock, both Seeking Alpha’s and Wall Street’s analysts also have a positive consensus on HPE, recommending it as a buy. While Seeking Alpha’s Quant Ratings suggests holding the stock, it is still far from a selling stance, reflecting a generally optimistic outlook. This consensus, in my opinion, showcases the market’s confidence in HPE’s ability to deliver solid performance and value to investors.

Seeking Alpha

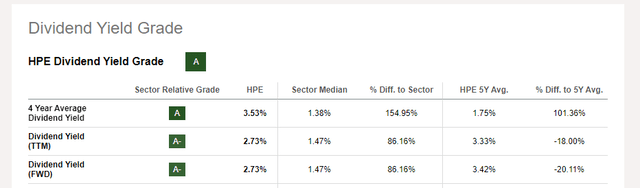

And for income-seeking investors, HPE’s current and 5-year average dividend yields are nearly double the sector median. This shows that, even though being a tech-oriented company, it still generates satisfactory distributions when compared to the price paid, and another venue for shareholder returns. So, even if it takes a while for the share price to appreciate, you’ll earn a fair share of dividends in the meantime.

HPE’s dividend yield relative to peers in the sector (Seeking Alpha)

The tech sector is challenging, and investors should be aware of that

I believe the current underpriced scenario for HPE provides a good margin of safety to investors, but we all know that the technology sector is not for amateurs. Even though the company poses to be a great choice for medium- and long-term investors, holders must be aware of the intrinsic risks that come with operating in the wild tech industry. Here is a bullet list of the risks HPE might face while you hold on to its shares:

-

Competitive Landscape: HPE operates in a highly competitive industry with numerous well-established players and emerging technologies. The intense competition from companies such as Dell Technologies, IBM, and Cisco Systems could impact HPE’s market share, pricing power, and profitability.

-

Technology Disruptions: The technology landscape is constantly evolving, and rapid advancements in cloud computing, artificial intelligence, and edge computing could disrupt HPE’s business model, just like they could disrupt any other business. Failure to adapt to emerging technologies or shifts in customer preferences could negatively affect the company’s growth and market position.

-

Execution Risks: Executing strategic initiatives, integrating acquisitions, and managing operational efficiency with mastery is crucial for HPE’s success. Any missteps in these areas, such as delays or cost overruns, could impact the financial results and lead to debt increase, which is a metric that is not exactly low right now.

-

Security and Data Privacy: As a provider of IT infrastructure and services, HPE faces risks associated with cybersecurity and data breaches. Any significant security incident or failure to address customer concerns regarding data privacy and protection could damage the company’s reputation and lead to financial and legal consequences.

Conclusion

In conclusion, Hewlett Packard Enterprise appears to be a great investment opportunity at the moment. The company’s underpriced valuation, as indicated by its low P/E, Price/Sales, and Price/Cash Flow ratios, suggests that the stock may be undervalued compared to its peers. HPE’s ability to generate strong cash flows, efficient capital allocation, and positive consensus from analysts further reinforce its potential for solid performance and value in the future.

However, it’s important to note that investing in the technology sector comes with inherent risks. HPE faces competition from well-established players and emerging technologies, and it must continually adapt to stay relevant. Execution risks, such as missteps in strategic initiatives and operational efficiency, could impact the company’s financial results. Additionally, cybersecurity and data privacy concerns pose potential threats

Read the full article here