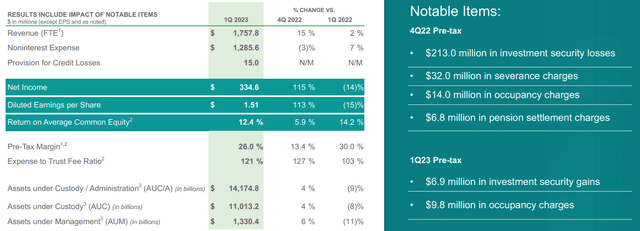

Northern Trust (NASDAQ:NTRS) is a Chicago, Illinois-based high finance company, which operates across asset servicing, wealth management, and asset management verticals. As of Q1’23, Northern Trust maintains >$14.17tn in assets under custody/administration alongside $1.33tn in AUM.

Northern Trust Q1’23 Presentation

Through these activities, Northern Trust has generated >$1.75bn in Q1 revenues, enabling a pre-tax profit margin of 26%- 30% higher YoY- and free cash flow of -176.40mn, with the 124.46% FCF decline driven by increased financing costs.

Introduction

The firm’s value proposition is propelled by a history of success – thus supporting a generally positive reputation, the utmost client-centricity which is largely a given with a high net-worth clientele, product and innovation leadership in asset servicing and wealth management arenas, and high levels of integration for premium service, efficient operations, and high margins.

Northern Trust Q1’23 Presentation

The combination of Northern Trust’s impressive legacy and core businesses, the vertical integration of the firm’s services, and a high propensity for shareholder returns, alongside trading at a heavy discount leads me to rate the company a ‘strong buy’.

Valuation & Financials

General Overview

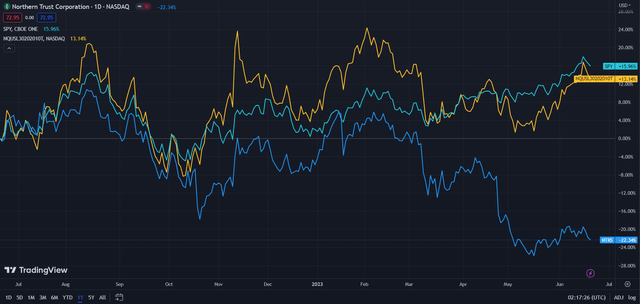

In the TTM period, Northern Trust- down 22.34%- has trailed both the Mid-Large Cap Custodial Bank Index – up 13.14% – and the broad market, represented by the S&P 500 (SPY), up 15.96%.

Northern Trust (Dark Blue) vs Industry & Market (TradingView)

I believe this reflects the impact of rising interest rates and recessionary pressures on the asset servicing and wealth management industry, with Northern Trust particularly sensitive to rate movements due to its specialization in high net-worth finance, while many other custodial firms operate across a wider range, such as megabank JPMorgan Chase (JPM) or investment banks such as Goldman Sachs (GS).

However, while Northern Trust has experienced declines in free cash flow, I believe interest rate headwinds are temporary and the company is adaptable to said headwinds, with increasing scale and revenues despite said issues enabling long term margin growth capabilities.

