Spectrum

Spectrum Pharmaceuticals (NASDAQ:SPPI) is a biopharmaceutical company that develops and commercializes hematology (blood) and oncology (cancer) products. Their current focus is on ramping sales of their recently approved product ROLVEDON.

On a separate note, Spectrum recently announced they will be merging with Assertio (ASRT), if you’d like to review Spectrum in relation to Assertio you can find my deal memo on Assertio here.

ROLVEDON

ROLVEDON is Spectrum’s primary product that was recently approved and received first sales of $10m in Q4 of 2022. What we do not yet have enough data to confirm, but there is evidence of, is ROLVEDON becoming the standard of care in treating chemotherapy induced Neutropenia.

ROLVEDON is a (G-CSF) granulocyte-colony stimulating factor drug competing in a growing (5-9%) and large ($12B) total addressable market . The applications for G-CSF products are oncological diseases (which I will focus on below), blood disorders, growth hormone deficiencies, and chronic disorders like autoimmune diseases. As expected in such a large addressable market there are a number of competitors and products already in the space.

ROLVEDON (eflapegrastim) is an additional G-CSF (not a biosimilar) to the current 4 types of G-CSFs on the market: lenograstim, filgrastim, lipegfilgrastim, and pegfilgrastim. Filgrastim and pegfilgrastim have multiple providers (biosimilars) and pegfilgrastim is the current standard of care in treating chemotherapy induced Neutropenia. Neutropenia occurs when you have too few neutrophils or white blood cells of which we need to fight infections. G-CSF is a type of growth factor that makes bone marrow produce more white blood cells.

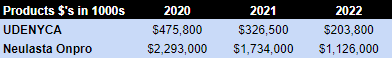

Pegfilgrastim’s current market size is ~$3.1B and Amgen, the owner of Neulasta accounted for $2.1B of the $3.1B in the LTM of domestic sales ending in March of 2022. There is a growing field of biosimilars for Neulasta (Fulphila, Fylnetra, Nyvepria, Stimufend, UDENYCA, Ziextenzo) and Coherus’s (CHRS) UDENYCA recently received approval and is in the process of launching another on body delivery system similar to Amgen’s Neulasta Onpro.

HIT Capital

In short, the market for pegfilgrastim is large but the competition is fierce and the ASP’s (average sales price) are falling. We can see the pricing trends for both Coherus’s UDENYCA and Amgen’s Neulasta Onpro product above and Coherus recently wrote down their UDENYCA inventory, all while the total number of patients for pegfilgrastim expanded.

Is ROLVEDON too little too late?

According to a well written article by Stephen Ayers “Spectrum’s ROLVEDON: An Undifferentiated, Small Player in A Vast Market”, ROLVEDON is undifferentiated, too small, and too late. I agree with Mr. Ayers that Spectrum (SPPI) (and even when combined with Assertio (ASRT)) is a small player entering a vast market but I don’t believe being small is a bad thing when you have a superior product and plan.

The following points lead me to believe ROLVEDON could be different than the other pegfilgrastim biosimilars and could ultimately become the standard.

ROLVEDON’s potential and current advantages, when compared to Neulasta Onpro, are:

-

Patient convenience and improved adherence – Neulasta and its biosimilars need to be administered 24 hours after the patient’s chemotherapy treatment. Spectrum is undergoing an Open-Label, Phase 1 Study on same day dosing, 30 minutes after the patients chemotherapy treatment. This trial could be done recruiting and have initial results by the second half of this year.

-

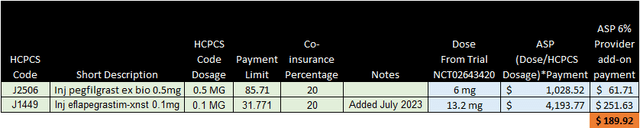

Quick adoption – When the physician administers ROLVEDON they are paid 4x more than pegfilgrastim. This should incentivize quicker adoption of ROLVEDON.

CMS

- Easy handling – ROLVEDON does not require extreme storage requirements and can be conveniently added to any physician’s office refrigerator operating in the range of 36-46 deg fahrenheit.

