Note:

I have covered Top Ships (NASDAQ:TOPS) previously, so investors should view this as an update to my earlier articles on the company.

It has been more than two years since my last update on Greece-based tanker operator Top Ships.

Since that time, the stock price has dropped by more than 98% as the vicious circle of relentless dilution and subsequent reverse stock splits has continued unabatedly.

In fact, investors would be well-served to prepare for another reverse stock split later this year due to the company’s renewed failure to comply with the Nasdaq’s $1 minimum bid price requirement.

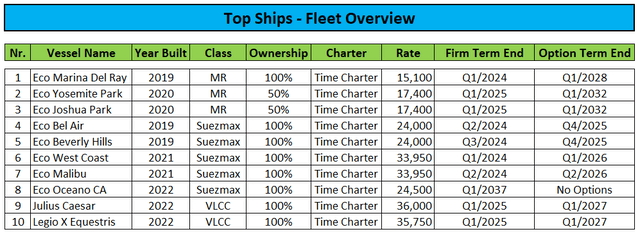

The company remains controlled by CEO Evangelios Pistiolis and has used the funds obtained from diluting common shareholders literally beyond recognition to build a diversified fleet of state-of-the-art tankers which are employed under long-term contracts:

Regulatory Filings

Top Ships currently has no vessels under construction.

Due to the long-term nature of the company’s charter contracts, Top Ships has been missing out on the recent tanker market bonanza and won’t have vessels available for new employment anytime soon.

According to the company’s annual report on form 20-F, Top Ships generated $33.4 million in cash flow from operations but used $142.7 million in cash from investing activities last year:

Net cash used in investing activities in the period ended December 31, 2022 was $142.7 million, consisting of $216.7 million of cash paid for advances for vessels under construction, offset by $71.7 million net proceeds from sale of vessels and $2.3 million of return of investments in unconsolidated joint ventures.

As usual, Top Ships financed cash outflows with a combination of long-term and related-party debt as well as proceeds from common stock sales.

Three months ago, management provided estimates for net asset value (“NAV”) per share (emphasis added by author):

TOP Ships Inc. (…) announced today that the Company’s management estimates the company’s Net Asset Value (“NAV”), based on charter free vessel values, debt and cash as of December 31, 2022 as adjusted for the equity offering that priced on February 14, 2023, to be $286 million.

This translates into an NAV of $14.05 per common share (based on number of common shares currently outstanding) and $5.27 per common share on a fully diluted basis (assuming exercise of all outstanding warrants for cash and conversion of all outstanding Series E perpetual preferred shares at their current conversion price).

Please note that management has abstained from adjusting NAV for the negative value of the fleet’s long-term charters in today’s tanker market environment.

On Wednesday, Top Ships announced the proposed spin-off of the Suezmax tanker Eco Malibu into a new publicly-traded company named Rubico Inc. or “Rubico”:

(…) As part of the spin-off transaction, TOP Ships intends to distribute 100% of the common shares of Rubico to its securityholders and expects there to be no overlapping board members or management between Rubico and TOP Ships.

The board of directors of TOP Ships sees this proposed separation of the companies as a strategic move. They believe it will yield a new investment opportunity focused on the Suezmax sector while allowing each company to follow its distinct business goals and operational priorities.

The creation of an opportunity for investors to make an independent investment decision between the two companies may unlock increased long-term value for the shareholders of both companies.

In particular, the board of directors of TOP Ships believes that the common shares of Rubico as a standalone company should not trade at the same discount to net asset value that is currently seen in the market price of the shares of TOP Ships.

One objective of the proposed spin-off is to allow TOP Ships’ shareholders to gain additional value by spinning off part of the assets of TOP Ships at a potentially higher market valuation which in turn could result in an improvement in the market valuation of TOP Ships. (…)

Please note that shares are expected to trade initially on the over-the-counter (“OTC”) market with application for an uplisting to a major stock exchange intended “as soon as practicable following the spin-off“.

