J.P. Morgan says semiconductor revenue for Taiwan Semiconductor Manufacturing’s foundry business may deteriorate worse than expected this year. But investors should not be too concerned and should instead focus on the company’s long-term potential, says the Wall Street firm.

On Tuesday, analyst Gokul Hariharan reaffirmed his Overweight rating for

TSMC

(ticker: TSM) stock and reiterated his price forecast of 650 Taiwan dollars (about US$20.95) for

TSMC’s

Taiwan-traded shares. The target represents roughly 14% upside from current levels in TSMC’s American depositary receipts.

We are “cutting estimates on a slower second half recovery…due to weaker end demand and persistently higher inventories,” he wrote. “We stay Overweight…given [TSMC] key foundational role in AI computing, led by continued process technology leadership and a comprehensive advanced [chip] packaging portfolio.”

Hariharan lowered his revenue estimates for fiscal 2023 and fiscal 2024 by 2% and by 8%, respectively. He noted the chip recovery is likely going to take longer than expected as demand for PCs, smartphones, televisions, and consumer electronics hasn’t improved.

And while revenue related to artificial intelligence will be only about 5% of TSMC’s top line this year, it could grow to 10% of revenue by 2026, he says. Hariharan says the positive investor sentiment surrounding AI will help TSMC’s valuation multiple over time.

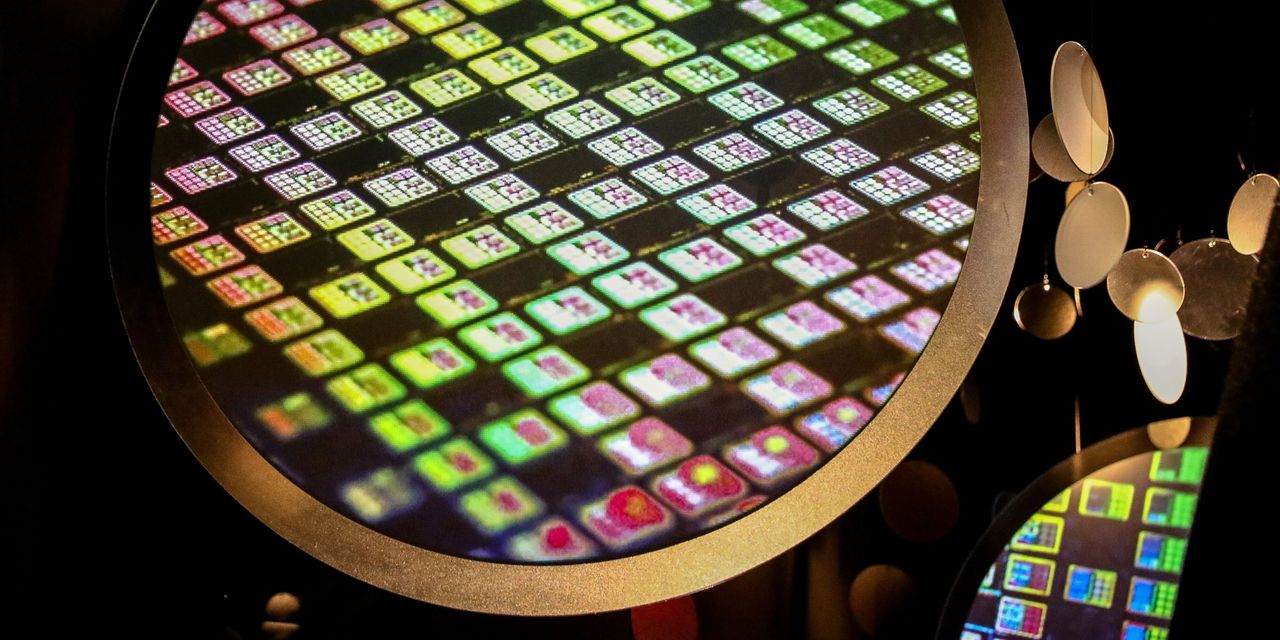

TSMC dominates the market for high-end chips. It makes the main processors inside

Apple

(AAPL) iPhones,

Qualcomm

(QCOM) mobile chipsets, and processors made by Advanced Micro Devices (AMD). According to TrendForce, TSMC has about 60% market share of the third-party chip-manufacturing business, followed by

Samsung

at 12%.

But there is also a rising competitive threat. Intel executives have been saying Intel Foundry Services offers a compelling proposition for chip customers, versus TSMC. The U.S.-based chip maker has cited its more geographically secure supply chain in the U.S. and Europe as a key selling point for its services. In comparison, most of TSMC’s chip-making facilities are in Taiwan.

Write to Tae Kim at [email protected]

Read the full article here