Back in May 2021, I thought Ford Motor Company (NYSE:F) was a gem hidden in plain sight. Until then, I had not thought of investing in the seemingly fallen automaker, with many analysts claiming its best days were behind the company. A closer look at Ford’s electrification strategy at a time when the company was being punished for cutting the dividend revealed how Ford was well positioned to benefit from Americans’ love for trucks.

Ford stock has been volatile ever since I invested in the company, but sitting on a gain of over 30%, I am not complaining today given that the S&P 500 (SP500) has gained just 6.5% in the same period. I believe Ford is still undervalued, and I expect the strong momentum behind earnings revisions to lift Ford stock to a new 52-week high in the coming weeks. This analysis focuses on how Ford is positioning itself to benefit from the growing demand for electric pickup trucks in domestic and international markets.

Recent Strategic Decisions

Ford recently announced the decision to join Tesla, Inc’s (TSLA) Supercharging network, the North American Charging Standard (NACS). Although this decision has sparked speculation about the future of the Combined Charging System in the United States, it has strategically placed Ford to appeal to a more extensive customer base alongside other major players in the electric vehicle (“EV”) market such as General Motors Company (GM) and Rivian Automotive (RIVN), who also have opted to utilize Tesla’s extensive charging infrastructure.

By aligning with Tesla, Ford ensures convenient and accessible charging options for its EV owners. Starting in early 2024, Ford electric cars will be compatible with Tesla Superchargers through a hardware adapter, and by 2025, they will feature built-in Tesla charging ports. Such cooperative initiatives are expected to drive higher adoption of EVs across the United States, creating a more interconnected charging infrastructure that benefits all electric vehicle owners.

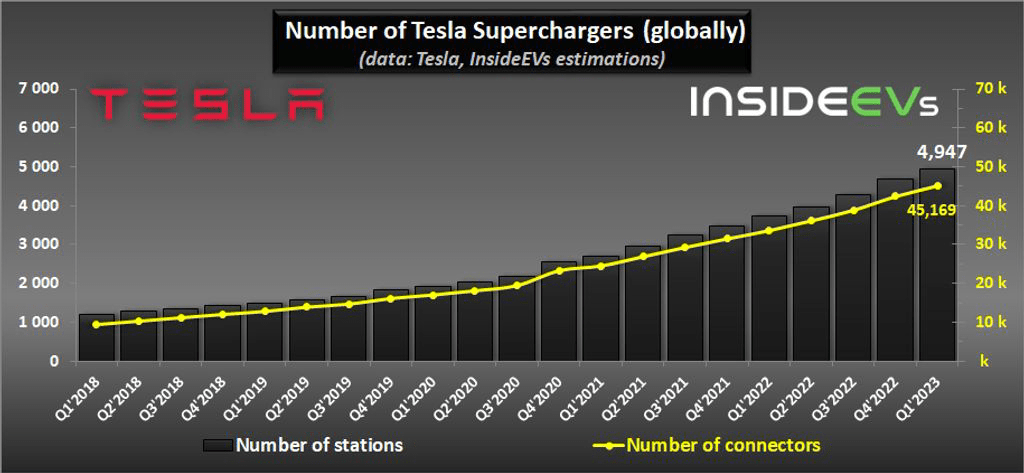

Exhibit 1: The number of Tesla superchargers globally (Q1 2023)

Inside EVs

Ford’s decision to utilize Tesla’s Supercharging network appears to be a strategic move to provide relief to Ford’s EV owners. Tesla’s extensive network of over 12,000 Superchargers offers significant benefits, particularly for highway driving. This collaboration, however, does not mean that the intensifying rivalry between Tesla and Ford will cool off. Ford CEO Jim Farley made pointed remarks about the Tesla Cybertruck shortly after the announcement of Ford’s participation in the NACS coalition. In an interview with CNBC, Mr. Farley emphasized Ford’s commitment to its target market, stating:

I make trucks for real people who do real work, and that’s a different kind of truck.

With the upcoming launch of Tesla’s Cybertruck, which directly competes with Ford’s highly successful F-150 Lightning electric pickup truck, the rivalry between the two automakers is poised to intensify.

Ford’s F-150 has enjoyed immense popularity as the best-selling pickup truck in the U.S. for over four decades. Seeking to replicate this success in the electric realm, Ford aims to establish itself as a leader in the EV truck market. In April, the company announced its entry into Norway, the world’s most advanced market for electric vehicles, where an astounding 80% of new car sales are electric. By venturing into this market, Ford is strategically positioning itself to tap into the immense potential and consumer demand for EVs globally, further solidifying its ambition to become a leader in the EV truck market.

While the initial response to the F-150 Lightning has been promising, the arrival of the Cybertruck is expected to bring a new level of competition. Reports indicate that Cybertruck’s launch is slated for the end of this year, with production ramping up in 2024.

