PIMCO 0-5 Year High Yield Corporate Bond Index ETF (NYSEARCA:HYS) offers exposure to high-yield corporate bonds, also known as junk bonds or non-investment grade bonds. What makes HYS unique is that this ETF holds short-term high-yield corporate bonds, while most of the big high-yield corporate bonds ETFs tend to be more long-term. With AUM of about $1B, HYS has a 30-day SEC yield of about 7.7%. While this is an impressive yield, this ETF comes with a lot of risk, and I don’t believe that a recession is completely priced in. Because of this, I rate HYS a Sell.

Holdings

HYS holds 698 corporate junk bonds, with most of them falling into the 0-5 year maturity time category.

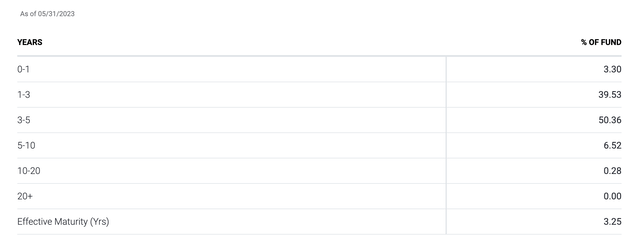

HYS’s holdings by maturity (pimco.com)

A little over 50% of HYS’s holdings are 3-5 year bonds, almost 40% are 1-3 year bonds, and the small remaining amount in either less than 1-year or greater than 5-year bonds. This gives the ETF an effective maturity time of 3.25 years.

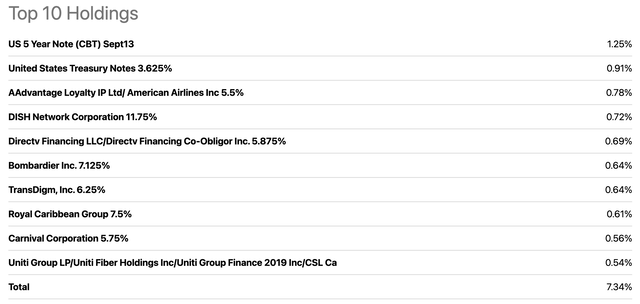

HYS’s top 10 holdings make up only about 7% of its AUM, making it a well-diversified ETF.

HYS’s top 10 holdings (Seeking Alpha)

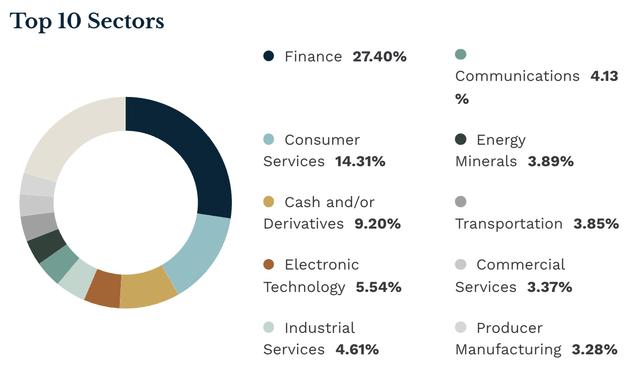

HYS is also pretty well diversified among sectors. It has a skew toward financials, but overall, it holds a wide variety of different sectors.

HYS’s holdings by issuer (ETF.com)

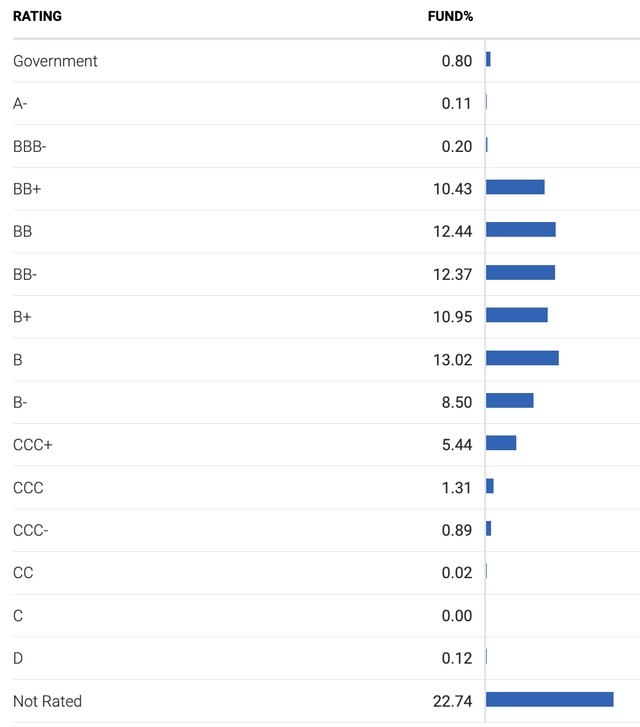

Finally, and most importantly, we must look at the credit ratings of the bonds HYS holds.

