Investment Thesis

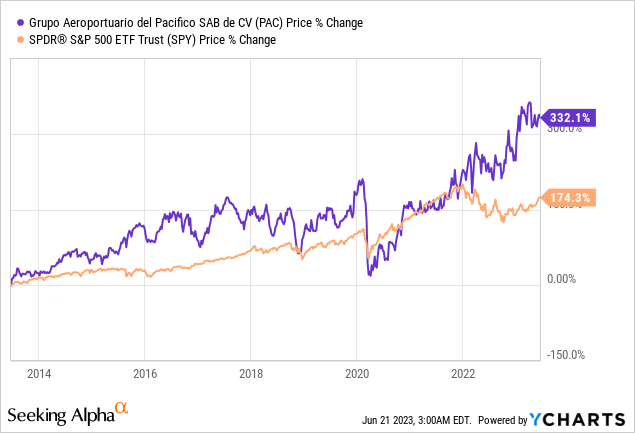

Grupo Aeroportuario del Pacífico (NYSE:PAC) has grown over 300% in the past decade, significantly outperforming the S&P 500 (SPY) by a wide margin. The company should continue to benefit from the emerging near-shoring trend, as more companies are now moving their production to Mexico.

It should also see strong tailwinds from the country’s growing travel industry, which has been seeing upbeat momentum with tourism revenue hitting an all-time high recently. Despite the rise in share price, the current valuation is still cheap. Considering the favorable backdrop, I believe the company should have meaningful upside potential in the long run.

The Near-Shoring Trend

Grupo Aeroportuario del Pacífico is currently the largest airport operator in Mexico, connecting the country with over 110 destinations across the globe. The company manages 12 airports that serve over 56 million customers annually, giving it a dominant market share of 30.1%. The company generates around 60% of its total revenue from aeronautical services and 40% from non-aeronautical services (eg. food, retail, lounge, and parking).

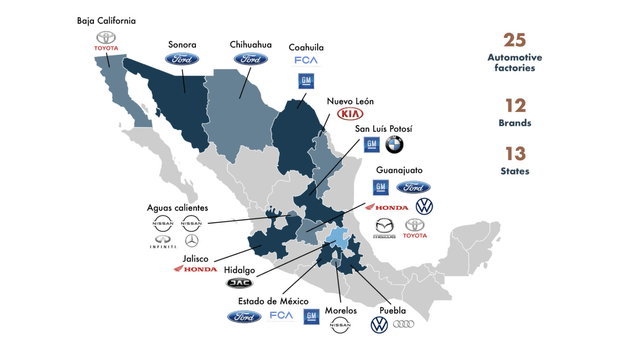

I believe the company is well-positioned to benefit from near-shoring, which has become increasingly popular among companies in the past two years. There are multiple catalysts driving its emergence. For example, many companies are trying to move away from China due to rising political concerns. After the supply chain disruption during the pandemic, many are also looking to diversify their operation locations in order to minimize logistic risks.

Mexico has been the most favorable option so far as it is close to the US yet wages and costs are materially lower. For instance, Tesla (TSLA) announced in March that they are building a new factory in Mexico, joining other major car manufacturers such as Ford (F) and BMW (OTCPK:BMWYY).

The emergence of near-shoring has resulted in a boom in Mexico’s investments. According to Bloomberg, foreign direct investment in Mexico surged 48% to $18.6 billion in the first quarter, as the trend continues to gain traction. These ongoing developments will likely boost the country’s air traffic, which should translate to meaningful tailwinds for the company moving forward.

Raul Revuelta, CEO, on near-shoring

We have some kind of near-shoring effect today on the traffic. It’s really early to understand that. What we are seeing in some of our airports or around of our airports is — are really having, I mean, real estate on the industrial parks in Guadalajara, Bajio, Aguascalientes, and in Tijuana. So, I will say that are the first sites of what could be the near-shoring effect on coming years.