In addition to Top Ships’ common shareholders, certain warrantholders and holders of the company’s Series E Preferred Stock will be receiving Rubico common shares:

In the spin-off distribution, TOP Ships intends to distribute 100% of the common shares of Rubico pro rata to the common shareholders of TOP Ships, to the holders of outstanding common stock purchase warrants of TOP Ships on an as-exercised basis to the extent such warrants contain anti-dilution provisions conferring an interest equivalent to the spin-off distribution, and to the holder of Series E preferred shares of TOP Ships pursuant to the terms of such preferred shares which entitle such holder to participate in the spin-off distribution on an as-converted basis.

The company anticipates that the spin-off to be completed in September 2023 with record date, distribution date and distribution ratio remaining subject to future announcement.

While Top Ships’ press release advertises Rubico as an independent company with no overlapping management and board members, the Pistiolis family will retain full control of Rubico via supervoting preferred stock as disclosed in Rubico’s initial 20-F filing (emphasis added by author):

Following the Spin-Off, Lax Trust, which is an irrevocable trust established for the benefit of certain family members of Mr. Evangelos J. Pistiolis, may be deemed to beneficially own, directly or indirectly, all of the 11,835 outstanding shares of our Series D Preferred Shares. Each Series D Preferred Share carries 528 votes. In addition, following the Spin-Off, the Lax Trust, through Family Trading Inc., or Family Trading, may be deemed to beneficially own 1,592 Series E Preferred Shares held by Family Trading, which will represent all of the Series E Preferred Shares that are currently outstanding and which will be convertible into approximately 175,768 common shares immediately following the Spin-Off. Each Series E Preferred Share carries 528 votes. Three Sororibus Trust of Cyprus, which is an irrevocable trust established for the benefit of certain family members of Mr. Evangelos J. Mr. Pistiolis, may be deemed to beneficially own all of the 433,114 outstanding shares of our Series F Preferred Shares immediately following the Spin-Off. Each Series F Preferred Share carries 5 votes.

By the Lax Trust’s beneficial ownership of 100% of our Series D Preferred Shares and Series E Preferred Shares, together with the ownership of common shares distributed in the Spin-Off pursuant to the terms of the Series E preferred shares of the Parent beneficially owned by the Lax Trust, and the beneficial ownership by Three Sororibus Trust of Cyprus of 100% of our Series F Preferred Shares, following the Spin-Off, the Lax Trust together with Three Sororibus Trust of Cyprus may be deemed to beneficially own 81.7% of our total voting power and to control the outcome of matters on which our shareholders are entitled to vote, including the election of our directors and other significant corporate actions.

Please note that Top Ships has agreed to grant Rubico the right of first offer over two additional Suezmax tankers.

While the Eco Malibu has a profitable time charter contract, Rubico’s cash generation is nowhere close to the level required for pursuing fleet growth without substantial dilution being suffered by common shareholders.

Given this issue, it is hardly a surprise that Rubico will enter the public markets with 1,000,000,000 in authorized common shares as compared to just 3,789,250 estimated to be outstanding initially.

In addition, Rubico won’t be required to seek shareholder approval for potential reverse stock splits anytime soon (emphasis added by author):

Prior to the Spin-Off, the Parent as our sole shareholder will also approve the amendment of our amended and restated articles of incorporation to effect one or more reverse stock splits of the shares of our common stock issued and outstanding at the time of the reverse split at a cumulative exchange ratio of between one-for-two and one-for-five hundred, with our board of directors to determine, in its sole discretion, whether to implement any reverse stock split, as well as the specific timing and ratio, within such approved range of ratios; provided that any such reverse stock split or splits are implemented prior to the third anniversary of the Spin-Off.

