Fremont, California-based Amprius Technologies (NYSE:AMPX) started trading in the summer of 2022 through a merger with a blank check company from the same SPAC sponsor that brought solid-state lithium-ion battery maker QuantumScape (QS) public two years prior. The company forms part of the surge of pre-revenue lithium-ion battery technology companies that embraced the stock on the back of investor hype, hope, and euphoria around the transition to low-carbon technologies and the pick-and-shovel tickers that would support this transition. The bull case is straightforward. Amprius is building dense lithium-ion batteries for a number of applications from electric vehicles, to aviation, to wearable tech. The company’s batteries were selected by AeroVironment (AVAV) for its Switchblade 300 Block 20 loitering missile system.

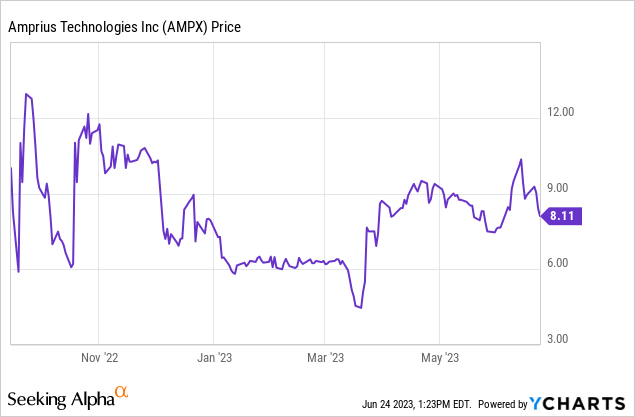

This is a broadly pre-revenue company whose latent value is being built around its technology, potential commercial traction, and target market. The $670 million market cap company recorded revenue of $680,000 for its last reported fiscal 2023 first quarter, a gross loss of $3.4 million, and a net loss of $9.1 million. This is against common shares that have staged a marked 81% recovery from their post-IPO low. The prize here is the growing market from the global automotive shift towards EVs. This is as a combination of federal and state subsidies, a sustained expansion of EV charging infrastructure, and changing consumer preferences for more sustainable and environmentally friendly transportation drives material year-over-year growth in EVs sold.

High-Energy And High-Capacity Lithium-Ion Batteries

Critically, I think some speculative exposure to futuristic battery technology companies is prudent. But bears who form the 4.25% short interest would of course highlight that this is a near-zero revenue ticker trading at a near $700 million market cap and that realized free cash outflow of $7.7 million during its first quarter. This has placed the company’s liquidity $64.2 million position in view as a Fed funds rate hiked to its highest level since 2008 at 5% to 5.25% has inverted previously buoyant investor sentiment toward tickers in high-growth but loss-making sectors. Amprius is looking to commercialize its high-density silicon anode lithium-ion batteries.

The company was founded by two Stanford University professors in 2008. Its name is an aggregation of amperage and Prius, a hybrid vehicle from Toyota that was one of the first mass-market vehicles to use lithium-ion batteries. The aim is the 100% replacement of graphite anodes with lighter silicon anodes that are able to store more energy in the same volume of space. The company has also stated that its batteries can be manufactured from existing manufacturing lines, reducing the need for complex bespoke production lines that demand high capital expenditure.

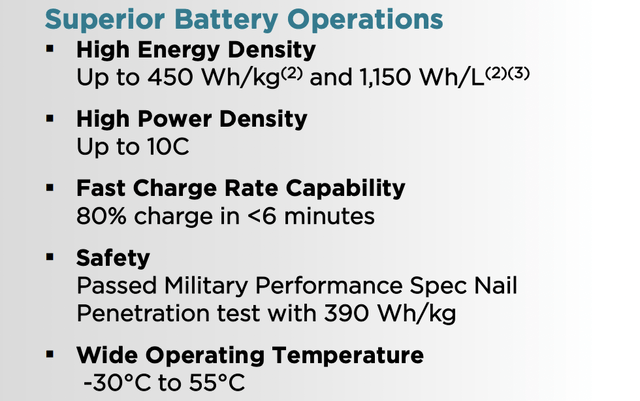

Its batteries can reach up to 450 watt-hours per kilogram and 1,150 watt-hours per liter. Battery technology is under constant creative destruction and evolution but Amprius compares extremely favorably to the average density of current lithium-ion batteries at around 150 to 250 Wh/kg and 300 to 700 Wh/L. However, silicon is prone to more expansive volume expansion than graphite. This can lead to mechanical stress and cause material electrode degradation or cracking. Amprius claims to have solved this through silicon nanowires that allow volume expansion without binders, graphite, or any inactive materials.

Amprius Technologies June 2023 Investor Presentation

The company shipped its batteries to 20 customers during the first quarter but did not disclose the size of its order book during its first quarter earnings call. And whilst management did state that the pipeline of interested partners continues to grow, it will be good to see more granularity around order numbers in future earnings.

A Future Electrified World

Strides in battery technology help push forward electrified tech, reducing costs and other inherent barriers to their adoption. EVs for example have had their relatively poor range and charging times cited as reasons for new car buyers sticking to ICE vehicles. Critically, range anxiety still remains sticky even against what’s now a generational buildout of EV charging infrastructure from companies like Electrify America, ChargePoint (CHPT), Shell’s Volta (SHEL), and Tesla’s (TSLA) Supercharger network. Infrastructure is 50% of the struggle to get ICE drivers to switch to EVs. Hence, Amprius could help boost the broader adoption of EVs by facilitating faster charging, higher energy density for a longer range, and greater safety including better performance in a range of temperatures.

This electrification forms a core part of the global drive towards a low-carbon economy. The 2022 Inflation Reduction Act was revolutionary through its sheer scale with tax credits for EVs and local battery production set to boost the market the company is chasing whilst reducing its overall cash outlay profile. Amprius is set to receive production tax credits for its proposed 775,000 square foot gigawatt-scale Colorado facility. The factory is targeting 2025 for its start of operations, was awarded a $50 million cost-sharing grant from the 2021 Bipartisan Infrastructure Law, and will initially see 500 MWh of production capacity in its first phase with the potential of this being expanded to 5 gigawatt-hours. An investment at this point is highly speculative but Amprius is operating in a fast-growing and expansive market.

Read the full article here