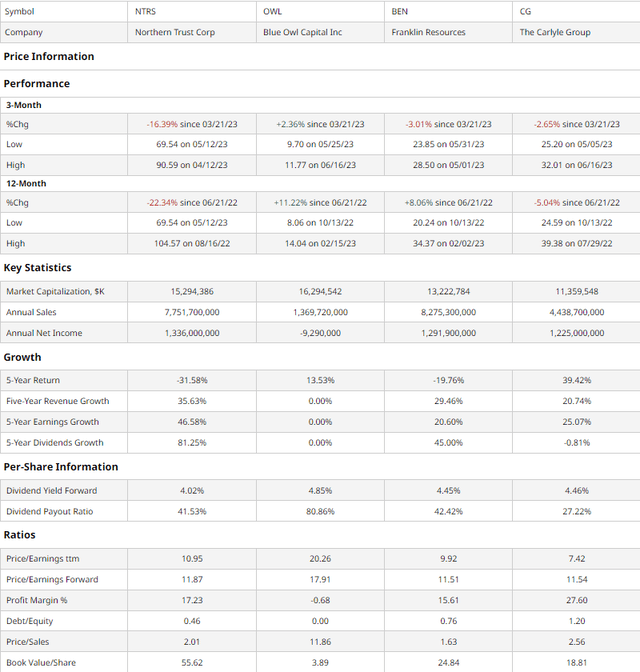

Comparable Companies

As previously discussed, the asset servicing and wealth management industries are dominated by larger, more universal firms, such that Northern Trust is not comparable to direct competitors. Thus, Northern Trust is best compared with asset management and other high finance firms of similar size, based on a market capitalization approach. Firms such as alternative asset manager, Blue Owl Capital (OWL) or ETF heavyweight Franklin Resources (BEN), and private equity major, the Carlyle Group (CG).

barchart.com

As illustrated above, despite maintaining strong multiples-based value, strong growth metrics, and strong investor returns relative to peers, the company has experienced the worst YoY and QoQ price action.

And this theme extends into the trailing 5Y period as well; while Northern Trust has experienced best-in-class revenue growth, peerless earnings growth, and has hiked its dividend at a greater volume than peers, Northern Trust still experienced the poorest 5Y performance.

Even when assessing multiples, Northern Trust maintains a low P/E, especially relative to the general market, the second lowest P/S, and the highest BV/share. And with a low debt/equity, Northern Trust is capable of significant reinvestment and bridge financing.

Valuation

According to my discounted cash flow valuation, at its base case, the true value of Northern Trust is $93.59, meaning at its current price of $71.56, the stock is undervalued by ~24%.

Calculated over a five year period without perpetual growth, my DCF model assumes a discount rate of 9%, reflecting Northern Trust’s low debt levels and slightly above average volatility- thus slightly higher equity risk premium. Moreover, although the average growth of the company’s revenue in the past 5 years is 6.84% – yet lower than it should be due to temporary headwinds in 2020 – I estimate a revenue growth rate of 4%, incorporating the potential for sustained high interest rates and recessionary pressures.

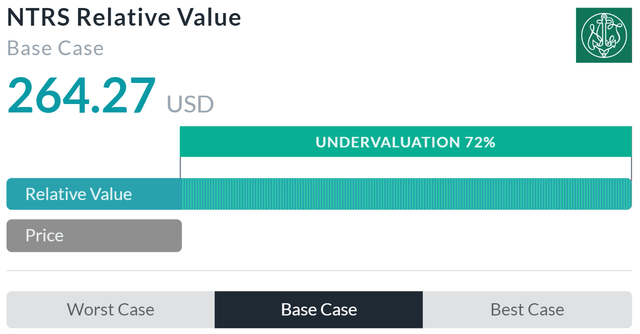

Alpha Spread

Alpha Spread’s multiples-based relative valuation more than supports my thesis on undervaluation, calculating a base case undervaluation of 72%, meaning the stock’s fair value is $264.27.

However, Alpha Spread’s model is unable to discount dividend returns and fails to adequately capture the beta of the stock, which may temporarily lead to inflated relative valuations.

Therefore, using a weighted average skewed toward my DCF and putting less emphasis on Alpha Spread’s valuation, the true value of Northern Trust is $117.55, meaning the stock is undervalued by 39%.

Asset Servicing & Premium Wealth Services Enable Differentiation & Margin Expansion

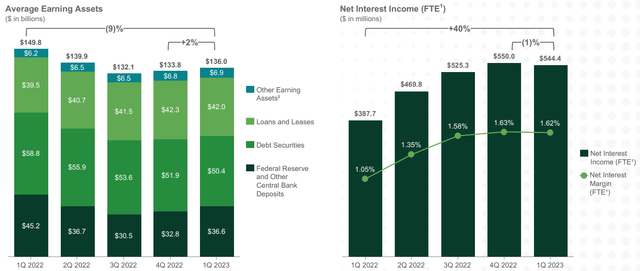

The central focus of Northern Trust’s business is its ability to provide value for high net-worth clients and institutions through its suite of integrated wealth products, encompassing asset servicing, wealth management, and asset management. Undergirding its success in these verticals is Northern Trust’s near-fortress balance sheet. Among earning assets, the firm holds a mix of highly-secure assets, including loans and leases, high-grade, generally treasury debt securities, and central bank deposits. Though Northern Trust has seen a YoY decline in average earning assets, this is no more than a blip driven by increasing interest rates, and the firm is seeing reversion on a QoQ basis. On the flipside, Northern Trust has seen outsized YoY growth of its net interest income, with a slowdown on a QoQ basis.

