A Quick Take On Dolby Laboratories

Dolby Laboratories, Inc. (NYSE:DLB) reported its FQ2 2023 financial results on May 4, 2023, beating both expected revenue and EPS estimates.

The company develops and licenses audio and imaging technologies for use in media, entertainment and communications applications.

Given the firm’s return to growth, improving financial metrics, and strong financial position, my outlook on Dolby Laboratories, Inc. stock in the near term is a Buy at around $82.80.

Dolby Laboratories Overview

San Francisco, California-based Dolby Laboratories, Inc. was founded in 1965 and develops various audio and imaging technologies primarily for media applications across a range of devices.

The firm is headed by Chief Executive Officer, Kevin Yeaman, who was previously Chief Financial Officer at Epiphany and VP of Worldwide Field Operations at Informix Software.

The company’s primary offerings span the industries of:

-

Music

-

Cinema

-

Gaming

-

Home Entertainment

The firm acquires customers through developing relationships with audio and visual equipment OEMs and with software developers.

Dolby’s Market & Competition

According to a 2022 market research report by Market Research Future, the global market for consumer audio products of all types is expected to exceed $234 billion by 2030.

This represents a forecast CAGR of 16.3% from 2022 to 2030.

The main drivers for this expected growth are rising demand for greater entertainment options, adoption of advanced wireless solutions, and a growing number of internet-connected homes.

Also, the North American region is expected to account for the highest market share through 2030.

Major competitive or other industry participants include:

-

Apple

-

HARMAN International Industries

-

Bose Corporation

-

Sonos

-

Sony Corporation

-

DEI Holdings, Inc.

-

Sennheiser Electronic GmbH & Co. Kg

-

VIZIO, Inc.

-

VOXX International Corporation

-

Plantronics, Inc.

-

Ossic Corporation

-

Phazon

-

TrüSound Audio

-

Jam

-

Earin

-

Human Inc.

DLB’s Recent Financial Trends

-

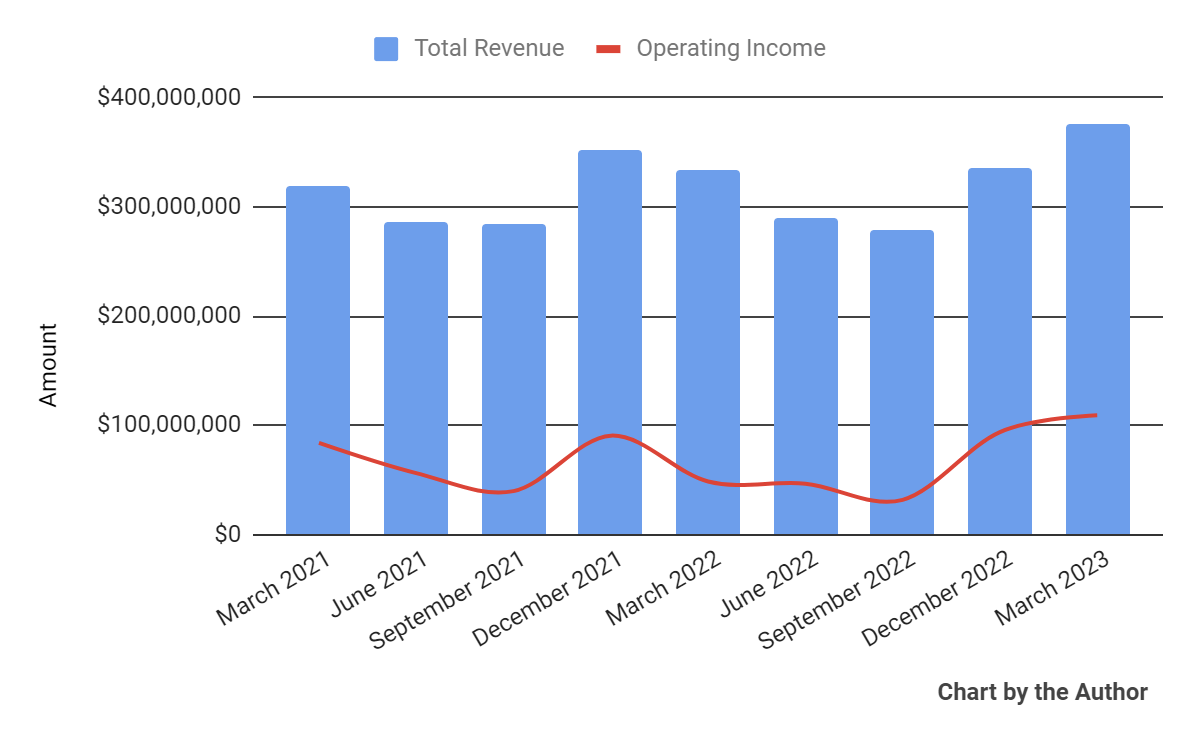

Total revenue by quarter has risen substantially in the most recent quarter; Operating income by quarter has also trended higher recently:

Total Revenue and Operating Income (Seeking Alpha)

-

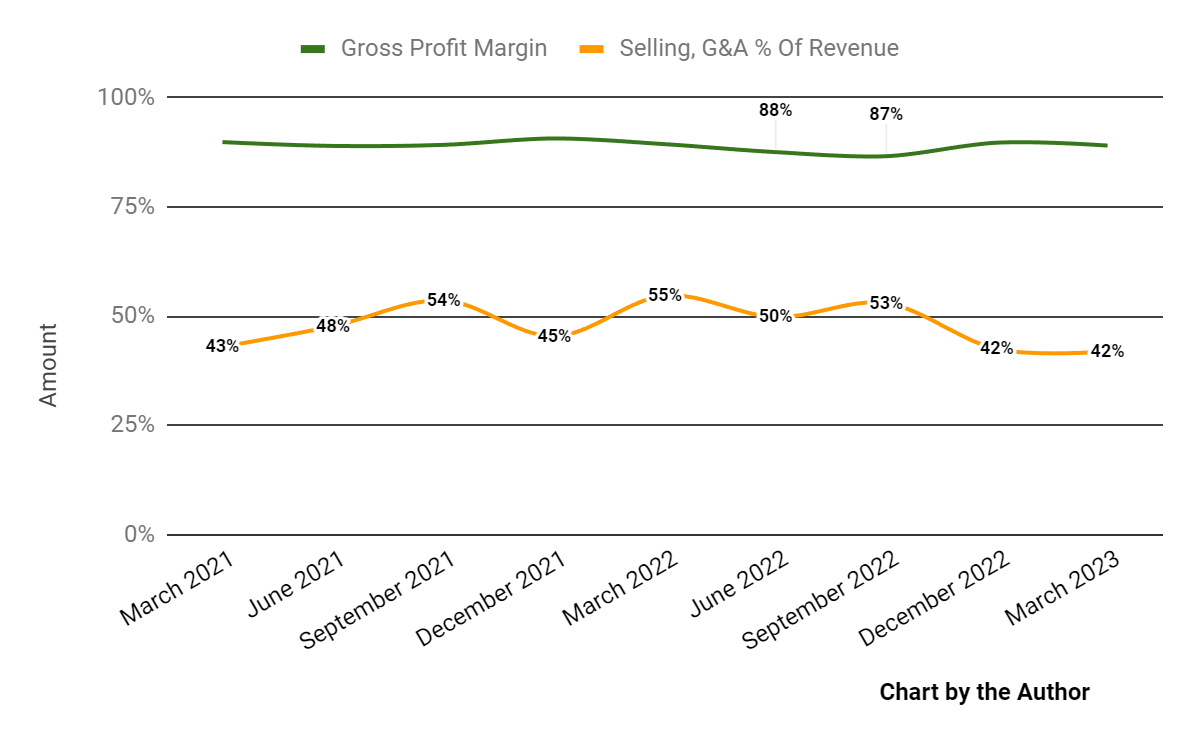

Gross profit margin by quarter has varied within a narrow range; Selling, G&A expenses as a percentage of total revenue by quarter have dropped materially in recent quarters, a positive signal of increasing efficiency:

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

-

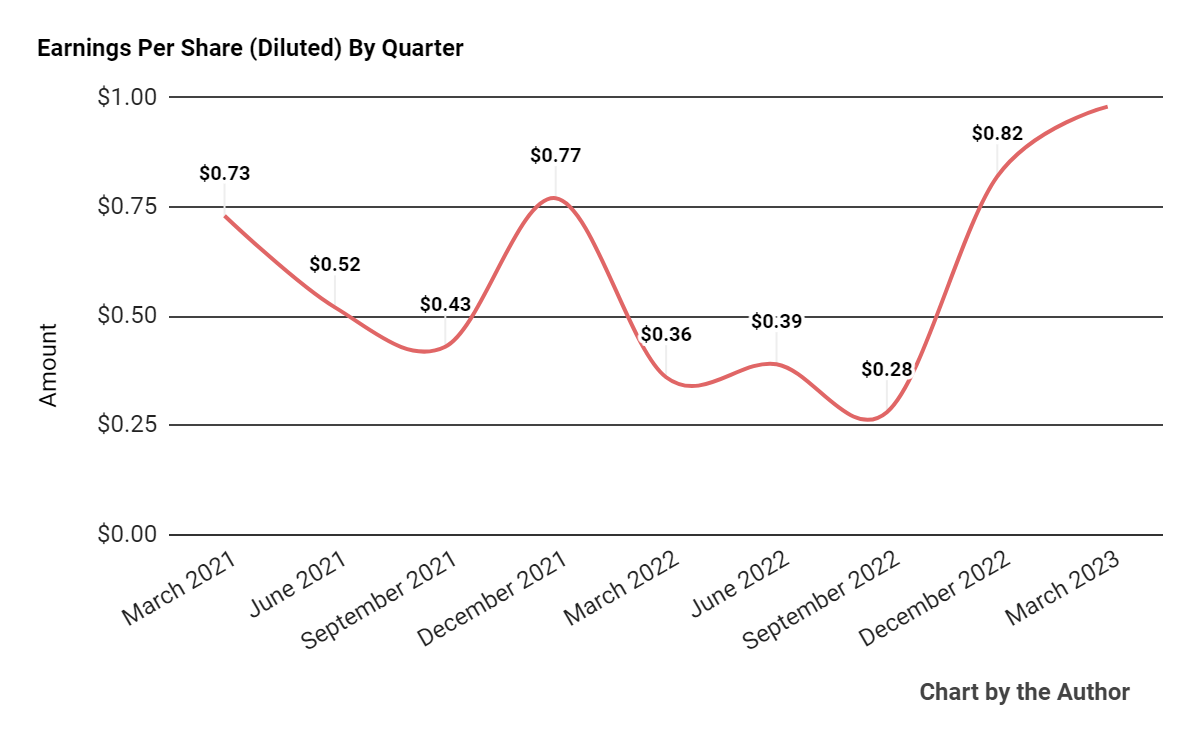

Earnings per share (Diluted) have improved markedly in the most recent quarters:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

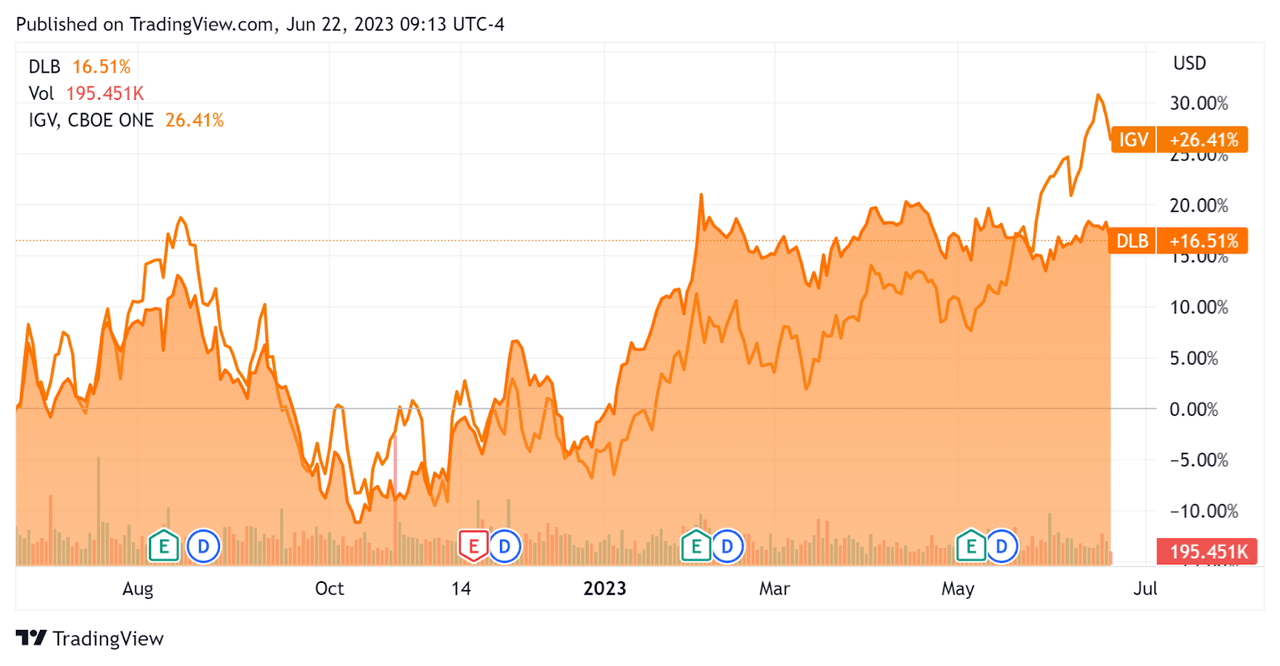

In the past 12 months, DLB’s stock price has risen 16.51% vs. that of the iShares Expanded Technology-Software ETF’s (IGV) rise of 26.41%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $814.8 million in cash, equivalents and short-term investments and no debt.

