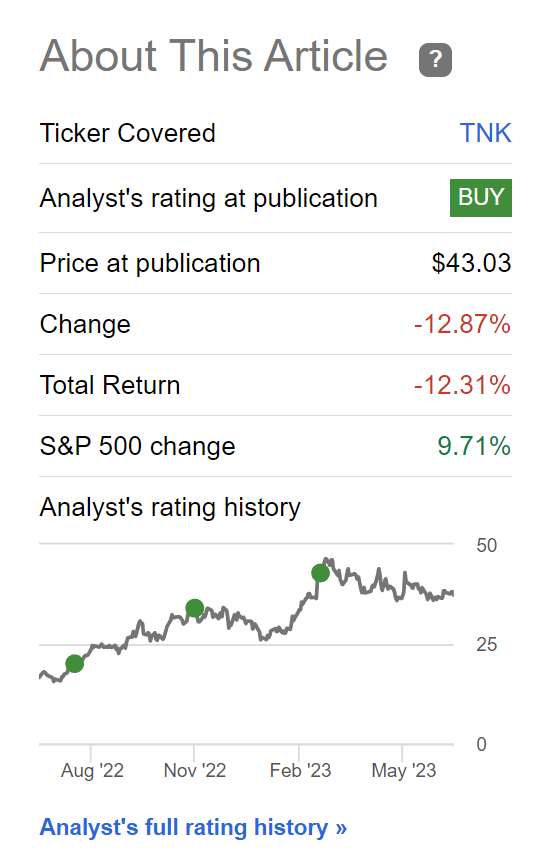

A few months ago, I wrote a bullish update on Teekay Tankers (NYSE:TNK), arguing that tanker rates could stay ‘higher for longer’ as the Russian crude oil diversion trade continues to play out. However, price action on TNK shares have not agreed with my thesis, as TNK shares have stalled out since February. Although shares are up 87% since I first called TNK a buy in July 2022, they are down 12% since February (Figure 1).

Figure 1 – TNK has stalled out since February (Seeking Alpha)

What is going on and am I still bullish on the Teekay Tankers?

Brief Company Overview

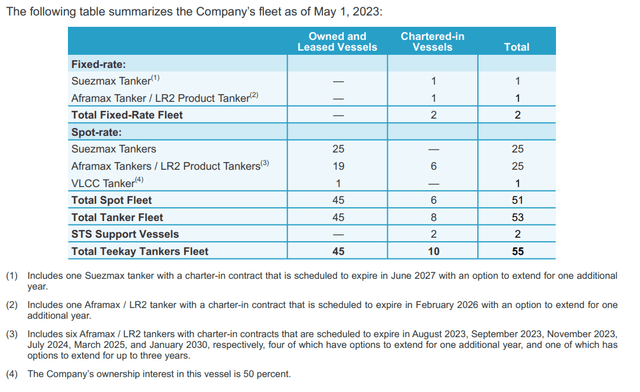

Before proceeding further, we first need to give a brief company overview for those new to the TNK story. Teekay Tankers owns and operates one of the largest fleet of product and oil tankers, with 25 Suezmax, 19 Aframax / LR2, and 1 VLCC tankers as of May 1, 2023. TNK have also chartered-in (TNK have chartered vessels from their owners at a fixed rate) 10 vessels for a total fleet of 55 tankers (Figure 2).

Figure 2 – TNK fleet (TNK Q1/23 press release)

TNK primarily operates in the spot market, although the company does look to lock in longer-term time charters if it deems the charter rates attractive.

Cash Flow Bonanza Continues In Q1

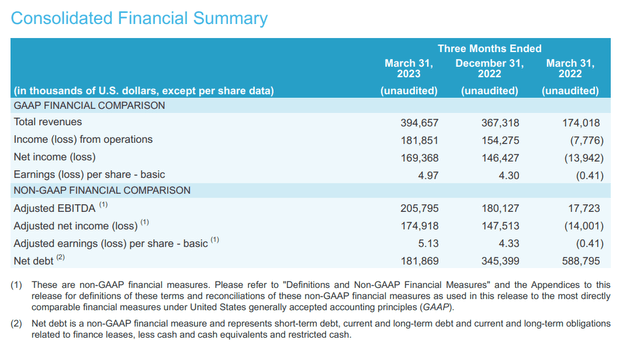

Recently, the company reported a strong start to 2023, with Q1/23 revenues of $395 million, more than double revenues in Q1/22 and even better than the fantastic Q4/22 results that I highlighted in my prior update. Q1/23 net income was $169 million, or $4.97 / share, compared to a loss of $0.41/share in Q1/22 and $4.30 in Q4/22 (Figure 3).