-

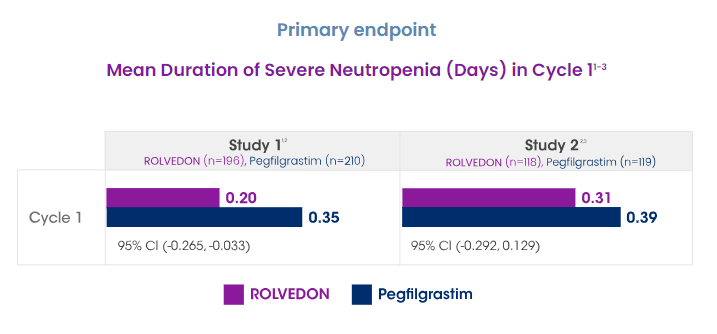

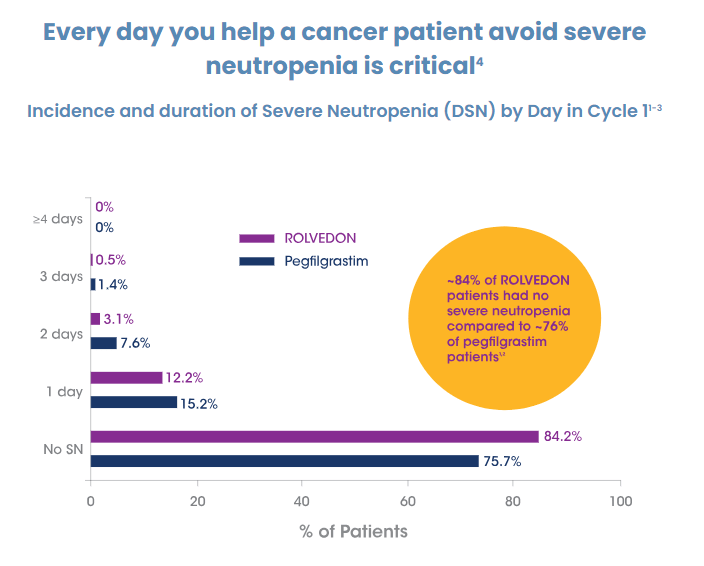

Improved efficacy – In two head to head trials with pegfilgrastim ROLVEDON’s patients achieved less duration of severe neutropenia than pegfilgrastim (0.2 to 0.35 and 0.31 to 0.39).

Spectrum

Spectrum

-

Reduced risk of future G-CSF induced cancers – Patients who received primary G-CSF experienced an increased risk of secondary malignancies. In the clinical trial NCT02953340 where the use of ROLVEDON resulted in improved efficacy over pegfilgrastim the ROLVEDON patients were given 40% less G-CSF than the pegfilgrastim patients (3.6 mg compared to 6 mg).

-

ROLVEDON has total control over the pricing and its own J-code because it does not currently have any biosimilar competitors thus offering a consistent price to both the patient and it’s provider.

Thus ROLVEDON increases efficacy, increase physicians pay, and could reduce patient’s future malignancy risk, increase adherence, and be more convenient for the patient and the physician. If that all comes to fruition it’s hard not to estimate ROLVEDON becoming the standard for reducing chemotherapy induced Neutropenia. This leads to Assertio/Spectrum conservatively supplying a +$1B/yr product.

Assertio (ASRT) Spectrum (SPPI) merger

Up until researching ROLVEDON it appeared Spectrum was getting quite a deal from Assertio. In the merger agreement Assertio agreed to pay a 65-94% premium and they plan on keeping the majority of Spectrum’s commercial team and infrastructure.

I think mine and the markets initial view of the merger is adjusting as more investors realize ROLVEDON’s potential, Assertio’s stock price bounced back, and we see how Assertio management saw the potential by means of the CVR’s (the Contingent Value Rights Agreement). These CVR’s have assigned milestone payments based on ramping ROLVEDON sales from $10M in Q4 of 2022 to $175M in 2024 and $225M in 2025.

Catalysts and risks

When Assertio and Spectrum combine they reduce their respective risks associated with having one drug as their primary source of income and it allows them both to share in each of their respective primary product upsides.

The following items are a few catalysts and risks I’ve identified and will be watching as a shareholder going forward. This list is complementary with Assertio’s here if the merger closes.

Catalysts

-

Spectrum merges with Assertio reducing downside risk and increasing ROLVEDON’s upside when their respective marketing teams combine

-

ROLVEDON becomes the standard of care for chemotherapy induced neutropenia (+$1B annual sales)

-

Study NCT04570423 evaluating the efficacy of ROLVEDON in kids is successful

-

Study NCT04187898 evaluating the efficacy in administering ROLVEDON 30 min after chemotherapy is successful

-

Assertio’s marketing model + Spectrum’s rep based team ramps ROLVEDON sales

- ROLVEDON recently received a J-code ramping sales further

-

-

Assertio management adds value to Spectrum as they have done the past 3 years with their own turnaround.

-

Assertio and Spectrum, once combined, have their valuation re-rate to be more inline with their pharmaceutical brethren.

- Spectrum and Assertio is added to the Russell and gains from additional market exposure

Risks

-

ROLVEDON is unable to differentiate itself from the other G-CSF products

-

The merger falls through between Assertio and Spectrum

-

Current or new legal issues arise or materialize.

-

Spectrum and Assertio’s sales model do not function symbiotically and they increase expenses without adding sales.

