Thesis

Taseko Mines Limited (NYSE:TGB) is positioned to exploit the expected boom in copper – a metal that is indispensable to the global electrification race. The company, a true copper “pure play,” is waiting on the EPA to approve one final permit to begin construction on a mine in Florence, Arizona that will boost Taseko’s output by about two-thirds. The market, however, might be underestimating the upside potential of Florence’s low operating costs, which will considerably enhance profit and cash flow margins, as I aim to demonstrate through a discounted cash flow analysis.

In Search of Undervalued Copper ‘Pure Plays’

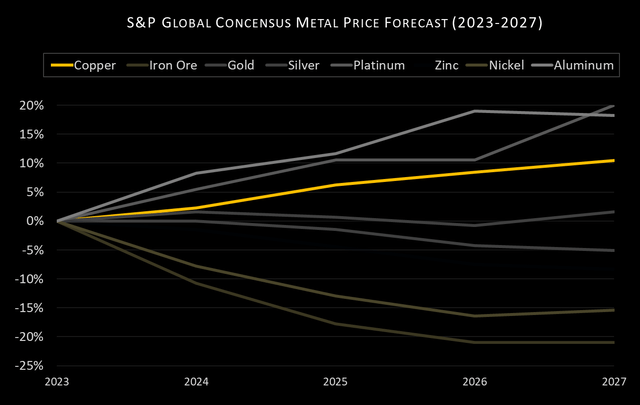

Copper demand is expected to outpace mining capacity over the next decade, driven by the global energy transition, with some projecting a shortfall of up to 10-12 million tons by 2035. Moreover, this gap is expected to represent about 20% of would-be global usage. The most recent S&P consensus commodity price forecast has copper among the top three metals projected to grow the most from 2023-2027. Copper is expected to rise by about 11%, followed by aluminum (15%) and platinum (20%).

Consensus Metal Price Forecast (S&P Global consensus targets as of 5/31/23)

This is the reason many investors are looking for exposure to copper. Now some of the largest copper producers are actually diversified mining giants, so they offer diluted exposure. Hence, any significant jump in copper demand, presumably accompanied by increased commodity prices, will have less of an impact on the stock versus a company like Taseko, which derives 92% of revenue from copper – the remainder coming from molybdenum. Moreover, analysts expect Taseko sales to grow over 30% this year from about $290 million in 2022.

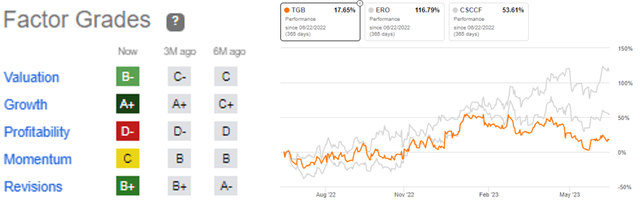

Despite this upside, the stock in the past twelve months has not performed as well as comparable mid-tier players like Ero Copper Corp. (ERO) and Capstone Copper Corp. (OTCPK:CSCCF), which are up over 100% and 50%, respectively. This relative weakness has driven TGB’s quant factor grade down to a C as illustrated below.

TGB Factor Grades (Seeking Alpha)

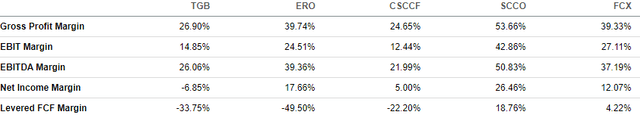

Even more concerning is the D- grade in profitability, partly driven by an EBIT margin of less than 15 percent. Industry titans Southern Copper Corporation (SCCO) and Freeport-McMoRan Inc. (FCX) delivered operating profit margins of 42% and 27%, respectively, in the trailing twelve months, while Ero posted EBIT % of nearly 25%.

TGB Profitability vs. Peers (Seeking Alpha)

However, this also presents opportunity. Because those margins will soon be rising – the extent to which may remain a mystery to many potential investors.

DCF Valuation

The DCF valuation is built upon the assumption that Florence will be fully permitted and ramped up by mid-2025. The company during a May 4 earnings call expressed confidence the EPA would issue the Underground Injection Control permit within the next “few months.”