Figure 3 – TNK Q1/23 financial summary (TNK Q1/23 press release)

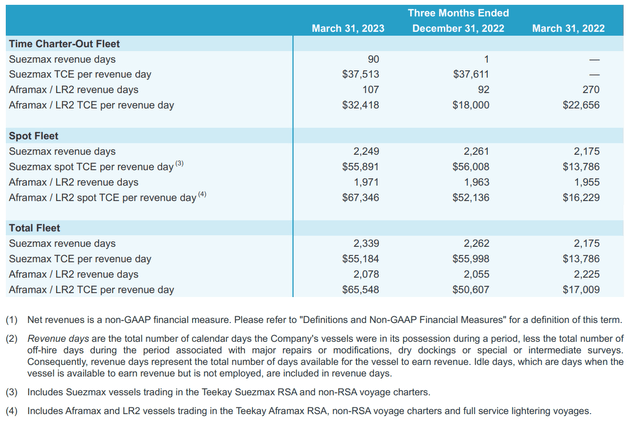

TNK’s strong financial performance in Q1/23 was driven by exceptionally high tanker rates, with TNK’s Suezmax fleet averaging $55k / day in time charter equivalent (“TCE”) rates and the Aframax/LR2 fleet recording $66k / day TCE (Figure 4).

Figure 4 – Financials driven by strong tanker rates (TNK Q1/23 press release)

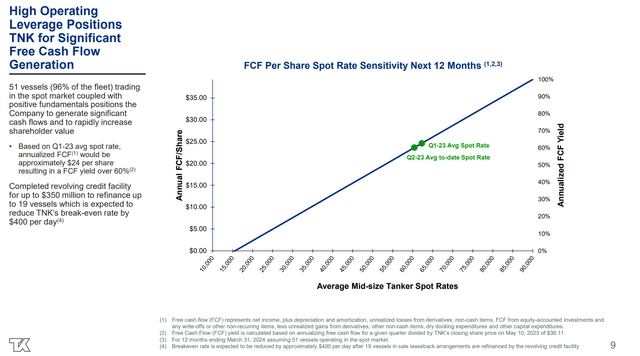

Importantly, at current high spot rates, TNK is a free cash flow machine, with the company being able to pay off more than $400 million in net debt in the past twelve months. At TCE ~$60,000 / day, TNK is estimated to be able to generate ~$24 / share in annualized FCF or a FCF yield of over 60% (Figure 5).

Figure 5 – Based on Q1/23 average spot rates, TNK can generate annualized $24 / share FCF (TNK investor presentation)

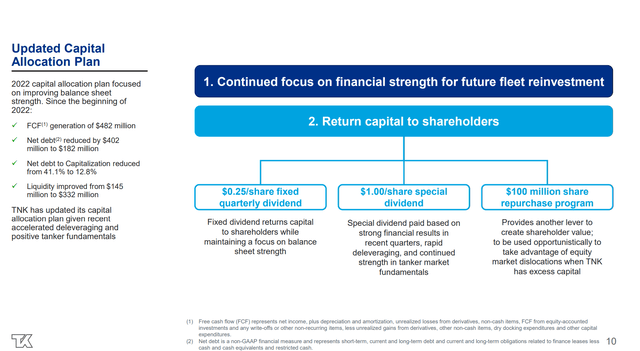

Announces Capital Return Program

As part of its Q1 earnings release, the company also announced a new capital allocation plan with the initiation of a $0.25 / share fixed quarterly dividend, the announcement of a $1.00 / share special dividend, and a $100 million share repurchase program (Figure 6).

Figure 6 – TNK announces a new capital allocation program (TNK investor presentation)

One of my biggest fears with regard to TNK is that management would foolishly go on an acquisition or shipbuilding spree, and it appears my fears were unfounded. The initiation of a quarterly dividend and share repurchase program looks very reasonable and prudent, so kudos to management.

Why Hasn’t The Stock Price Rallied?

With such strong financial performance in Q1, investors may be left wondering why hasn’t TNK’s stock price rallied? Since February, TNK’s stock has actually declined 10-15%, as mentioned at the beginning of the article.