Valuation

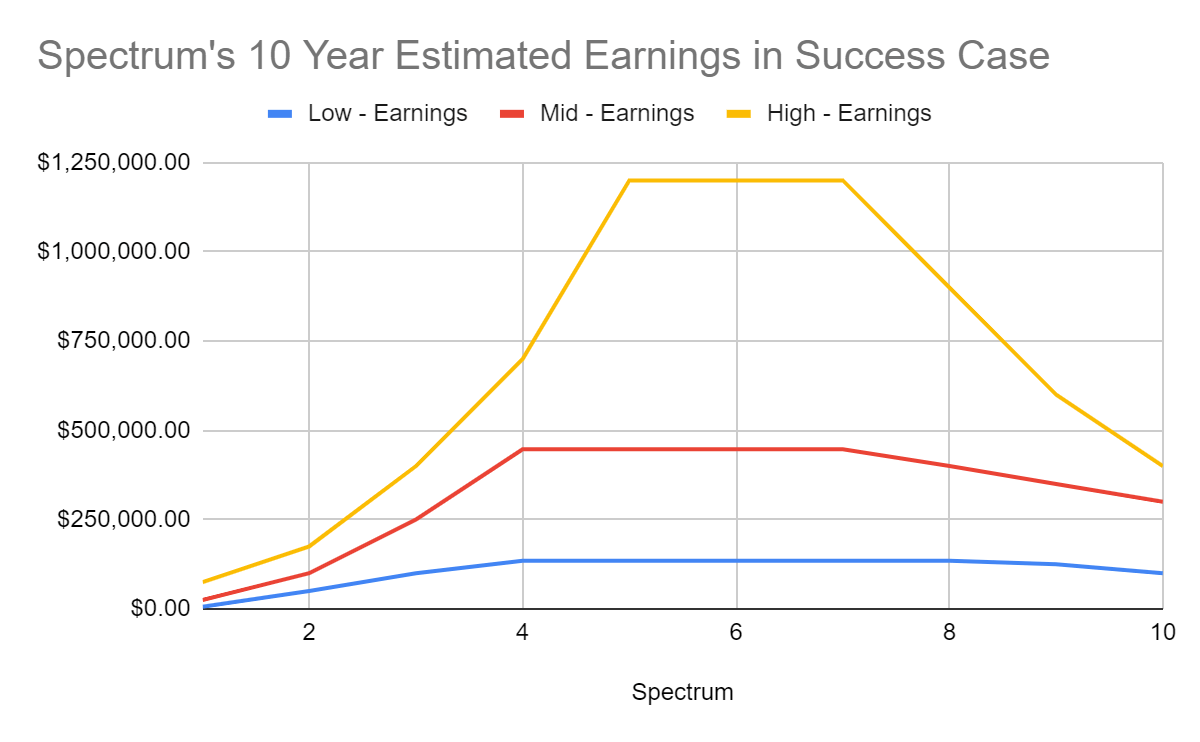

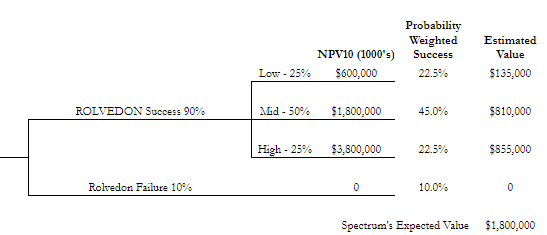

Spectrum’s estimated value is based on the following inputs:

-

a 90% probability of a commercial success (if not successful Spectrum is worth $0).

-

If ROLVEDON is successful there are three cases

-

the low and high case each having a 25% chance of success and the mid case having 50% chance of success.

-

The net present values were discounted at 10% and

-

In the low case I used a peak sales revenue of $312M in year 4, and

-

In the mid case a peak sales of $858M in year 5 and

-

In the high case a peak sales of $2.25B.

-

-

The earnings used over the 10 yr estimated time frame were based off of an 81.5% gross margin, SG&A ranging from $60-83M/yr, 25% effective tax rate, and $5M/yr in R&D.

HIT Capital

Spectrum’s expected value using the inputs above is $1.8B.

HIT Capital

Assertio + Spectrum’s value

Now if we combine Assertio and Spectrum we have two pharma companies that reduce our risk of failure by adding ROLVEDON’s potential with INDOCIN’s market expansion alongside a management team that has recently created a competitive marketing advantage over their late stage pharma peers.

Most of the catalysts stated above will be coming to fruition within a year and I expect the companies value to adjust accordingly. If you can size your bets appropriately I see Assertio + Spectrum as a nice bet on a potential multi-bagger.

Assertio’s estimated base case value came in at $790M and Spectrum’s expected value is $1.8B giving us a total estimated value of $2.6B.

Spectrum’s current enterprise value is about $262M and Assertio’s $382M totaling $644M.

The combined companies are estimated to provide a return of 4x over the next couple years.

Read the full article here