HYS’s holdings by credit rating (pimco.com)

This is a junk bond ETF, so it’s expected that almost all of the bonds are non-investment grade or not rated. However, the highest credit rating category is not rated. These bonds are likely not rated because they carry such high risk. The junk bonds HYS holds are already risky but holding over 22% of not rated bonds makes this ETF extremely risky. The more risk a bond ETF carries, of course, the higher the yield.

Junk bond and 10-year treasury bond spread

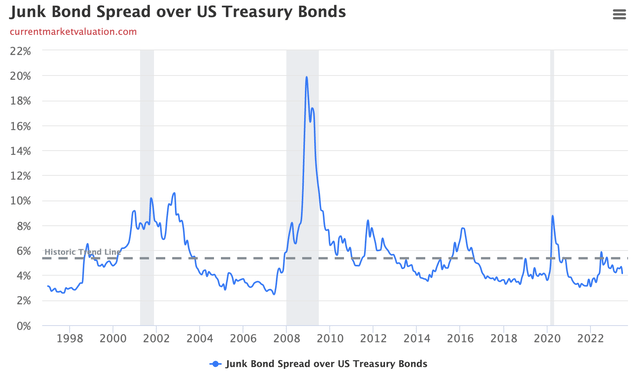

HYS has an impressive 30-day SEC yield of about 7.7%. While this is a high yield, after considering the junk bond spread over 10-year treasury bonds (shown below), I don’t think it’s enough to justify the risk.

Junk bond spread over 10-year treasury bonds (currentmarketvaluation.com)

The historic trend line is at about 5.5%. Right now, the spread is at about 4.2%, suggesting that we are in an average economic time. However, I believe we are headed to a recession is on the way. If this is the case, there will be more default risk for the junk bonds HYS holds. In my view, there is no justification for the spread to be below the historic trend line. It doesn’t take into account the recession on the horizon.

HYS is in all the wrong places

In addition to the low spread, HYS isn’t in a good position to ride out the coming recession. This is a short-term junk bond ETF. The recession is expected in the short term, likely within the next year. Other junk bond ETFs tend to be long-term, such as JNK. Longer-term junk bonds don’t have to worry about repaying the principal for a long time, all they have to pay is the coupons. The short-term junk bonds HYS holds not only have to pay the coupons but also repay the principal relatively soon. This puts more strain on bonds issued by companies that are already experiencing financial difficulty.

A future outlook on junk bonds

While we have seen some small signs of the economy slowing, there is still much more economic unrest ahead of us. The Fed raised interest rates very fast in the past 15 months to a 2-decade high, and they plan on 2 more rate hikes in 2023 to battle the very sticky inflation we are experiencing. This has put a strain on the economy, and we are starting to see its effect on the junk bond market. Junk bond defaults have been climbing steadily in 2023, and this is expected to continue into 2024.

Right now, Fitch Ratings is forecasting a default rate for junk bonds of 4.0%-4.5% in 2023 and 3.5%-4.5% in 2024. Moody’s sees defaults reaching as high as 5% in 2024. It’s a gamble to take a risk on HYS. But the worst part is, the junk bond and treasury bond spread are acting like this is just a normal time for the junk bond market, so the yield is not high enough to justify the risk.

There are other high-paying alternatives

If you’re an investor looking for high yields, there are better, much safer options. SGOV, a 0-3 month treasury ETF is currently paying out a 5.1% yield. While this is about 2.5% lower than HYS’s yield, in my opinion, investing in a practically zero-risk ETF and getting 5.1% is far better than taking on all the risk HYS comes with, especially considering the low junk bond treasury spread and the fact that we are headed for recession.

Conclusion

HYS tracks short-term junk bonds. While HYS has a high 30-day SEC yield of about 7.7%, the risk of this ETF makes it not worth it. The junk bond spread over 10-year treasury bonds suggests that we are in a normal economic situation, but we are not. We are headed for a recession. Junk bonds are likely to have a rough rest of 2023 and 2024. Because of all this, I rate HYS ETF a Sell.

Read the full article here