Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on June 13th, 2023.

Utilities can often be seen as a core foundation for a great dividend portfolio. They aren’t necessarily the most exciting bunch of equity positions one might own, but that’s precisely what makes them great. WEC Energy Group (NYSE:WEC) is a solid long-term utility play that can be a great fit in one’s long-term dividend growth portfolio.

Utilities, in general, are considered fairly safe investments required for society to function. This necessity means that no matter the overall economic conditions, cash flows tend to continue rolling in for these boring names even during recessions.

However, that doesn’t mean they aren’t infallible either. Due to rising interest rates, these have been impacted in a couple of different ways. First, they make any needed additional debt for growth projects more expensive as financing costs rise. Utilities are a capital-intensive business to be in.

Second, utilities are often seen as an income play primarily. Therefore, when we have rising interest rates that push up risk-free yields, there can be a dent in demand for investing in even utilities that are generally seen as fairly safe.

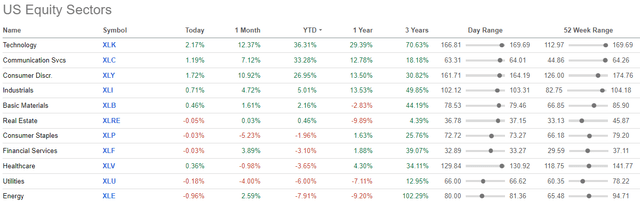

This is also what can make them more attractively priced at this time, as they have taken a hit this year. Utilities are actually down on a YTD basis, with only the energy sector falling further.

Sector Performance as of June 13th, 2023 (Seeking Alpha)

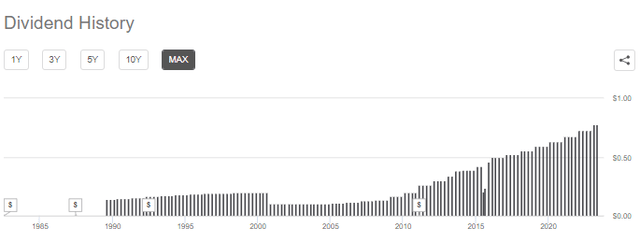

Just like bonds, assuming the dividends aren’t cut, we would see that yields rise after a share price drop. That can make them more competitive at this time, and they have a good chance of growing their dividends going forward. In the case of WEC, they have a long track record of annual dividend growth. They also come with an outlook of expected continued earnings growth to back up dividend growth into the future.

WEC Energy Group

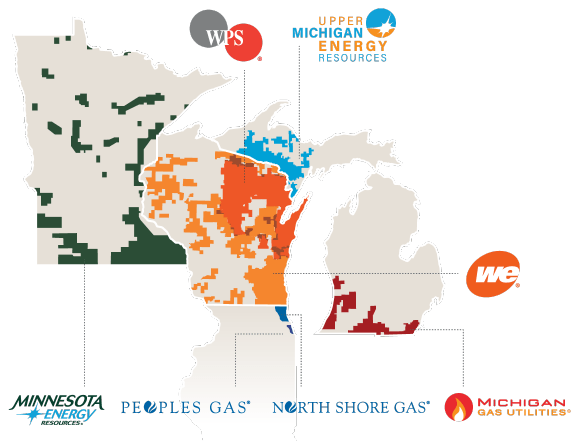

WEC is a multi-utility company with electric and natural gas operations throughout the Midwest. With its subsidiaries, they serve “4.6 million customers in Wisconsin, Illinois, Michigan, and Minnesota.”

Being diversified across several states through different subsidiaries can be seen as a strength. Just as one’s own portfolio should be diversified, a diversified basket of subsidiaries means each operation leads to less individual risk on the parent company.

WEC Utility Operations (WEC Energy Group)

Earnings Outlook

In the coming years, their latest expectations are for long-term EPS growth of around 6.5% to 7% per year. Like most utility companies, a major push has been into new ESG projects, and WEC is no different. They are looking to spend $5.4 billion in regulated renewables from 2023 to 2027. That includes solar, battery, and wind projects. That is part of their new plan, where they bumped up the anticipated capital plan. Their goal is to use coal only as a backup fuel by 2030 and then a complete exit of coal by the end of 2035.

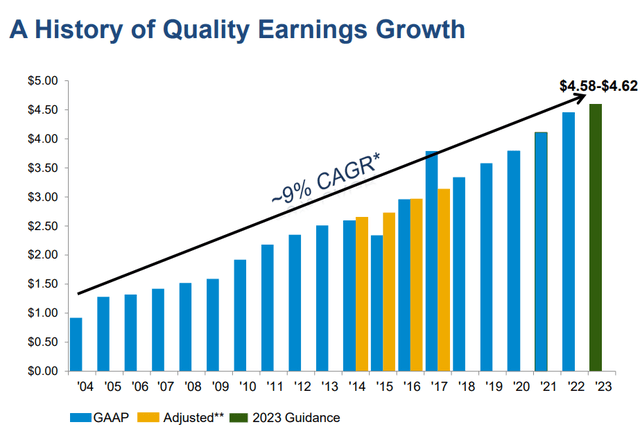

That anticipated earnings growth going forward is similar to what the company has experienced historically. Although analysts expect 2023 to be a bit softer for growth, they anticipate growth to pick up in 2024.