Over the trailing twelve months, free cash flow was an impressive $348.3 million, during which capital expenditures were $36.6 million. The company paid $115.6 million in stock-based compensation in the last four quarters, the highest trailing twelve-month figure in the past eleven quarters.

Valuation And Other Metrics For Dolby

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

5.7 |

|

Enterprise Value/EBITDA |

20.1 |

|

Price/Sales |

6.4 |

|

Revenue Growth Rate |

1.7% |

|

Net Income Margin |

19.0% |

|

EBITDA % |

28.5% |

|

Net Debt To Annual EBITDA |

-2.2 |

|

Market Capitalization |

$8,070,000,000 |

|

Enterprise Value |

$7,310,000,000 |

|

Operating Cash Flow |

$384,850,000 |

|

Earnings Per Share (Fully Diluted) |

$2.47 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

DLB’s most recent Rule of 40 calculation was 30.2% as of FQ2 2023’s results, so the firm has improved materially since the middle of 2022 in this regard, per the table below:

|

Rule of 40 Performance |

FQ3 2022 |

Current Quarter |

|

Revenue Growth % |

-0.5% |

1.7% |

|

EBITDA % |

25.4% |

28.5% |

|

Total |

24.9% |

30.2% |

(Source – Seeking Alpha)

Commentary On Dolby

In its last earnings call (Source – Seeking Alpha), covering FQ2 2023’s results, management highlighted their belief that “there has never been greater demand for entertainment content,” so the firm’s underlying technologies provide “high-quality immersive experiences” in that regard.

The first half of the fiscal year was characterized as “stronger than expected” but the remainder of the year will likely see a finish that is within management’s expected guidance range.

For its Dolby Atmos and Dolby Vision technologies, leadership expects to “double these revenues in the next three to five years.”

To achieve this, management will continue to focus its efforts on “movies and TV, music and automotive and user-generated content” markets.

Management did not disclose any company or customer retention rate metrics or characterize customer churn in any way.

Total revenue for Q1 2023 rose 12.4% YoY, and gross profit margin dropped 0.3 percentage points.

Selling, G&A expenses as a percentage of revenue decreased 12.8 percentage points year-over-year, a positive signal indicating increasing efficiency in incremental revenue generation.

Operating income grew by more than double year-over-year to $109.3 million.

Looking ahead, leadership guided to full-year fiscal 2023 topline revenue growth of approximately 3.7% over fiscal 2022’s results.

Notably, fiscal year 2022 produced a revenue contraction of 2.15% YoY, so if the company achieves guided growth, that would be significant.

The company’s financial position is quite strong, with high liquidity, no debt and substantial free cash flow.

DLB’s Rule of 40 performance has been improving but is still in need of further advancement.