Ford also secured a conditional loan of $9.2 billion from the U.S. Department of Energy, aiming to construct three battery plants dedicated to producing batteries for future Ford and Lincoln electric vehicles. This substantial financial injection will support Ford’s ambitious goal of manufacturing 2 million EVs annually by 2026. This will allow the company to bolster its manufacturing capabilities, strengthen its supply chain, and contribute to the broader transition toward sustainable transportation.

Moreover, the loan is aligned with the Energy Department’s objectives of achieving net-zero electricity in the U.S. by 2035 while ensuring that EVs account for half of all new car sales by 2030. To facilitate the implementation of this project, the loan will be provided to BlueOval SK, a joint venture between Ford and SK On, a South Korean-based EV battery manufacturer.

Ford’s Entry Into The European EV Market

On June 12, Ford unveiled its Cologne Electric Vehicle Center in Germany, marking a significant investment of $2 billion to transform the historic Niehl plant, which was first established in 1930. This transformative project positions Ford as a key player in the future of automotive production in Europe. The advanced facility, spread across 125 hectares, boasts cutting-edge technology, including a new production line, battery assembly capabilities, and state-of-the-art automation, enabling an impressive annual production capacity of over 250,000 electric vehicles. The digital advancements include integrated self-learning machines, autonomous transport systems, and real-time big data management, which will allow the company to continually enhance the efficiency of its production processes while ensuring high quality.

Building on the successes of models like the Mustang Mach-E, E-Transit, and F-150 Lightning, Ford’s Cologne EV Center will produce the electric Explorer as its first electric vehicle, followed by a sports crossover. This manufacturing hub holds immense significance, as it will be Ford’s first carbon-neutral assembly plant worldwide. The project aligns with the company’s commitment to achieving carbon neutrality across its entire European footprint, encompassing facilities, logistics, and direct suppliers, by 2035.

To achieve carbon neutrality, the facility relies on 100% certified renewable electricity and biomethane for its operations, ensuring that all electricity and natural gas used are carbon neutral. The heat required for the facility is also generated in a carbon-neutral manner, with the local energy provider offsetting corresponding emissions from the assembly plant.

Looking ahead, the energy provider plans to reduce its operating emissions for heat delivery by approximately 60% by 2026 and eliminate these emissions by 2035. Ford Cologne’s EV Center will undergo independent certification as a carbon-neutral facility, with regular audits and purchasing high-quality carbon offsets for any remaining emissions. The carbon-neutral Cologne EV Center serves a broader strategy for Ford in minimizing environmental impact and achieving carbon neutrality in Europe as part of its global decarbonization plan.

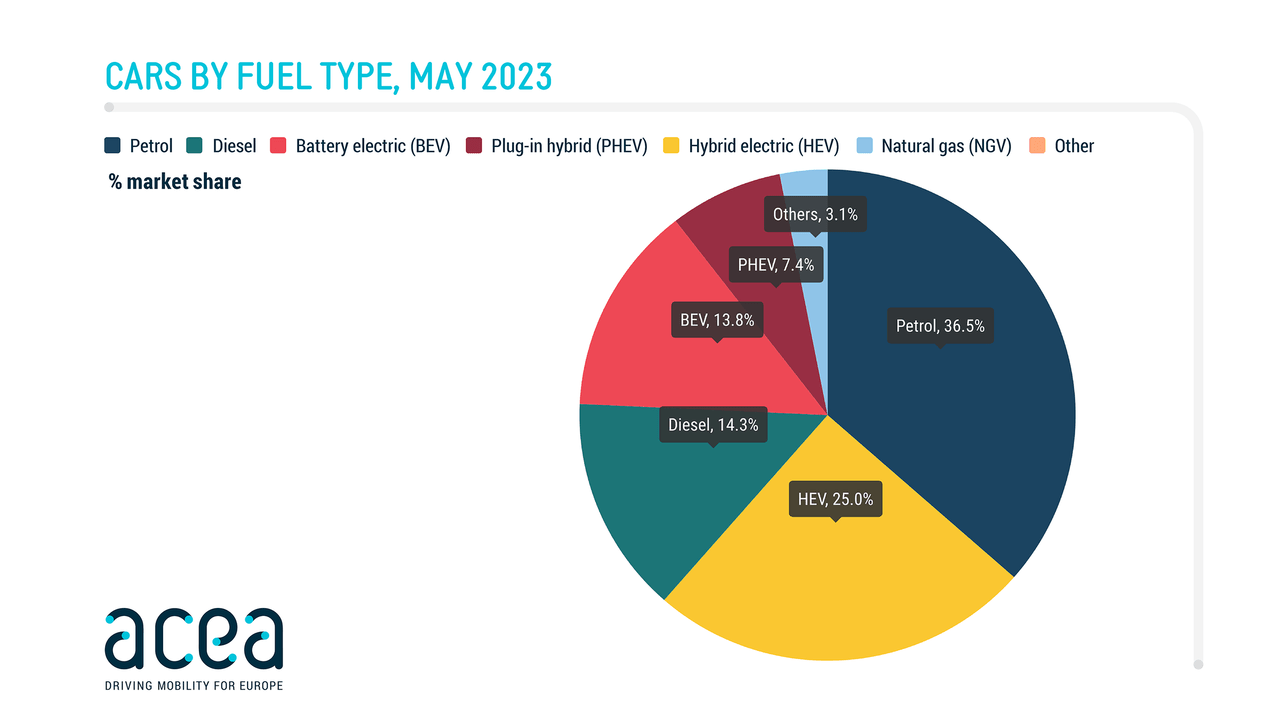

European Union countries are experiencing a significant surge in EV sales, with a remarkable 71% increase in May. This growth reflects the continued expansion of the EV market in the region, driven by government incentives and the increasing demand for low or zero-emission vehicles. According to the European Automobile Manufacturers Association, EVs accounted for 13.8% of all car sales in May, marking a substantial rise from under 10% the previous year.

