Thesis

Lyft (NASDAQ:LYFT) is a leading business in the ridesharing market which focuses on customer satisfaction and experience. Year to date, LYFT stock’s valuation has declined 12.68% due to a mixture of mediocre financial performance as well as a change in business leadership, with new CEO David Risher taking over in May. The largest impact of LYFT’s valuation came from a 36.4% decline on February 9, after the announcement of the change as well as the forecast of an underwhelming financial performance in Q1 2023. However, despite the poor stock performance in the past year, the optimistic future in a profitable sector leads to a hold rating.

Company Overview

Lyft, a company based on rideshare services for customers, sources most of its income from direct consumer purchases, such as rideshare services. Additionally, Lyft recently introduced another revenue source in the form of the membership subscription Lyft Pink, granting members faster pickups, preferred rides, and savings opportunities.

Industry Overview

Lyft’s market share in the rideshare industry is growing compared to the largest competitor Uber (UBER). The rideshare industry, which was valued at $85.8 billion in 2021, is projected to grow to $185.1 billion by 2026. Lyft’s market share is 26%, compared to the 74% dominance of Uber. This marks a drastic shift from the start of the pandemic, with Lyft originally holding 38% to Uber’s 62%.

Competitive analysis

Lyft is able to differentiate itself from the main competitor of Uber through the approach it takes to public perception. Lyft, focusing on a more friendly and welcoming environment compared to the business-centric Uber, tends to be priced barely higher than competitors in rush hour times, but tends to be cheaper during other hours. Additionally, Lyft stands out from the newly implemented Lyft Pink subscription service, granting members discounts on services other than Lyft (i.e. car rentals, Grubhub+), for $9.99 per month. Compared to Uber Pass, which is $24.99 per month to access only premium Uber subscriptions, Lyft Pink would benefit a wider audience from branching out to other daily services.

Financials

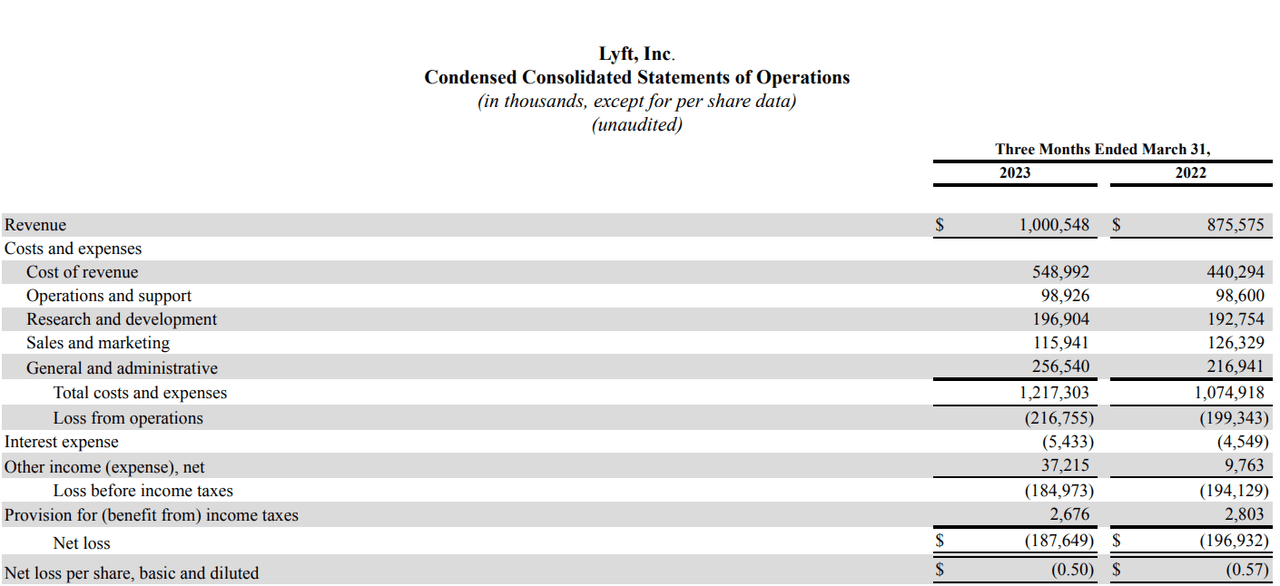

Following an underwhelming performance in Q1 2023, Lyft stock fell 15% after earnings and revenue figures were announced. The company announced $1 billion in revenue, marking a 14.3% increase year over year. However, the sales announcement also identified a decrease of 14.9% in revenue, compared to the $1.2 billion received during Q4 2022; the revenue accounted for also marks a decrease compared to Q3 2022’s financials.

Lyft

The largest factor behind the decline in Lyft’s profits is Uber. Uber, which reported a 29% increase in revenue, has faced larger levels of popularity than Lyft post-pandemic, leading to a large audience of Lyft customers gravitating to the competitor.

During the earnings call, Lyft announced the projection of $1~$1.02 billion in revenue for Q2 2023 or a 2% increase at most in revenue for the current quarter. Additionally, the corporation announced the layoff of 26% of its employees, reflecting the change in the regime as well as the poor financial outing this past quarter. A conjunction of both announcements can be attributed to the 15% drop in LYFT valuation.

