Introduction

Cal-Maine Foods (NASDAQ:CALM) is a leading producer and distributor of shell eggs throughout the United States. Shell eggs and egg products are essential sources of nutrition in most households. Therefore, any fluctuations in food expenses or population rates can directly impact CALM’s financials and operations. To mitigate these risks, the company has implemented a “Culture of Sustainability” in its production and supply chain. It is worth noting that despite the volatile nature of their business, CALM’s main customers include Walmart Inc. (WMT) and Sam’s Club, which provide a high-quality customer base for the company. In this comprehensive analysis, I have examined CALM’s financial results and market outlook to assist investors in making informed decisions.

CALM’s market outlook

As many of you may have noticed, egg prices in the U.S. skyrocketed in 2022 due to the Highly Pathogenic Avian Influenza (HPAI) virus, also known as bird flu. This virus significantly reduced the nation’s egg-laying capacity and had a negative impact on most poultry suppliers throughout the United States, resulting in price surges. Fortunately, Cal-Maine Foods announced that their products are immune to HPAI and as of the end of March 2023, there have been no positive tests for HPAI at any of their facilities. However, according to the USDA division of Animal and Plant Health Inspection Service’s report on March 27, 2023, approximately 43.3 million commercial layer hens and 1.0 million pullets have been depopulated due to HPAI since February 2022. As a result, the supply shortfall and demand surge are likely to continue until the end of the year.

Another significant factor that contributed to the aggressive prices was the Russian annexation of Ukraine, which resulted in a substantial increase in feed costs. CALM’s farm production costs per dozen rose by 18.2% compared to the previous year, mainly due to the significantly higher feed expenses. All in all, CALM could benefit from high egg prices and reach a high number of profits in 2022. However, the question is whether that skyrocketing profit would drop and cause loss for investors.

CALM’s financial outlook

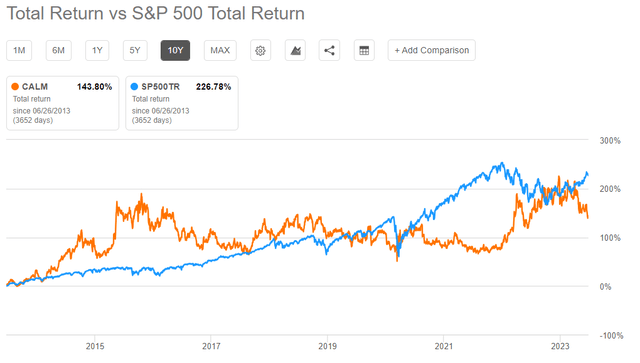

Over the past year, the average net selling price of a dozen eggs has increased by approximately 104%, reaching $3.298 in Q3 2023 compared to $1.612 in the same quarter of 2022. These robust prices have resulted in a quarterly net sale of $997.5 million, which is a significant increase of 108% from the comparable quarter in 2022, when sales were $477.5 million. It is important to note that the domestic egg market has always been highly competitive and volatile, even under normal market conditions, as stated by the CEO. Therefore, it is crucial to consider that this stock may be a good long-term investment but may not be profitable for short-term analysis. this is indicatable, when comparing Cal-Maine Foods’ total return with S&P 500’s during the last ten years (see Figure 1).

Figure 1

Seeking Alpha

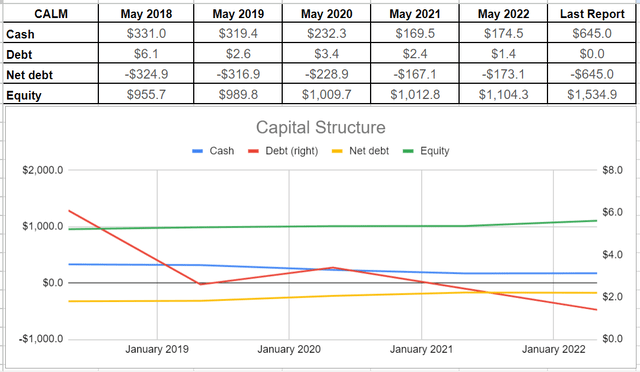

By the end of the third quarter of fiscal year 2023, CALM had accumulated a cash balance of $645 million. Albeit their sales price will decrease back to normal, it is worth noting that the company has consistently generated an average of $245 million in cash from 2018 to 2022. This strong cash flow is sufficient to provide returns to shareholders, especially since CALM has had negative net debt levels for several years. Additionally, CALM’s equity level has remained above $1 billion, on average, for the past five years and reached $1.53 billion by Q3 2023. However, what makes CALM’s situation particularly interesting is its debt-free status (see Figure 2).