Exhibit 2: New car sales by fuel type in the EU in May

ACEA

The data also reveals a shift away from traditional petrol and diesel cars, which accounted for less than 51% of sales combined. This shift highlights the changing landscape of the automotive industry, with consumers embracing greener transportation options.

The Growing Midsize Pickup Truck Segment

The midsize pickup truck segment has emerged as a flourishing market, driven by the shifting preferences of consumers toward utility vehicles. These once-basic work trucks have transformed, now featuring luxurious elements that allow them to command premium price tags exceeding $60,000. Consumers are increasingly willing to pay higher prices for midsize pickups, as evidenced by a 53% price increase over the past decade. This growth outpaces the overall industry’s average, highlighting the market’s readiness to invest in these vehicles that now come equipped with enhanced features, amenities, and stylish design elements. Midsize pickups are no longer confined to budget-conscious buyers; they now cater to those seeking both functionality and luxury.

Recognizing the immense potential for profitability, Ford, General Motors, and Toyota Motor Corporation (TM) have strategically positioned themselves to capitalize on this growing segment. By offering larger, more capable, and pricier models, these leading automakers aim to cater to the evolving demands of discerning customers.

The surge in midsize pickup truck sales over the past decade has been remarkable, with sales more than doubling and accounting for 4.4% of total U.S. vehicle sales in 2022. This remarkable growth reflects a notable shift in consumer preference away from sedans and towards utility vehicles, including crossovers, SUVs, and pickup trucks. Motivated by the expanding market size, automakers have stepped up their game, introducing redesigned models and intensifying the competition to secure a larger slice of this profitable market.

Toyota currently leads the pack in midsize pickup truck sales, holding around 40% of the market share since 2019. Its dominance has slightly waned with the entry of rival automakers into the market. General Motors, through its Chevrolet brand, commands the second-largest market share, followed by Stellantis’ (STLA) Jeep Gladiator and Nissan Frontier. Ford Ranger, although not capturing a substantial market share, still maintains a presence in the segment. Ford has streamlined its offerings by reducing the number of cab and pickup box configurations. Special variants and high-end models, such as Ford’s performance Raptor and GMC’s AT4 and AT4X models, contribute to higher profit margins, despite sharing many components with their standard counterparts.

Looking ahead, the midsize pickup segment is projected to continue its growth trajectory, although its market share is expected to peak at 4.6% in 2026. While Toyota is likely to maintain the dominant position, the future of midsize pickups appears promising, presenting ample opportunities for Ford to benefit from the changing consumer preferences.

Strong Earnings Revision Momentum

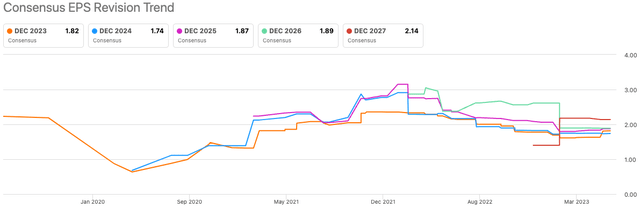

At Beat Billions, we believe earnings surprises and earnings revisions will play a key role in determining long-term stock prices. In the last 3 months, earnings expectations for Ford have trended meaningfully higher, with analysts now expecting Fiscal 2023 EPS to come to $1.82 compared to $1.60 in February.

Exhibit 3: EPS revision trend

Seeking Alpha

Aided by the continued strong demand for EV pickup trucks, the limited options available in the market, the aggressive push by governments to promote environmentally sustainable transportation solutions, and the significant brand loyalty Ford enjoys in the pickup trucks market, I believe long-term earnings estimates will move substantially higher from the current levels, paving the way for a significant increase in Ford’s market value.

With EPS estimates for the next Fiscal year trending higher, the momentum behind Ford stock is likely to persist for much longer.

Takeaway

The recent strategic moves made by Ford will likely strengthen its position in the EV and pickup truck market. Ford’s collaboration with Tesla to enable access to Superchargers highlights the industry’s collective efforts to support the widespread adoption of EVs and enhance charging infrastructure. Meanwhile, Ford’s focus on the midsize pickup truck segment reflects how the company is planning to benefit from the changing preferences of consumers and the potential for profitability in this market. With a long runway for growth in both domestic and international markets, I find Ford stock very attractively valued today.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here