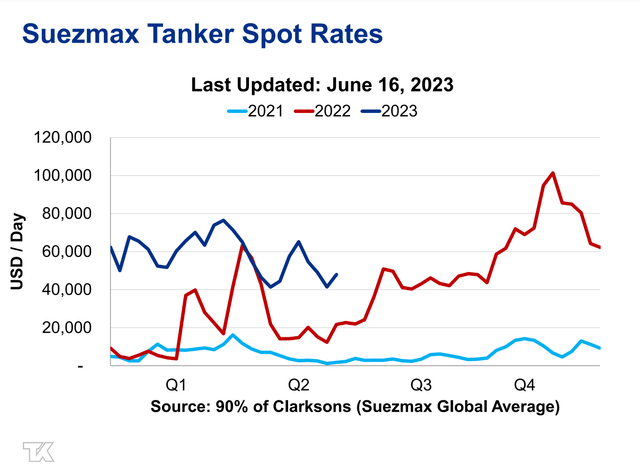

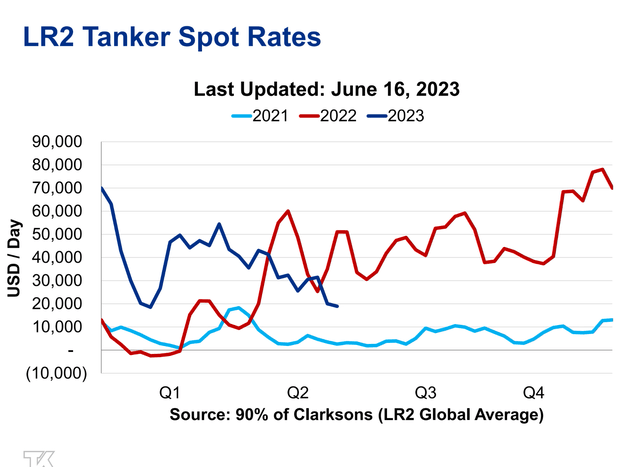

I believe the problem for investors is that the market does not believe the good times will last. For example, in recent weeks, we have seen spot tanker rates moderate, with Suezmax and Aframax rates dipping to the low $40ks / LR2 rates seeing even steeper declines (Figure 7 and 8).

Figure 7 – Suezmax spot rates dipping to low $40k (teekay.com)

Figure 8 – LR2 spot rates dipping to low $20k (teekay.com)

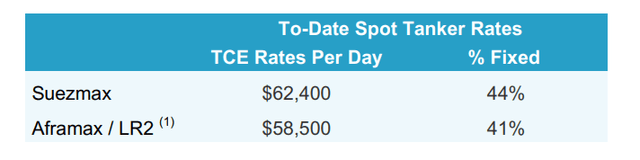

At the current pace of declines, TNK may actually see a QoQ decline in business fundamentals in the upcoming quarter, despite management having previously provided an upbeat outlook during the Q1 earnings release (Figure 9).

Figure 9 – TNK Q2 to date spot rates as of early May (TNK Q1/23 press release)

OPEC+ Announce Another Cut To Production

As I highlighted in my prior article, one of the key risks to TNK is weak global economic growth, which could dent crude oil demand. That appears to be occurring in real time, as we are seeing China’s recovery falter and recently OPEC+ announced further production cuts into 2024 to support oil prices. Reduced production from OPEC+ hurts tanker demand and tanker rates.

Long-Term Outlook Remains Bright

On the positive side, the longer-term outlook for crude oil tankers remain bright, as there appears to be no conclusion to the Russian oil ban in sight. The diversion of Russian crudes to the far-east (India and China) will continue to tie up tankers on long-haul voyages, which should keep tanker rates elevated relative to historic levels.

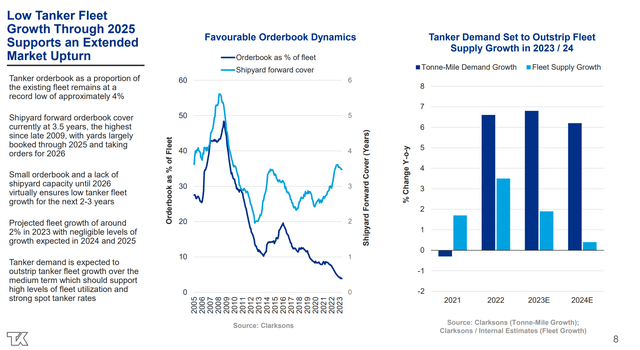

Furthermore, the tanker orderbook remains historically low as shipyards continue to be at full capacity through 2025, so tanker demand will continue to outstrip supply (Figure 10).

Figure 10 – Tanker orderbooks remain low (TNK investor presentation)

Conclusion

Balancing the risks of further economic slowdown and related oil production cuts from OPEC+ against strong long-term fundamentals from a small orderbook and Russian crude oil diversion, I believe the prudent action is to downgrade TNK to a hold and take profits. As I have said from day one, shipping stocks are trading assets and one must sell them when the ‘funnymentals’ look the brightest.

Read the full article here