Figure 2 – CALM’s capital structure (in millions)

Author

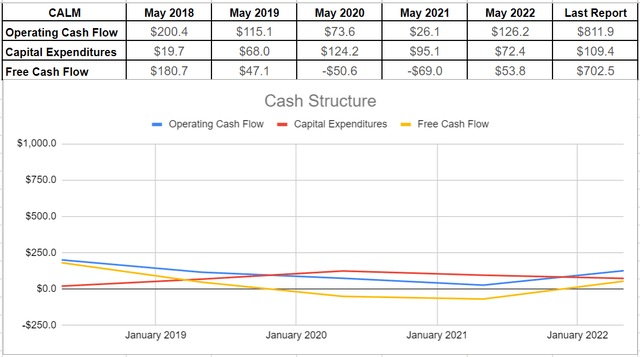

Additionally, CALM has maintained an average cash flow from operations of $108 million between 2018 and 2022, which surged to approximately $812 million by the end of Q3 2023. This significant increase in cash flow resulted in $702.5 million of free cash flow. While this boost in cash is temporary and expected to decline, CALM’s strong balance sheet, including its debt-free status, assures investors that the company can provide returns through dividends and share buybacks even in a normal market. The company has also increased its capital expenditures to over $109 million and plans to continue expanding its specialty egg production capacity to meet changing customer demand (see Figure 3).

Figure 3 – CALM’s cash structure (in millions)

Author

The demand for cage-free eggs has experienced a considerable increase in recent years, prompting many of CALM’s customers to request that all eggs be cage-free by 2026 and some other customers’ timeline is 2030. In response, the management has decided to expand their production to meet this new demand. Cal-Maine Foods has invested heavily in its production and distribution capabilities, as cage-free eggs are expected to make up a larger portion of the company’s products. In fact, sales of cage-free dozens increased by 14.9% during the third quarter of fiscal year 2023 compared to the same period in fiscal year 2022.

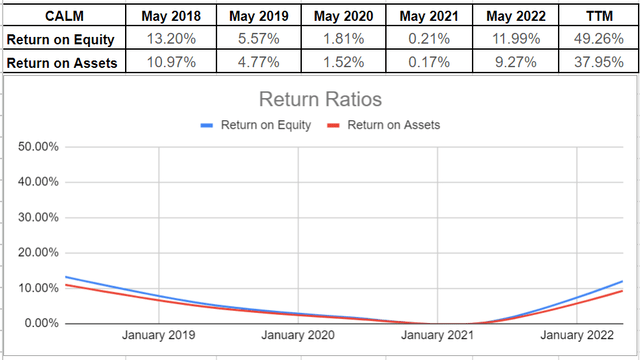

Cal-Maine Foods has announced a cash dividend of $2.2 per share for the third quarter of fiscal 2023, in accordance with their policy of paying dividends equal to one-third of each quarter’s net income. The company’s net income surged in 2022, resulting in a significant increase in their return on equity and return on assets. Their return on equity rose to 49.2% in TTM, compared to around 12% at the end of fiscal 2022, while their return on assets ratio reached 37.9% in TTM, far exceeding the 9.2% recorded at the end of fiscal 2022. Despite this supernormal market condition, Cal-Maine Foods has maintained healthy average amounts of ROE and ROA from fiscal years 2018 to 2022 at 6.56% and 5.34%, respectively, demonstrating their ability to generate profits for investors beyond this period (see Figure 4).

Figure 4 – CALM’s return ratios

Author

Why I might be wrong

First and foremost, Cal-Maine Foods faces a significant risk associated with the volatility and cyclicality of wholesale shell egg market prices, which can have a significant impact on their operating results. Decreases in prices can adversely affect their revenues and profits. Additionally, due to weather-related shortfalls in production and yields, ongoing supply-chain disruptions, and the Russia-Ukraine war’s impact on export markets, supplies of corn and soybean were short relative to demand in the third quarter of fiscal 2023. For fiscal 2023, management expects continued upward pricing pressures for corn and soybean, as well as further market volatility that will affect feed costs. Feed costs are the largest element of CALM’s shell egg production, accounting for between 55% to 62% of their total farm production cost. This situation may increase CALM’s costs and adversely affect their return on investment and cash generation.

Conclusion

Since 2022, egg prices have surged due to shortfalls in shell egg supply caused by bird flu. Cal-Maine Foods, the largest egg producer in the U.S., has greatly benefited from this circumstance. Meanwhile, the feed costs increased after the Russia-Ukraine war began, which further accelerated the increase in egg prices as the feed costs increased. Cal-Maine Foods has taken full advantage of this trend by maintaining a debt-free balance sheet and a cash balance of $645 million. The company’s profitability, as measured by ROE and ROA ratios, has been consistently healthy at 6.56% and 5.34% on average, respectively, over the last five years. In conclusion, I believe that Cal-Maine Foods is a profitable long-term investment opportunity.

As always, I welcome your opinions.

Read the full article here