WEC Earnings Past And Estimates (Portfolio Insight)

WEC has been incredibly consistent in its history of delivering on EPS guidance. They boast that they are the “only utility to beat guidance every year for 19 years running.” That’s from 2004 through 2022. So being able to top the expected EPS growth that the project is important for them to keep this streak alive.

They are currently projecting that EPS for 2023 will be in the range of $4.58 to $4.62.

WEC Earnings Growth (WEC Energy Group)

Despite a softer Q1, they reaffirmed their 2023 guidance. They noted that weather was a major factor in seeing EPS come in at $1.61 for the first quarter. It was a mild winter (and for that, I was thankful as a Michigan resident.)

That said, their guidance going forward is set on “normal weather going forward.” As is always the case with utilities, there are going to be a lot of outside factors that can be unpredictable and are just completely uncontrollable. That’s why it can be a good thing that WEC generally under-promises, to give them a bit of leeway to over-deliver.

This was detailed in their earnings call. Where they mentioned specifically that weather contributed to around a $0.12 per share hit. They are targeting O&M reductions and anticipate issuing debt at lower rates than planned, as they went with some conservative estimates in the first place.

Q1 weather was about $0.12 deficit as I mentioned in the prepared remarks. So, we’ve identified O&M reduction target that can offset $0.04, $0.05, $0.06 of that. We also built some conservative financing assumptions in the plan. So, in terms of issuing debt at rates lower than the plan or continued execution later this year, we expect the financing savings to be $0.05 to $0.06 also. So, between those two items, we could offset the Q1 weather deficit. But we also have other initiatives we’re looking at beyond those two items.

Dividend Outlook

The earnings growth is important to keep up with the growing dividend, which they expect to continue to grow at the same pace as their EPS growth. This is because they are targeting a payout ratio of 65-70% of earnings, and they are at that mid-point now.

Given their current outlook, that could mean dividend growth of around 7% going forward or even higher should they continue to exceed their earnings guidance. That should help keep their current 20-year dividend streak alive.

WEC Dividend History (Seeking Alpha)

They had actually lifted the dividend by 7.2% for 2023 when they took the quarterly dividend up to $0.78 from $0.7275. That’s been fairly consistent with what we’ve seen in the last three and five years, with 7.23% and 7.05% CAGR, respectively. The longer-term 10-year CAGR came in at 8.95%.

Valuation

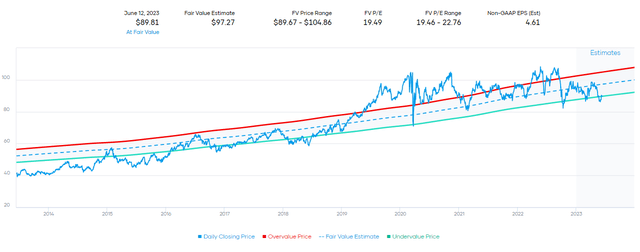

As mentioned at the open, utilities have taken a hit, and WEC is no exception. They’ve also dipped along with the broader utility sector. That’s seen as the P/E multiple contracts from where it was, combining that with a bit of anticipated growth going forward, and it currently puts us at the bottom of the fair value range. Given the historical range, that would suggest that a fair value estimate for WEC is closer to $97, which could indicate some upside potential.

WEC Fair Value Estimate (Portfolio Insight)

Given interest rates, though, being near the lower end is probably more appropriate for this environment. However, it also means that it really isn’t necessarily overvalued either. I believe that is what makes it a fairly solid choice for an investor going forward. Noting that at a forward P/E of 19.5x, WEC is an overall relatively more expensive utility name relative to some of its peers. That’s tended to be the case as the company has been able to deliver above-average growth.

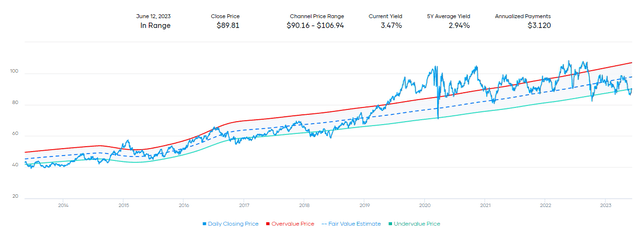

In looking at the valuation of WEC in terms of its dividend yield, we see a similar picture. It would suggest that the channel range for fair value is anywhere from around $90 to $107 per share. The mid-point on that would be right around $98.50.

WEC Fair Value Estimate Yield (Portfolio Insight)

We know risk-free yields have ticked higher, so seeing the yield for WEC comes in at around 3.5% from the 2.94% 5-year average makes sense.

Conclusion

WEC can be a solid position for a dividend growth investor to consider in their portfolio. Utilities are defensive and provide recession resistance, being able to generate cash flow no matter the overall market environment. This is a utility name that has experienced relatively strong growth in terms of its earnings that have funneled into the growth of the dividend. As they are within their target dividend payout ratio, growth in the dividend is anticipated along with the EPS growth they’re able to deliver.

Read the full article here