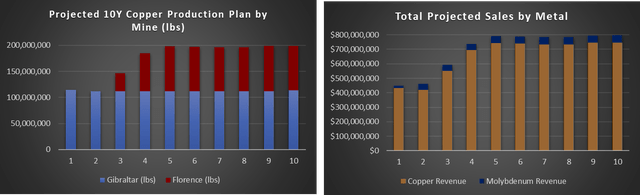

Hence, in terms of when to phase-in Florence production, I am assuming the permit will be issued by the end of 2023 and that construction will take 18 months, per a Mitsui statement at the end of last year. Based on the company’s technical reports for Florence and Gibraltar, I project the former adds 35Mlbs annually beginning in year 3 of the model before rising to over 80Mlbs/year. This comes on top of Gibraltar’s roughly 112Mlbs/yr (net of Mitsui’s cut), before the combined total output almost reaches 200Mlbs in years 5-10.

Meanwhile, the company is projected to produce on average of about 2.3Mlbs of molybdenum per year, which I incorporated into the DCF model. Based on a copper price of $3.75/lb and Mo. price of $20/lb, Taseko’s annual revenue should climb to nearly $800 million.

MH Analytics’ 10Y Forecast of Taseko Production (MH Analytics, company mine plans)

As Seeking Alpha’s Atlas Equity Research pointed out in an analysis in April, just as important as the boost in volume is Florence’s low-cost profile. Operating costs at Florence are expected to be $1.11/lb, significantly lower than the $2.82/lb Gibraltar registered in Q1. Once Florence volumes are fully online, Taseko should see its overall weighted cost drop to roughly $1.85/lb.

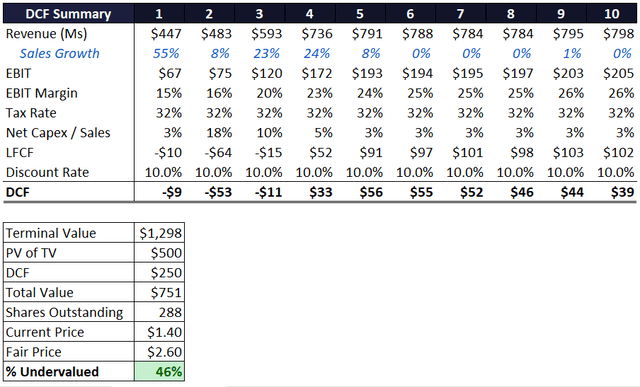

I also assume the Gibraltar mine will enhance its margins gradually from 15% to 20% as more cash is reinvested in generating efficiencies. I project Florence’s average EBIT margin will reach about 35%, which will drive the total company operating profit margin from 15% to around 26%. After adding capex spend, taxes, and interest expenses, the DCF model projects Taseko’s stock is undervalued by 46%.

MH Analytics’ DCF Analysis of Taseko’s Stock (MH Analytics)

From a sensitivity standpoint, if the average annual copper price changes +/ 25 cents, the valuation shifts as such:

- $3.50/lb = 41% (Worst case)

- $3.75/lb = 46% (Base case)

- $4.00/lb = 51% (Best case)

Risks

The first obvious risk is that the EPA could refuse to approve the UIC permit or continually delay its final decision. Taseko’s debt levels could turn out to be problematic as well. They have significantly higher debt ratios compared to their pure copper peers, and it has negatively impacted levered cash flows. Based on its most recent filings, Taseko has an interest cover ratio of 1.43, D/E ratio of 169%, and a Net Debt/EBITDA ratio of 4.8. On the other hand, the company has received stable outlooks from all three major credit rating agencies and future interest payments imply better coverage ratios.

Conclusion

TGB’s stock seems to be mispriced because the market is not fully appreciating the impact the Florence, Arizona mine, once up and running, will have on both the top and bottom lines. Florence will boost production by 60% and operating profit by even more. A catalyst in the form of an EPA greenlighting of the project is potentially a few months away. In the end, I found TGB almost 50% undervalued. Hence, I recommend the stock as a buy.

Read the full article here