Key Catalyst

The largest catalyst which could propel Lyft into profitability and regain market share from Uber is the transition in company leadership, especially with the onboarding of new CEO David Risher. David Risher, the co-founder and former CEO of the nonprofit organization Worldreader, hopes to change company culture and appeal to the market. Taking business inspiration from former boss Jeff Bezos, Risher aims to create services that mimic strategies incorporated in Amazon. Risher has already rolled out a service that allows customers to pre-order rideshares to airports and aspires to implement more substantial services in the near future.

Additionally, David Risher has announced his plans to shift the appeal of Lyft to a comfortable and friendly rideshare experience compared to the business-centered aspect of Uber. Risher has announced plans to create faster queues for customers and improved driving experience for drivers, hopefully leading to an influx in both drivers and consumers. The change in leadership has the potential to change the market appeal of Lyft to one which engages with a larger audience, regaining lost market share in previous years.

Valuation

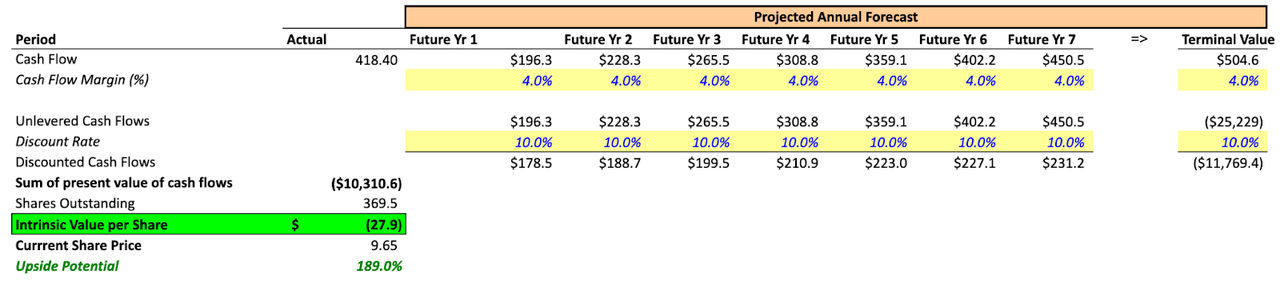

My discounted cash flow model uses a 10% discount rate and a 12% terminal growth rate, in conjunction with a 16.3% annual compound growth rate per the projected market growth of the rideshare sector. Profitability for the sector is common, with projections of the valuation reaching around $250 billion by 2028; Lyft is in a great place to take advantage of those projections and capitalize on market growth. Intrinsic value per share is projected at $27.9, compared to the $10 Lyft currently hovers around.

Author’s own materials (excel)

However, despite the high valuation of this stock, the transition in leadership as well as the poor financial performance in the past quarter marks a potential roadblock in Lyft’s success. LYFT is valued at a hold rating due to the uncertainties which lay ahead, as well as the uncertainties that originate from the stock’s performance in the past year. Pending Q2 2023 financial announcements, which would be the first full term of new CEO David Risher’s new position, the valuation would increase with improvements in financials.

ESG

Lyft has a number of measures in place to ensure comfort for all drivers, customers, and employers, as well as plans in place to sustain security in the environment and customer privacy. Lyft has implemented diversity measures, attributing to 73% of drivers identifying as members of a racial minority, as well as 7.5% identifying as a member of the LGBTQ+ community. Drivers and employees, both part and full-time, receive benefits and rewards such as premium Lyft subscriptions, and service centers for cars.

From an environmental standpoint, Lyft is gradually progressing into a 100% fleet of electric vehicles. Express Drive, Lyft’s rental car program for drivers who wish to not use personal vehicles, has started to gain more EVs in replace of gas-powered vehicles, offsetting potential carbon footprint. Lyft also partners with various programs such as California’s GRID Alternatives to advocate for further EV and hybrid inclusion on the roads.

Risks

The largest risk to Lyft’s valuation and commercial success is the dominant competitor of Uber. The competitor to Lyft currently holds a striking 74% market share in the ridesharing industry, compared to Lyft’s 26%. Additionally, Uber also significantly outperformed Lyft in Q1 2023 by reporting a 29% increase in revenue despite Lyft suffering from a decline in quarterly revenue.

From a commercial standpoint, Uber takes the reigns from the success of the Uber Eats food delivery program, one which Lyft suffered a major slump in. In 2017-2018, Lyft attempted to create a food delivery program in works with Taco Bell, but customer and driver disapproval led to plans falling through. Although today, Lyft drivers have the option to participate in food or pharmacy delivery, that service is not coordinated directly through Lyft and leaves a major revenue source on the table. Uber, on the other hand, has the service of Uber Eats widespread among a number of continents as well as the majority of stores with rideshare delivery capabilities. This led to a large factor in the way Uber differentiated itself from competitors, due to Uber Eats being Uber-incorporated as well as a great tool to utilize during the pandemic. Uber Eats sourced more customers during the pandemic shutdown and led to more customers transitioning to Uber services from Lyft.

Conclusion

Despite having a tolling past few quarters, Lyft has the ability to take advantage of the prosperous growth of the rideshare industry and capitalize on the new customers and services which will be associated with it. Shrinking market share and reduced revenue are both major problems the old administration faced, but with the onboarding of new CEO David Risher, Lyft aims to reset business back to post-pandemic levels of success and regain a consumer base that has shifted to Uber. Although the competitor is a looming threat to business, the conjunction of risk and profits on the horizon leaves a margin of upside for investors, leaving Lyft with a hold rating.

Analyst Recommendation by: Rahiil Sengupta

Read the full article here