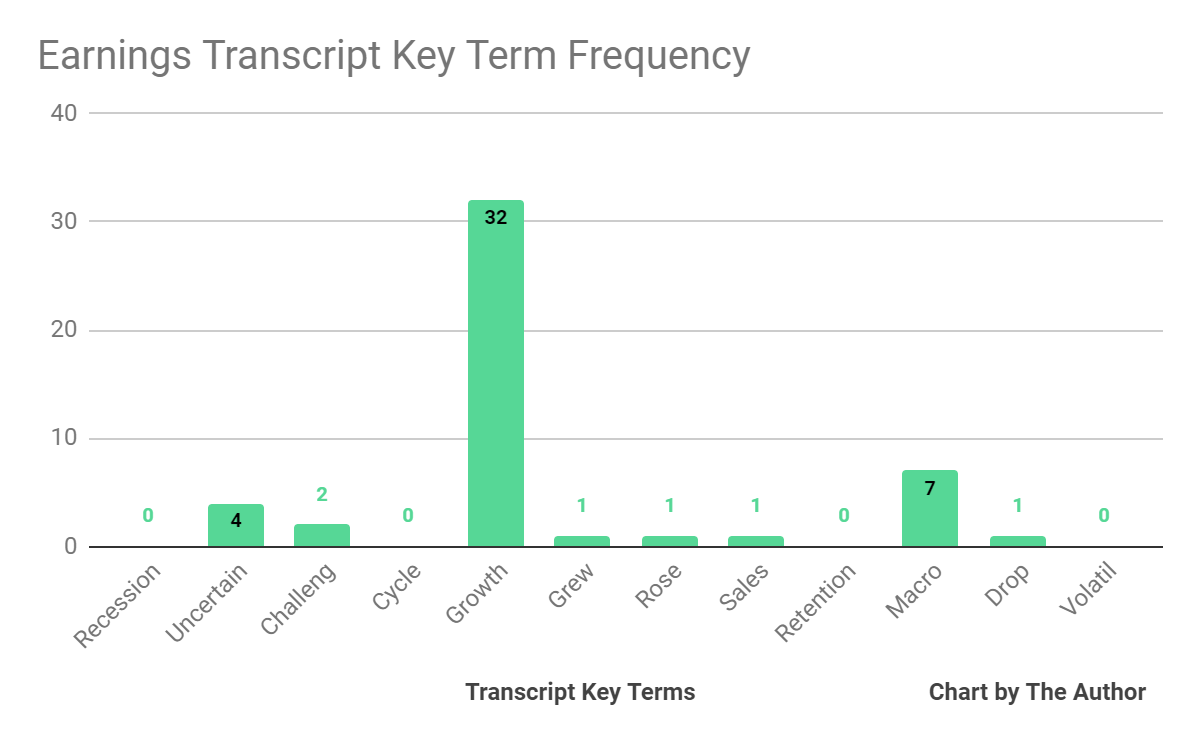

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below:

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management or analyst questions cited “Uncertain” four times, “Challeng(es)(ing)” two times, “Macro” seven times and “Drop” once.

The negative terms refer to management’s admission that the current environment in the markets it operates in is “challenging and uncertain.”

While company leadership acknowledged an uncertain environment, it noted success with closing deals faster than expected, seemingly at odds with a more cautious approach by customers across software industry verticals.

When questioned by analysts on this point, management highlighted the firm’s diversification across several device categories.

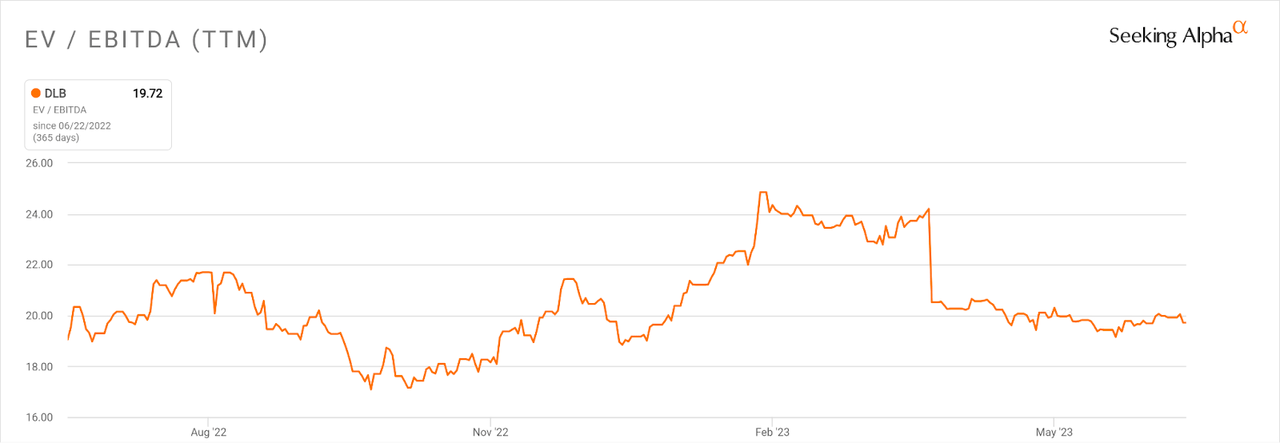

Regarding valuation, the market hasn’t pushed up the firm’s EV/EBITDA valuation multiple in the past twelve months net-net, although there has been some volatility, as the chart from Seeking Alpha shows below:

EV/EBITDA Multiple History (Seeking Alpha)

A potential upside catalyst to the stock could include further growth in its Atmos and Vision/imaging segments.

Given the firm’s likely return to growth, improving financial metrics, and strong financial position, my outlook on Dolby Laboratories, Inc. stock in the near term is a Buy at around $82.80.

Read the full article here