Northern Trust Q1’23 Presentation

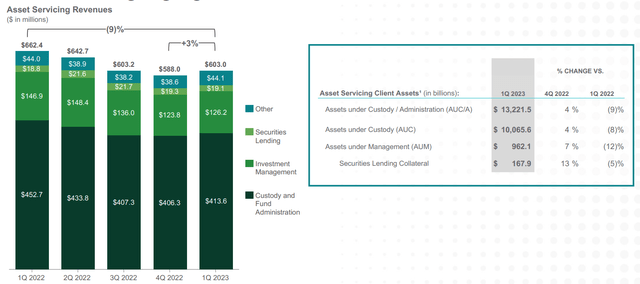

Northern Trust’s increasing interest income demonstrates its long-run ability to adapt to shifting macro-financial environments. In spite of increased interest incomes, however, Northern Trust has not been able to compensate for YoY declines across asset servicing and wealth management verticals. Nonetheless, the segment remains strong, with diverse revenues driven by highly specialized legal and financial talent. Custody and Fund Administration lead asset servicing revenues, followed by investment management and securities lending revenue, the latter of which I expect to grow over the years with growing complexity of financial markets.

Northern Trust Q1’23 Presentation

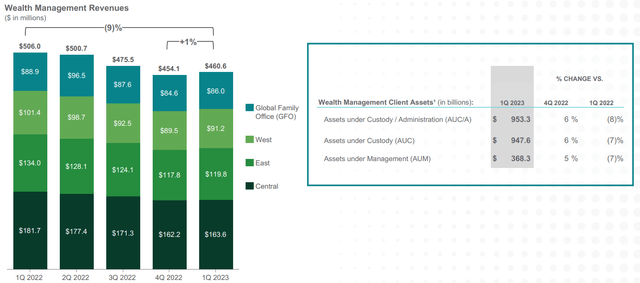

The theme of YoY revenue declines and QoQ revenue growth reversion extends into Northern Trust’s wealth management business, thus stressing the level of integration the firm maintains. High net-worth clients and institutions, often enticed by wealth management services, are incentivized to simultaneously utilize Northern Trust’s asset servicing and asset management products, leading to similar results across all segments.

Northern Trust Q1’23 Presentation

Wall Street Consensus

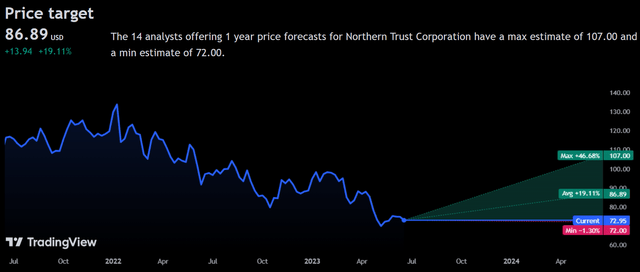

Analysts support my highly positive view on the stock, estimating an average 1Y price increase of 19.11% to a price of $86.89.

TradingView

Even at the minimum projected price of $72.00, a decline of 1.30%, investors will have net positive returns with the firm’s 4.02% dividend.

These price targets mirror analyst sentiment on the market’s overreaction to temporary headwinds for Northern Trust.

Risks & Challenges

Increased Implied Volatility Across Markets

As a wealth-oriented company, Northern Trust depends on the stability of financial markets for the preservation of client wealth. As such, increased volatility in markets will both reduce Northern Trust’s ability to support client objectives, reduce predictability of cash flows, and reduce the firm’s ability to generate periphery revenues such as through securities lending if liquidity deteriorates.

Reputational & Third Party Dependency

In business for over 150 years, Northern Trust’s ability to attract high net-worth clients is built upon the dual pillars of stability and reputation. Any harm to reputation, whether it be related to potential legal difficulties or financial capabilities, will perpetuate a negative flywheel of asset outflows, scale reduction, and service decay.

Conclusion

Northern Trust remains a secure business, with built-in growth and leadership across premium finance verticals. Combined with a heavy undervaluation, the firm’s integrated operational growth is indicative of growth potential and sustained capital returns.

Read the full article here