Mexican Association for Automotive Industries

Growing Travel Industry

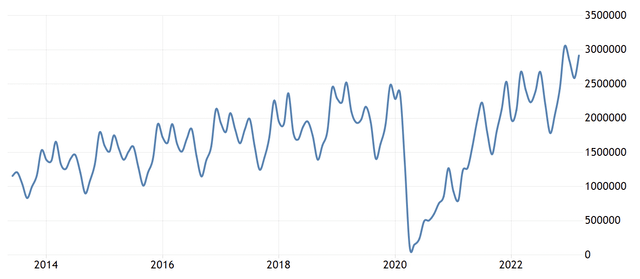

Mexico’s growing travel industry should be another major growth driver of Grupo Aeroportuario del Pacífico. According to Statista, Mexico’s travel & tourism market is forecasted to grow from $14 billion in 2023 to $17.2 billion in 2027, representing a solid CAGR (compounded annual growth rate) of 5.3%. While the travel industry took a huge hit in 2020 due to the unprecedented pandemic, it has quickly rebounded and already regained all its losses. Last December, Mexico’s monthly tourism revenue hit an all-time high of $3.05 billion, up 25% YoY (year over year) as shown in the chart below.

Thanks to rising traffic, more hotels are now expanding in Mexico, which should further increase capacity. For instance, notable attractions such as Los Cabos currently have over 1,200 rooms under construction. There are also major developments going on in Puerto Vallarta, the country’s fourth-largest tourist destination. Three theme parks alongside multiple hotels are set to debut in 2024, which is going to double the city’s current room capacity. These ongoing expansions and developments should further boost the country’s tourism industry, which subsequently drives air traffic as well.

Trading Economics

Compelling Valuation

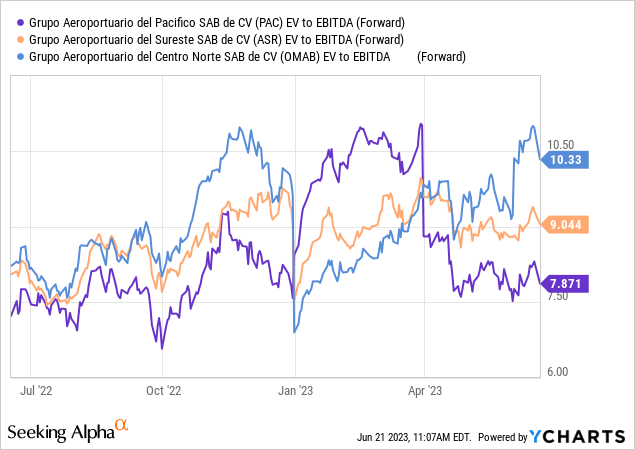

Despite trading near its all-time high, Grupo Aeroportuario del Pacífico’s valuation still looks very compelling. The company is currently trading at an fwd EV/EBITDA of 7.9x, which is notably lower than other major Mexican airports operators such as Grupo Aeroportuario Del Sureste (ASR) and Grupo Aeroportuario del Centro Norte (OMAB), as shown in the chart below. The peer group has an average fwd EV/EBITDA of 9.7x, which represents a premium of 22.8% over the company.

The current multiple is also discounted on a historical basis, representing a meaningful discount of 38.8% compared to its 5-year average fwd EV/EBITDA of 12.9x. The valuation is especially attractive when considering its growth. In the latest quarter, revenue and EBITDA grew by 38.7% and 26.6% respectively, which is extremely strong under the current macro environment.

Macro Risks

Macro uncertainty remains a notable risk in my opinion. Due to the company’s presence in the discretionary travel & tourism industry, it is highly exposed to the economy. A slowdown in the economy will likely impact travel volume, as consumers cut down on spending. Investments in the country should also slow, as companies become more prudent with their capital deployment. The current backdrop looks healthy but it is worth keeping track of the economy.

Investors Takeaway

Grupo Aeroportuario del Pacífico is an excellent GARP (growth at a reasonable price) company in my opinion. The company’s airports are well-positioned to benefit from the emerging near-shoring trend and the rising Mexico travel industry. Its growth should also be very durable as the company has an extremely strong moat. The airport industry has high regulatory barriers and massive capital and land requirements, which makes it nearly impossible for new companies to enter the market. Macro uncertainty is a risk but I am not too concerned as of right now. I believe the strong fundamentals alongside the discounted valuation should translate to ample upside potential.

Read the full article here