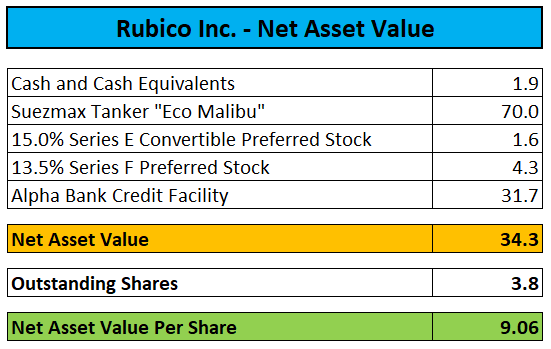

With the Eco Malibu’s charter rate more than 20% below current 12-month Suezmax time charter rates and the vessel not likely to come up for new employment until May 2026, a substantial discount to the vessel’s current charter-free market value of more than $80 million seems appropriate:

Regulatory Filings, MarineTraffic.com

Both the Series E and Series F Preferred Shares can be redeemed at the option of the company at a 20% redemption premium.

In addition, the Series E Preferred Shares will be convertible into new common shares at 80% of the lowest daily VWAP over a 20-day period.

Moreover, the Series E Preferred Shares remain protected by anti-dilution provisions.

According to Rubico’s 20-F, 1,401,563 common shares will be distributed to the Lax Trust, an entity controlled by the Pistiolis family.

This would leave 2,387,687 shares for distribution to outside common equity- and warrantholders.

As of June 20, Top Ships had 20,346,091 common shares and 17,861,910 eligible warrants outstanding which would result in a spin-off ratio of one Rubico share for each sixteen common shares or eligible warrants of Top Ships owned.

At prevailing prices, it would require a $10.24 investment in Top Ships common shares to become entitled to receiving one Rubico share with an estimated NAV of $9.06.

That said, given the track record of Top Ships and the apparent requirement to dilute Rubico shareholders for growing the company, I would be surprised to see Rubico’s common shares trading anywhere close to $9 per share upon consummation of the spin-off.

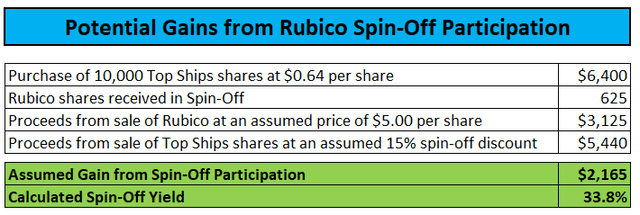

But even when applying a 45% discount to NAV right from the start, the potential spin-off gain for Top Ships’ common shareholders would likely still be substantial, at least under the scenario outlined below:

Author’s Assumptions and Calculations

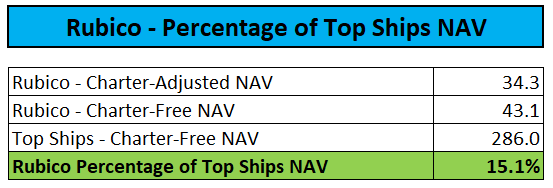

Please note that there are considerable uncertainties regarding the post spin-off trading prices of both Rubico and Top Ships but with Rubico’s charter-free net asset value only representing approximately 15% of Top Ships’ charter-free NAV, my discount estimate for Top Ships’ share price post spin-off looks reasonable:

Author’s Estimates / Company Press Release

With the anticipated spin-off date still a couple of months away and considering ongoing risk of further dilution for Top Ships’ common shareholders, speculative investors looking to participate in the spin-off should wait for additional information being released by Top Ships in the weeks and months ahead.

Bottom Line

The price of Top Ships’ common stock has dropped by more than 98% since my last update on the company as the vicious circle of relentless dilution and subsequent reverse stock splits has continued unabatedly.

While there’s little reason to assume that things will change at Top Ships going forward, the proposed Suezmax tanker spin-off represents an interesting speculation for investors willing to take the risk of becoming involved with one of the worst-performing stocks in recent years.

To minimize the risk of being caught flat-footed by another Top Ships equity offering, investors looking to participate in the spin-off should consider buying into Top Ships closer to the spin-off date, which has yet to be announced by the company.

Suffice it to say, it will be imperative for participants to dispose of both Top Ships’ and Rubico’s common shares as soon as practicable following the spin-off to avoid potential dilution.

While my fundamental assessment of Top Ships hasn’t changed by any means, the potentially lucrative spin-off speculation has caused me to temporarily raise my rating from “Sell” to “Hold“.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here